Market

Last week, with one analysis from Matrixport that presented a view on the ETF postponement decision, the market plummeted in an instant. Many long positions were liquidated. As a result, the funding fee was reset to a normal value and overheating disappeared. Clean cleaning. It was absolutely necessary, but honestly, I didn’t expect it to come so quickly. But ultimately, the market has become very healthy.

The main debate in the market over the past two weeks has been “Sell The News” or “Buy The News.” I shared my thoughts in last week’s analysis post, but I don’t care about that. PA may be very choppy, but I believe the trend is still likely to hold until actual approval, and whether trading begins after approval and meets our expectations will have more impact on the movement in the near term. Regardless of the outcome, I think the BTC spot ETF is having a bigger moment than people think and I don’t understand why people are underestimating it. In the long run, this is definitely a good thing.

BTC is still in an upward trend. ETF approval is just around the corner. I keep the existing view. I think somewhere between 48k and 53k will be the short-term peak. There is a possibility that BTC will cool off the indicators from its current position and correct to the 45.9k level, but the only bearish case I see currently is the postponement or rejection of ETF approval. Chartwise, BTC should not return to the price range (40-45k) of the month. That would be a bearish signal.

There’s a lot of talk about ETH, so let me share my thoughts: I think ETH looks good in the short term. This opinion is very risky, but it is so anyway. ETH/BTC cannot be judged to be at the bottom based on trading volume, but it is experiencing a continuous decline and is expected to be close to the bottom in the short term. If the actual BTC spot ETF is approved, it could fall further, but since the SEC does not regulate ETH as a security, I believe that if BTC is approved, ETH will also be approved. The new story about ETFs may be converted to ETH.

People have too many bearish opinions about ETH. I could be wrong, but I’m taking the opposite view from some people.

Finally… Don’t listen to what others say, trust your own thoughts. Don’t think too much. Manage risk and moderate your greed. That’s what you have to do.

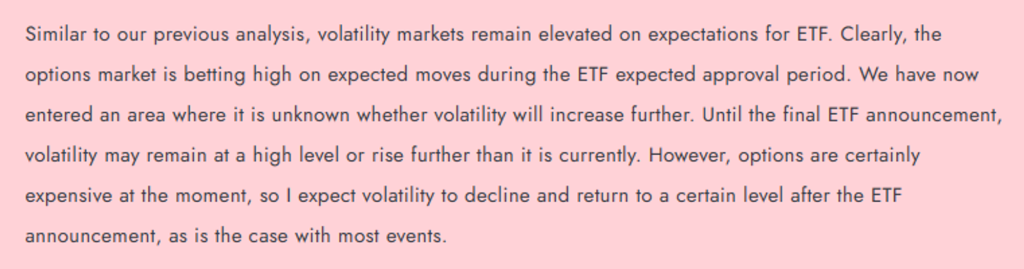

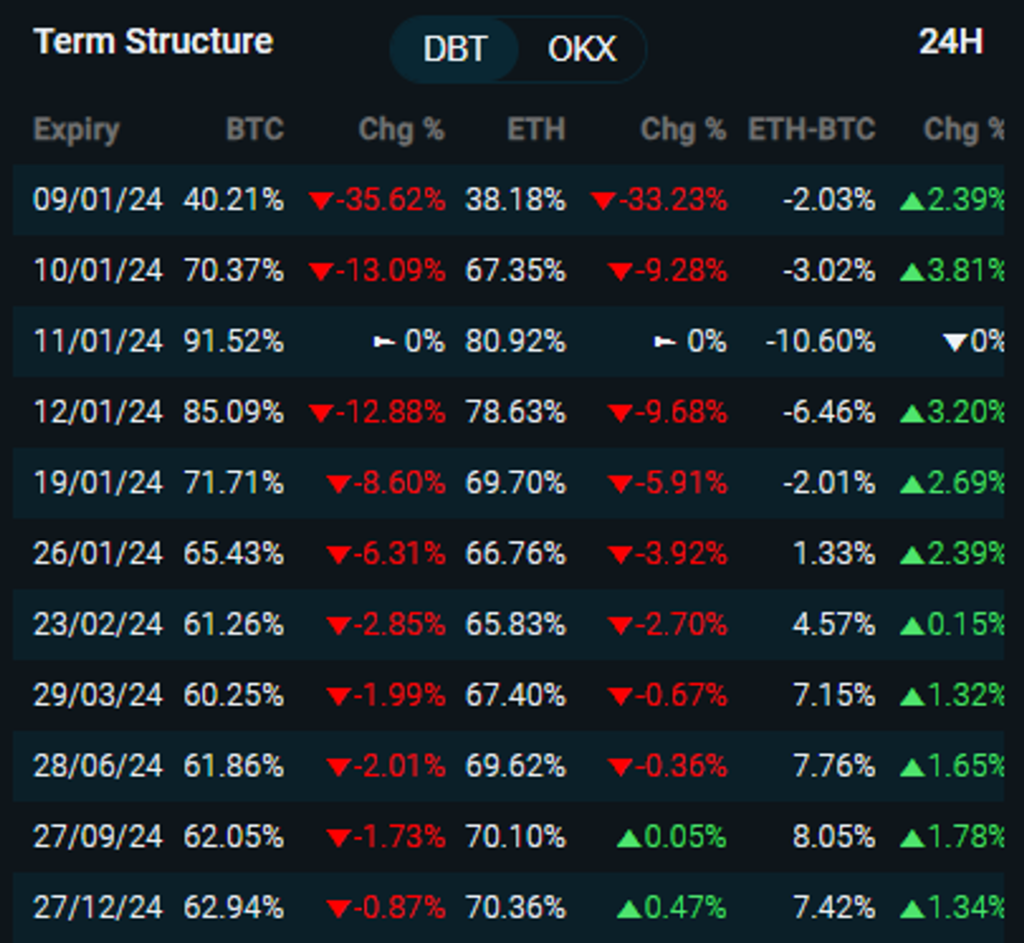

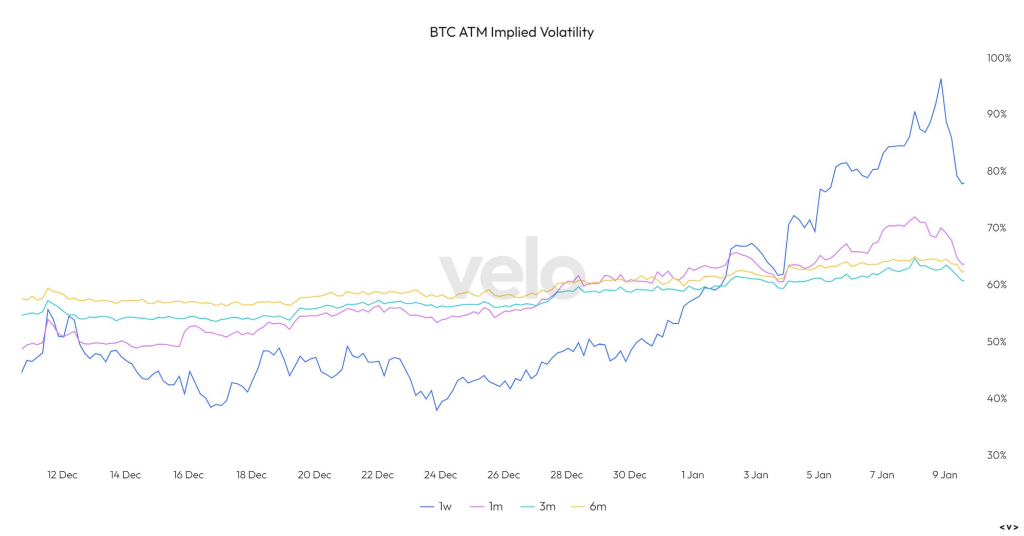

Volatility

Regarding volatility, I continue the previous view as a base. Volatility will remain high until we are certain of ETF approval, but as we get so close to approval, volatility is likely to decline like other events and return to some level. Already after Chairman Gensler’s tweet, the probability of ETF approval actually approached 99.9%, and BTC and ETH vol fell 8 points each, faster than expected.

The ETF story has performed well over the past two months due to expectations. I believe that even if the market continues to rise, future implied volatility will not rise significantly but will be compressed. Since VRP is still high and options are relatively expensive, I don’t think buyers will be as involved as they used to be. It’s time to get back to some level before a new story emerges.

Recently, people asked questions about selling vol, and I advised them not to be too hasty. I am not a fan of vol sells, but I think it is actually difficult for beginners to handle. In particular, keep in mind that option volatility is relative, so you must be especially cautious when trading when such a large event occurs.

Macro

The market’s upward trend so far is due to a variety of reasons, but one of them is expectations of an interest rate cut by the Federal Reserve. Excessive expectations always arise in the beginning and then decrease over time, but I think this CPI can have some impact on that situation.

There is a CPI announcement this week (January 11th). I believe the disinflation trend will continue as per the previous view, but the release of these results may be more important than before. If a higher-than-expected CPI figure is announced, I think it could have some impact on the market in the short term by lowering expectations of a quick interest rate cut. (If CPI does not rise excessively, it will not have a serious impact on the market)

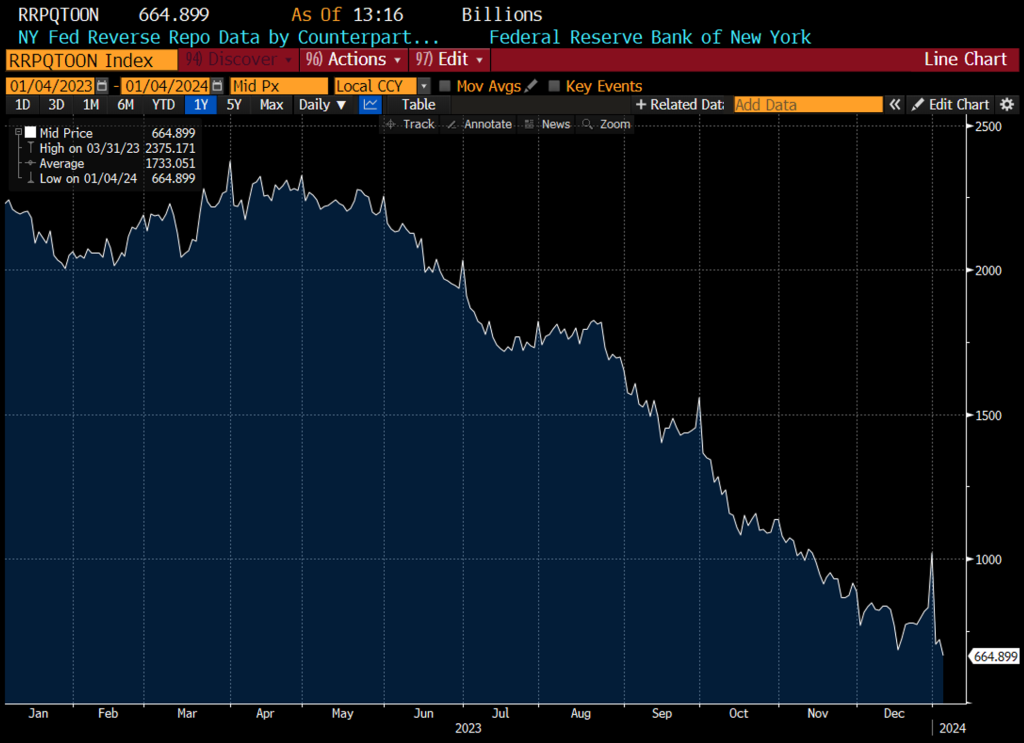

Lastly, a story about RRP. RRP played a role in increasing market liquidity while the Federal Reserve’s QT continued. Market liquidity plays a very important role for risky assets such as BTC. According to experts, the RRP balance will be close to zero by the end of February or early March. There is a strange overlap between the end of the current and upcoming market rally and the timing of the RRP balance approaching zero. It is best to be cautious during this time.

Arthur Hayes wrote a good article about this a few days ago. I recommend you read it.👇

Comments