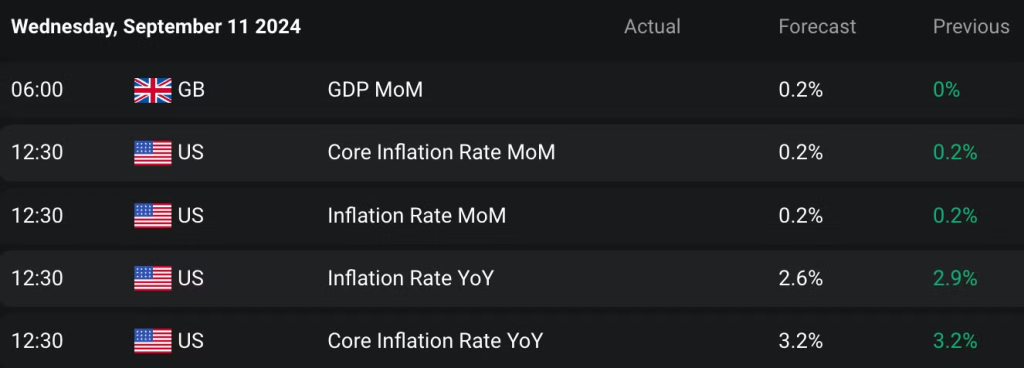

CPI data is released this week. You may feel tired of me repeating myself, but prices are still not that important. We have seen continued disinflation for nearly two years. The August CPI data to be announced this time is not expected to bring any major surprises. Perhaps this will be another piece of data that proves that disinflation is solid.

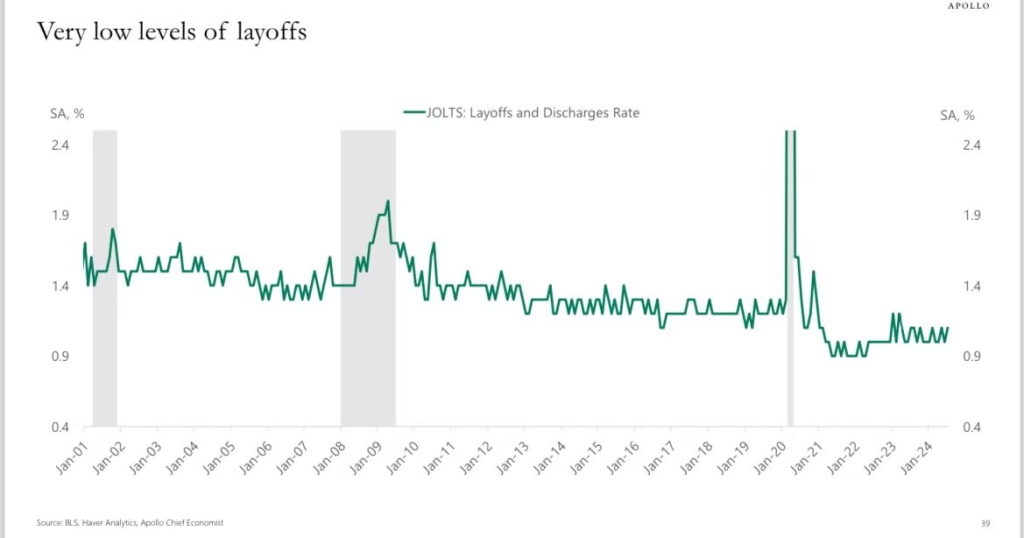

“This is a soft landing. .. The US economy is not in a recession, and there are no signs of a recession on the horizon.” – Apollo

I still think market fears of a recession are overblown. I could be wrong, but I continue to stick to my view. The NFP and unemployment figures released last Friday indicated that the Fed would cut by 25 basis points rather than 50 basis points at the September FOMC meeting. 25bp… That’s optimistic…

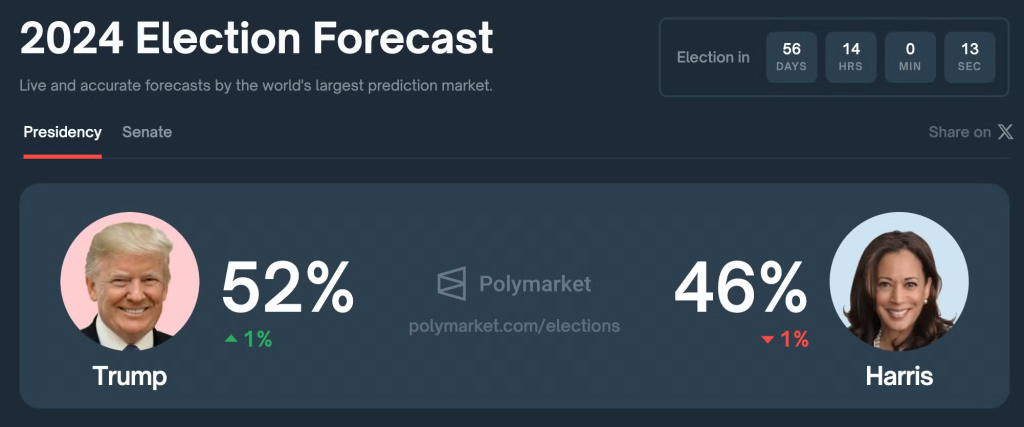

The key event this week will be the Trump-Harris debate on September 10th. As with last week, Harris is likely to show a weak performance in the debate. Trump’s approval rating is also currently rising ideally, so unless there is a major change, Trump’s approval rating is expected to continue to strengthen. It is uncertain whether this debate will have a significant impact on the BTC price, but given that the market is hungry for positive news, I think it will have a small positive effect.

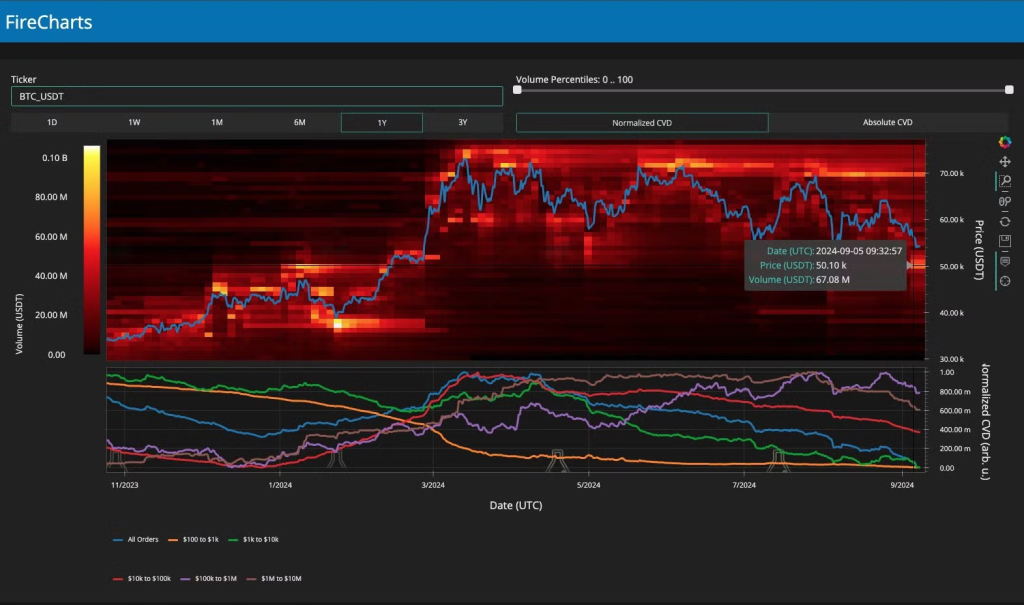

The BTC price action looks positive to me. It hasn’t broken the previous low of $49,000 and has bounced to $58,000. And buy orders are ahead of sell orders, which is the highest level this year.

“Bitcoin bid liquidity is stacking at $50k. This is the first time we’ve seen a heavy concentration of bids that exceeds the volume of asks in a long time.” – Material Indicators

There will be some sideways or slight declines until the next event, but it seems important to hold $56,000 for further upside. Given the current structure, I don’t think BTC needs to break the low of $49,000 to continue the uptrend. A few weeks ago, I thought the uptrend wouldn’t break even if it reached $44,000… but I don’t think so now. If there’s another big drop below $56,000, it could take more time.

I think this sideways/consolidation period is almost over. I could always be wrong, but I still believe we’re in a bull market.

<2024.09.05 – Some Thoughts on September>

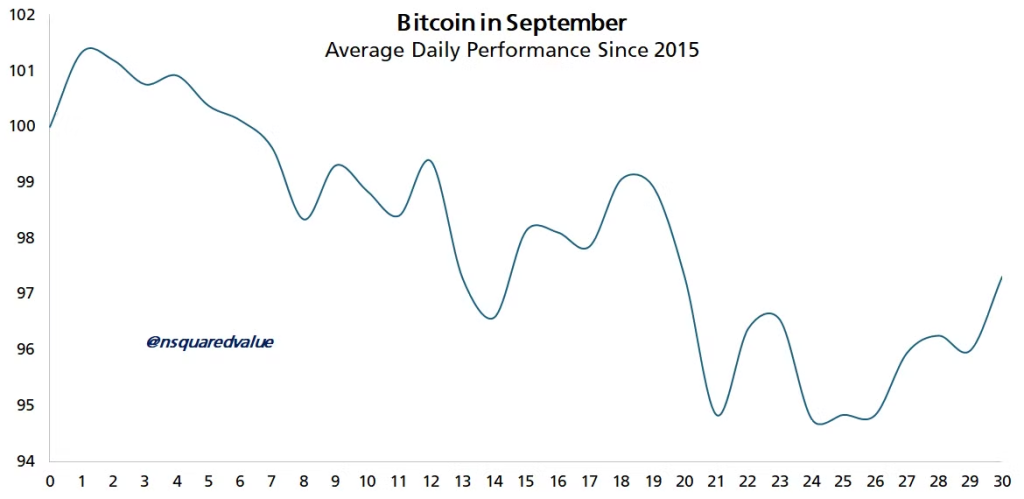

1. About BTC September seasonality: To be honest, BTC September seasonality is very bad. It has never been good. Considering that we have updated ATH earlier in this ETF cycle, it is possible that the seasonality is not correct in the past, but the key point of seasonality is the effect on the whole part, not a specific part. That is, we cannot 100% rule out such statistics. If we look at the most recent September of last year, we got the August crash and went up/sideways. If we can get this move, it will be a good signal. However, if the bearish move continues, the 44k that CT is talking about is not a dream. 44k is definitely a big drop, but it is not a drop that breaks the uptrend in this cycle. If we can really get 44k without a recession, I hope you buy it.

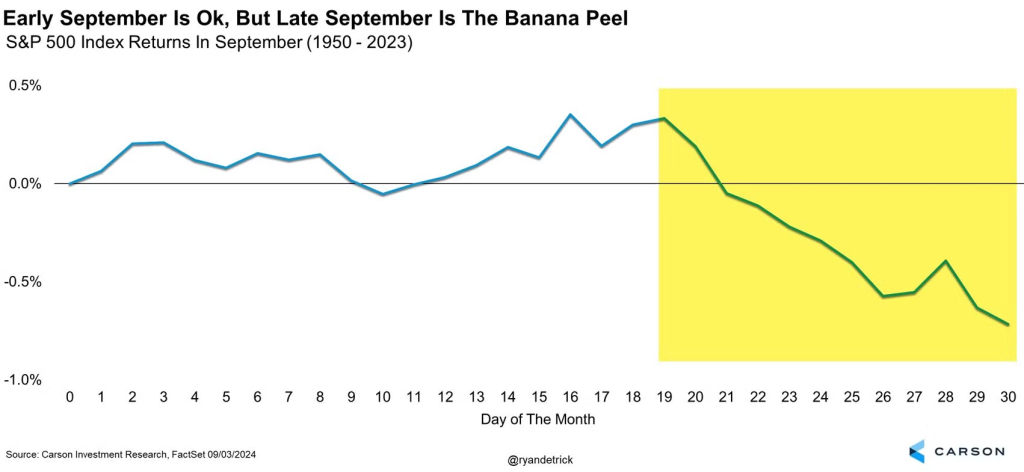

2. About September seasonality of stocks: Stocks generally tend to show a weak movement from September to mid-October. This generally provides a bit more reliable statistics over the long history of the stock market. September stock market declines tend to occur after September quarter OpEx. Also, mid-September is the corporate tax payment period. Although statistics do not provide 100% accurate movements, I think this information will be helpful to all of you, so I am sharing it.

3. As you all know, I am still assuming there will be no recession in 2024. I expect the Fed to cut rates by 25bp in September FOMC and the economy will continue to grow. The economy is currently a mix of good and bad data. Manufacturing is clearly weak, but the US is a service-oriented country unlike other countries. I wouldn’t call this a perfect soft landing, but I don’t think it’s terribly bad either. If Powell wants a rate cut as the economy recovers and is resilient, this will be bullish in the long run. The market is currently trading in a recession amid mixed data. There is still a chance that tomorrow’s service PMI and Friday’s unemployment rate will reverse the current concerns. If my assumption is wrong, BTC is likely to fall below 40k.

Lastly, HYG (High Yield) is showing the opposite movement of the sentiment shown in the market. In other words, there is no serious decline. I could be completely wrong, but I still dream of hope and look forward to a bright future.

NFA DYOR

<Source : Material Indicators, TensorChart, Apollo, Deribit, Polymarket, Timothy Peterson, Ryan Detrick>

Comments