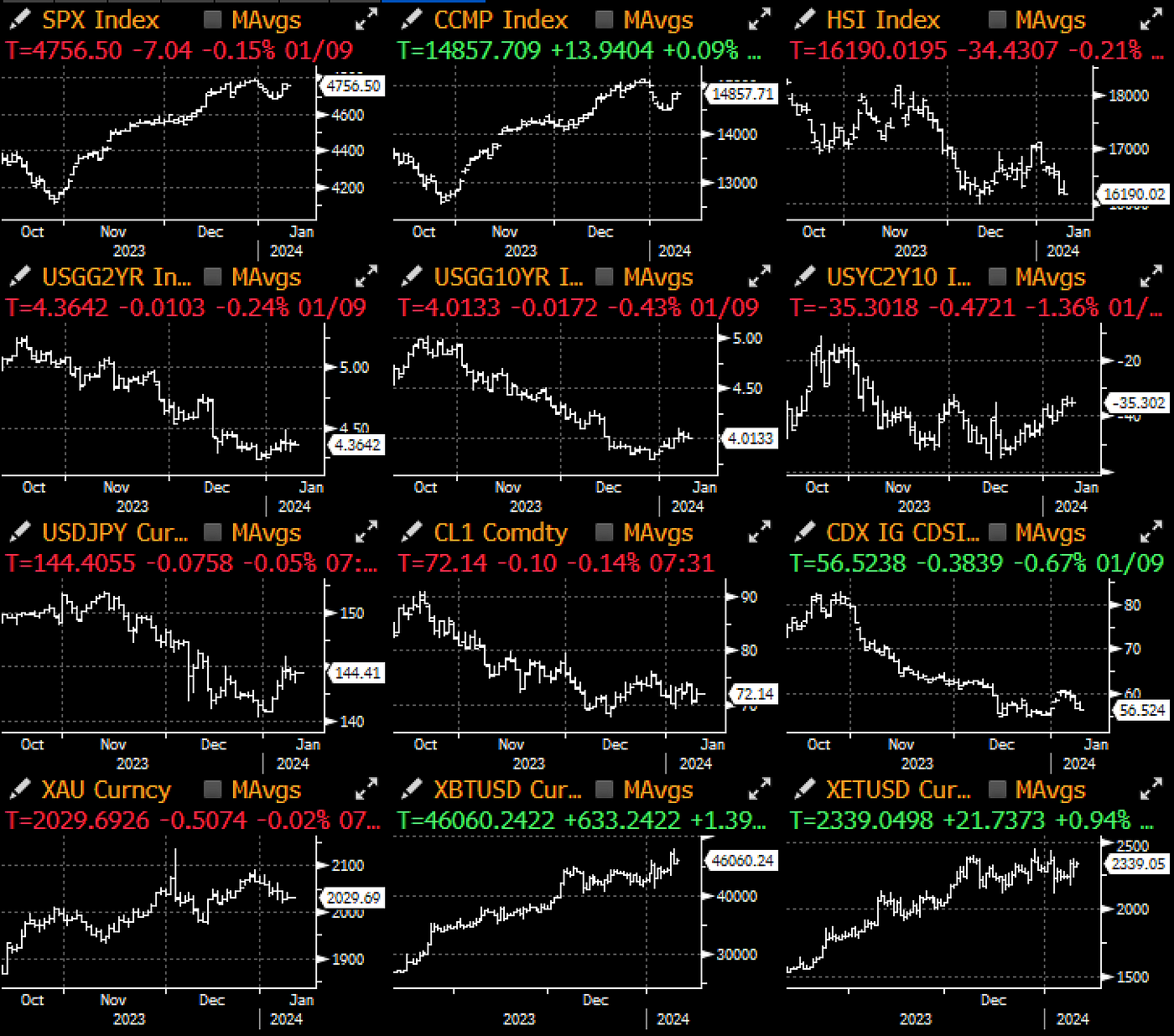

Issuers took the brief lull in data and market activity to continue with their issuance bonanza, and European supply saw a record breaking day with over $50bln new issues from SSAs, financials, and corporates, while Belgium saw €72bln in bids for their €7bln 10y bond (10x), UK saw £8bln in bids for £2.25bln of their 20y bonds (3.6x), Italy saw >7x demand for their 7yr and 30y paper, while Dutch (6y) and Austria (9y & 30y) also saw exceptional demand for their bonds as investors aggressively put fresh capital to work in the new year.

US treasuries saw similarly decent demand for their upsized 3yr auction, with results coming in -1bp through on $139bln in bids for a 2.67x bid to cover ratio, and indirect bidders taking a solid 65% of the 82% end-user allocation.

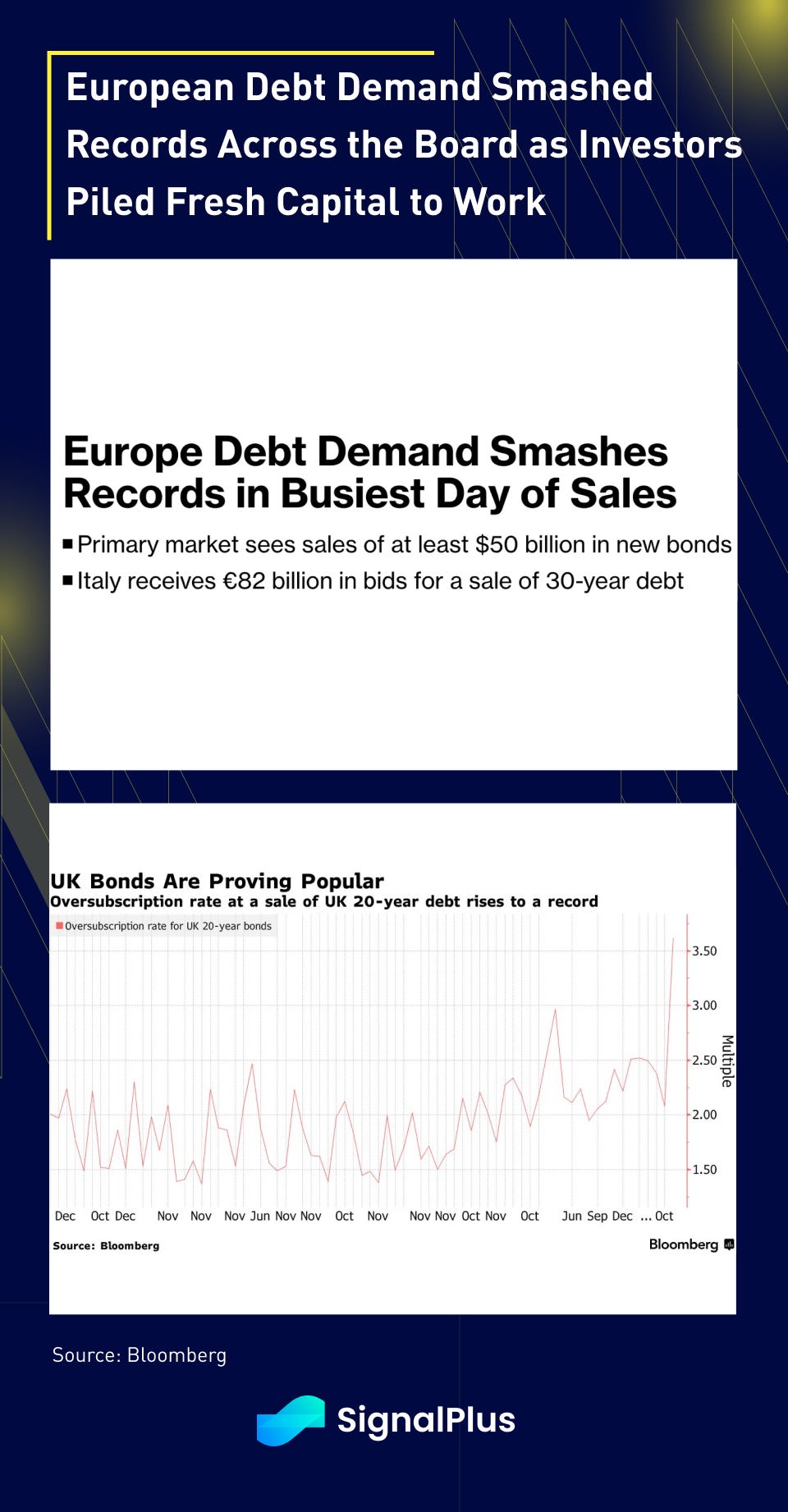

The rush to bonds continued even after a recent ~100bp drop in yields, as bellwhether fixed income giants such as PIMCO are issuing bullish prognosis on bonds on expectations that the Fed would be more aggressive in rate cuts. Specifically, they noted:

…if current economic conditions persist, bonds have the potential to earn equity-like returns based on today’s starting yield levels. If the economy enters recession, bonds will likely outperform stocks. If inflation revives and central banks need to hike again, both bonds and stocks would likely be challenged, but high starting yields can provide a potential cushion for bonds.

Based on a sample of 140 rate-hiking cycles across 14 developed markets from the 1960s to today, central banks have tended to cut their respective policy rate by 500 basis points (bps), on average, when their economies are entering recession. During cutting cycles that didn’t coincide with recession, the central banks still cut by 200 bps on average in the first year of easing. This is twice the every-other-meeting pace of 25-bp cuts embedded in the Federal Open Market Committee’s (FOMC) latest Summary of Economic Projections.

— PIMCO, January 2024 Cyclical Outlook

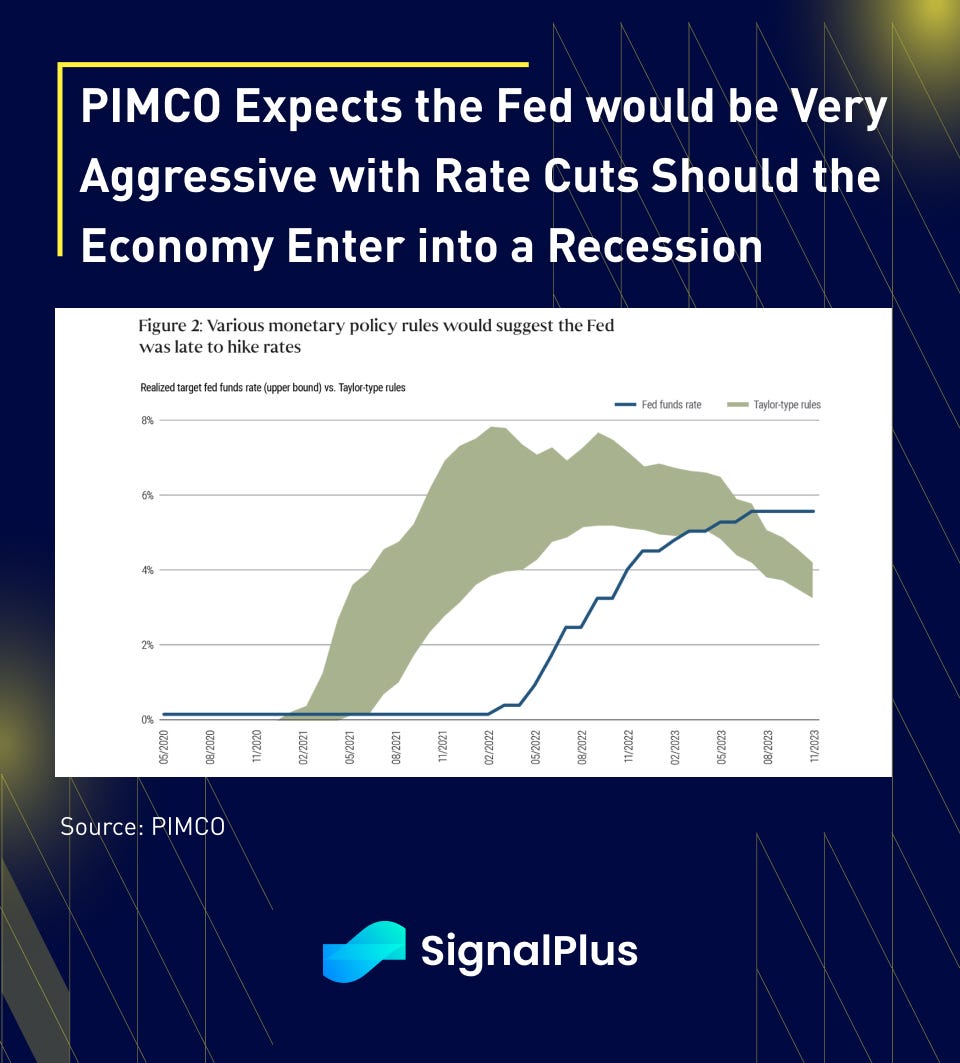

Markets were quiet otherwise in TradFi land with more action coming out of crypto. Towards the late NY session, a flurry of action and subsequent confusion happened in BTC, where SEC’s official X account seemed to have announced that they had given their blessings for spot ETFs to be listed, along with an accompanying message from Gary Gensler. However, the tweet was deleted within the hour followed by a personal declaration from the Chairman himself that the @SECGov account was hacked and the earliest tweet was a fake statement.

Spot BTC spiked to nearly 48k on the news, before falling back to the mid 45k on the subsequent denial, reminiscent of the cointelegraph ‘headfake’ episode from last October. Lots of theories and speculation abound over whether it was indeed a true hack, or if it was a messy retraction of a trigger-happy staffer who might have leaked a ‘draft statement’ ahead of time.

Nevertheless, with today (Jan 10th) being the deadline for the SEC’s final deadline to respond to the Ark 21 Shares application, we should get a resolution to this drama within the next 24 hours one way or another. It’s looking to be an exciting way to end an already busy week!

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments