Market

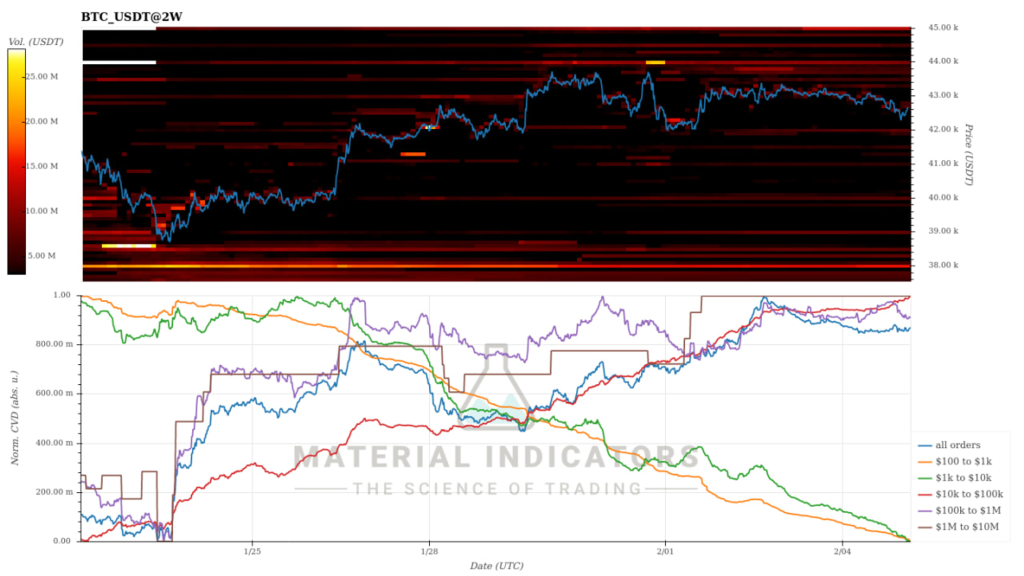

My market review this week will be short and simple. BTC didn’t reach the 44k I expected last week, but I’m still optimistic about the market. After trading sideways at 43k over the weekend, BTC fell to the 42.3k level on Monday morning Korean time and is showing signs of rebound. BTC continues to defend well against the 42.5k line I drew and I do not see this as a negative sign.

To be honest, the crypto market feels like it’s full of fear right now, unlike the stock market. If you maintain that level after breaking through 43k again, there is a high possibility of challenging 44k. 44-45k is the key resistance level and the level where the actual spot sell wall lies. I’m not 100% sure it will get there, but if BTC reaches the 44-45k level, it would be a good idea to secure your profits appropriately.

If it falls again and draws a threatening chart again, it is likely not good. Observe movement at key levels.

ETF Flow

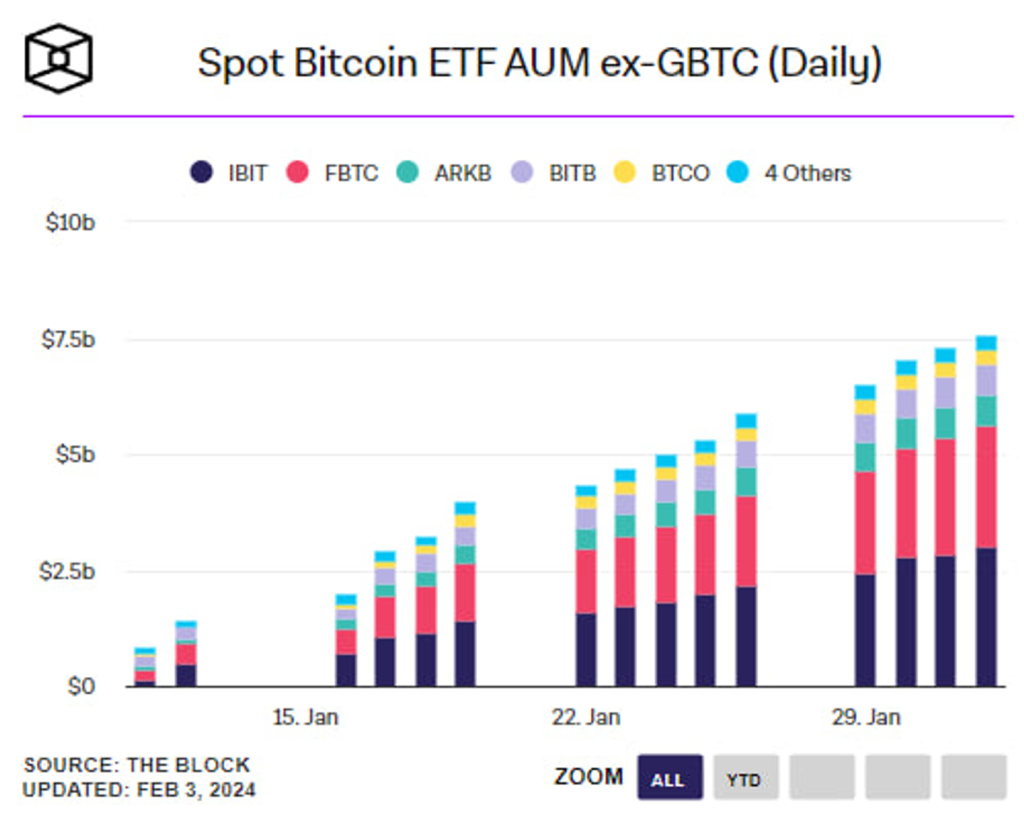

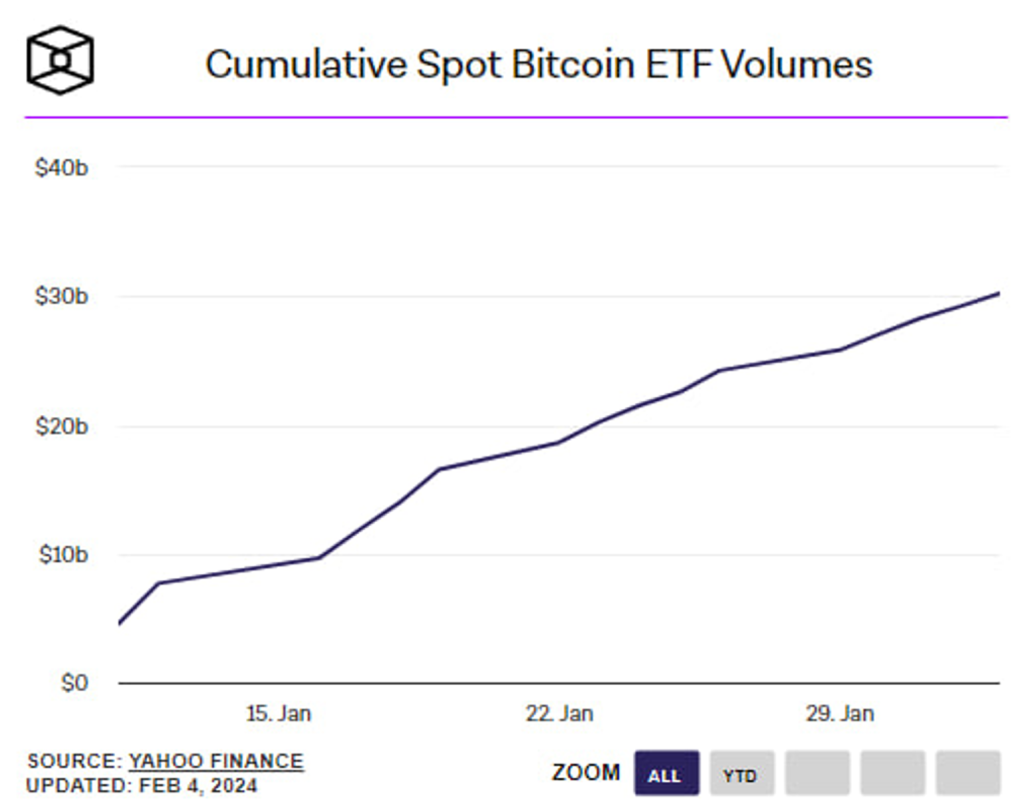

GBTC outflows are still ongoing, but on a smaller and smaller scale. IBIT has $3B in AUM, which is an impressive record. Genesis requested the court to allow the sale of its GBTC holdings. This potential supply will continue to exist in the future. Although this may create excessive fear among most market participants, ETFs have quietly continued to grow. This continues to be a good sign for BTC in the long term.

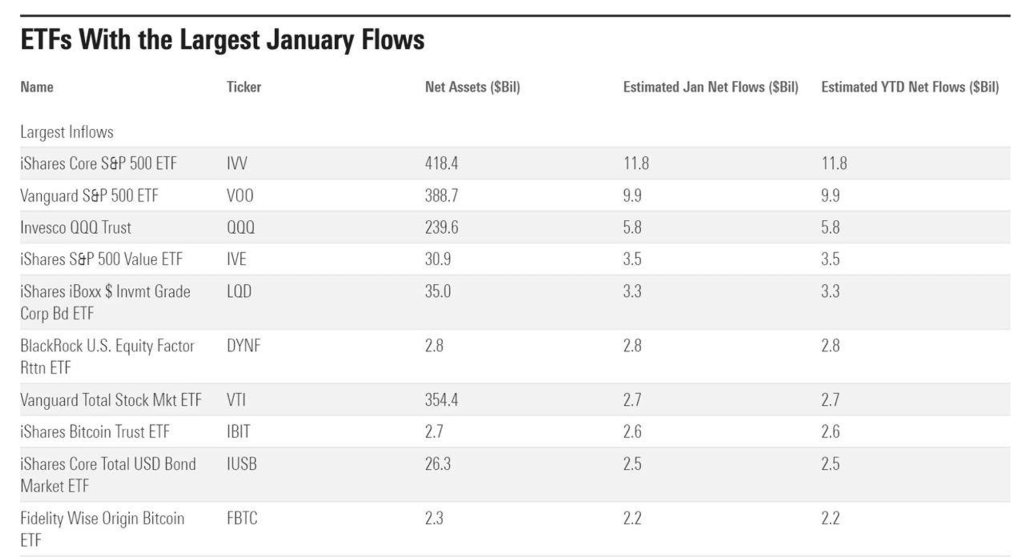

Additionally, IBIT (BlackRock) and FBTC (Fidelity) ranked 8th and 10th, respectively, in total market ETF inflows in January. It’s really cool and awesome. I feel the continued demand for BTC from people. (This is not a story about price changes)

Options Market

The options market doesn’t have much to say… We still maintain a low volatility regime. Currently, options traders prefer to sell volatility. Barring any major events for the time being, it is likely that volatility will continue to remain low. Vol does not change from short to long all at once. But one thing is clear: As Vol continues to move lower, we are entering an environment where it is increasingly difficult for option sellers to oversell options.

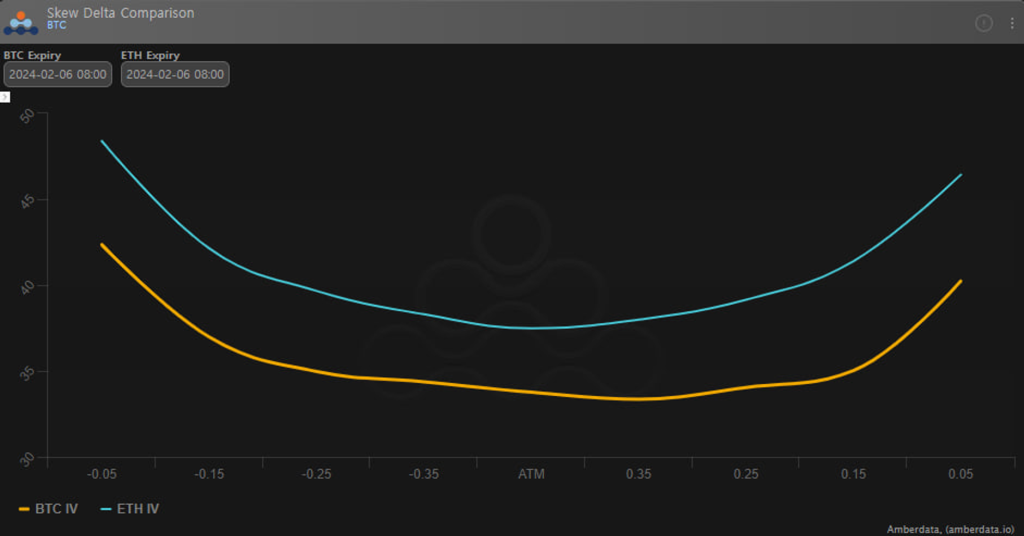

BTC and ETH smiles are showing overall stability. There is a slight bias towards put options, but there is no significant difference. Options markets remain quiet.

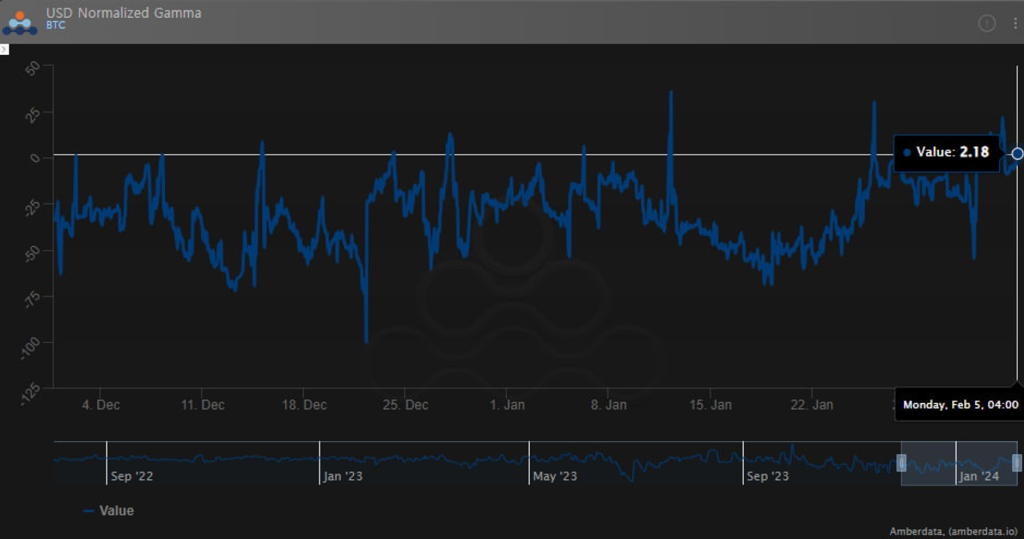

BTC GEX (Gamma Exposure) shows 40k and 42k interest in the market. Market gamma is at positive gamma and it seems unlikely that the options market will experience significant volatility in the short term. The options market size is too small to significantly move BTC due to the hedging dynamics of the options market. Although GEX data doesn’t show every part of the market, I think it’s helpful in giving us a sense of people’s interest levels.

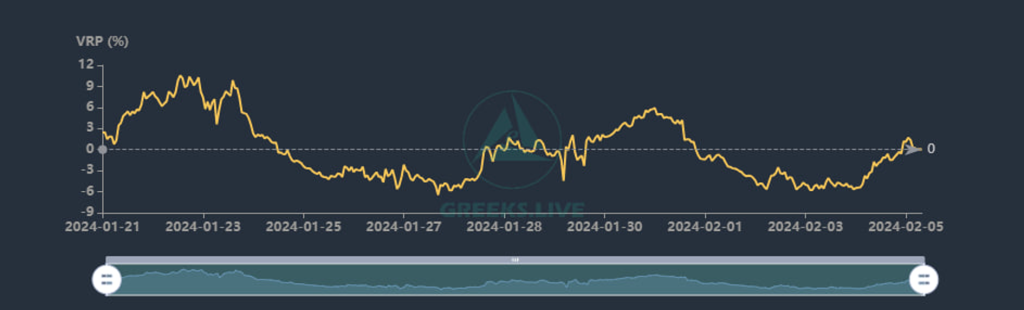

Because both IV and HV remain low, the 7D VRP is close to 0. Short-term options are currently not “expensive” (ATM 37%). One-week options don’t seem like a bad idea, as there is a possibility of a “fast” move if the market moves upward this week.

Macro

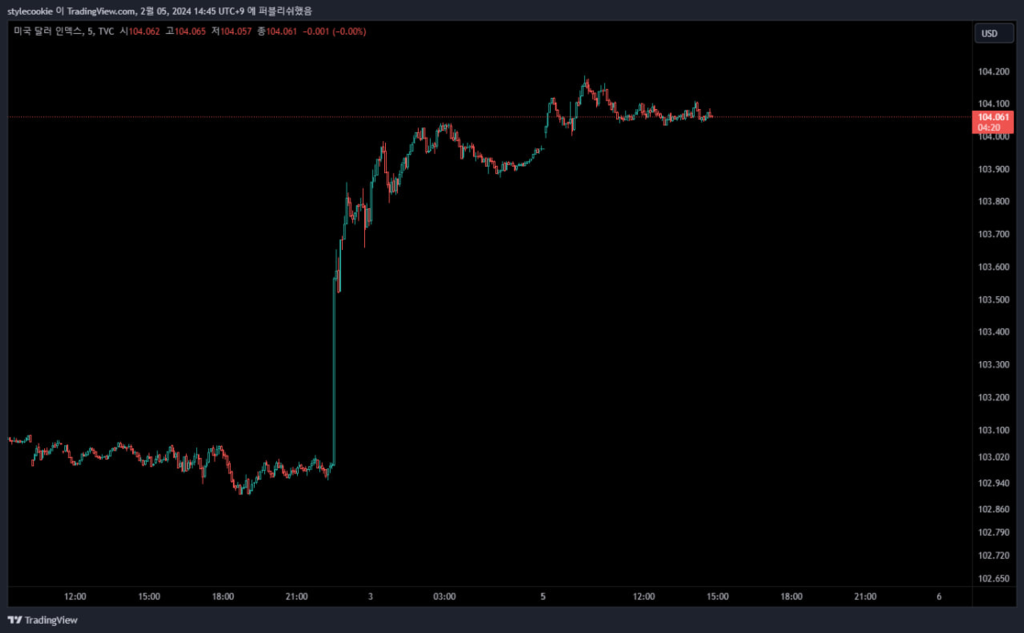

Last week was a huge week for the macro sector. There were many issues including QRA, FOMC, NYCB, and NFP. DXY broke through 103.x resistance after the NFP announcement, which showed a stronger-than-expected labor market. And the Fed told the FOMC that a March rate cut was premature. Powell’s remarks clearly dampened market expectations. It has recently shown a positive correlation between DXY and US stocks, but it seems clear that we will have to watch carefully for some time.

Let’s summarize the areas that market participants are currently worried about and take a quick look at each one!

- Bank bankruptcy risk such as NYCB (related to commercial real estate)

- Inflation

- Recession

- RRP Balance

- NYCB

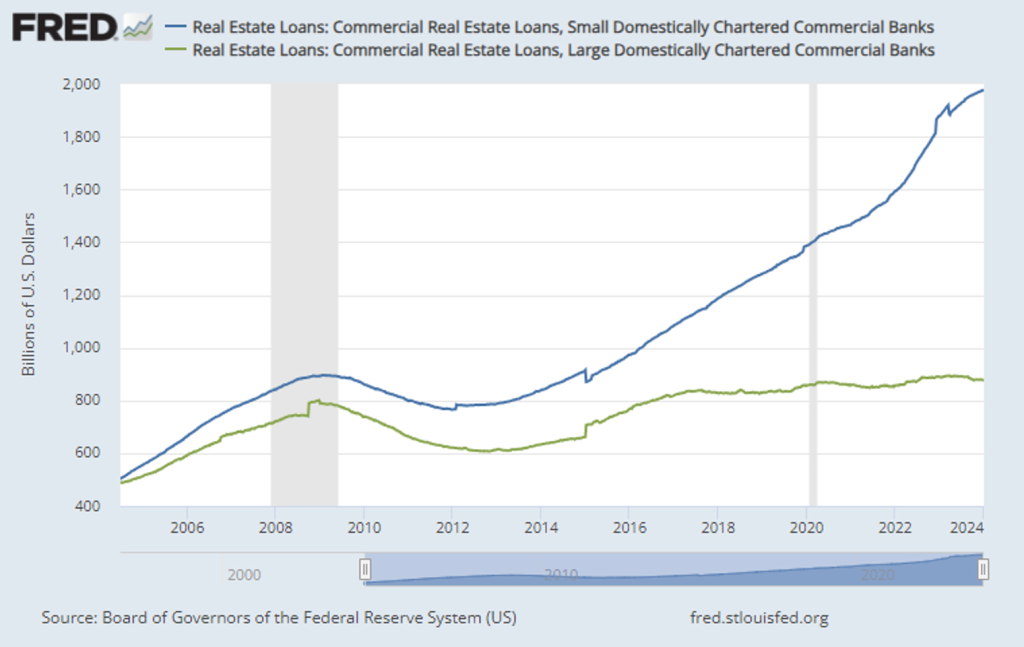

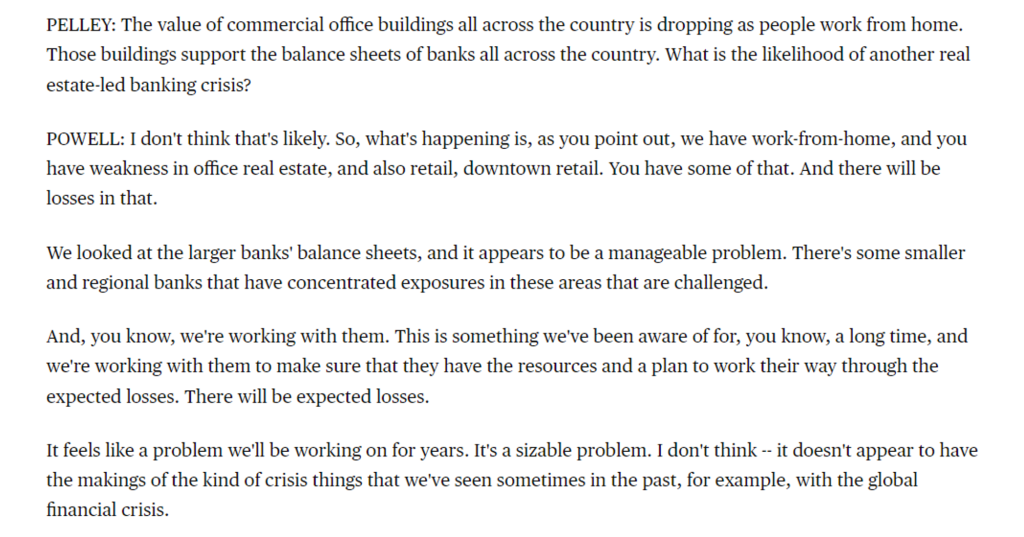

Well, if a property is going to disrupt the actual system, it’s residential, not commercial. Smaller banks will certainly be affected, and it is entirely possible that this could lead to a short-term liquidity crunch. More banks may suffer damage in the future. However, I do not think it is at the level where the banking sector will collapse and systemic risks will arise. This is because small and medium-sized banks account for a larger proportion of commercial real estate loans.

The United States and the Federal Reserve have experienced many of these system collapses and have become resistant. Although it may temporarily affect liquidity, it is expected that there will be no major problems in receiving emergency liquidity using the discount window (DW). If it is judged to be a real crisis, the government will likely take action. This is because the United States is a country with a strong stance of trying to save its banks. In conclusion, I think it is unlikely that it will develop into a financial crisis. If a major problem occurs, I will provide additional updates.

2. Inflation

Truflation’s US inflation indicator is pointing to 1.44%. Considering that this figure is about 6 months early, it appears that disinflation has been progressing well since last year. People have been tweeting strange fractal charts to create panic, but CPI has been steadily falling over the past year.

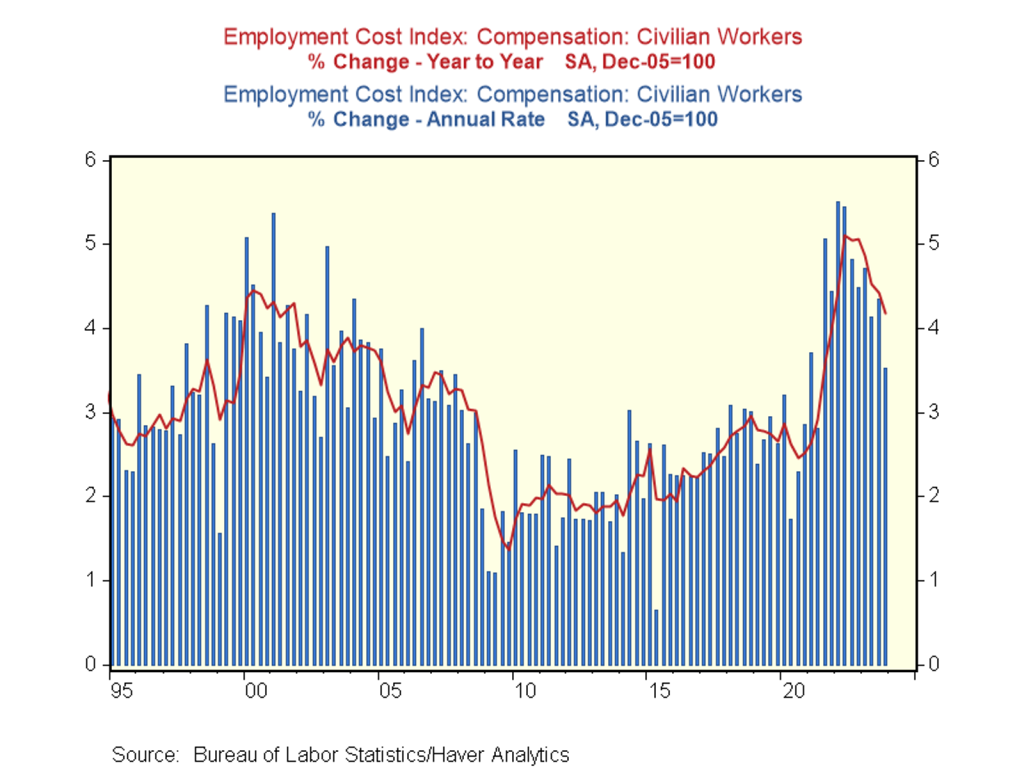

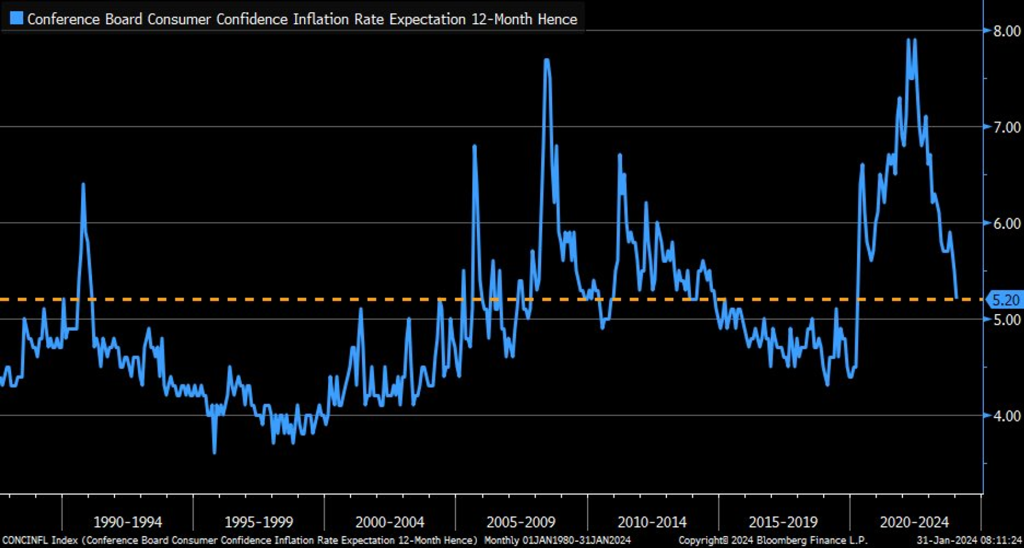

The ECI index and inflation expectations directly mentioned by Powell continue to show a gradual decline. Obviously, inflation may rise again temporarily. But I think there’s still a good chance that it will continue to be low or even lower.

3. Recession

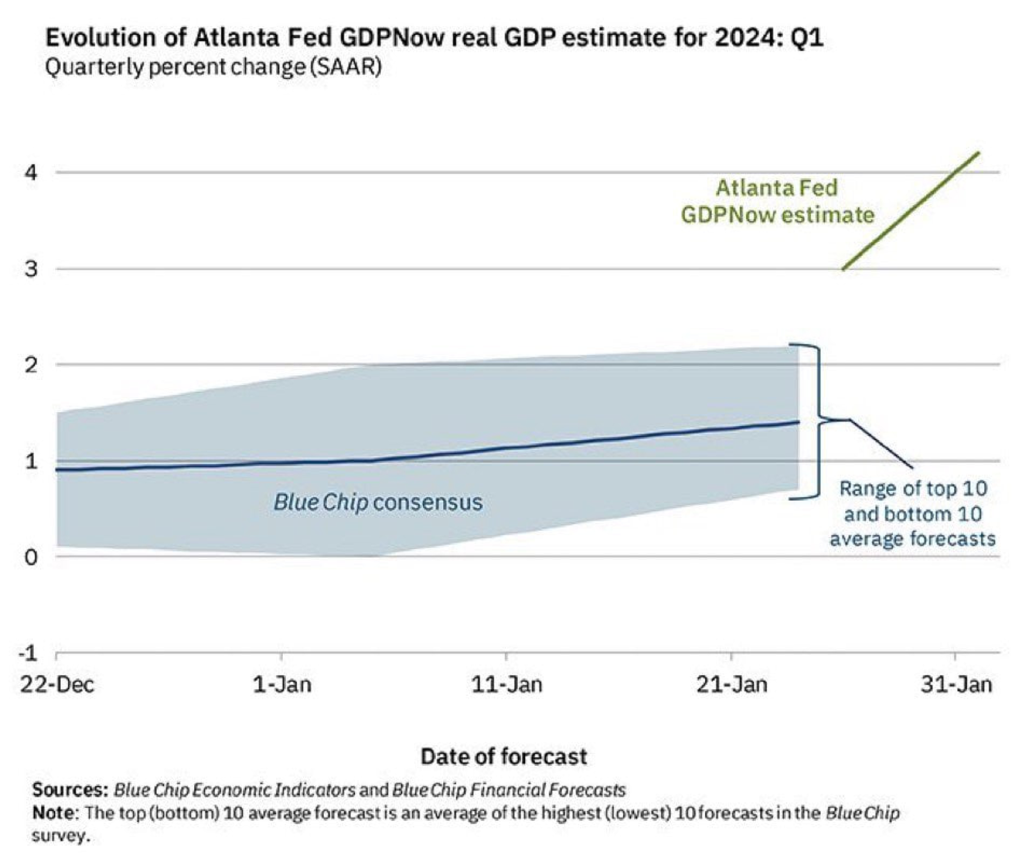

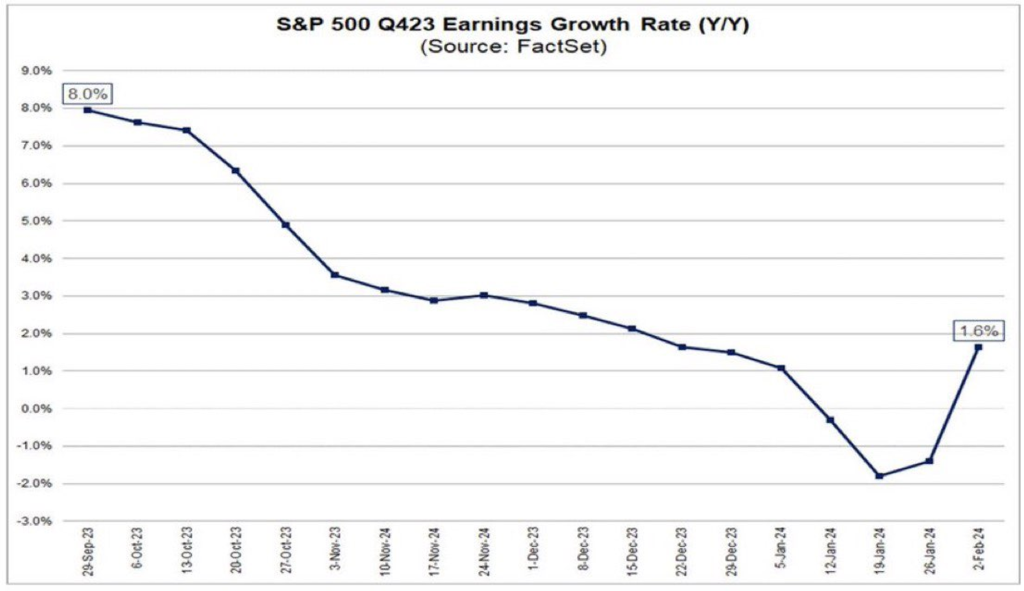

Throughout the year starting in 2023, people have been saying that inflation will rise again and there will be a recession. But the economy was very good in 2023. U.S. GDP in the fourth quarter of 2023 is +3.2%. The Atlanta Fed’s current GDP forecast is +4.2%. The Atlanta Fed’s hit rate was good for 2023, but can they hit it this time too?

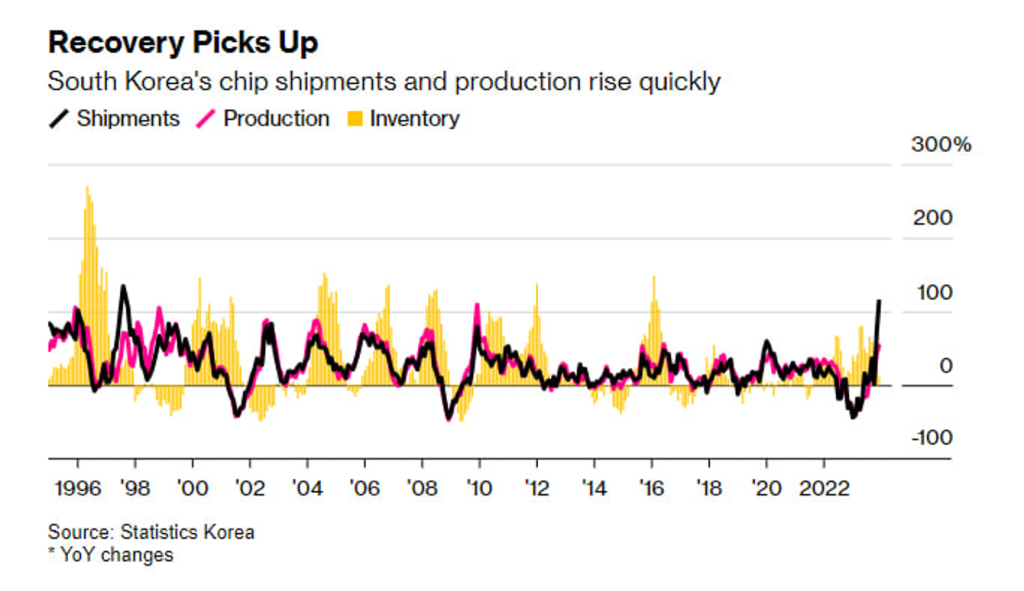

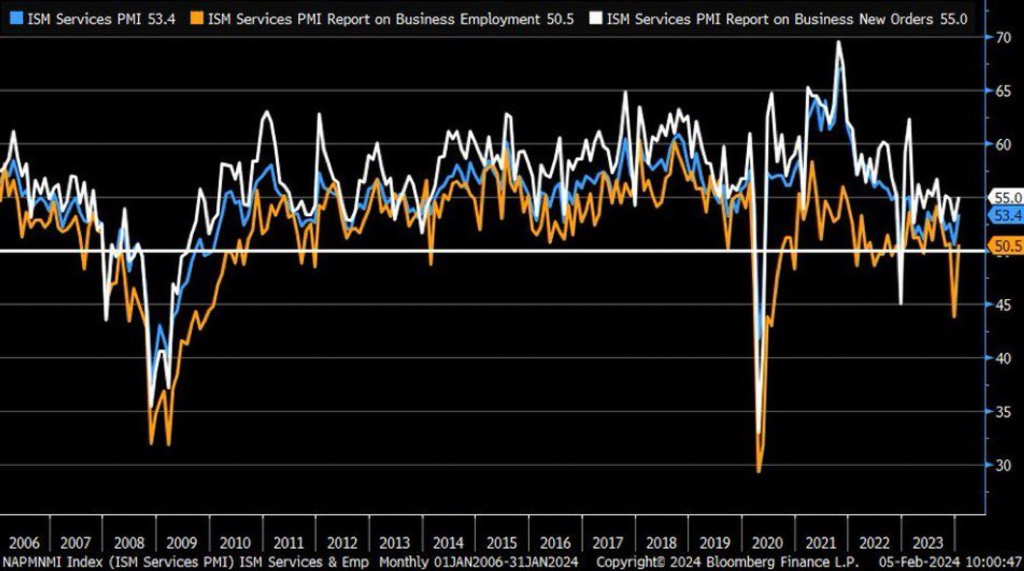

South Korea’s semiconductor chip shipments are the second highest ever. The semiconductor economy of Korea and Taiwan sometimes precedes the global economy. As a result, ISM showed signs of rebound.

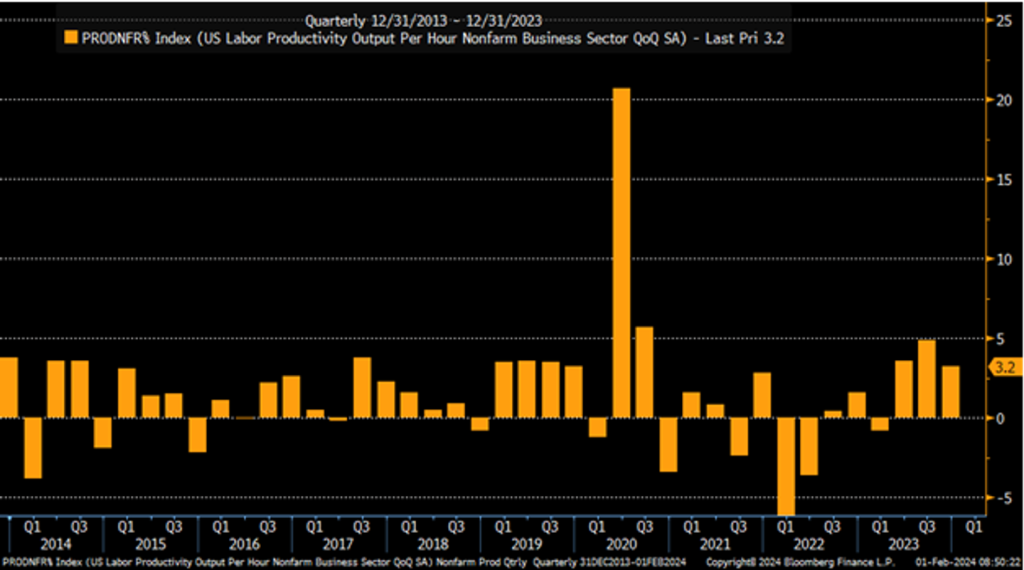

As I have sometimes said in the community, I believe that the development of AI technology is similar to the spread of the Internet in the past. AI is a great technology that will change the world in the long term more than many people think. I think people are underestimating the impact of these technologies (not on stock prices). Such productivity and corporate development are significantly growing AI-related big tech companies such as META and NVDA. In fact, productivity indicators also show +3.2% growth. I would like to encourage you to believe in a bright future rather than worrying too much about a recession that never comes.

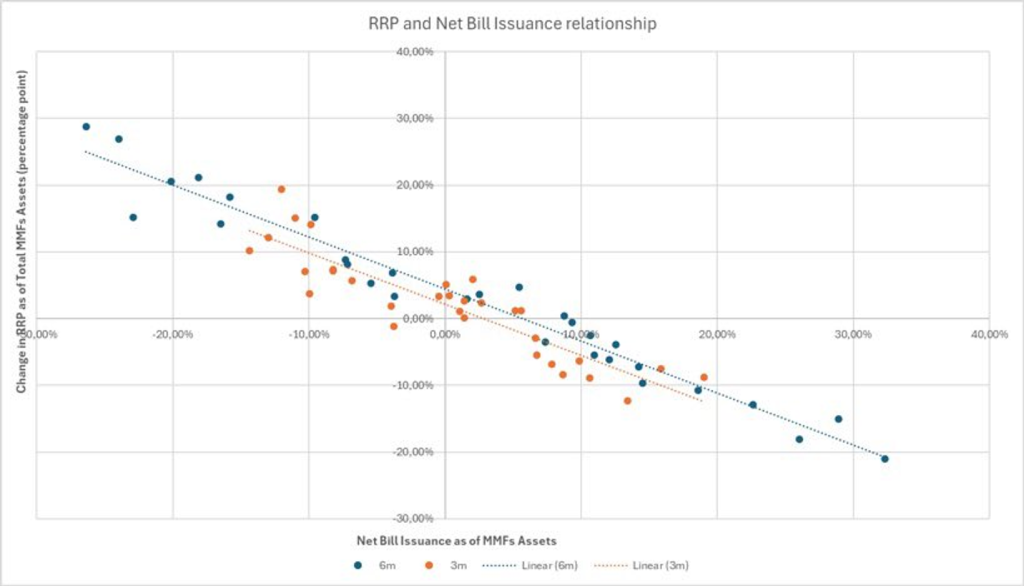

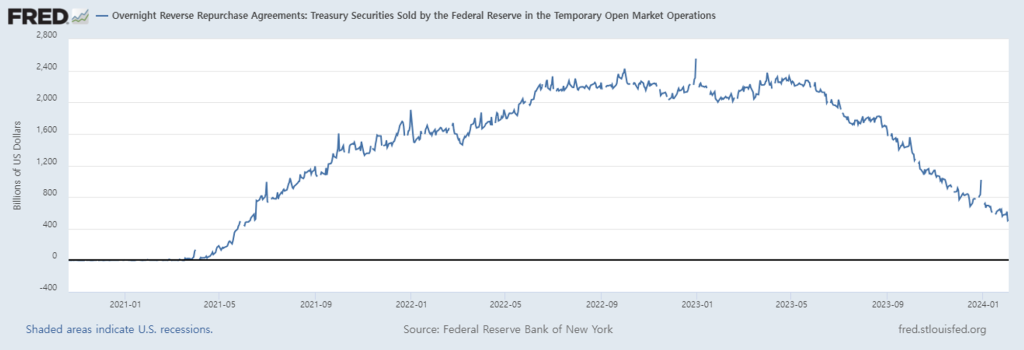

4. RRP Balance

Before the QRA was announced on January 31, there was a bearish theory that the RRP balance would reach zero around March and market liquidity would decrease. However, with the Treasury QRA now announced, it seems more likely that RRP will increase again rather than zero.

Easy summary: Q2 T-Bill net issuance was -$317B. Even taking into account the impact of taxes in April, the net repayment trend is expected to be maintained. Therefore, unless there are special cases, the RRP balance may not decrease but rather increase from Q2 onwards.

China

The current situation in China does not look very good… The stock market is plummeting every day, and the value of the currency against the dollar has been falling continuously since 2014. Xi is forced to buy stocks or provide liquidity to the market to save the market, but… It seems like the market has lost a lot of trust.

Crucially, it appears that China is under a lot of pressure from the dollar (foreign currency funds). I’m not sure if the situation in China will turn into a potential risk, but it certainly seems like we need to be careful.

Lastly, I highly recommend that you watch Chairman Powell’s interview released on Sunday

Jerome Powell: Full 2024 60 Minutes interview transcript

Next week we have long holidays in China (2/10-17) and Korea (2/9-12). Good luck to everyone this week!

NFA DYOR

- 2024.02.06

Services PMI released yesterday shows economy is strong with no problems.

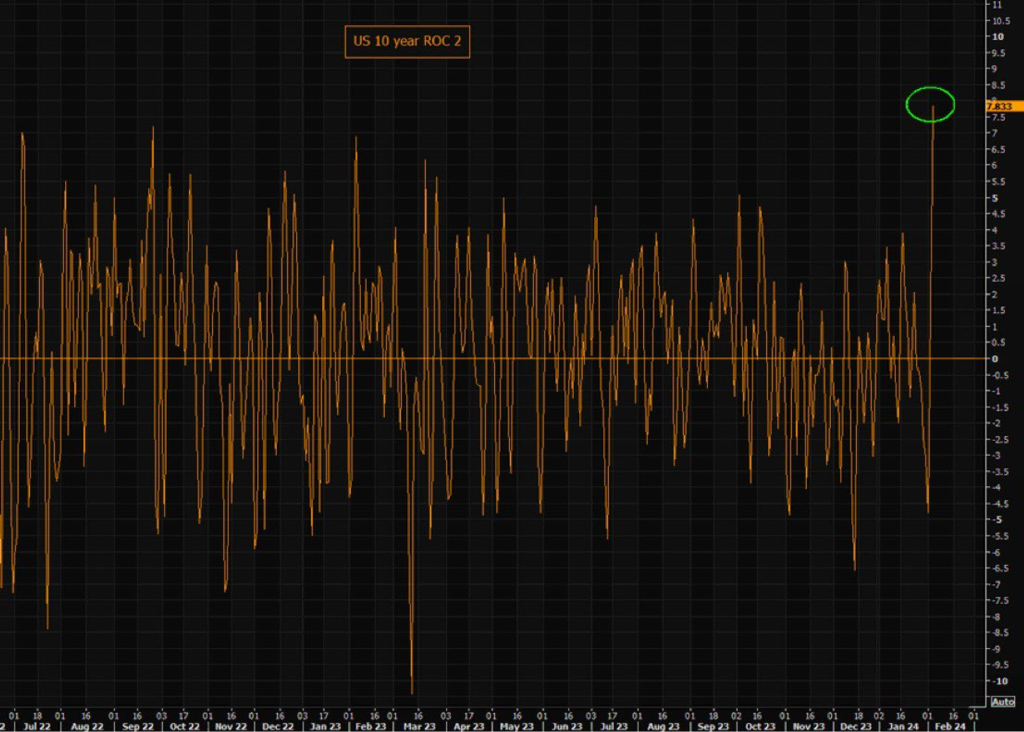

But the price made people afraid. There is a risk perception in the market that inflation will rise again. As a result, 10Y showed a big change in just 2 days. In other words, people’s expectations of a quick interest rate cut are decreasing.

Comments