ES – CPI & PPI & Retail Sale

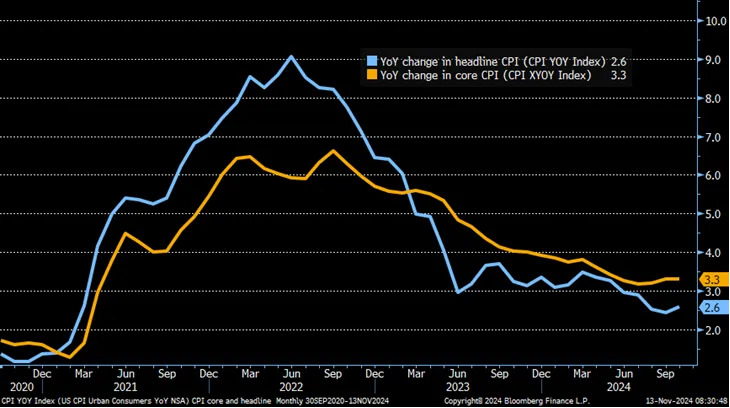

I personally don’t think there was any particular surprise in CPI. +2.6% YoY and still the same sticky. In September, I said “The disinflationary trend is clearly evident, but CPI is likely near the bottom,” meaning that since CPI fell so quickly from 9% to 2%, the rate of decline will now begin to slow. ex-shelter is still low at +1.3%.

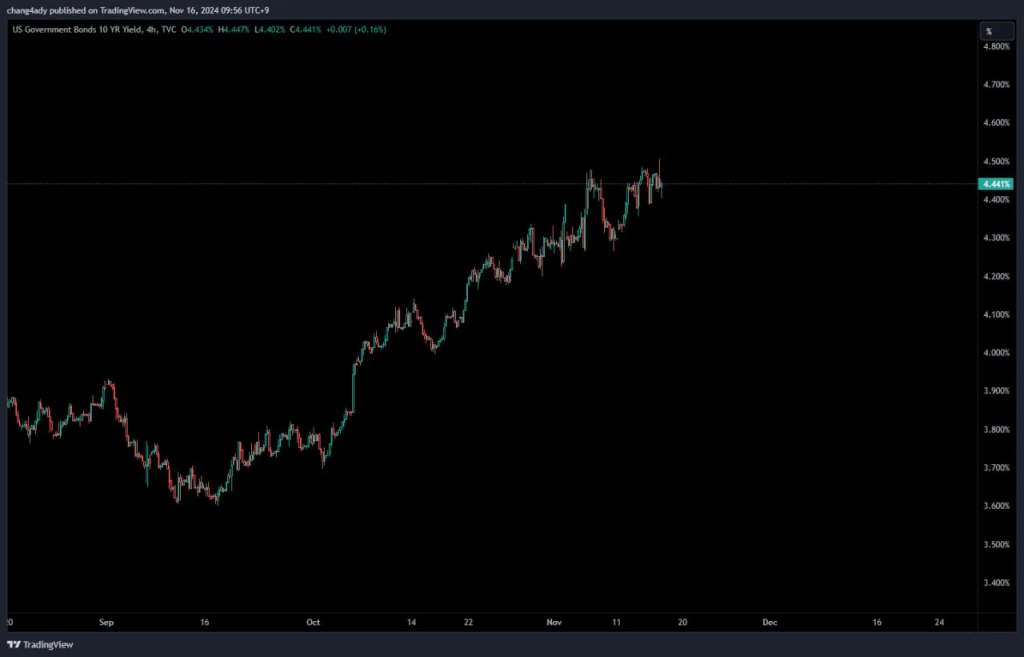

I think the PPI and import price increase were not enough to satisfy the market as they caused the upward revision of PCE. It seems that the market is still worried that inflation may rise again along with CPI. As a result, 10Y reached 4.5%, ES fell, and yield continues to put pressure on the stock market.

Powell: “The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully”

CPI, PPI data changed the market expectation of Fed’s December rate cut. 0, 25, 50. I was not thinking of a 50bp cut at all in the first place, and for now, I would say that the market expectation of a 50bp cut is noise. I think the market was affected by Powell’s remarks, and I think the meaning of this is not that the Fed will not cut rates, but that he wanted to lower the market consensus for a 50bp cut. I agree that he was less dovish.

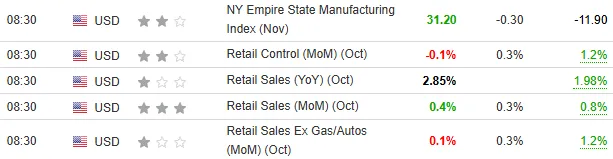

I think retail sales were neither good nor bad, but in the middle. The rise in import prices may have added a little bit to inflation concerns, but there may be a positive evaluation in the consumption sector. However, the control group reflected in GDP recorded -0.1%, so there may be concerns that there may be a slowdown in GDP in the future. (NY Fed +2%, Atlanta GDP Now +2.5%)

Depending on the additional data that comes out in the future, I still don’t think inflation will rise “significantly” again, so I think the Fed will cut 25bps at the December FOMC meeting. As things stand, I believe we are on a path to a rate cut cycle.

Overall, it’s been a confusing week for the stock market. I think uncertainty will continue to linger in the market next week with NVDA Earnings.

BTC

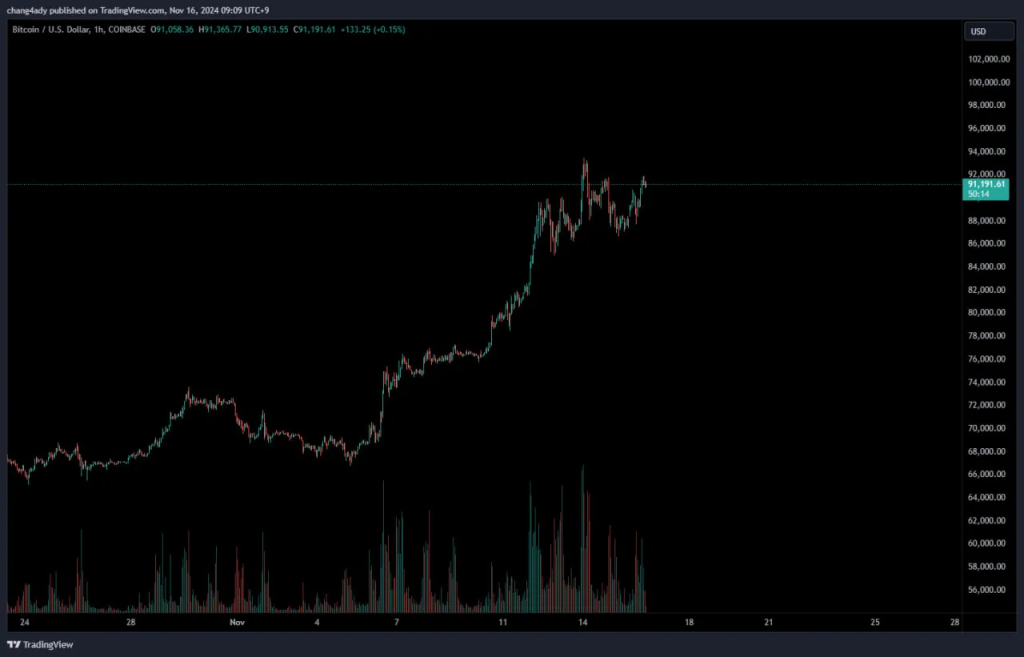

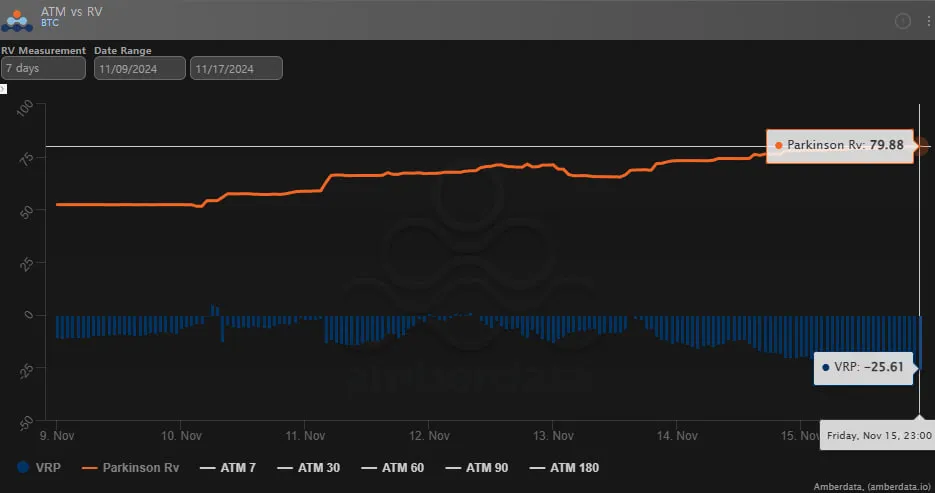

BTC has exploded since last week’s article, going from 76K to 90K. I still believe BTC is in a bull cycle. There’s a good chance it could reach 100K quickly, but I’m trying to think rationally as the market has already shown enough upside. IV is suppressed but RV has seen a significant uptick. Although it is not a good situation to sell IV, I believe that the good time to utilize gamma has passed to some extent. My first view is the possibility of BTC reaching 100-110K in December after trading sideways at 80-90K level.

I am thinking that there may be some positive news in terms of BTC price movement, as it does not show any correlation with the stock market. Additional institutional purchases are likely expected in 13F. If the market goes down, I will be a buyer. Clearly, I am not bearish.

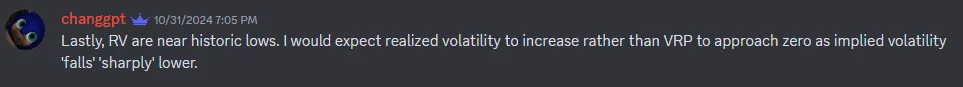

Finex appears to have secured some profits after BTC reached 90K.

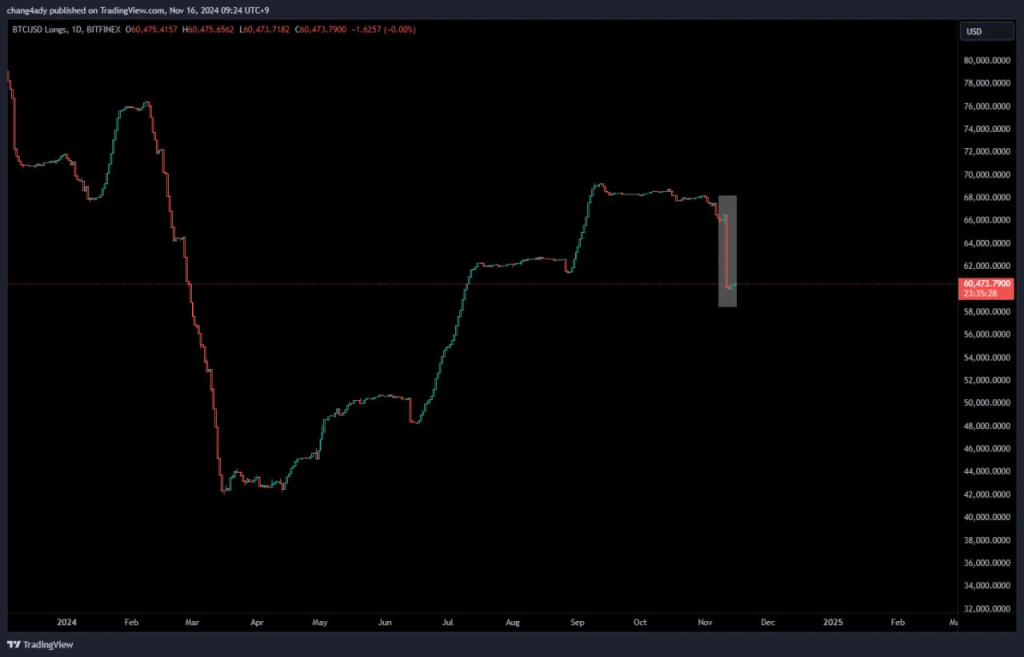

ETH & Alt

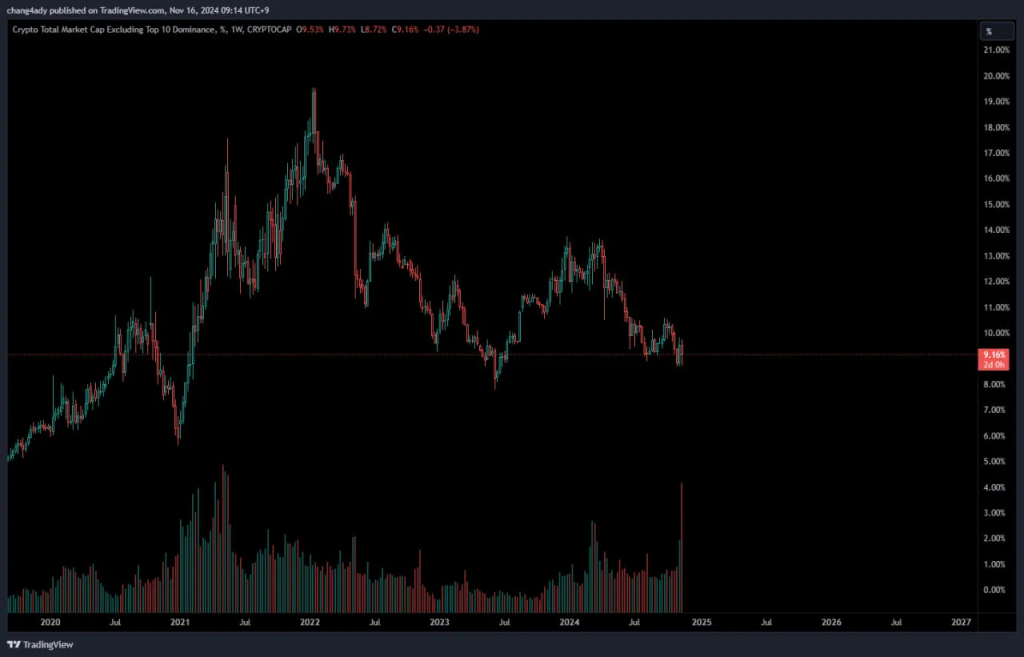

While BTC.D continues to pressure Alts, I think there are opportunities for some Alts when I look at OTHERS.D. I don’t usually trade Alts, but I’ve been watching them lately. Although I am not 100% certain for altcoins in the current environment where the macro is quite chaotic, I think dominance has contracted enough that there is a possibility of a sufficient rise. Also, I still have high expectations for ETH.

NFA DYOR

<Source: Kathy Jones, The Transcript, Investing.com, Earnings Wispers, Amberdata, Volatility Crew>

Comments