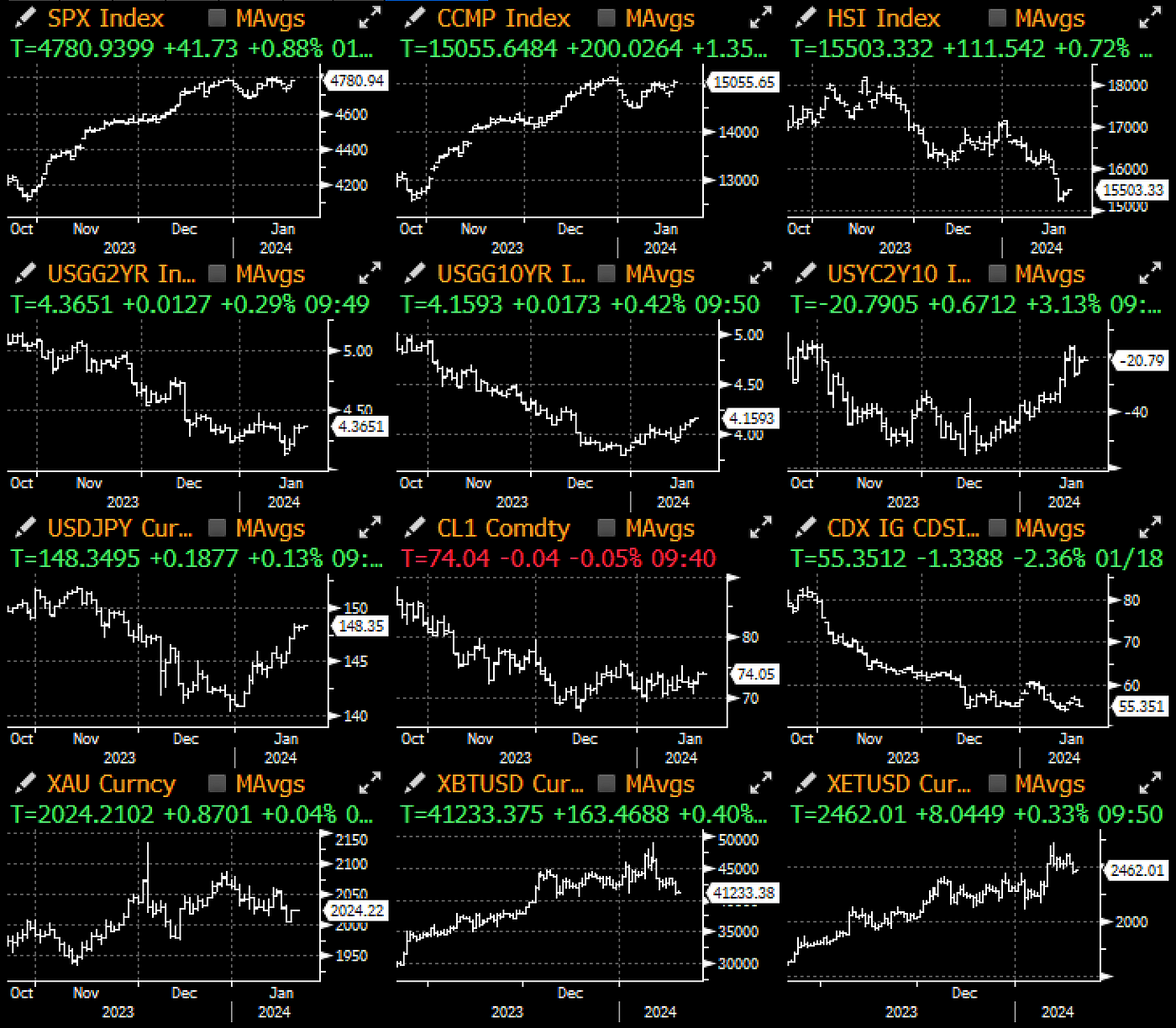

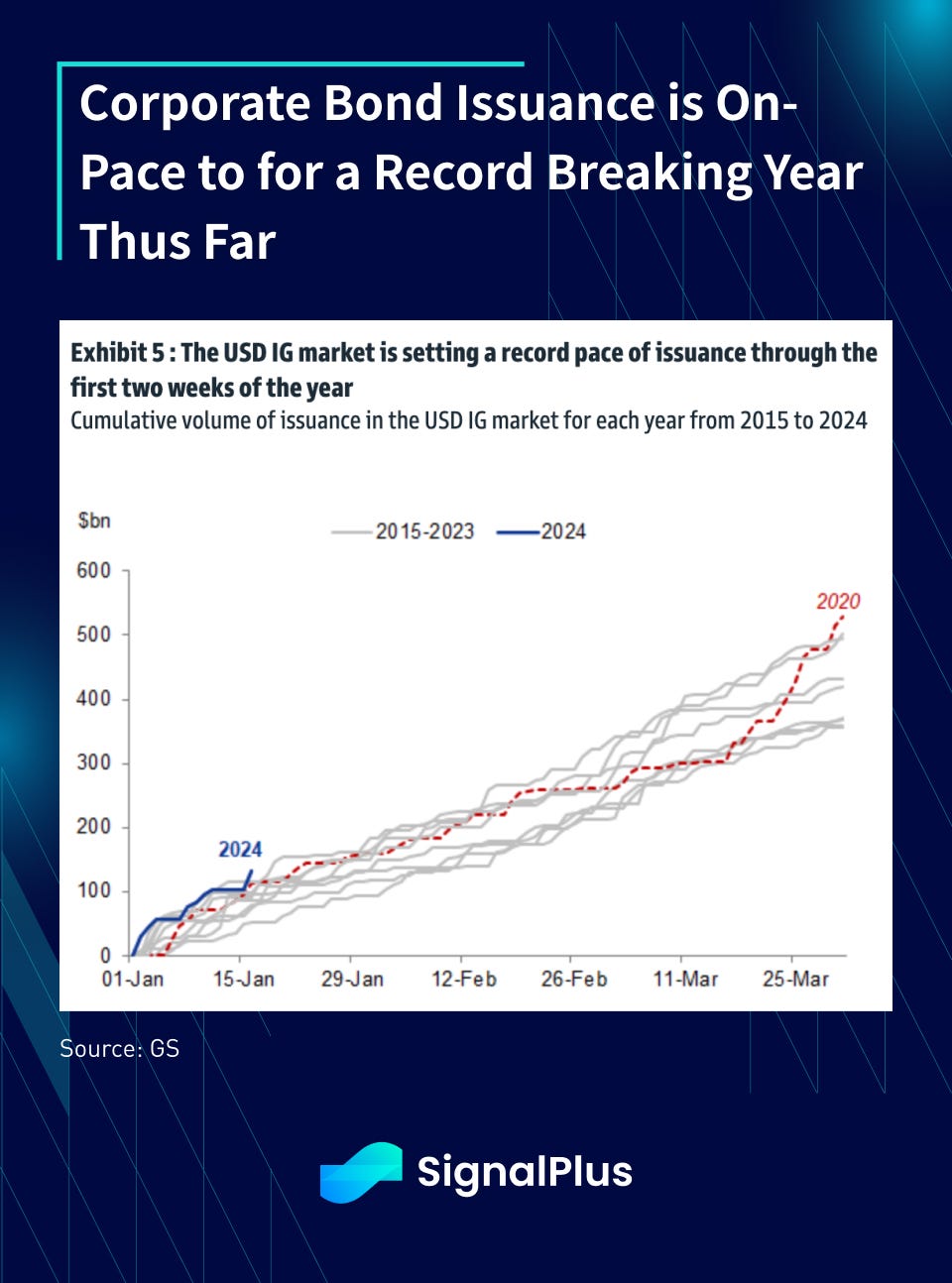

After a messy recalibration of front-end yields yesterday, it was the long-end’s turn for repricing on the back of strong housing figures, a 1-year low in initial claims, and supply capitulation across both Europe and US markets. Spain and France saw tepid demand for their latest bond offerings, while the duration weight of ~$35bln (WTD) in US IG corporate and SSA (Supras & Sovereigns) issuance took long end yields by about 6bp on the day.

Markets were initially caught off-guard with a big drop in initial claims to 187k (vs 202k), the lowest print in over a year and a number that would go into BLS reference calculations for NFP. Data followed suit with a better than expected print in housing starts and permit data, showing continued demand for housing over the start of the new year, thanks in part to the drop in mortgage rates.

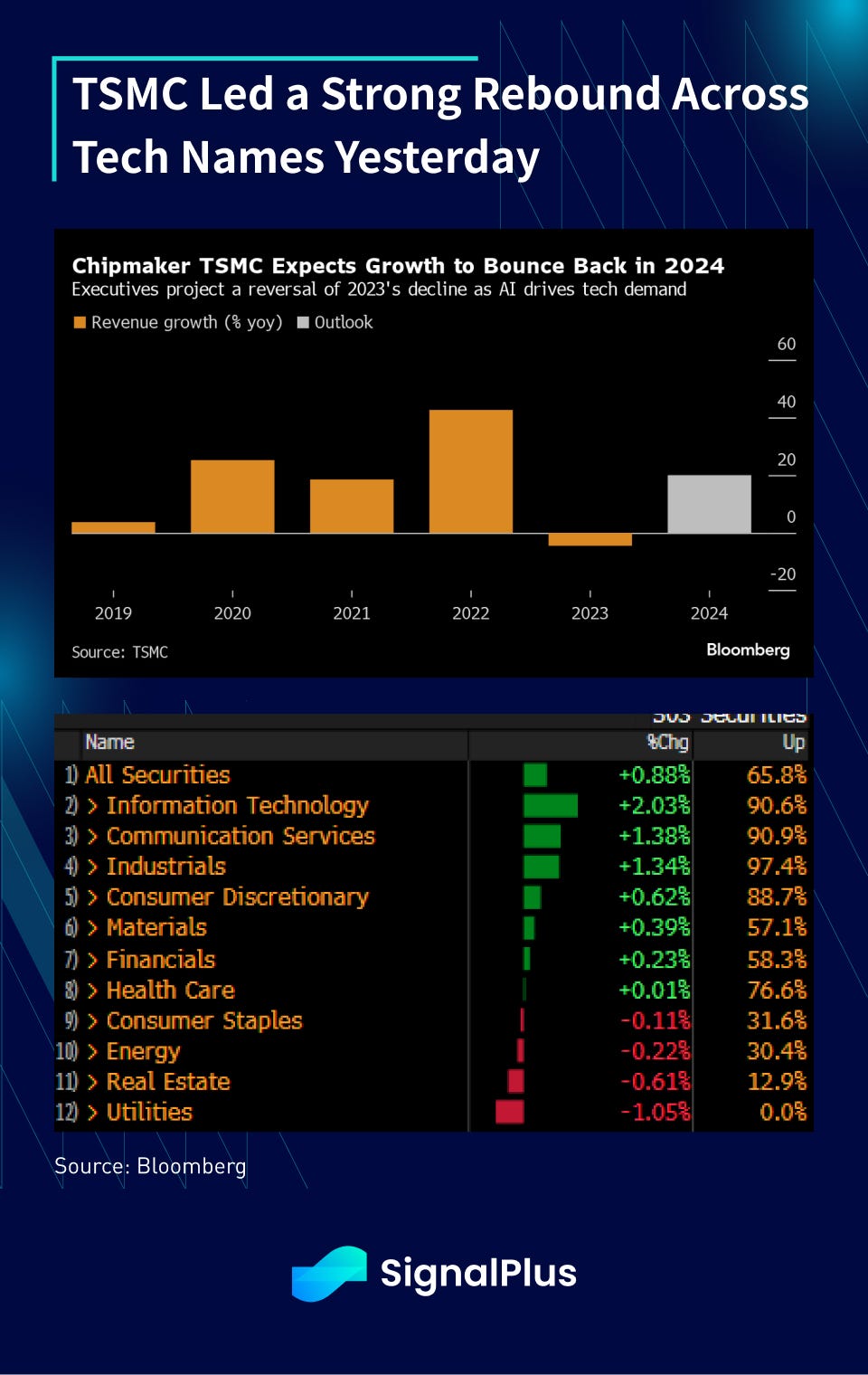

Equities enjoyed a healthy bounce led by technology stocks, as TSMC jolted the Philly Semiconductor Index higher as the chip-bellwether expects a return to “healthy growth” in 2024. The company is expecting FY2024 revenues to jump by 20%, and is budgeting capital spending of $28 to $32bln to account for global expansion plans to Japan, Arizona, and Germany.

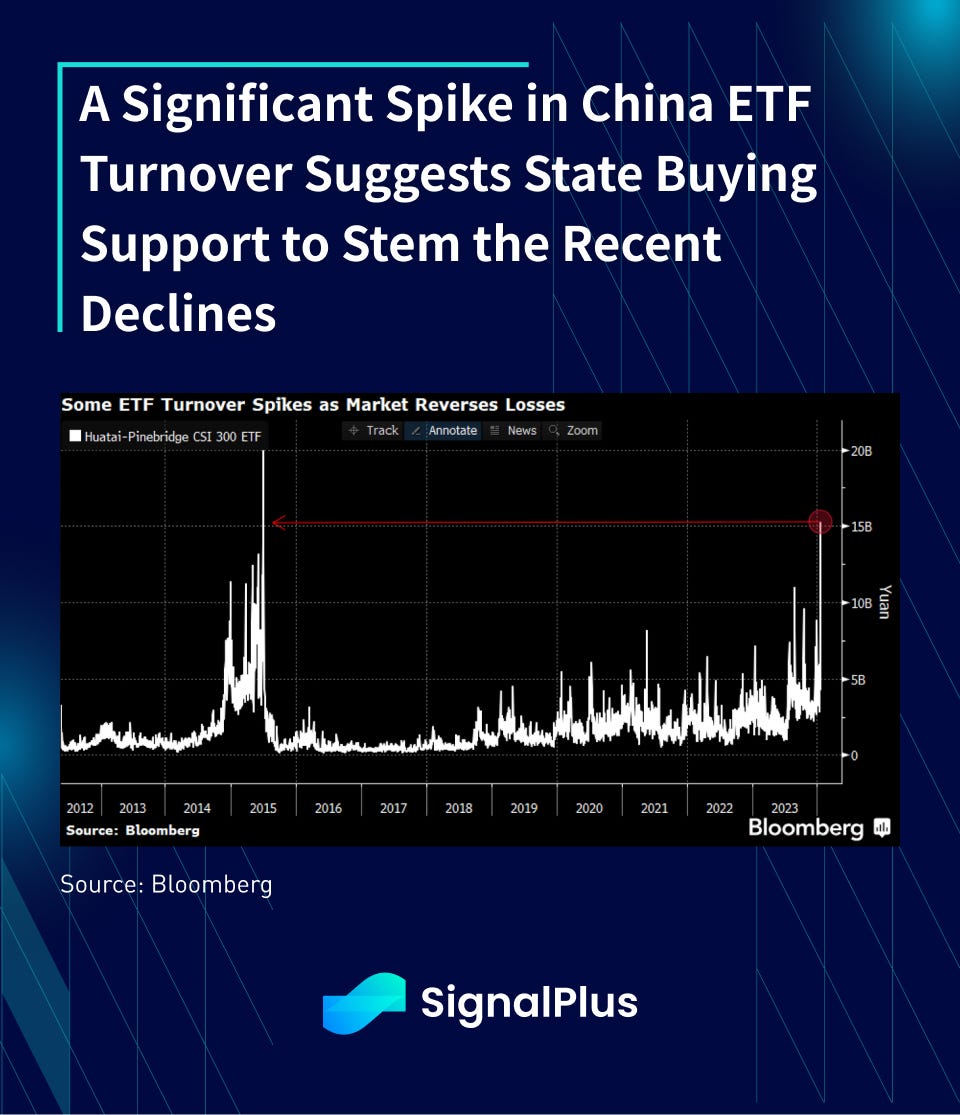

Furthermore, Chinese equity indices rebounded late yesterday afternoon, as some large-sized ETFs saw significant trading turnover, leading to speculation that state funds are coming in with some buying support to stem the recent slides. The traded value of a number of Chinese ETFs saw the biggest strike in volume since 2015 (!!), coinciding with a ~3% reversal in the CSI 300 benchmark (from -1.8% to +1.4%).

In crypto, prices have come off a fair bit since the ETF launch as the GBTC outflows continued, and some of the initial excitement from the approvals have waned. A reversal of the fund’s discount (back down to -0.956%) also suggests the dominance of some short-term selling pressures.

On the positive, the oral arguments given on Jan 17 on the Coinbase vs SEC case appears to have been favourable for the former based on some early options. Early comments suggested that the case Judge was exceptionally prepared and knowledgeable about the relevant issues, drafting over 14 pages for the hearing and is well-versed in crypto terminology and technology. Coinbase presented strong arguments that crypto assets traded on its platform do not satisfy the elements of the Howey test for investment contracts, and there appeared to be a general consensus that tokens are not “in and of themselves securities”.

However, it also didn’t appear that the Judge Failla was willing to dismiss the case purely on ‘Major Questions Doctrine’ (issues of major importance should be made by Congress, not agencies like the SEC), so it’s still possible that the case will go forward to discovery, which will take many more months to work out.

In short, the case appears to be heading in Coinbase’s (and crypto’s) favour in terms of another win versus the SEC, but it’s likely going to drag on for many more months and longer than many might have hoped.

(Please note that all of this is pure personal opinion only and should not be treated as advice of any sort!)

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments