As we enter the first week of December 2023, the cryptocurrency market has experienced a notable surge, with Bitcoin (BTC) leading the charge. BTC has impressively broken the $40,000 barrier, reaching highs around $42,000. This movement is primarily BTC-led, as Ethereum (ETH) and most altcoins, despite being in the green, are slightly lagging behind. The spike in BTC’s price is attributed to a combination of factors, including increasing spot demand and a significant amount of short liquidations, amounting to approximately $160M.

Market Sentiment and Trading Dynamics

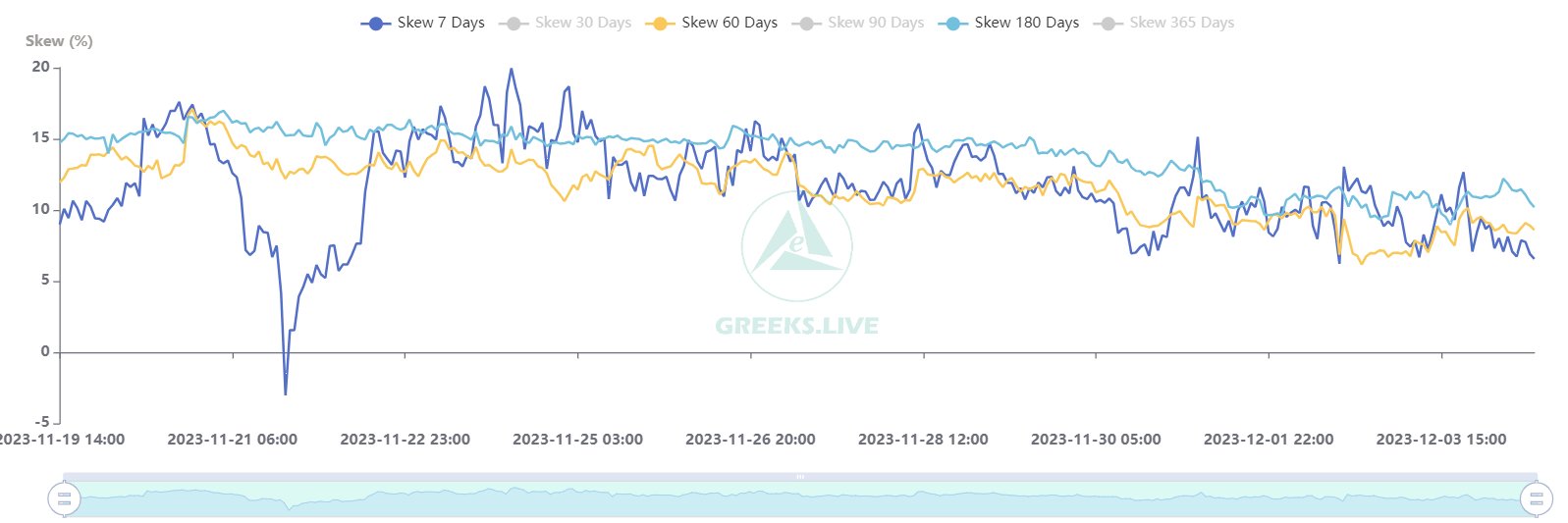

The market sentiment is overwhelmingly bullish, demonstrated by leveraged traders establishing new long positions and a high volume of shorts being liquidated. Despite this bullish trend, there’s an observable caution among traders taking profits, given the elevated volatility and price levels. ATM implied volatility has climbed since November 30th, and the skew continues to show a preference for calls, indicating a sustained bullish sentiment in the options market.

Notable Developments and Impact on the Crypto Sector

Several key developments have shaped the market over the last week:

Major Gains in Crypto and Related Sectors: On December 4th, alongside BTC’s surge past $42,000, there were significant gains in related sectors. Stocks in crypto mining companies like Marathon Digital and Riot Platforms saw large increases, as did Coinbase and other crypto-related stocks.

Anticipation of New Bull Market: Prominent figures in the cryptocurrency industry are now anticipating the onset of a new bull market, with expectations of Bitcoin reaching new all-time highs in 2024, potentially surpassing the $100,000 mark. The upcoming Bitcoin halving event in May 2024 is also a focal point, expected to significantly influence Bitcoin’s price trajectory.

Altcoins and AI Tokens: The altcoin market has seen a surge in trading volumes, especially in AI tokens. Notable examples include Worldcoin (WLD) and Render (RNDR), which dominated trading volumes in November. Solana’s SOL and Avalanche’s AVAX have also seen their prices more than double over the past two months, driven by narratives around AI, layer 1 blockchains, and gaming.

Macro Trends and External Factors

There have been no significant changes in macro trends or external factors since last week. The traditional equity markets have seen moderate movements, with the S&P 500 experiencing several weeks of positive performance. Notably, gold reached a record high of $2,110 per ounce before slightly retreating.

Upcoming Events and Market Watch

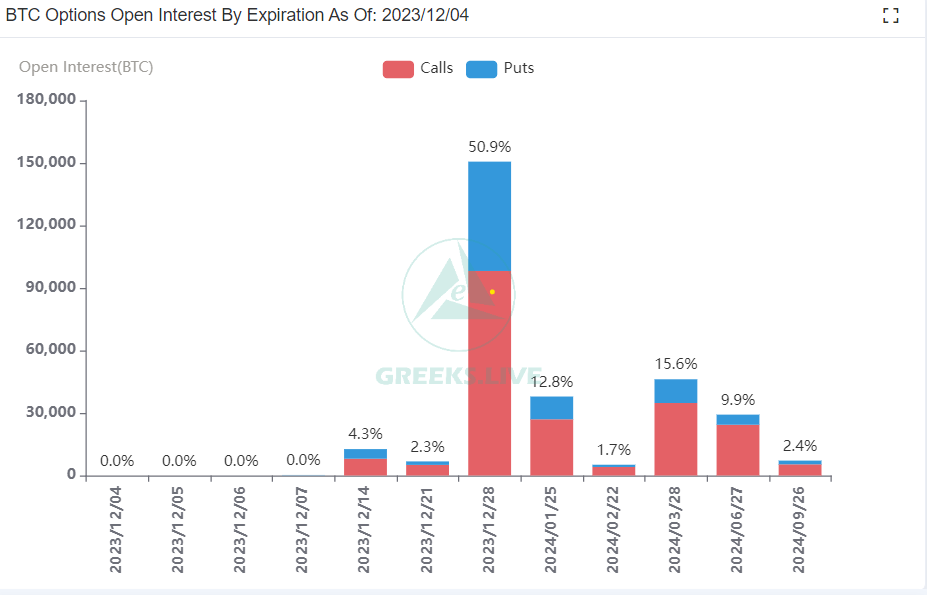

The largest open interest (OI) expiry is still set for December 29th, with most interest and flows in this expiry. Market participants will be closely watching several upcoming data releases.

Other Notable News

Brazil’s largest bank, Itau Unibanco, launched Bitcoin trading.

FTX filed to dismiss IRS claims of owing $24b.

Grayscale hired a managing director for distribution and partnerships.

Digital asset investment products recorded $1.8b in inflows over the last 10 weeks.

Conclusion

This week’s market movement demonstrates a robust and bullish sentiment in the cryptocurrency space, with Bitcoin leading the surge. The market is also closely eyeing upcoming events and potential macroeconomic impacts, maintaining a cautious but optimistic outlook. Investors and traders will continue to monitor these developments as they navigate through the evolving landscape of the cryptocurrency market.

Comments