The first week of June!

Although the market has been confused by weak growth data over the past two weeks, BTC has continued to rise. BTC remains above $65,000 and in this situation, I maintain a bullish view on BTC. Simply put, bullish above $65,000 and bearish below $65,000. The bigger picture is that the price is still trading sideways in the range, so holding above $72,500 will be important for further upside.

The market is likely to move sideways today until the NFP is announced, and I think the range will be broken soon…

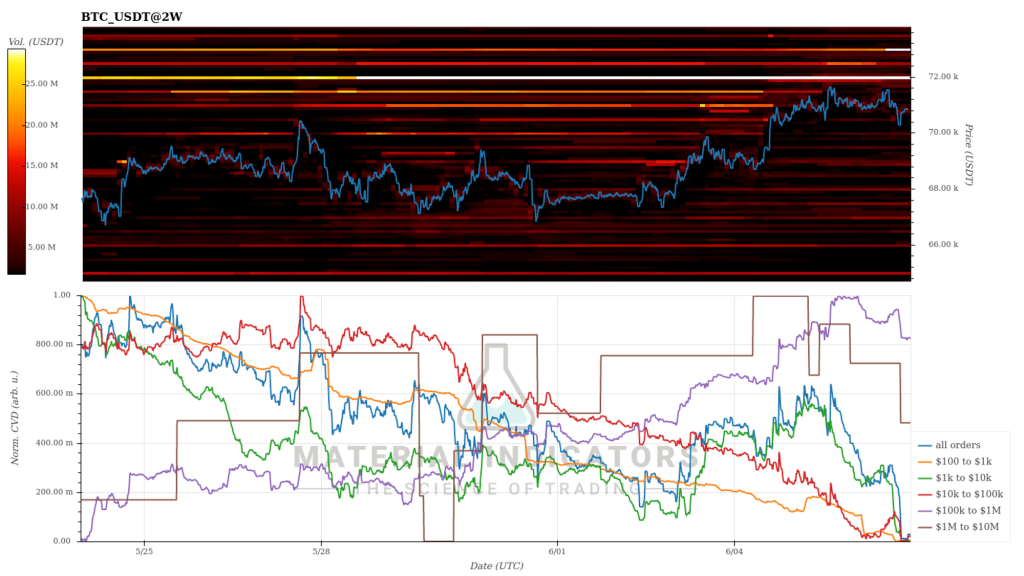

From the order book perspective… Binance and Coinbase still have plenty of sell orders above $72,000. The need for a large number of spot purchases is the same, and there appears to be no other special issues.

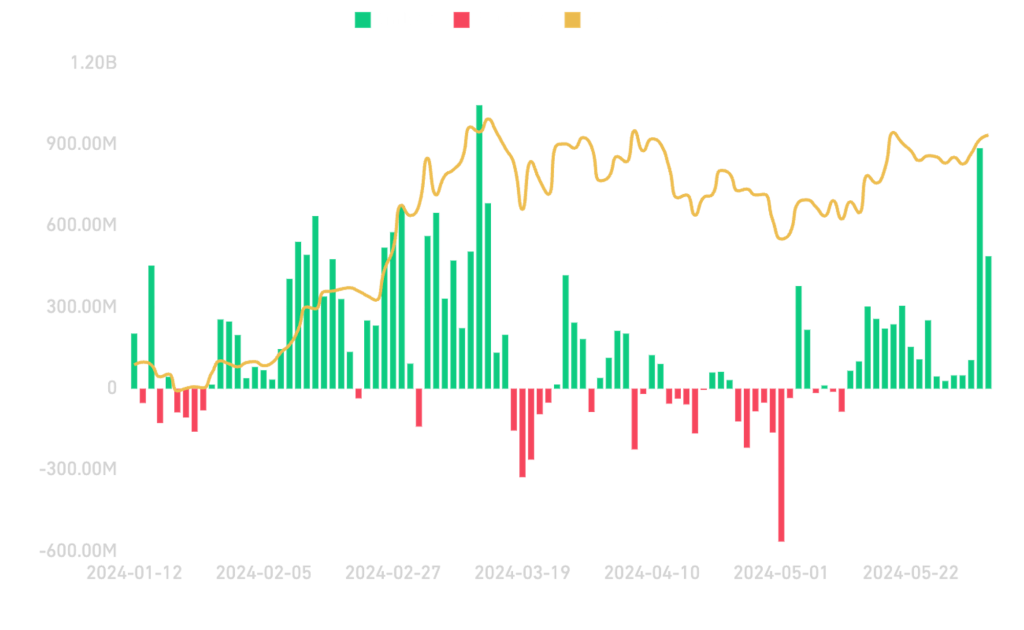

The BTC ETF has had a great two weeks overall. June 4 marked the second highest inflows since the ETF was launched with $884M inflows. This morning’s data showed an outflow of $96.6M from ARK but an inflow of $347M from IBIT. If this data is accurate, the inflows are continuing until today, June 7th. There are cases where BTC is purchased directly in the market, but it does not seem to have a significant impact on the price due to the high proportion of OTC transactions. Recently, CBP (Coinbase Premium) is changing depending on the inflow/outflow of FBTC & ARK ETFs.

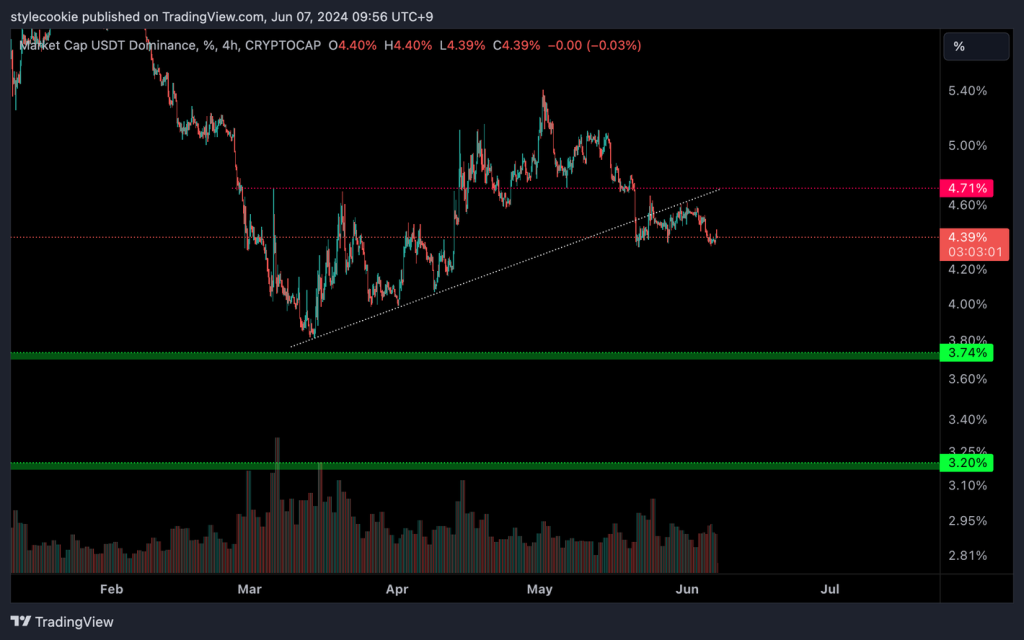

I think USDT.D has definitely reversed and patience seems necessary… If BTC shows an upward movement, USDT.D appears to have room to fall by 3.74-3.2%.

$COIN is showing good movement. Recently, Coinbase launched a smart wallet that allows users to access on-chain easily and conveniently. They continue to operate and profitability is improving. Although the rise in $COIN price is not directly linked to the rise in BTC, we expect it to have a positive impact

Semler Scientific, after buying $17M more BTC, now holds 828 BTC and is raising $150M to buy more. Corporate holdings of BTC and adoption of strategic assets continue to occur and we expect to see more of this in the future. The news that the number of buyers is increasing is optimistic.

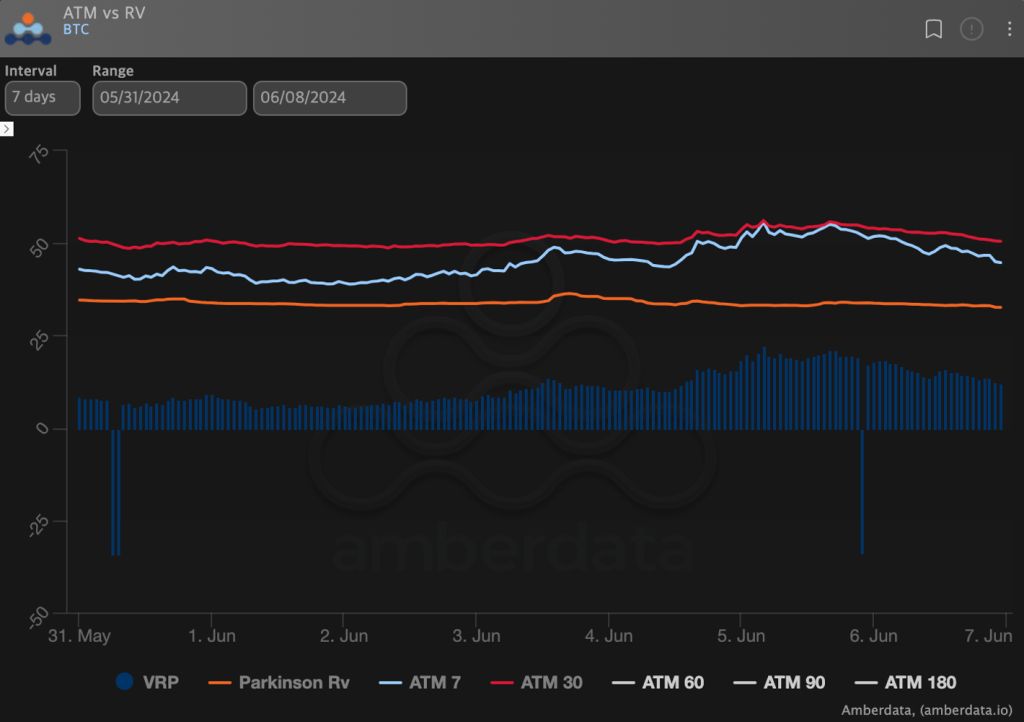

Options markets are generally quiet. Clearly, BTC is showing a bullish move, but it has failed to hit a new ATH and remains range-bound. Spot-Vol correlation remains positive… DVOL has fallen to 52, and since market movements are not large on average, Vol is quickly being reversed. People still seem uncertain about the direction.

From VRP perspective, option prices are expensive, but I don’t think they are absolutely expensive… In particular, Long Term Vol.

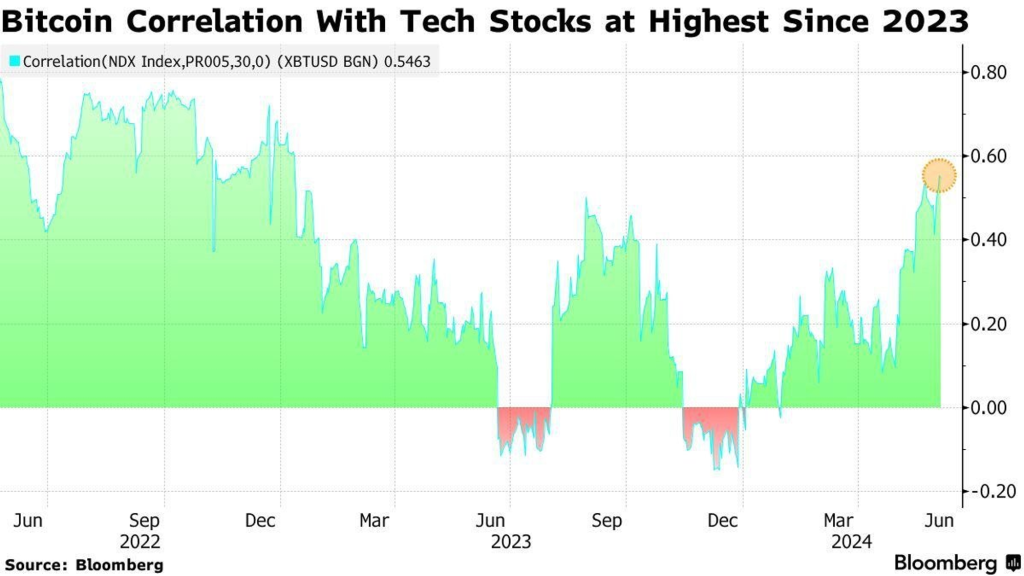

ES showed a wonderful recovery, just as I stated in last week’s article! Record new ATH. I think hitting a new ATH is not bearish and means there is more upside… BTC-Tech stock correlation has risen significantly. BTC is likely to follow ES/TradFi market movements in an upward cycle.

TLT broke a downtrend of about 160 days… This movement may not last long due to the bonds to be supplied in mid-June and the macro situation that can change at any time, but the breakout of the trend seems meaningful. Considering the correlation between risky assets and yield, there is a possibility that this will be a positive situation for risky assets. If this positive correlation does not work and risky assets weaken… This means that bonds are acting as safe assets.

The most important macro event today is NFP. When looking at ADP and JOLTs, it seems very unlikely that the data will show surprise numbers. If market expectations are correct, I think risk assets will rise with the NFP announcement.

ECB, Canada, Switzerland, Denmark… More and more countries are cutting interest rates. Now all that’s left is the Fed. Despite this situation, there has been no upward movement in DXY to date… I think this is optimistic. It feels like the market still has expectations that the Fed will soon cut interest rates as well.

If today’s NFP results in a positive reaction in the market, we expect the DXY to begin a downward movement that will take it down to 102-102.5.

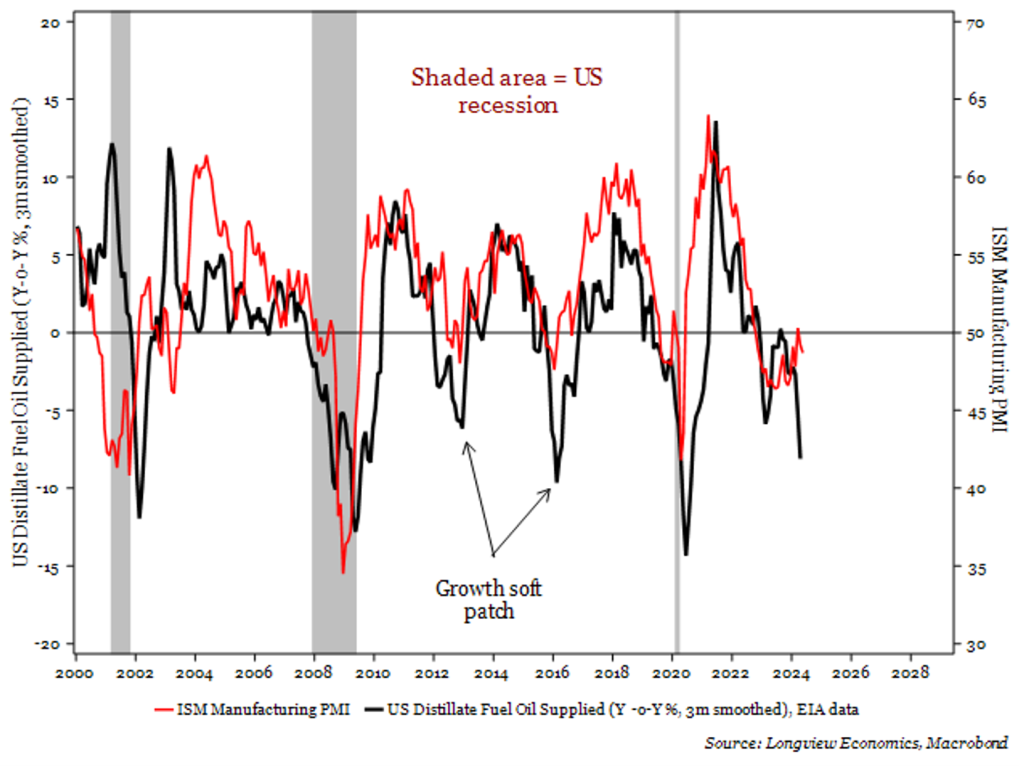

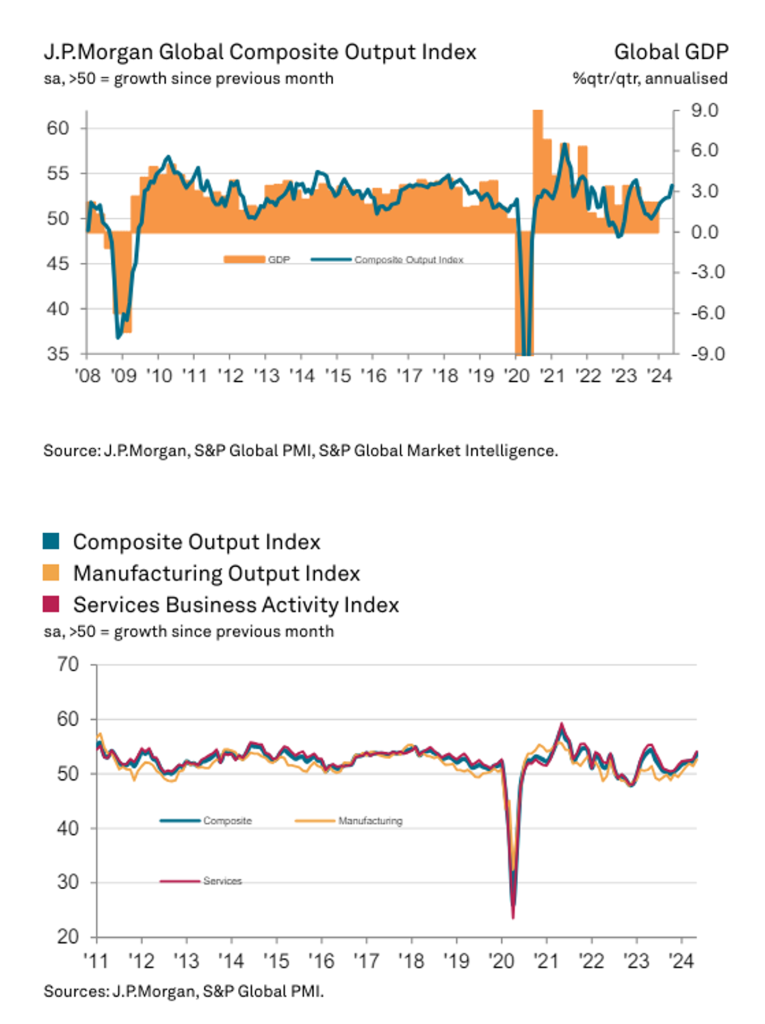

The last two weeks of growth data have clearly signaled a “growth retreat”. As a result, fears of a recession arose again in the market, and stocks/BTC/Yield/Gold/Oil all fell on the day of the Chicago PMI announcement. There are always different opinions on macro, but I think the current phenomenon is a soft patch, not a recession…

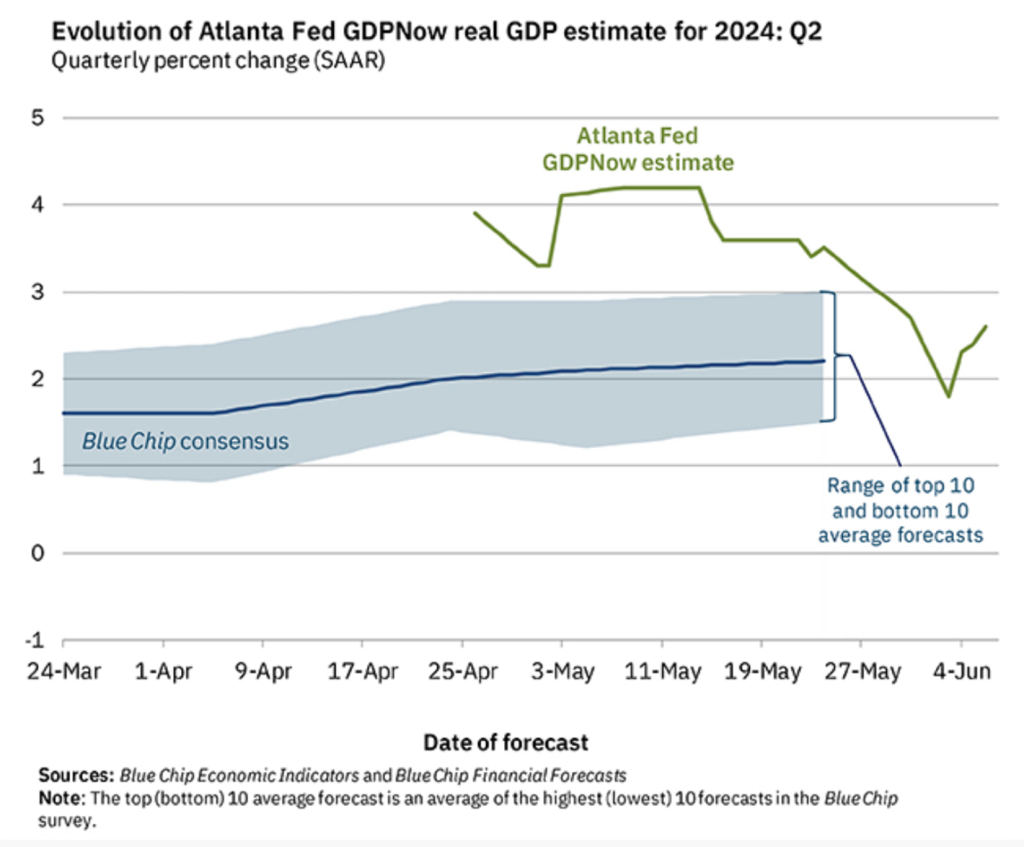

According to S&P Global, the global economic growth rate in May hit the highest in 12 months, and Atlanta GDPNow shows it has risen again to 4.2% > 1.7% > 2.6%. As mentioned above, growth has clearly been below expectations and is retreating. However, the economy is resilient and is still growing rather than declining. Soft patch.

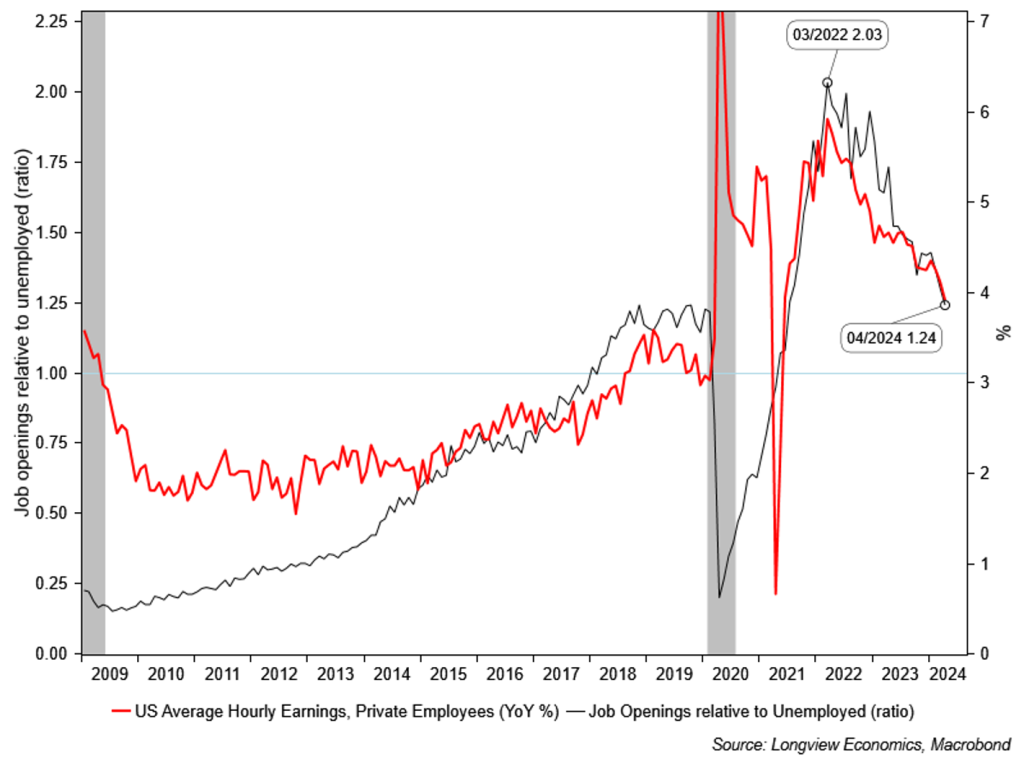

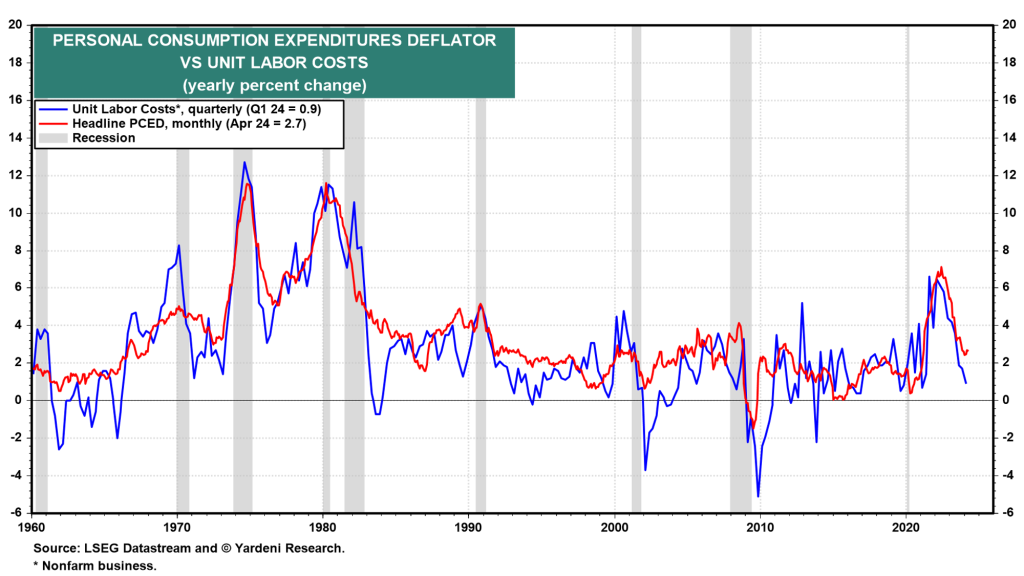

JOLTs missed expectations. The tight labor market is easing. Additionally, wage data continues to suggest upward pressure on wage inflation will diminish. This will affect the headlines. CPI will likely remain sticky, but I think the disinflation trend will continue.

- 6/12 – CPI

- 6/13 – FOMC

Currently, people’s main interest is growth rather than prices… Anyway, I expect there will be no reinflation in the 6/12 CPI, and I think a soft CPI will increase the probability that the Fed will show a dovish stance at the 6/13 FOMC. I am looking forward to seeing this reflected positively in market movements.

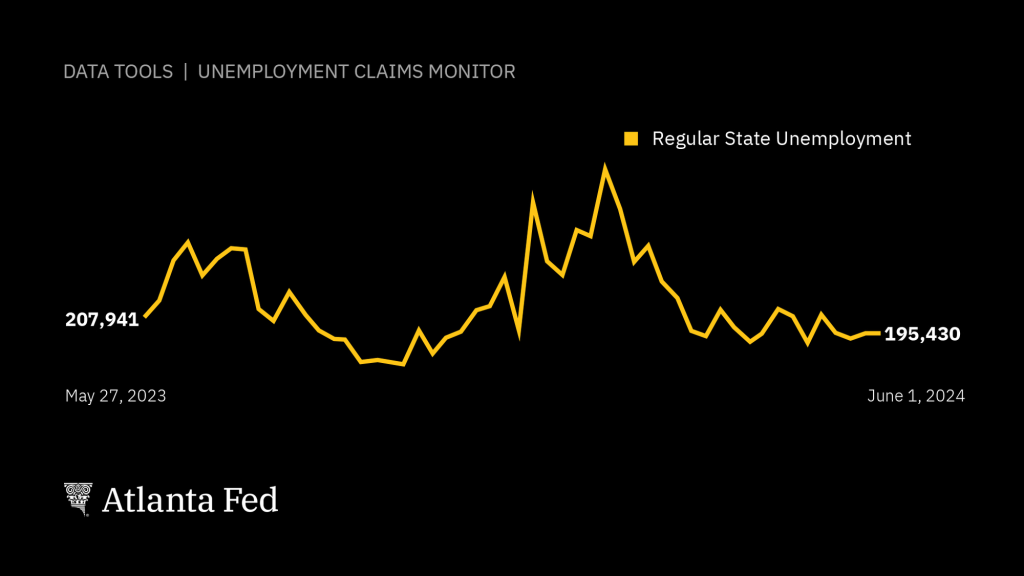

Unemployment claims fell 0.9% from last week… There is no recession in sight.

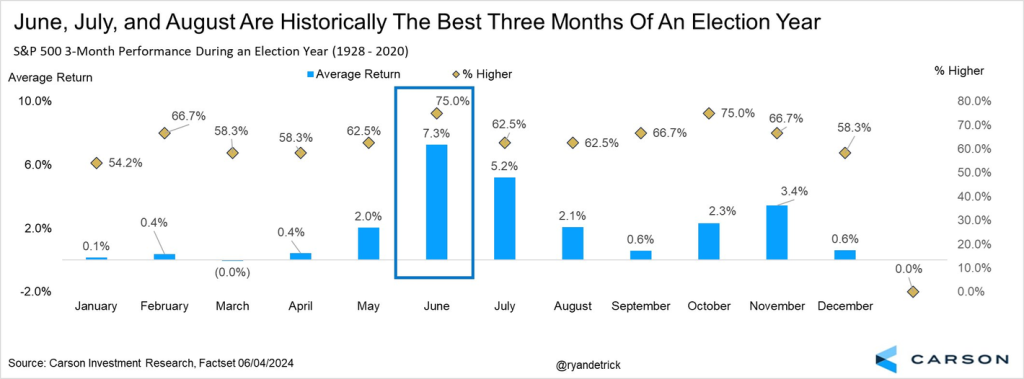

Seasonality of the election cycle saw the best returns in June, July, August.

Nevertheless, if the market is weak… This is definitely bad sign. Good Luck. NFA DYOR .

<Source : TradingView, Material Indicators, Tensor Charts, Coinglass, Amberdata, Greekslive, Atlanta Fed, Yardeni Research, Carson Investment, Longview Economics, S&P Global, Coindesk>

Comments