Market

The ETF was finally approved and the first transaction began quickly! The biggest win in crypto history! congratulations.

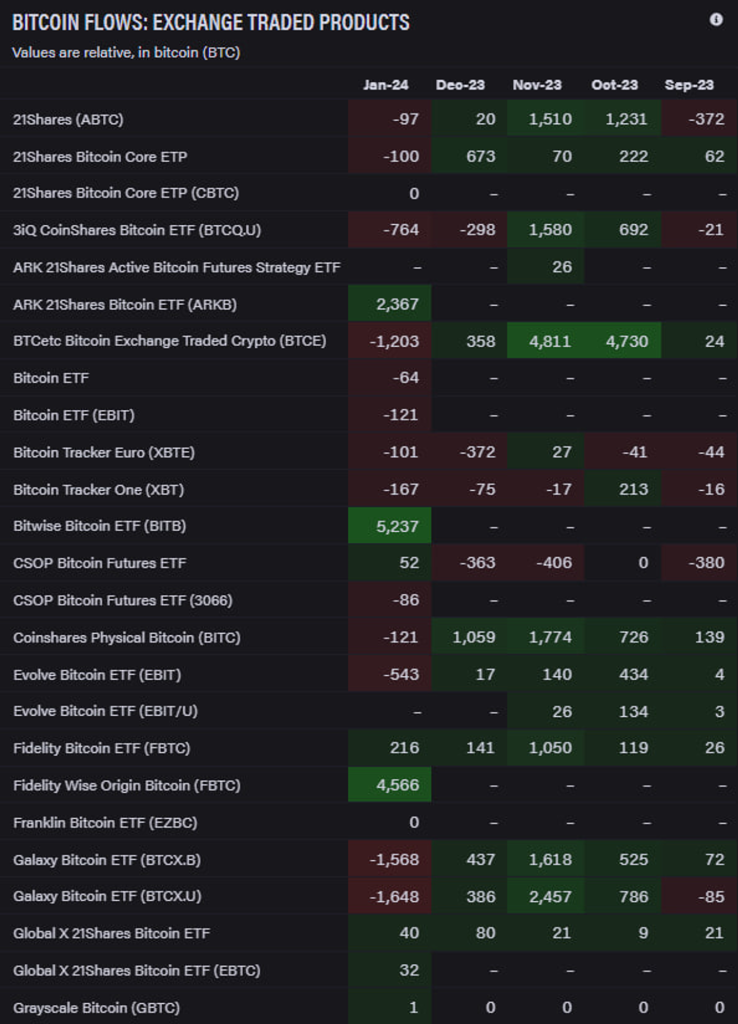

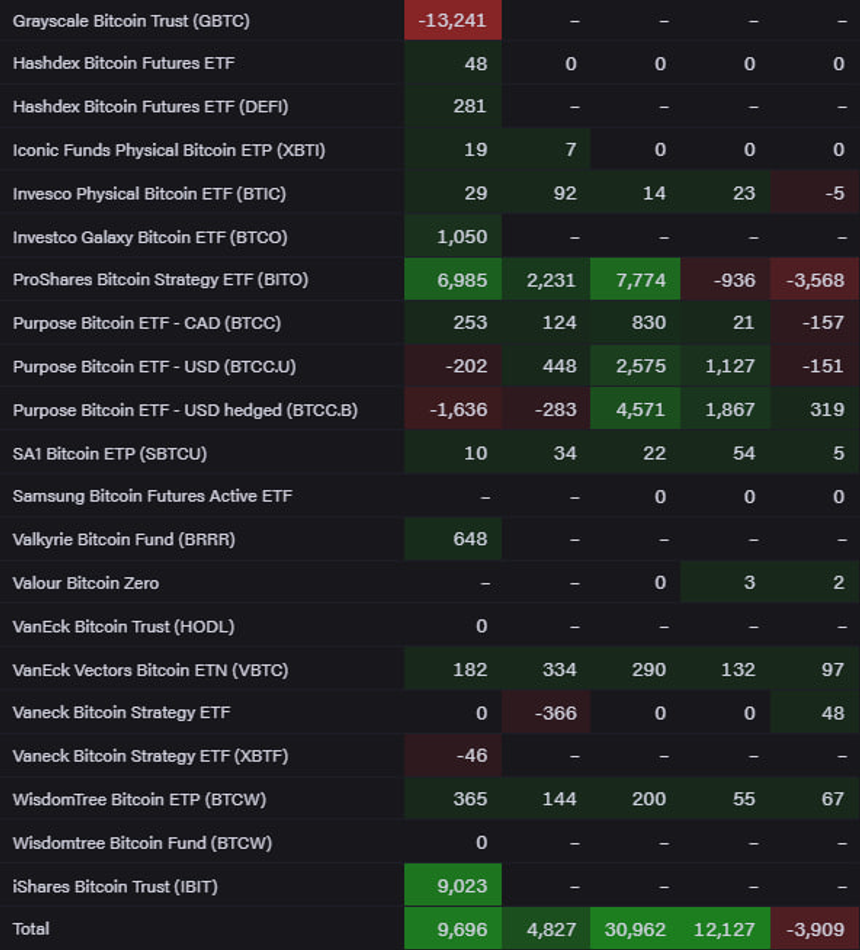

Let’s move on to talking about BTC. BTC rose to 49k after ETF approval and before actual trading began, but quickly fell to 42k after trading began. It was the highest trading volume in recent times. Sell The News might have been right. I suspect that the selling pressure related to the GBTC outflow may have been the reason why the price of BTC began to fall sharply. Also, market movements to secure profits may have had an impact.

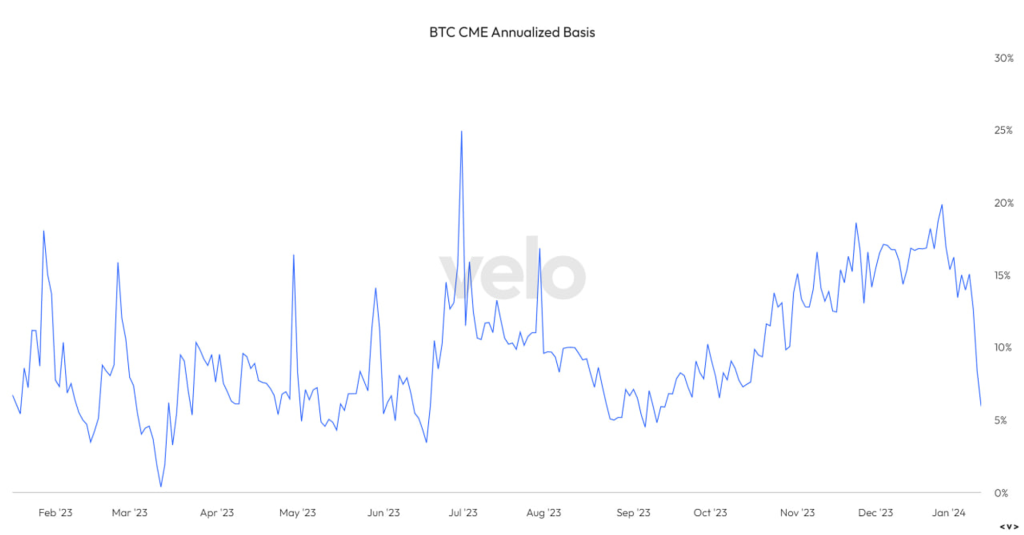

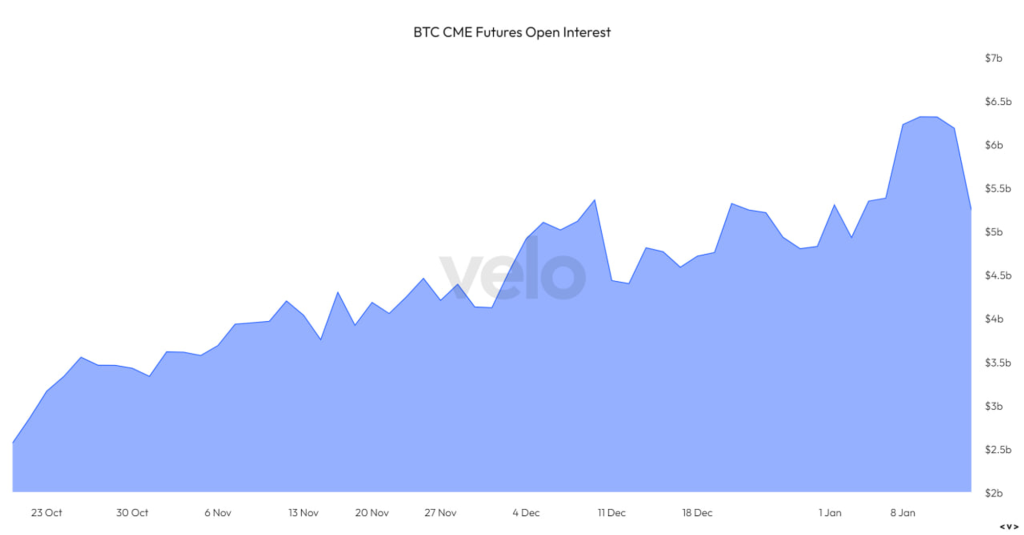

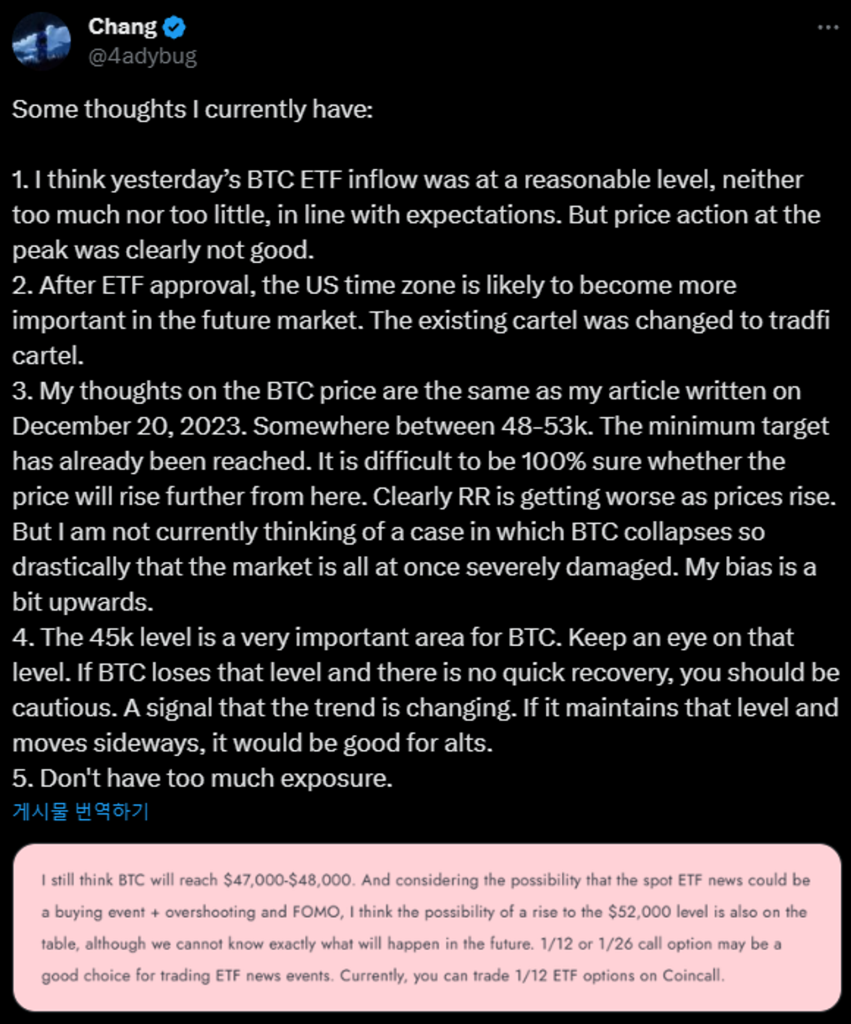

The CME premium has mostly disappeared and the Coinbase premium has become negative. Liquidating GBTC positions may have had a significant impact on the Coinbase premium becoming negative (or selling by actual market participants). As ETFs are approved and the TradFi cartel becomes more important, the US time zone will mean a lot to the crypto market and become important.

I think the market is currently seeing GBTC outflows and remaining ETF inflows canceling each other out. Since there is a possibility of a rotation from GBTC, which has the highest management fees, to other ETFs with lower management fees, the market may be waiting for that to be completed while reassessing the current value of BTC.

Clearly, ETFs will play an important and positive role in the long term. Don’t overestimate the short-term impact and underestimate the long-term impact.

Last week, while sharing some thoughts, I mentioned the importance of 45k. 45k is still a critical level for BTC to maintain. Until that level is recovered, BTC is likely to decline gradually or remain in its current range. 48k may or may not have been the peak for one cycle, but we reached our minimum target anyway. I see this as a time to take a break and would not recommend adding too much exposure.

Please note the levels shown in the chart. I believe BTC is in an upward trend unless a natural disaster occurs and I don’t think BTC will go to 12k at all. If BTC loses the 40k level, the next most important level is 37-38k. The most important level I’m looking at. My current thinking is that BTC will reach the 38k level. I don’t know what will happen, but I’m not in too much of a hurry and plan to wait slowly.

The market seems to be feeling quite scared, but I expect the market to show some recovery from last week’s decline this week, barring any special news.

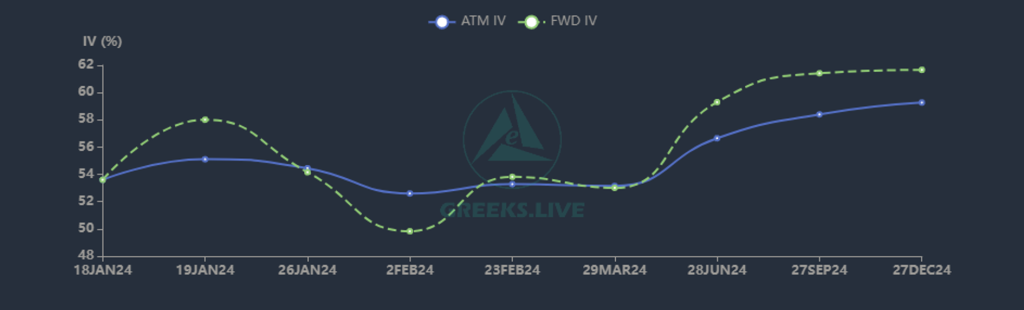

Volatility

Volatility has clearly fallen from its highs following the ETF’s approval. The event died and we were down about 20 points. As realized volatility rose and implied volatility fell, VRP turned negative. Volatility is not as easy to assess the sustainability of ups and downs as in general prices, but I think volatility has fallen more in a short period of time than I thought.

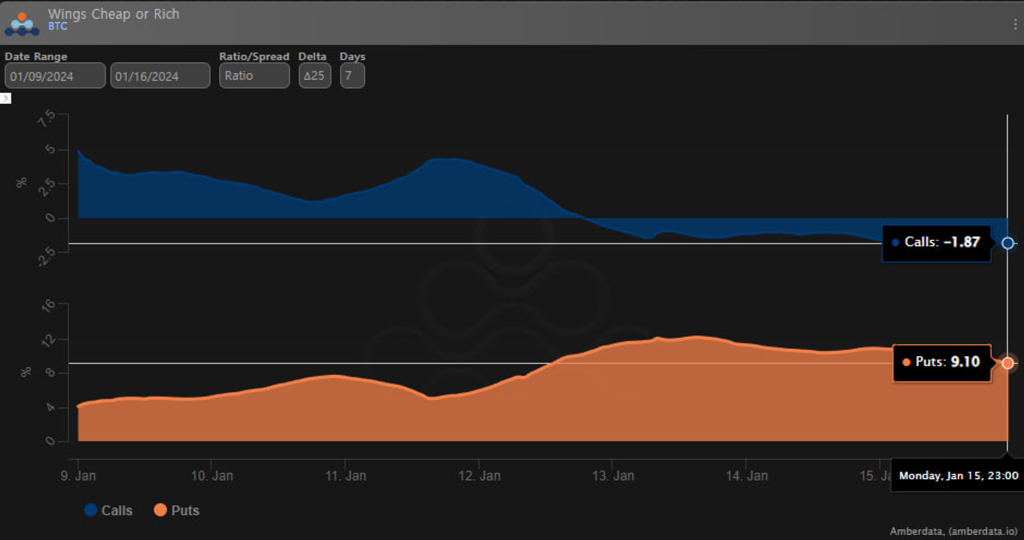

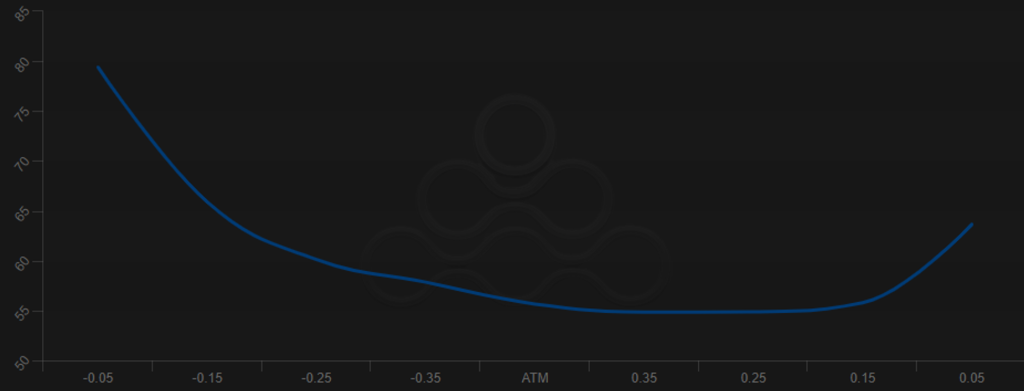

There is currently a bearish sentiment in the options market. Demand for OTM put options is high, and the enthusiasm for call option buying has cooled down significantly. Now that the event is gone and BTC price has risen a lot, people will start to re-evaluate the current value of BTC.

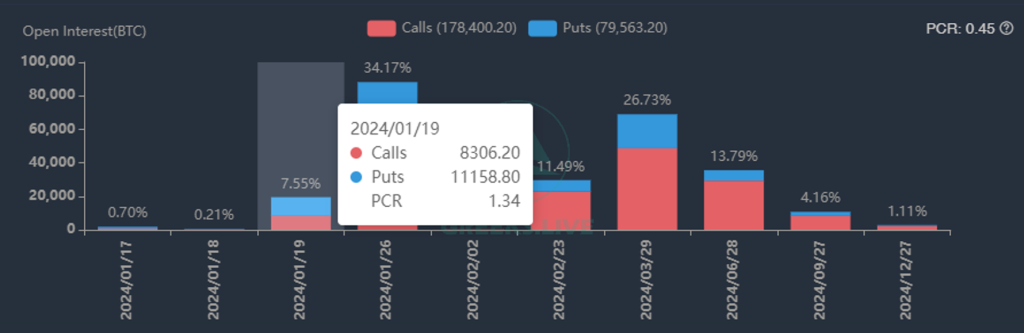

I like protecting my portfolio with puts, but I haven’t bought any puts yet. I think the wings are pretty expensive right now. The 1/19 option has higher put option open interest than call options. It would be nice if it works out as people expect, but unless BTC falls sharply, high premiums can sometimes be an opportunity.

News

There is a SEC vs Coinbase hearing this week on the 17th. I’m not sure what the result will be, but it will have some impact. Please refer to the corresponding tweet.

Comments