Key metrics: (5Aug 4pm HK -> 12Aug 4pm HK):

· BTC/USD +11% ($52,700 -> $58,500) , ETH/USD +8% ($2,360 -> $2,550)

· BTC/USD Dec (year-end) ATM vol -0.5% (62-> 61.5), Dec 25d RR vol +0.3% (3.3 -> 3.6)

· Global risk unwinds sent BTC quickly below the 58–59k pivot level and this triggered stop-losses down to the major support level at 50k.

· BTC traded back above 54k which puts the expected trading range to be 54–64k for now.

· Short term support expected at 57k and resistance ahead of 63k

Market Themes:

· Market recovered from the lows after the sharp pickup in volatility triggered stop-losses across Tradfi markets. With the recent pickup in global asset realised volatility the market was choppy in the aftermath as it sought to resize its positioning.

· Geopolitics were reasonably quiet last week and most of the volatility intraweek was driven by what appeared to be flows in thinner liquidity than any major shifts in overall sentiment.

· BTC markets found strong buying interest around 50k, likely from accumulator products that buy 2x below ~50k region creating demand for coins. Eth over-positioning has left some overhang in the market as it has struggled to bounce back as quickly at BTC (on a vol basis you would have expected more like 15% than 8%).

· Crypto vega spent most of the week better bid as dealers appeared slightly wrong footed and caught short vol. However fresh selling Thursday evening and Friday appears to have filled them in and vega drifted back lower into the weekend. Realised vol remained elevated as the spot and perp liquidity remained thin.

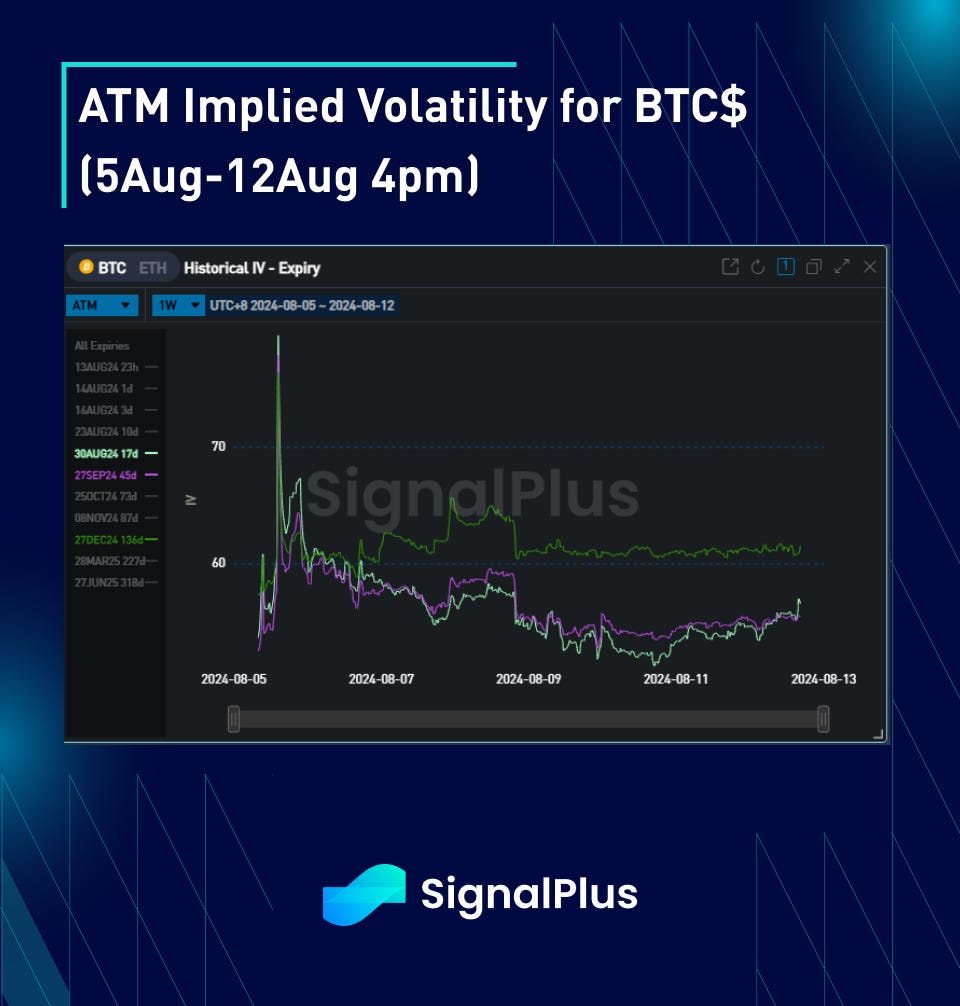

ATM implied vols:

· Front-end over the week continued to deflate the spike in implied vols following the spot move. However, vega remained supported for most of the week before being given lower from flow on Thursday evening and Friday.

· In Tradfi the VIX spiked on Monday to 65 vols before deflating to a 22–28 range for the rest of the week before settling down to 20.6 for the close.

· Ahead of CPI front end vols have reflated from the weekend lows; if CPI is quiet and we hold in this range we would expect to see the front-end normalising to late July levels. We expect belly FVAs might outperform in that environment.

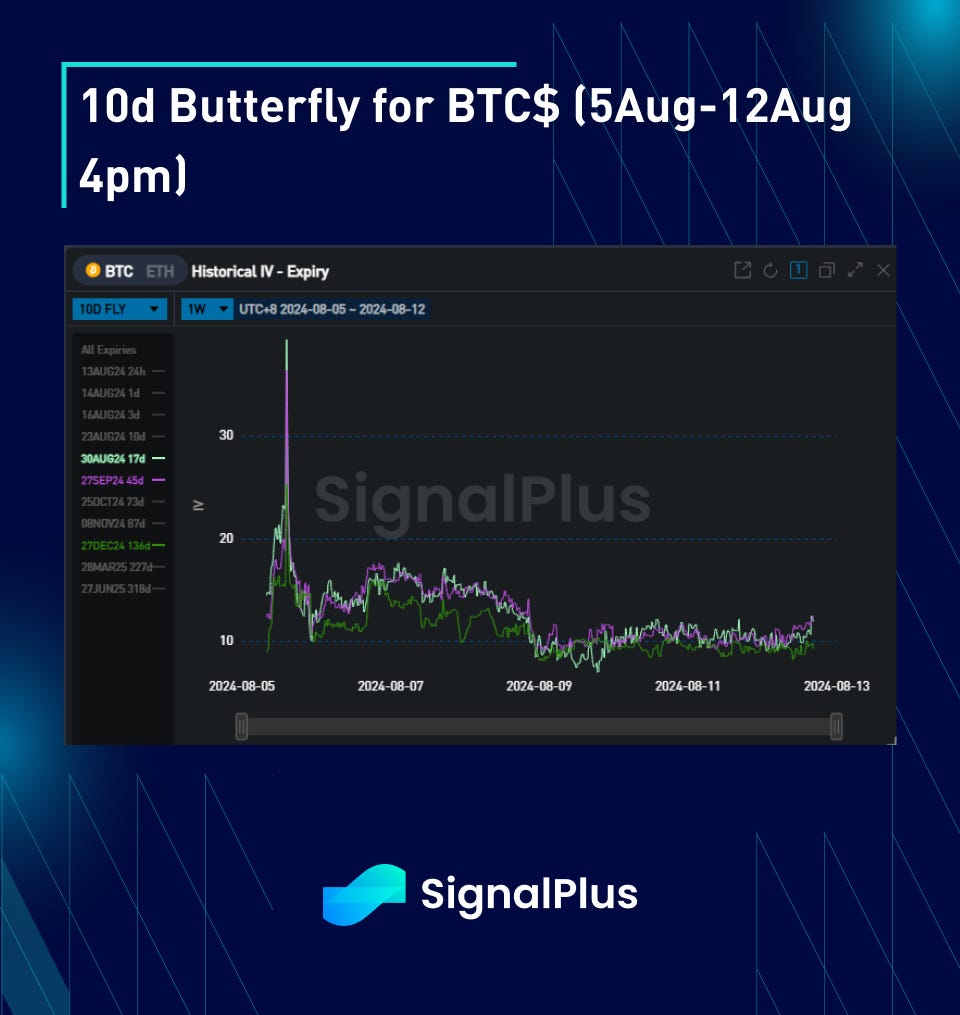

Skew/Convexity:

· The market panic bought convexity on Monday night and then retraced quickly as spot recovered. Flies and RR deflated over the course of the week and are now comfortably back in the middle of the longer term range. There was a slight squeeze Monday morning in the front dates ahead of CPI but this has been easing back over the morning.

· Spot-Vol correlation very locally is quite negative; ie. When spot comes back off the highs the implies are quickly paid up as dealers remain nervous. Some overlay supply is helping dealers to be more comfortable letting vols getting marked lower on higher spot.

· Continues to be demand / buying flow for top side Vega, while supply of year-end topside may subside at these lower levels of spot

Good luck for the week ahead!

You can use SignalPlus Trading Compass on t.signalplus.com to get more real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members:

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments