Market

Hello! This is the first market analysis article of 2024. I hope you take good care of me this year too.

There is nothing special to add following last week’s analysis. BTC is still trending upward. By protecting the sections that should not be broken, it surpassed 45k at the same time as the CME opened today, showing a new high and a significant rise. Coinbase premiums have also temporarily shown very high premiums and there is a steady premium for every BTC rise.

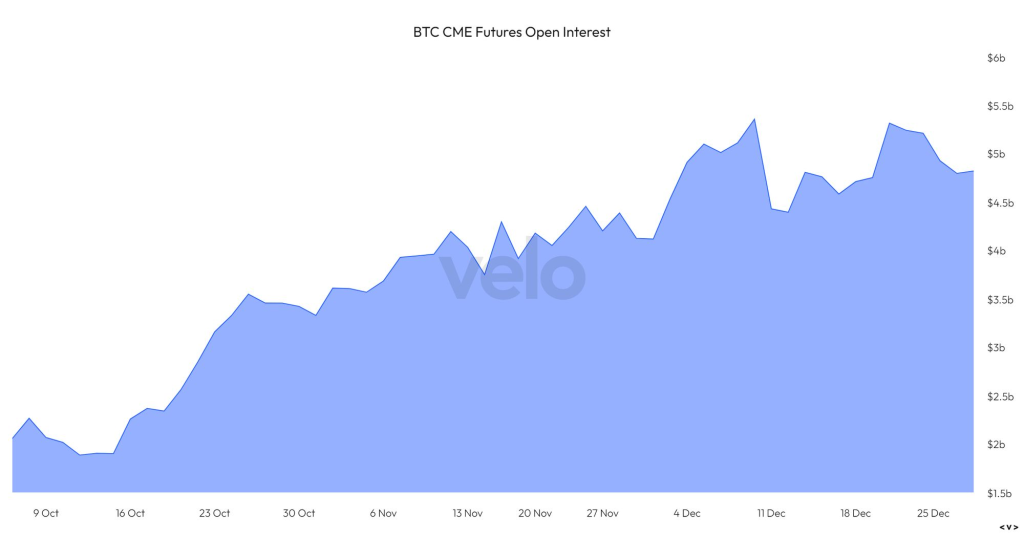

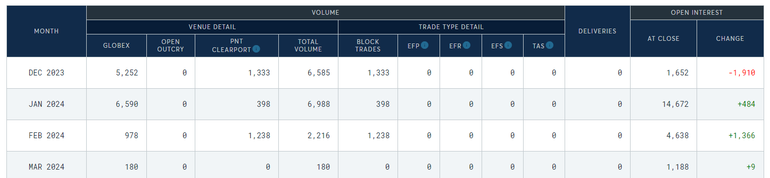

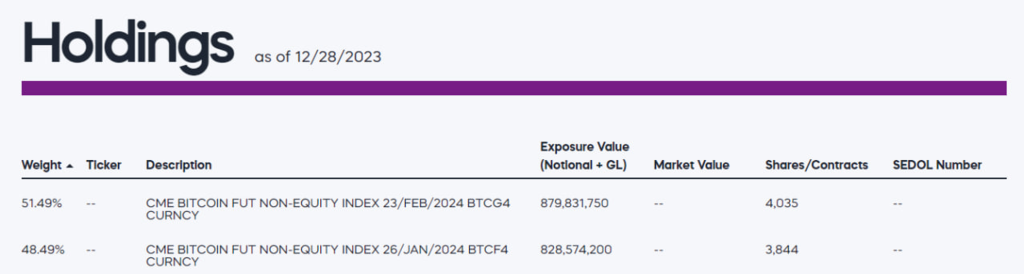

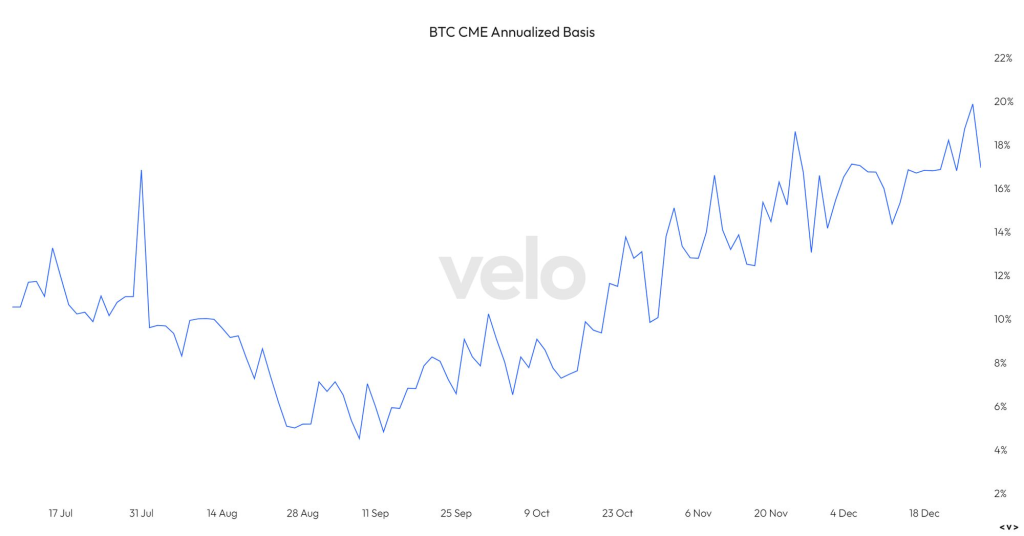

CME has increased its gap since opening and is forming a premium that is very different from the general market price. Prior to the expiration of December futures in the last week of December 2023, most CME futures positions have been rolled over to January and February 2024 futures. There is no significant change in open interest.

CME futures had higher open interest than general market (Binance, Bybit, etc.) futures and actually contributed greatly to the rise in BTC price. That’s why I thought it was very important to track changes to CME positions. My interpretation of the CME position is that TradFi clearly wants BTC exposure. TradFi rolled over most of its futures positions, paying higher premium costs. I decided that there was still excitement in the market about ETF.

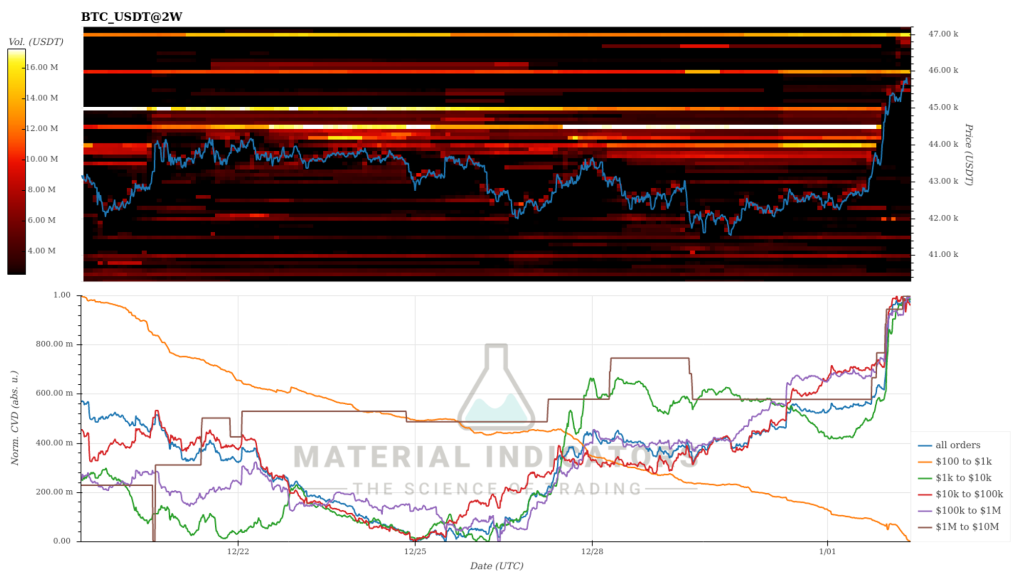

If you look at the red line, the total futures CVD, it has fallen to the point of reversing all previous gains, but the BTC price has shown a defense of 40k. I don’t know exactly what’s happening here, but I think the spot CVD rise since last week has greatly contributed to the defense of the BTC price.

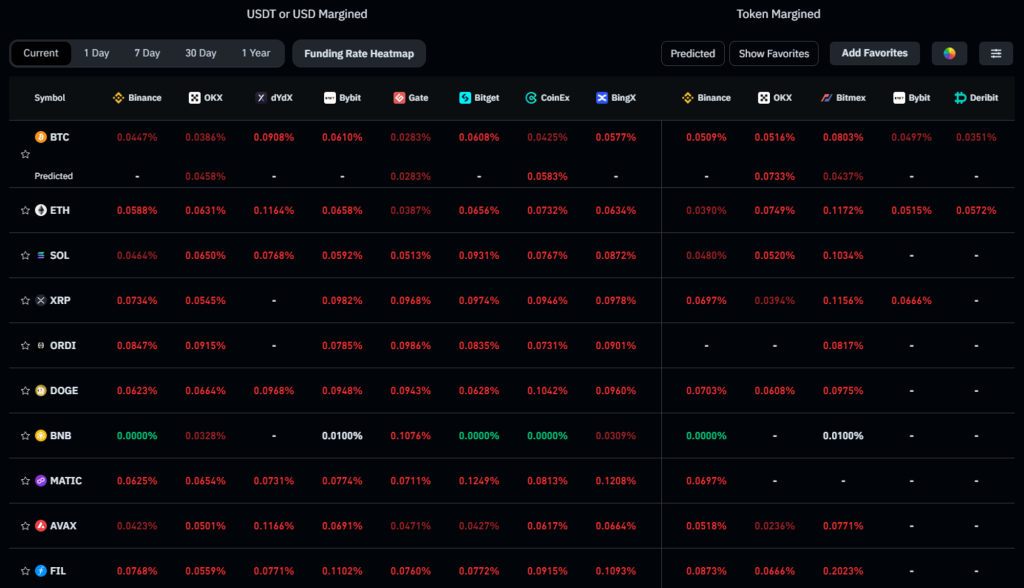

I said in my previous analysis that if the market goes up, it will be close to the last move. Funding is heating up and we are waiting for ETF news. I still maintain the same position. I don’t know if it will be Sell The News or Buy The News, but I don’t care about that. If BTC reaches the target I thought before the ETF announcement, I plan to look at the market conservatively. At this point, option buying and perp are not attractive, so spot trading is recommended.

It will not be an easy two weeks and anything can happen. Always remember to secure your profits!

Volatility

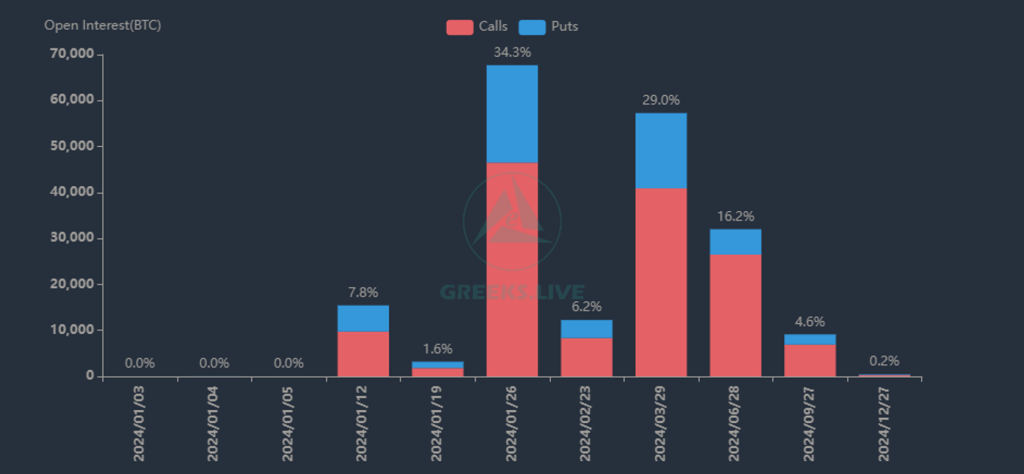

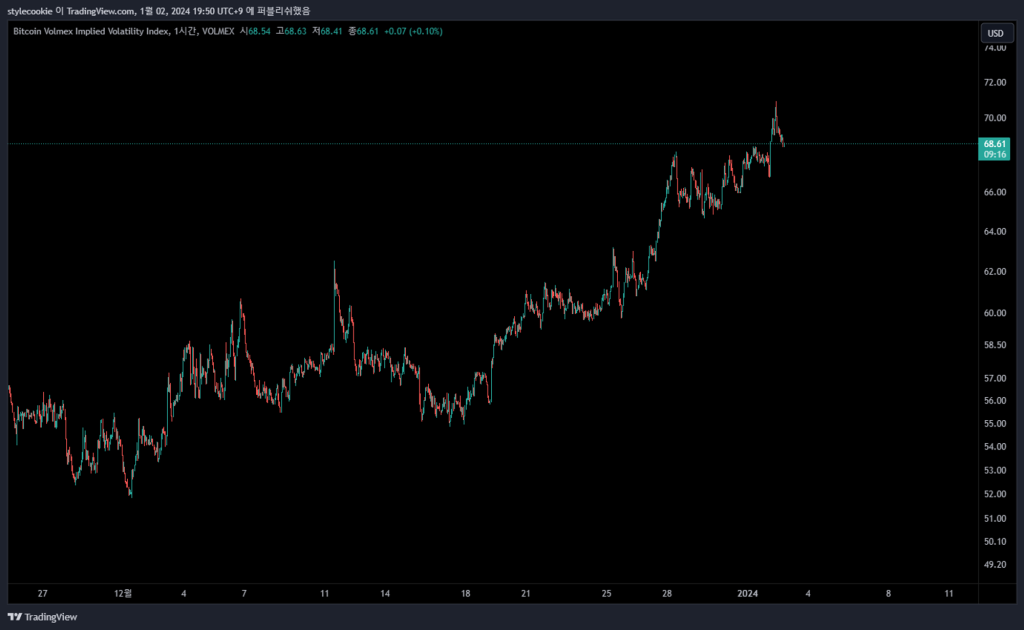

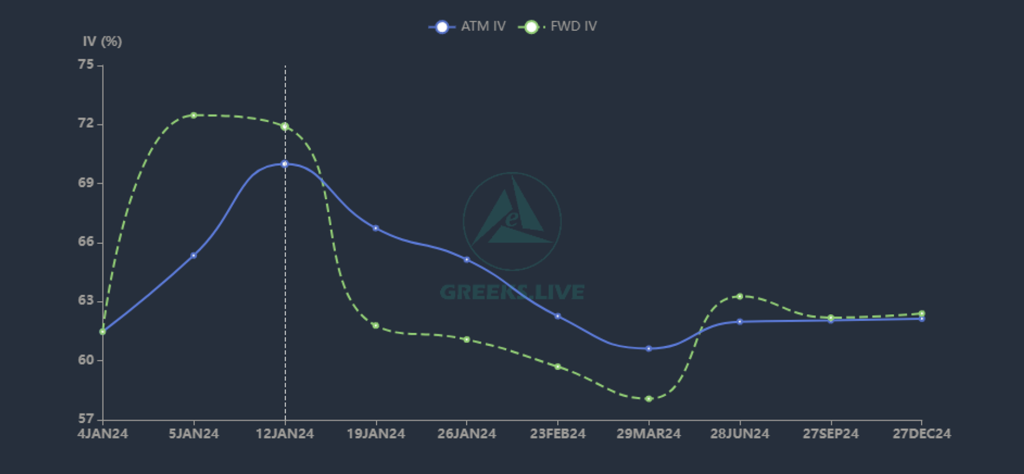

The options market had a massive $11B options expiration on December 29, 2023, and as a result, there is currently a concentration of over 30% of option open interest on January 26. I left a comment about option expiration last week. Due to the special circumstances of the last week of December and the scheduled expiration of large options, we judged that it would be difficult for the market to experience significant changes. In reality, the market only moved within a range because this sentiment likely shaped people’s sentiment throughout the market.

Similar to our previous analysis, volatility markets remain elevated on expectations for ETF. Clearly, the options market is betting high on expected moves during the ETF expected approval period. We have now entered an area where it is unknown whether volatility will increase further. Until the final ETF announcement, volatility may remain at a high level or rise further than it is currently. However, options are certainly expensive at the moment, so I expect volatility to decline and return to a certain level after the ETF announcement, as is the case with most events.

There was a big bullish bet last week. BTC 42-50k call spread 1475 contracts and ETH 2400-2900 call spread 43500 contracts. It’s not easy for these bets to be made at a time like this. I think this was the most interesting deal last week. (Options trading tape does not directly mean that BTC will rise 100%)

Today’s Interesting Tape

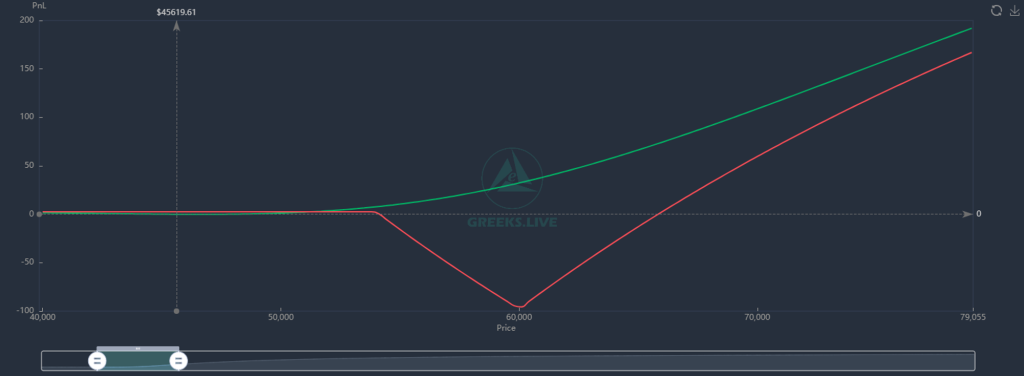

1.1×2 Volatility Spread: 26JAN24 54k(2000)-60k(1000)

Volatility spread is a strategy used when it is thought that the price of the underlying asset is likely to rise significantly due to higher volatility than the current level. This is a strategy that is sensitive to volatility. This trader expects BTC to see a bigger rally by January 26th. They also seem to think that volatility levels are low at the moment.

The advantage of this strategy is that even if BTC does not rise significantly, the risk is limited and out-of-the-money call options can be purchased cheaply. In other words, if the prediction is correct, there is a large profit, and if the prediction is wrong, the loss is limited. The worst outcome here would be when the option expires with BTC at a price between 54-60k.

2. Diagonal Spread 29MAR24 60k(1100)-28JUN24 70k(1100)

I think the diagonal spread here can be understood as slightly neutral/bearish. It is best that the BTC price does not exceed 60k by March. Since the value of the June 70k call option remains after the front-month option expires, additional positions can be opened to create a different spread strategy.

Comments