Traders uauslly tend to use a common set of terms to describe the varying levels of an option. The terms they use are time until expiration, time value, intrinsic value, and moneyness.

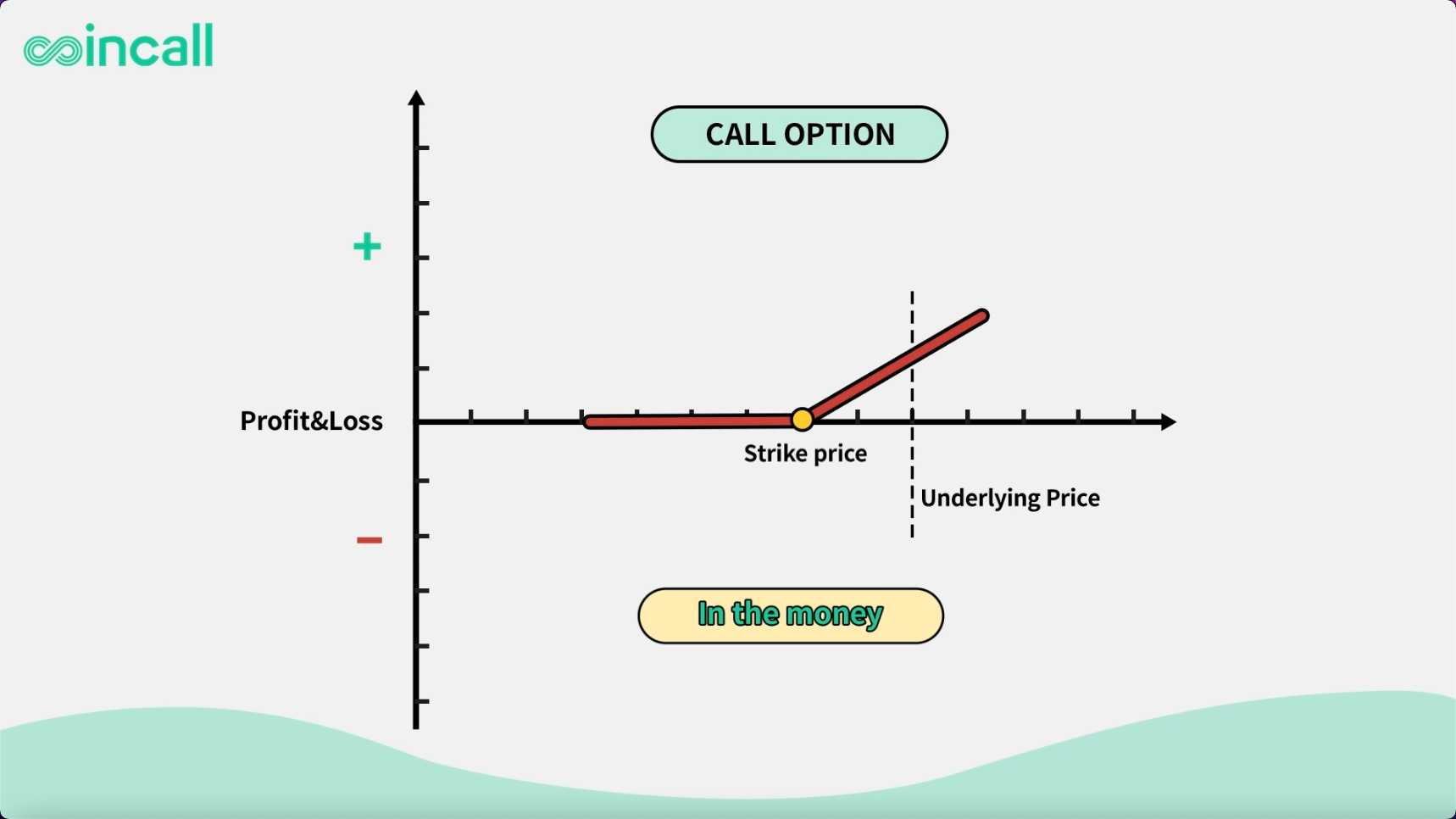

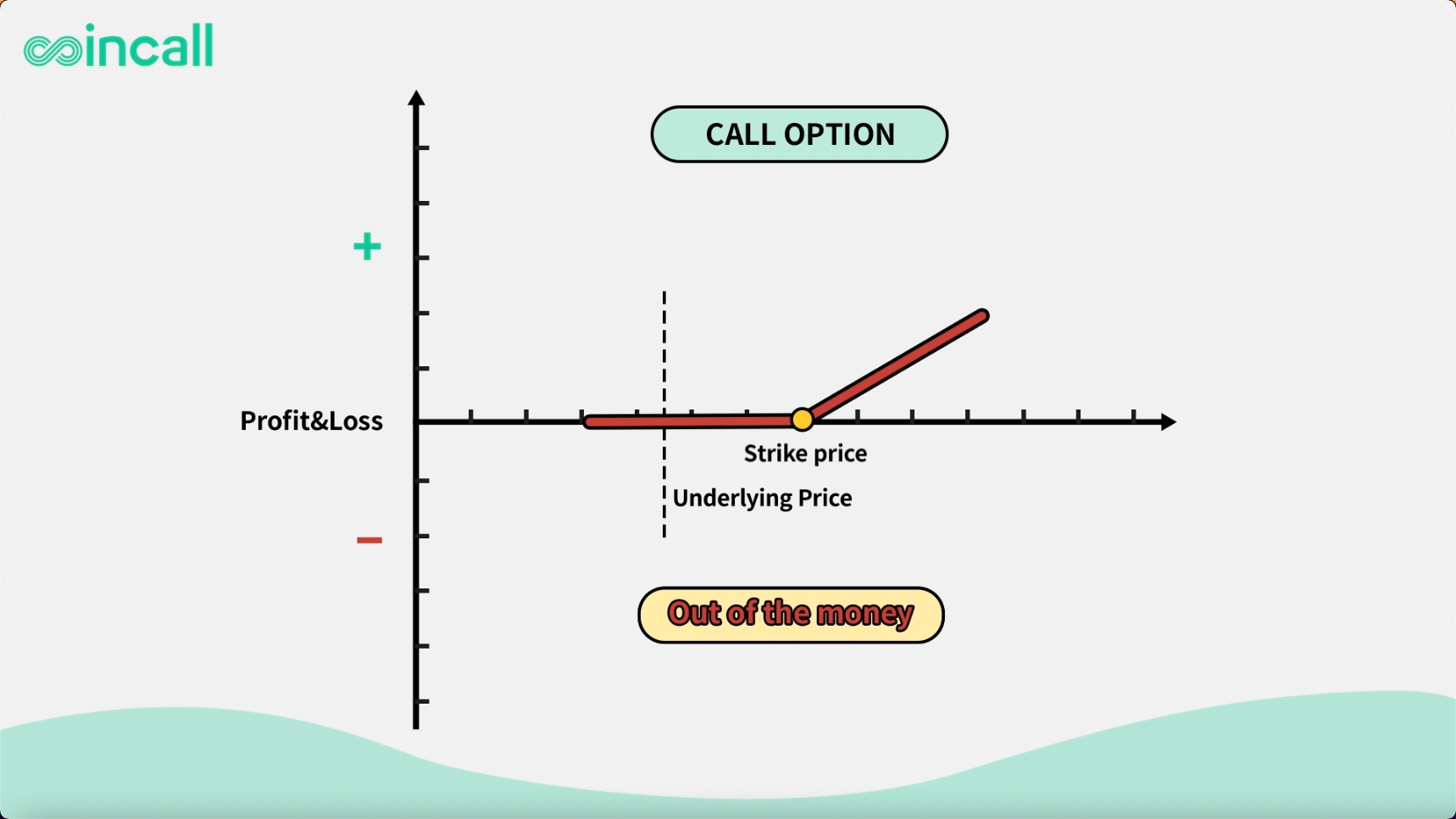

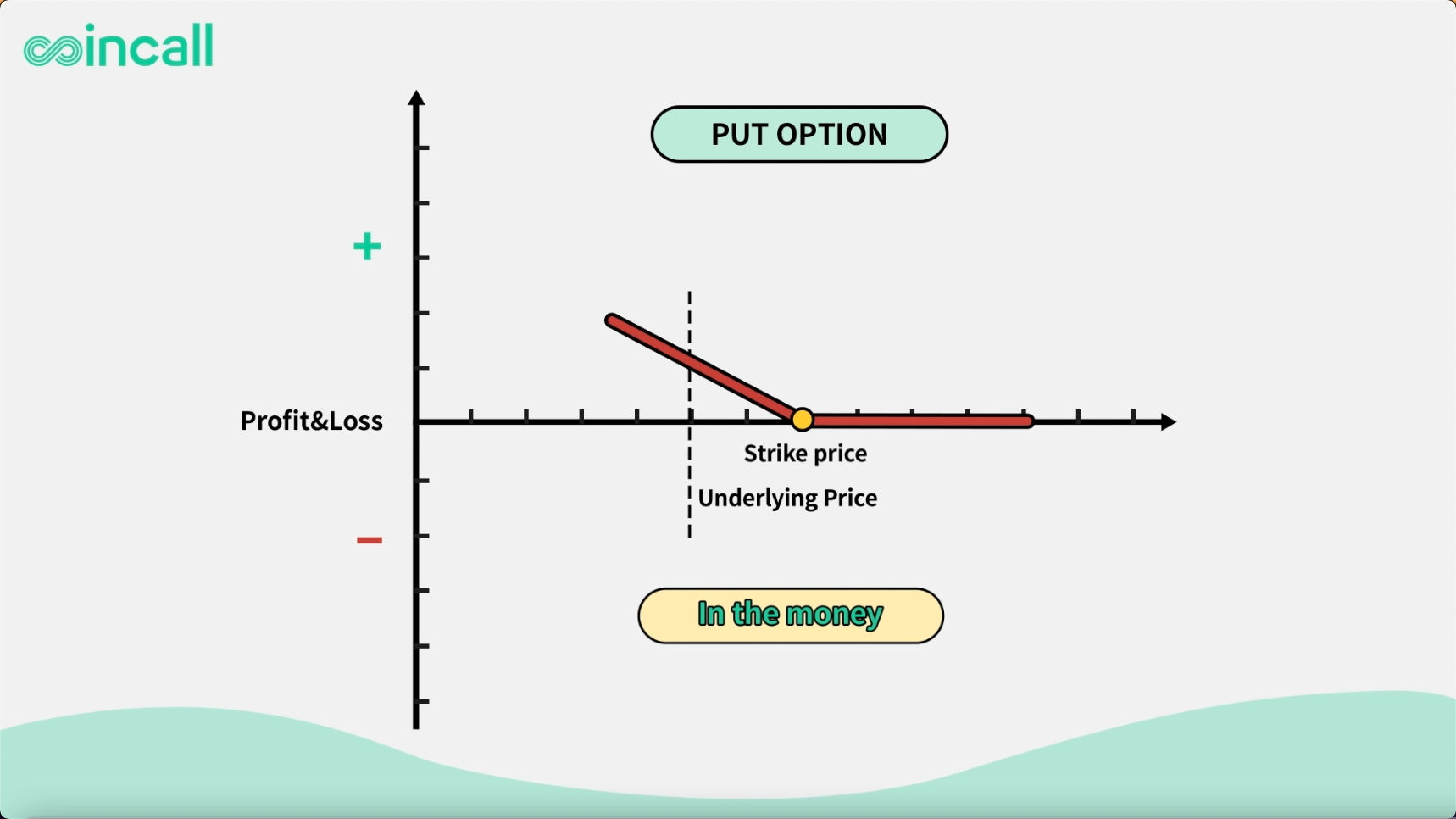

Moneyness is a term to describe whether an option is either “in the money”, “out of the money”, or “at the money”.

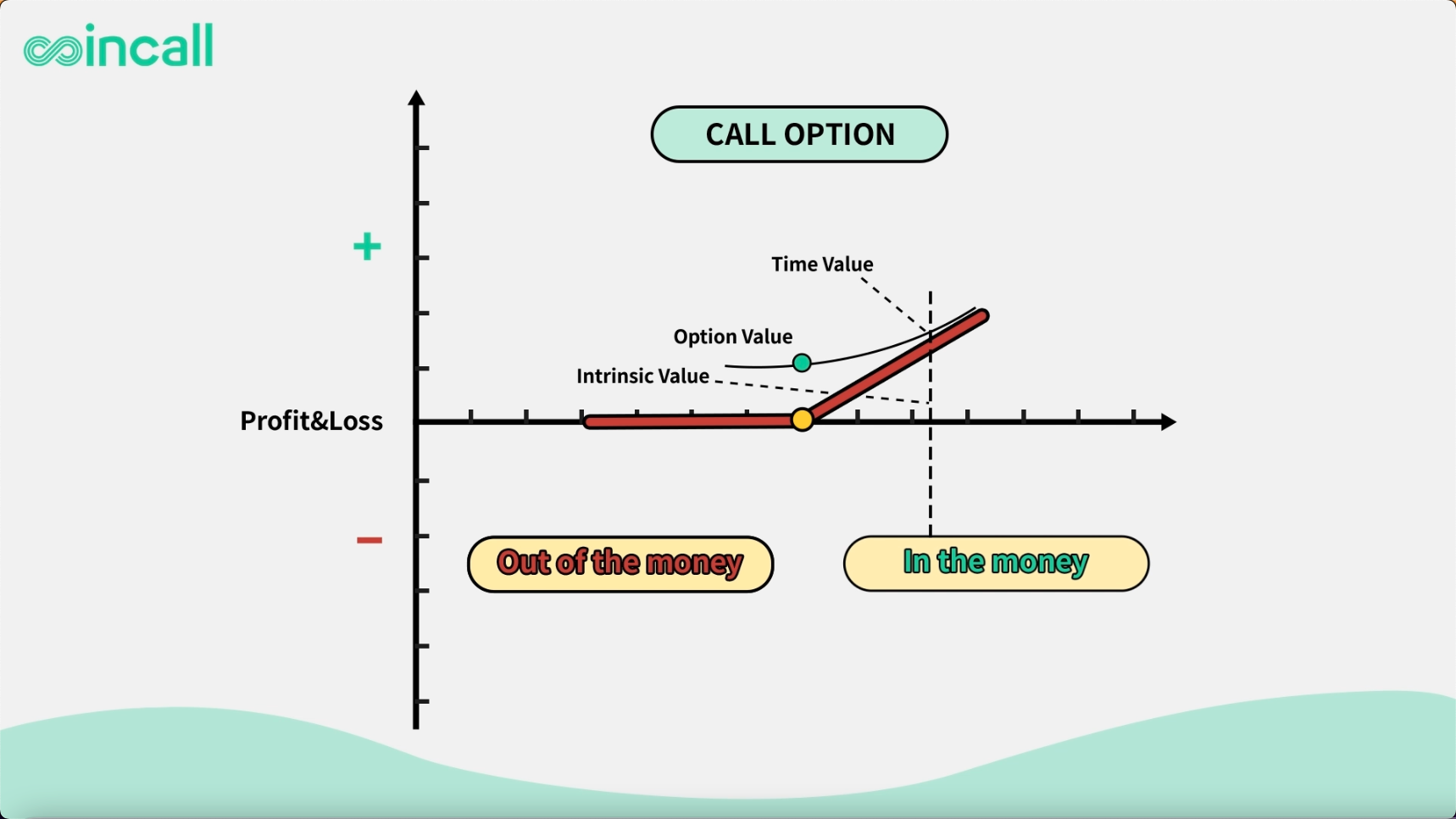

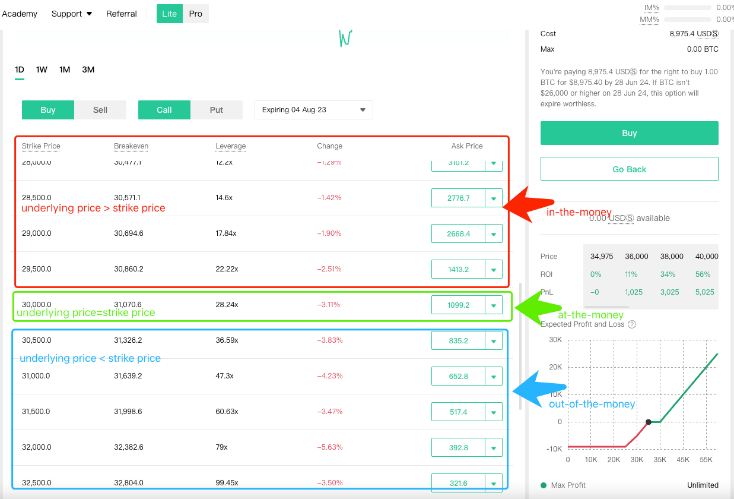

A call option is said to be “in the money” when the underlying price is above the strike price. A call option is “out of the money” when the underlying is below the strike price.

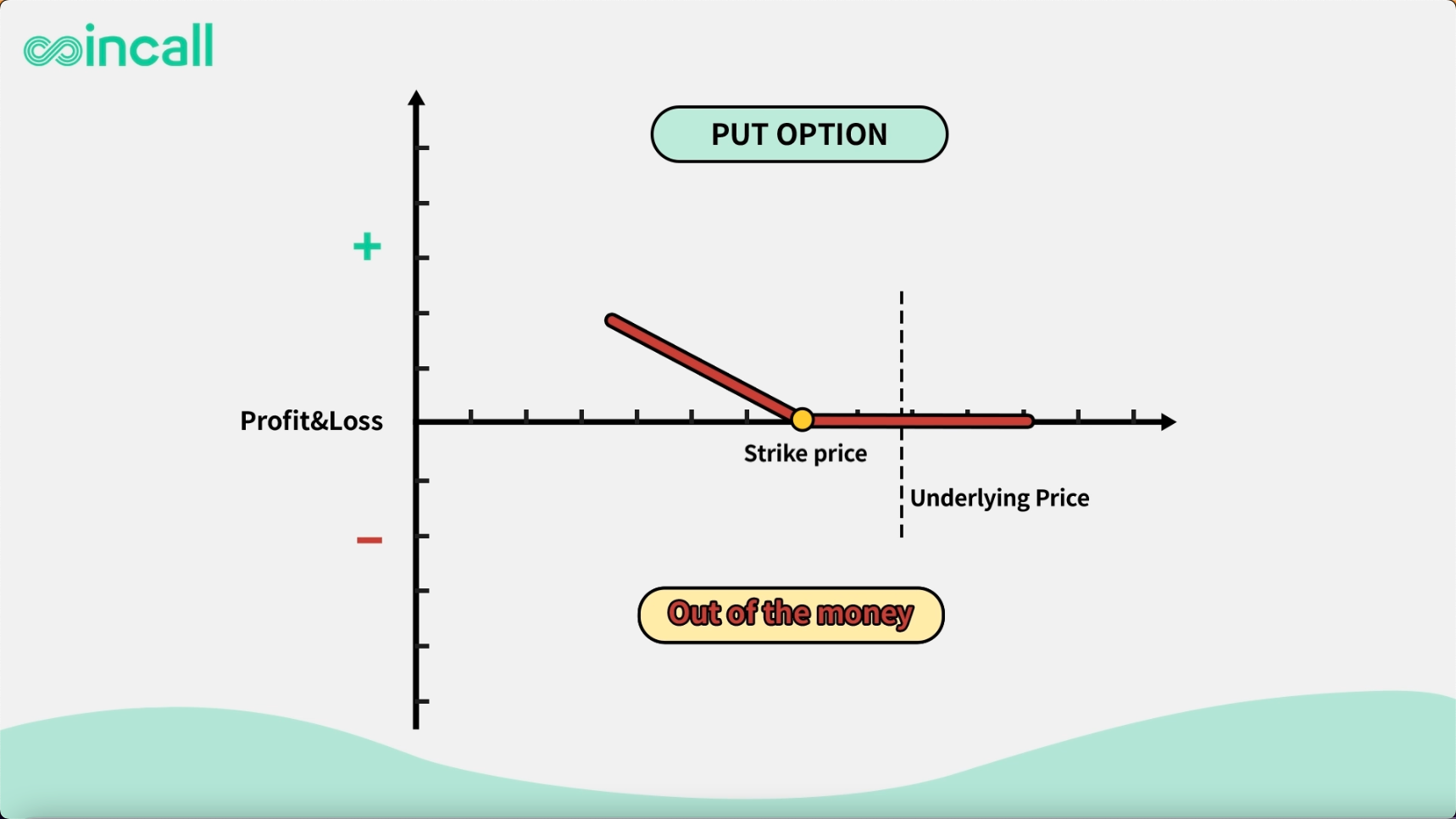

For a put option, the contract is said to be “in the money” when the underlying price is below the strike price, and “out of the money” when it is above the strike price.

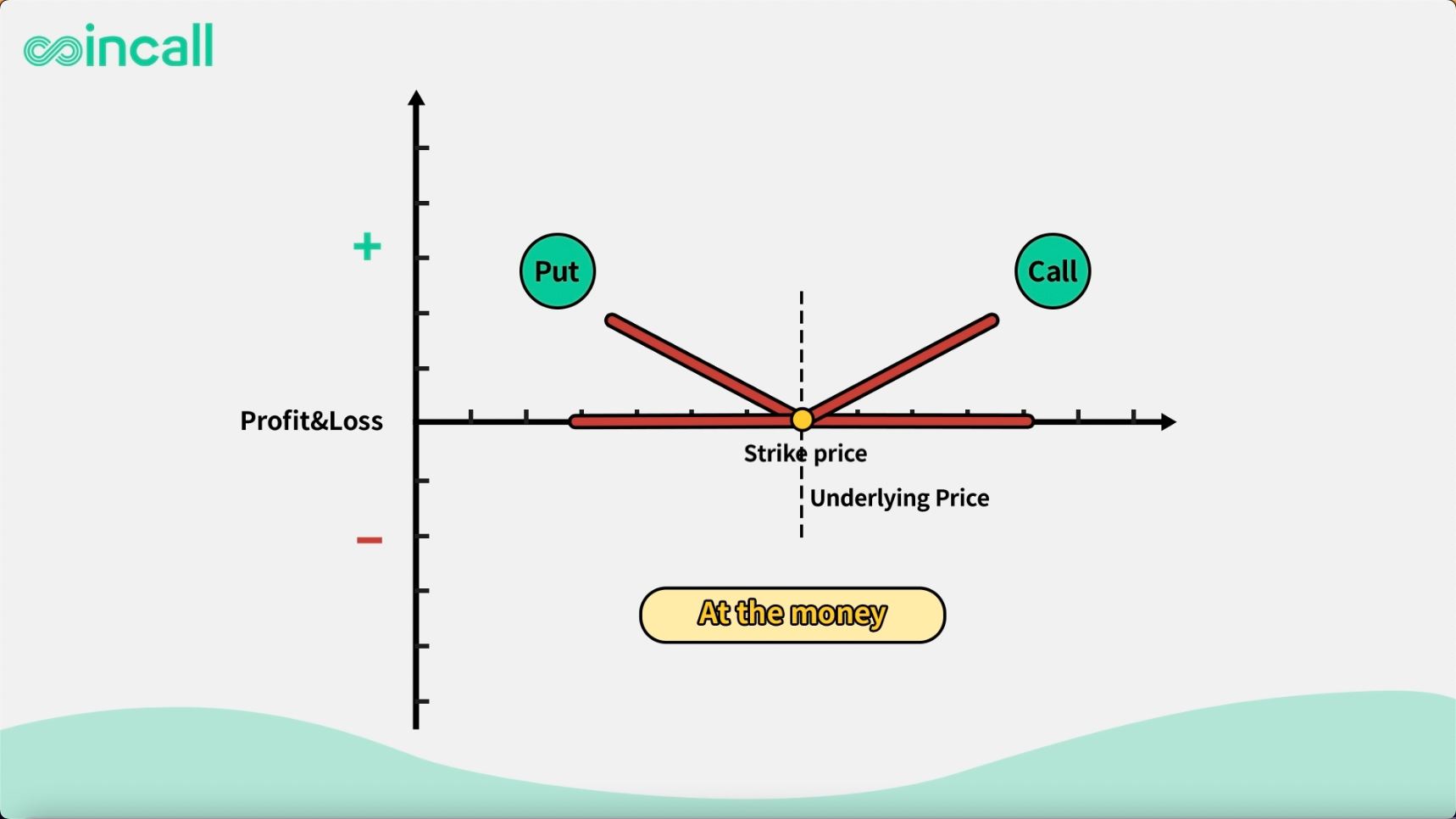

The term “at the money” refers to the strike that is closest to the underlying.

When this happens both the call and the put option will be “at the money” at the same time.

The terms “in the money” and “out of the money” refer to the option itself and do not represent the profitability of your trade, nor does it depend on whether you have bought or written the option.

When an option is in the money, it is said to have intrinsic value, and when the contract is out of the money it has no intrinsic value.

When an option expires out of the money, traders will say that it has “expired worthless”.

Intrinsic value is the value of the option if it expired at this moment.

Up to this point we described the value of an option at the point of expiration, but what is the value of the option before expiration?

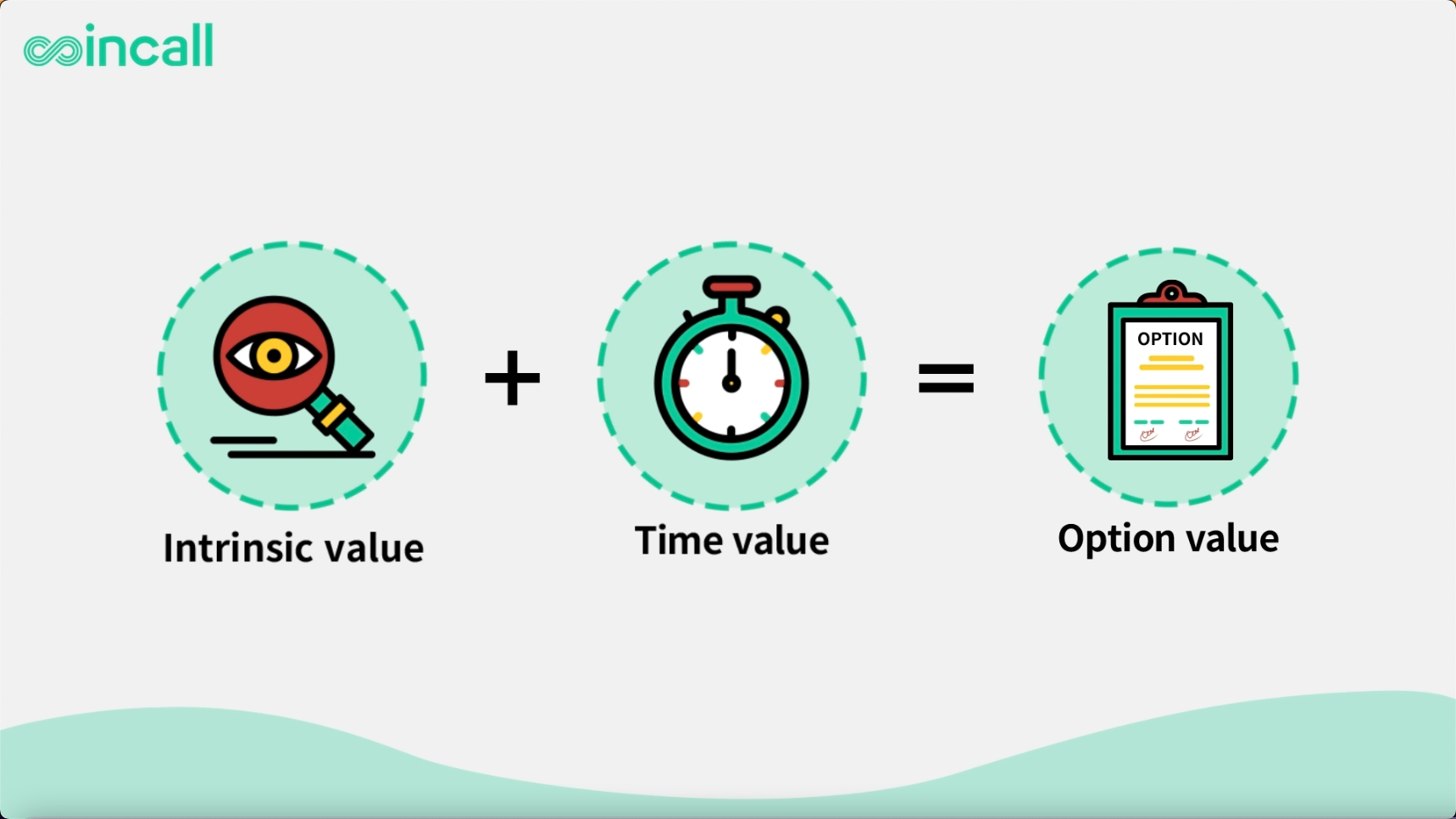

The value of an option is comprised of two parts, the intrinsic value and the time value. When added together, they give you the “option value”.

When an option expires, the time value would be zero. At this point the option value is equal to the intrinsic value.

Let’s look at an example when the option has time value greater than zero.

Suppose a call option will expire in one month. Here the option value will be higher than the intrinsic value.

Even as the underlying price moves around, the option value will still be greater than the intrinsic value, and that difference is the time value.

As time moves towards expiration, the time value shrinks or decays.

The time value of an option (before its expiration date) will always be greatest when the option is at the money.

You can see the entire option value will always be greater than the intrinsic value until it reaches expiration.

Explore Coincall’s product page for buying call options expiring on August 4. At a hypothetical underlying price of 30,000 on that day, some options are in-the-money, some are out-of-the-money, and one is at-the-money.

There you have it

For more information regarding available options, visit Coincall’s product pages.

Comments