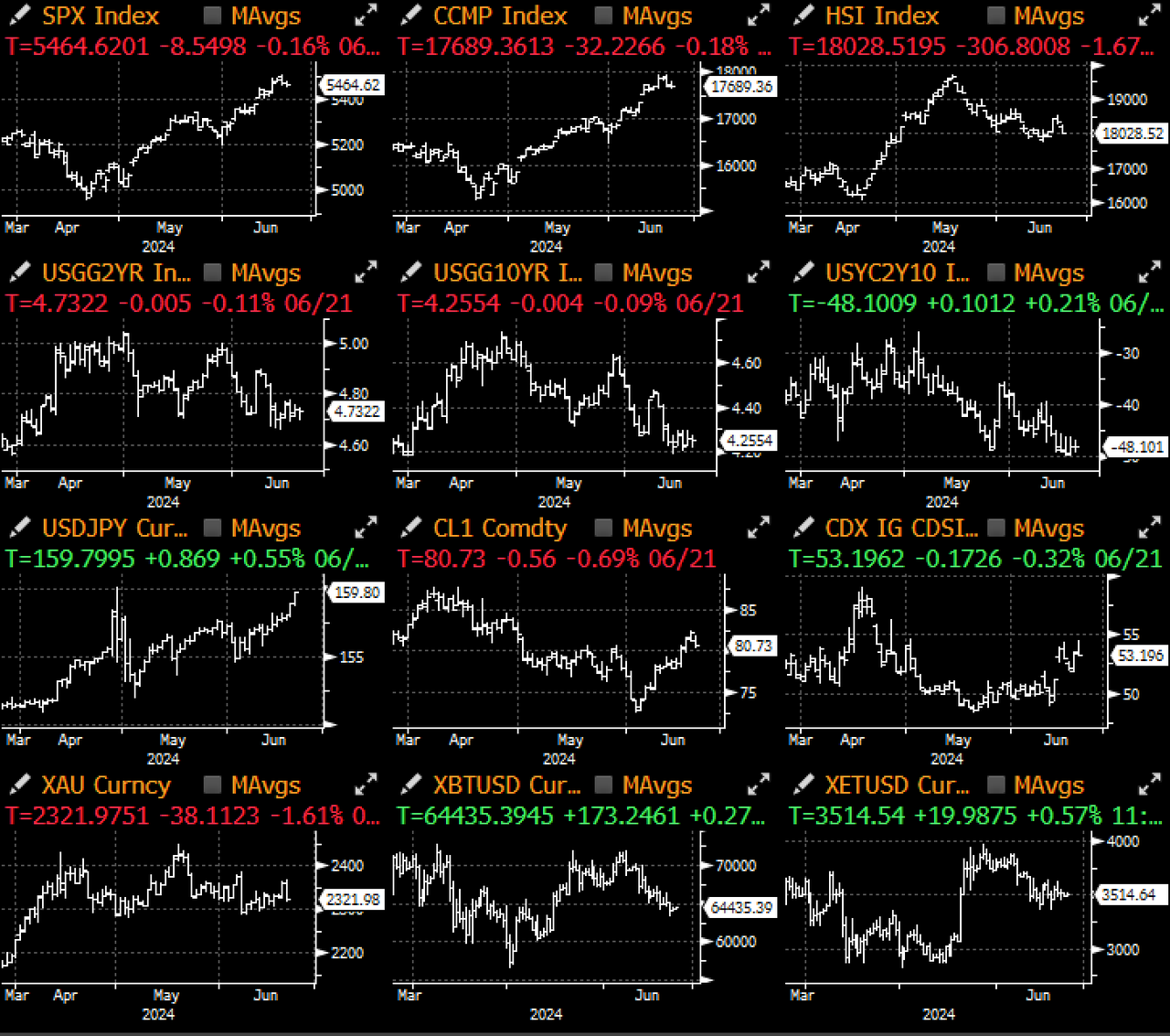

‘Quad-witching’ Friday concluded without making much of a hitch, with SPX staying close to its ATHs with Nvidia taking a short-breather after becoming the most valuable company in the world.

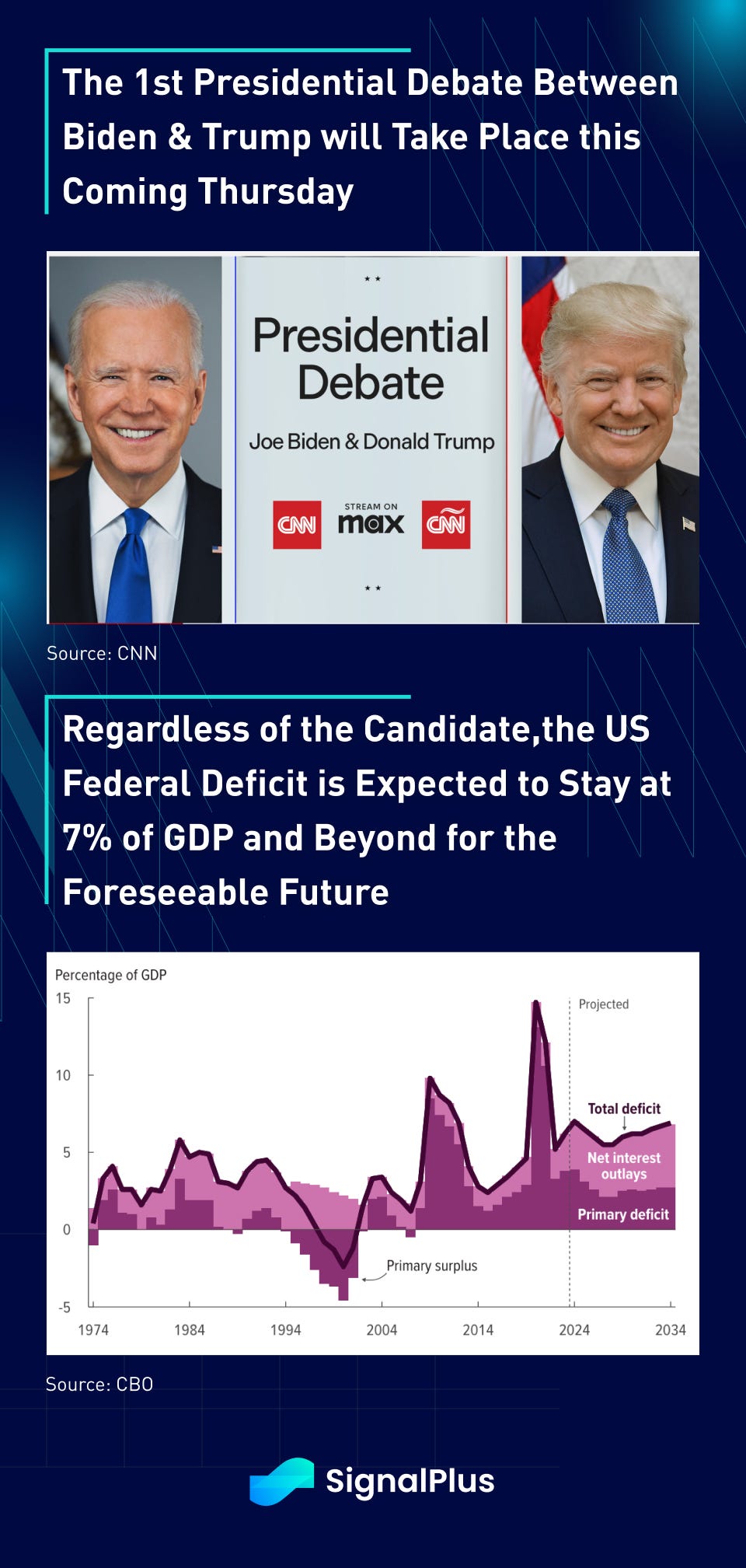

With the mid summer approaching and equity markets continuing to scale the wall of worry, attention shall begin to shift towards politics going forward, with Thursday’s US election coming in as the earliest in history with high stakes. Betting odds have shifted heavily in favour of ex-President Trump following the court-ruling, though both candidates are likely going to keep pursuing an unsustainable expansion in US fiscal policy anyhow. The CBO raised the 2024 deficit to 7%+ of GDP, and are expected to be floored at that level for the foreseeable future.

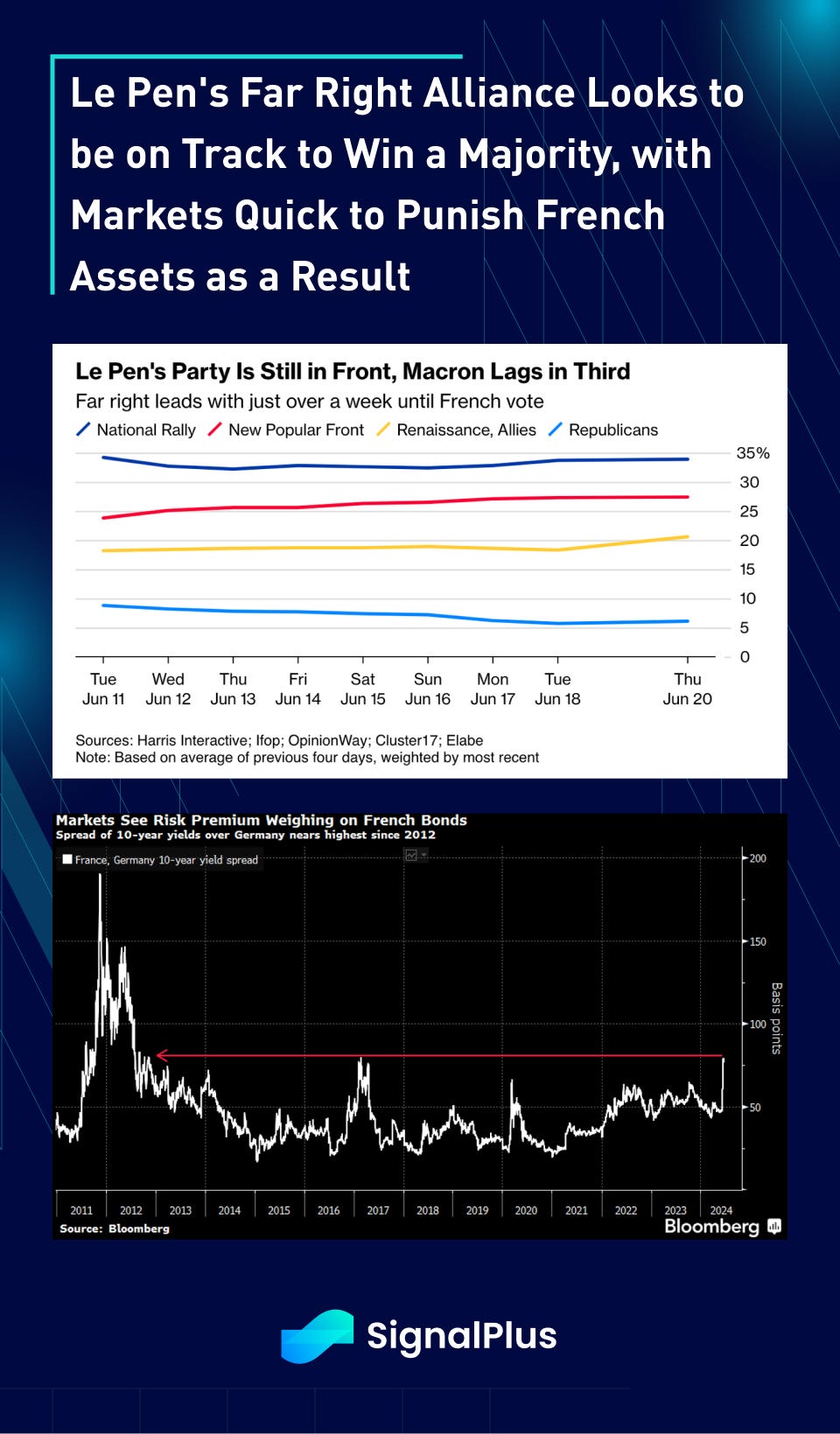

France will see its own election begin on June 29/30, and round-2 taking place on July 6/7. Markets have done its work to punish French assets with OATs widening (cheapening) to the widest levels vs bunds since 2012, with Le Pen’s National Rally party still comfortably in the lead, with a far-right alliance looking to establish a clear majority.

Speaking of punishment, FX-related tensions are starting to mount as well, with China’s offsure Yuan cheapening to the weakest levels this year as the Chinese growth continues to underwhelm, and risk-reversals suggesting that the market is bracing for more weakness to come.

Pressures are growing in the Yen as well, with USDJPY approaching 160 and the street estimating that the MoF only has around $200–300bln of intervention capital left, and BoJ officials still dragging their feet on rate hikes. Markets are braced for a move towards 165 before they expect to see the next wave of BoJ intervention over the next month or two.

While Nikkei continues to hover around its cycle highs, cracks are starting to show in other pocket, as Japan’s Norinchukin bank (‘Nochu’), the nation’s largest agricultural bank with a benemouth US$357bln (JPY 56 trillion) in balance sheet, became the latest casualty of the Fed’s prolonged rate-hikes. Nochu, affectionately known to the Street as Japan’s ‘CLO Whale’, surprised the market as it warned that losses for this fiscal year could exceed US$9.5bln (JPY 1.5 trillion), 3x larger than earlier expected, due to losses from its massive CLO holdings on higher funding rates.

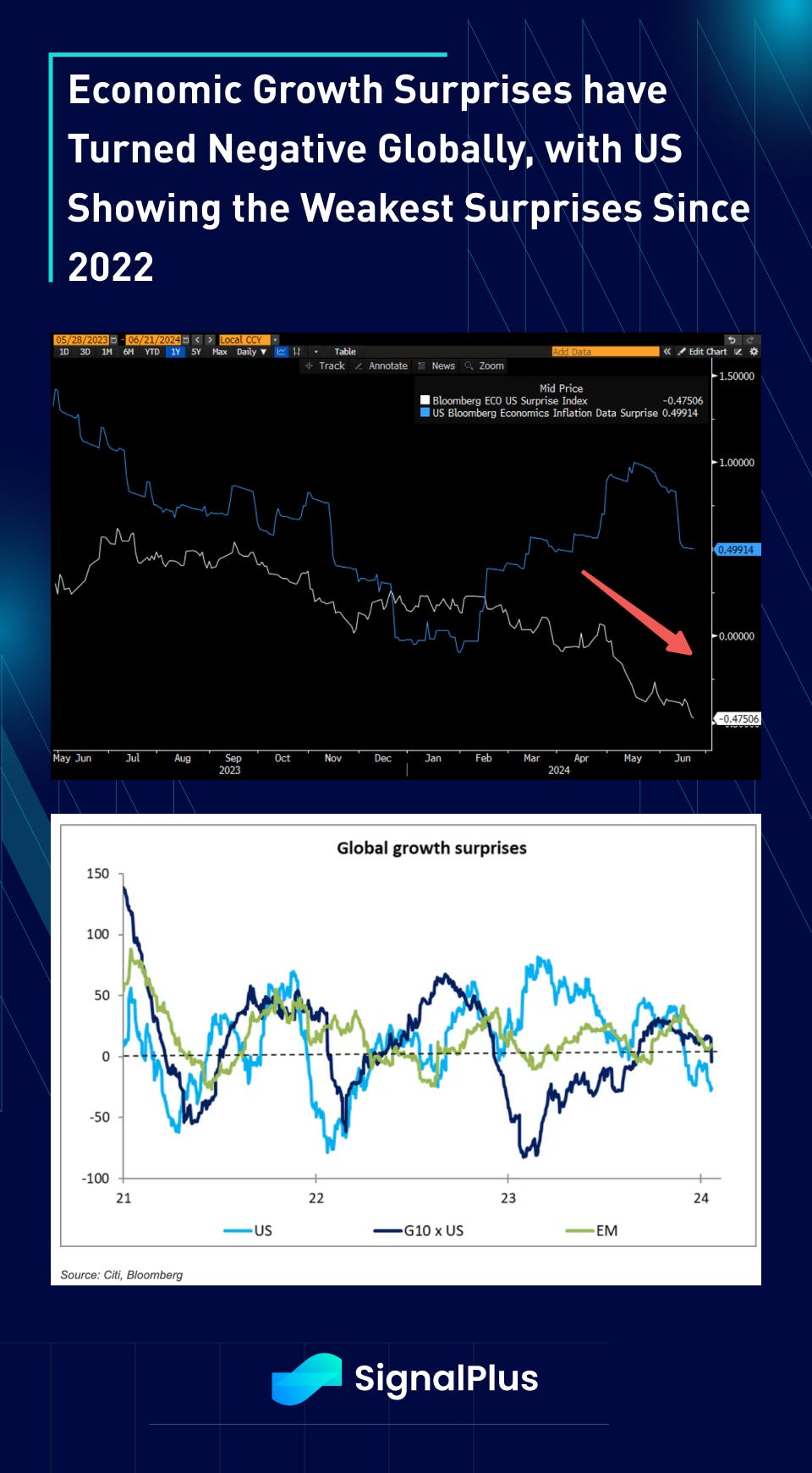

On the economic side, we are seeing further signs that the US is finally slowing down, with US growth surprises trending to the lowest levels since 2022, with the rest of world also joining the US in negative territory.

Furthermore, the teflon US consumer is also finally showing some early signs of capitulation, with credit card delinquency rates rising to the highest levels since 2012, as the pandemic era savings have been fully spent. On the labour front, while the headline growth numbers have been decent, data seem to suggest that a record number of employees are holding multiple ‘full-time’ jobs, which one can read as there is too much demand for labour, or that individuals need to maintain multiple income roles to sustain the escalating cost of living. Our bias is towards the latter camp.

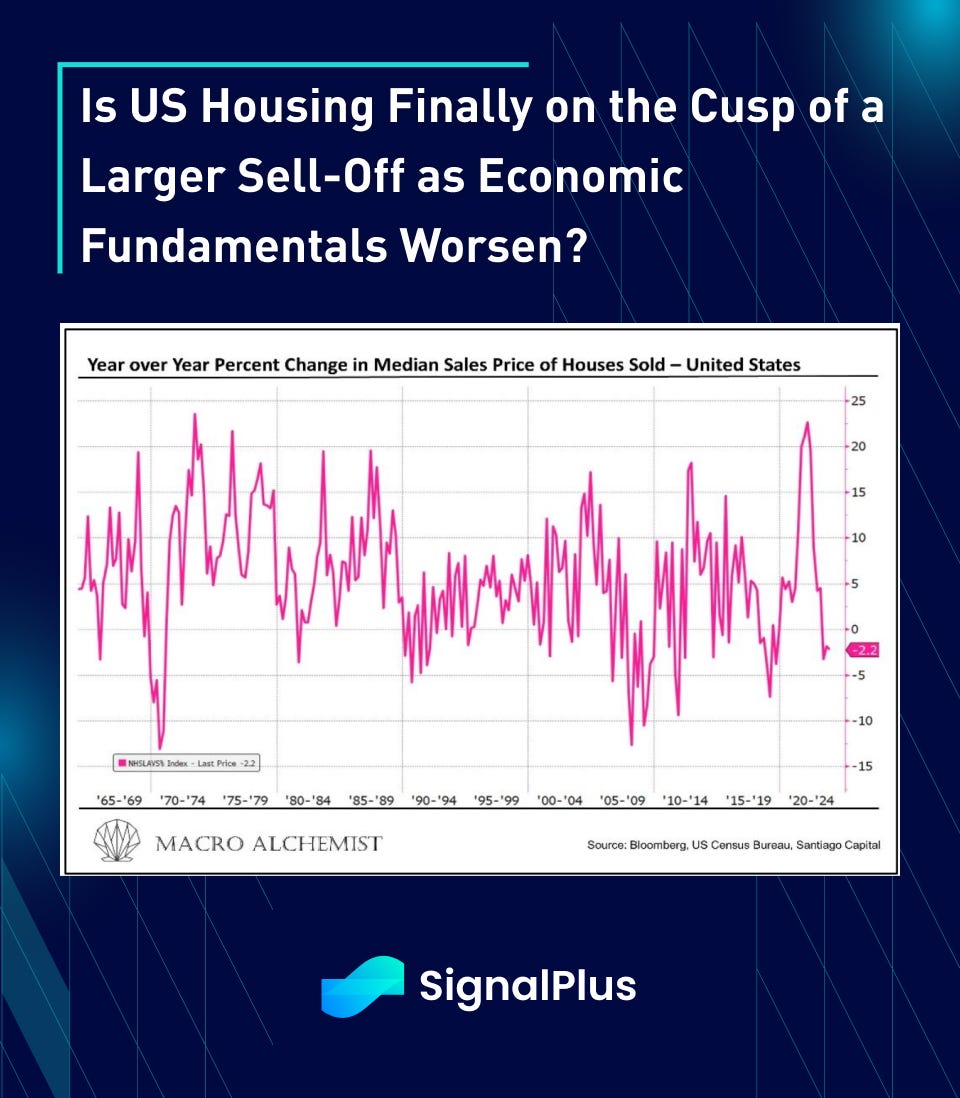

High living costs, a slowing labour market, and expensive mortgage rates are causing US home prices to finally drop YoY, where the earlier price gains were due to low supply stemming from sellers not being able to refi their cheap mortgages towards a new house. Is US residential housing the next shoe to drop, following in the footsteps of its global brethren?

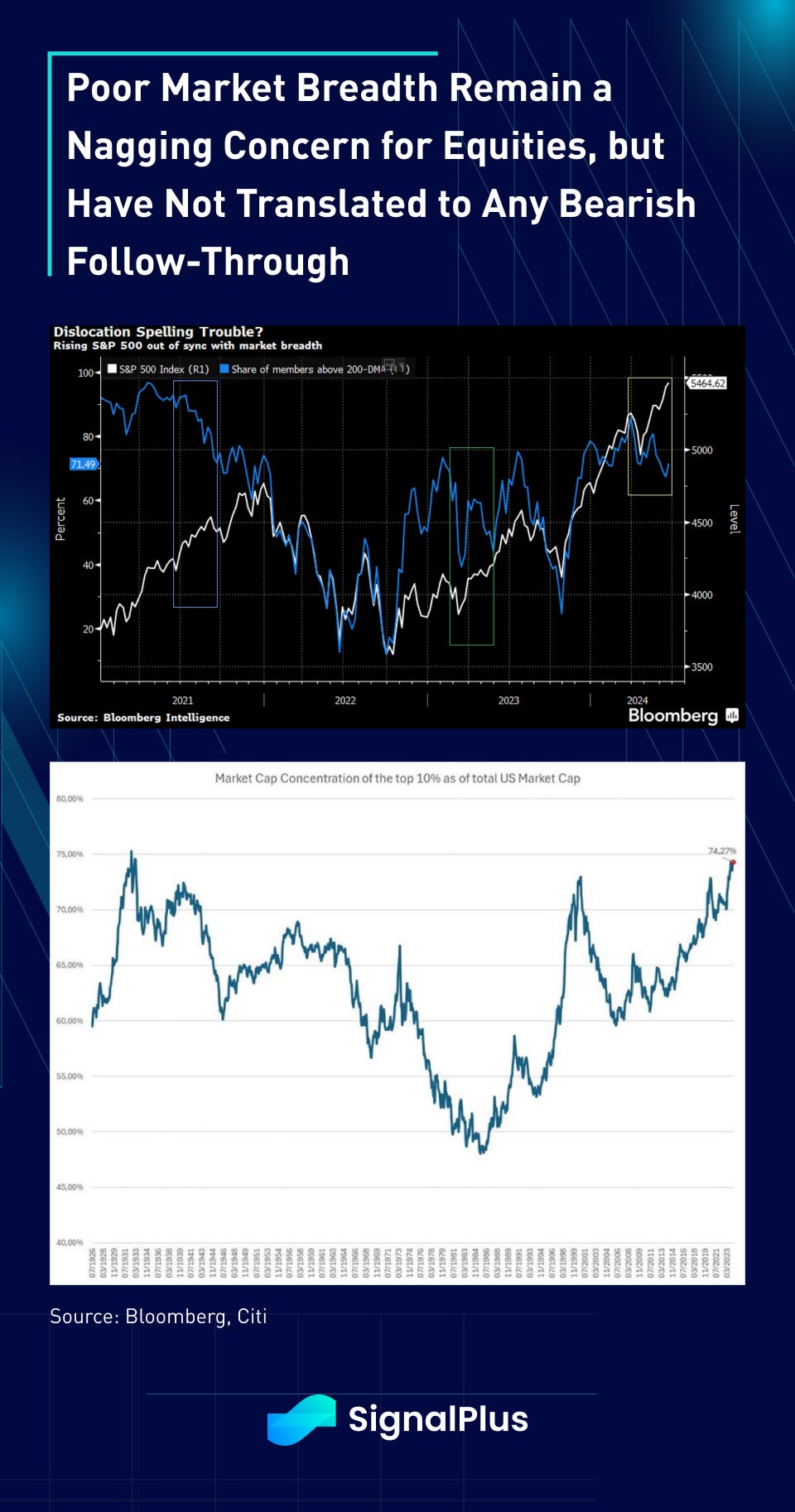

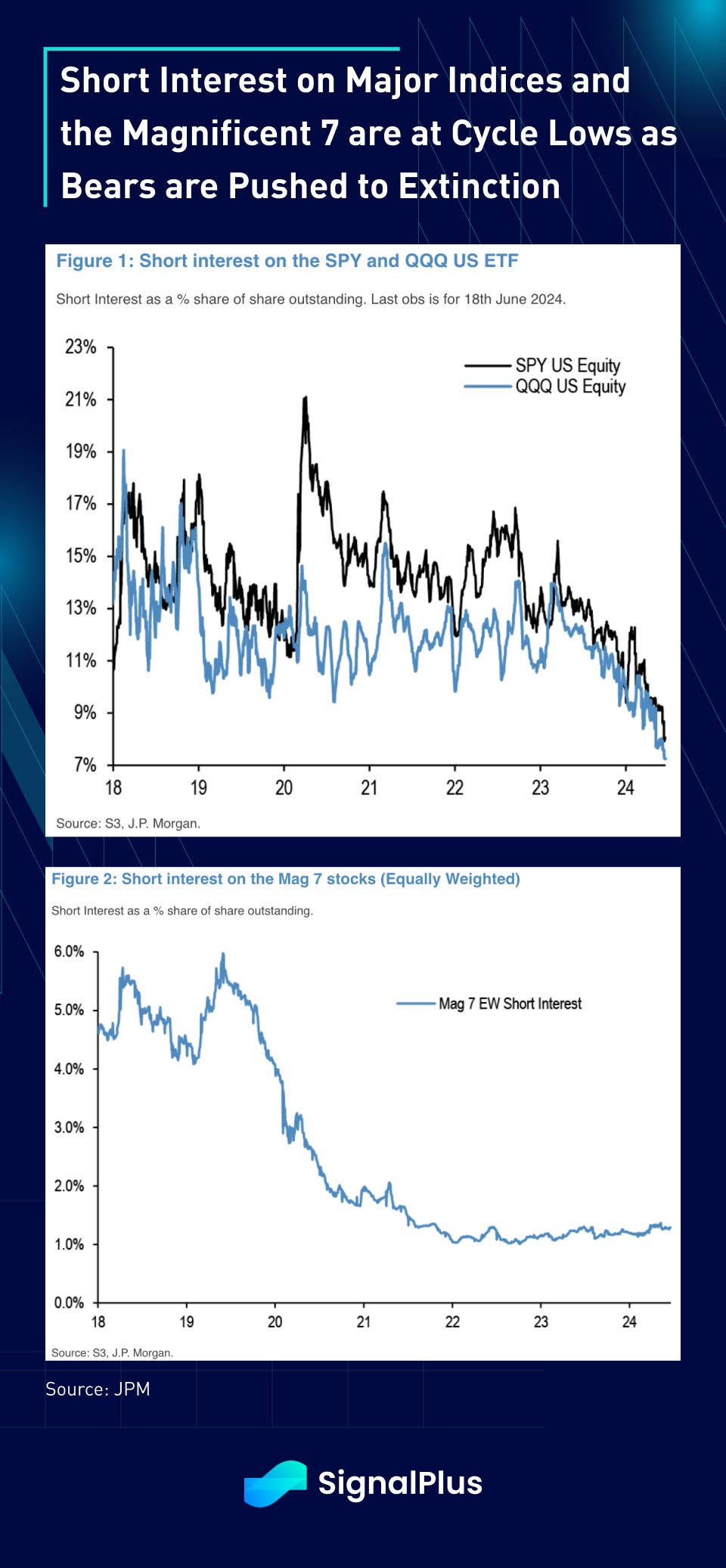

Equities ended Friday in the but it was another robust week all around for the main index. Banking dealers reported continued short-covering all week as the main index refused to budge, with core PCE on Friday to be the biggest data release this week. Thin market breadth and continued narrow leadership remain a persistent thorn for equities, though so far they have not yet translated to any material weakness. Short-sellers continue to be obliterated into extinction, with short interest on the SPX, Nasdaq, and the ‘Magnificent-7’ at multi-year lows. Don’t fight the tape.

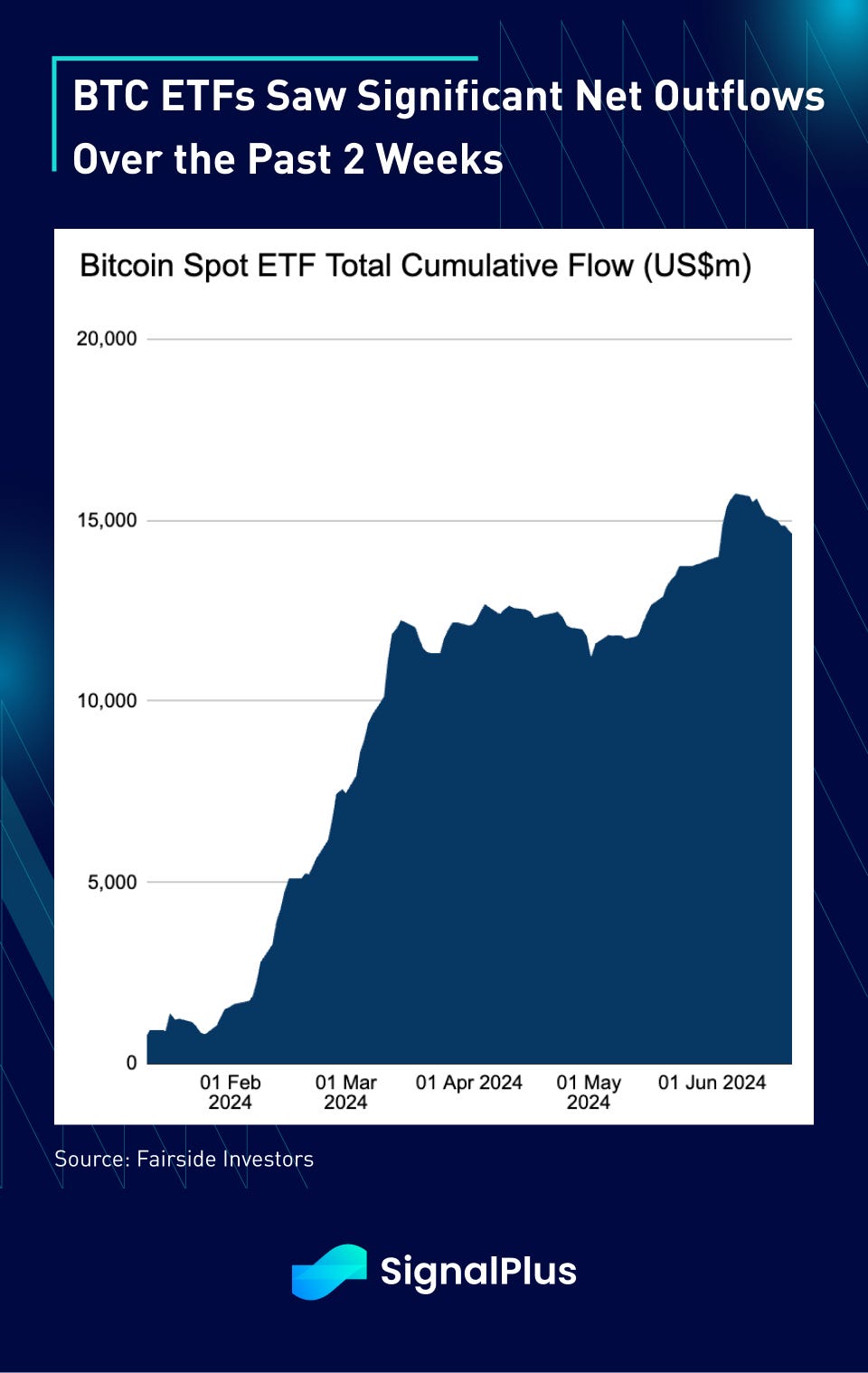

Speaking of poor sentiment, the one asset class that has suffered in the past week was crypto, where a -3% weekly drop on the majors (BTC/ETH) masked a major sell-off in altcoins, with many major names losing -10–15% on the week, and nearly 70% from the recent highs. Significant net outflows for BTC ETFs certainly didn’t help matters either.

While we have long discussed the difference of this cycle, where a rally in majors was unlikely to lead to positive spillovers in altcoins/NFTs, the native market was especially hard hit last week with various airdrop ‘conspiracy’ with reputable DeFi projects. Without going into the nuanced details, many natives had been diligently farming airdrops as the new ‘alpha’ over the past year, but significantly lower-than-expected announced payouts from the likes of zkSync, Layer Zero, Eigenlayer and the likes have shattered confidence in the sector. In fact, the uproar has been so large that it’s leading to a lot of chatter about the airdrop ‘era’ being over. Along with cratering NFTs, memecoins, and Ethereum L1 fees, are we due for another seismic change in the native ecosystem? It certainly has been an interesting year, to say least.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments