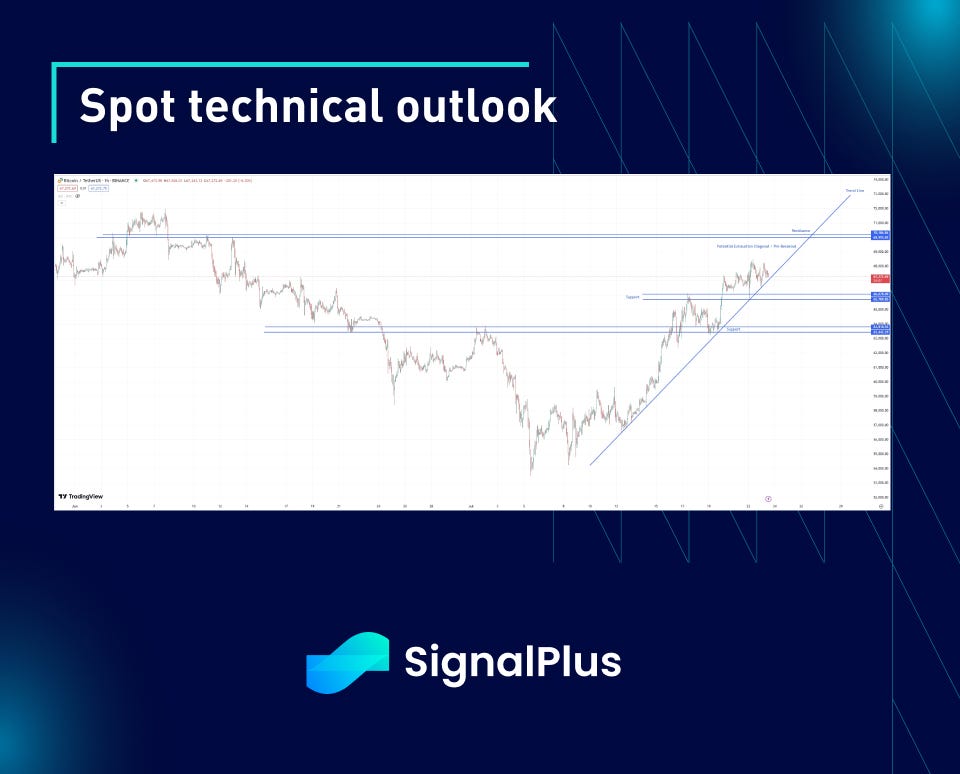

Key metrics: (15Jul 4pm HK -> 22Jul 4pm HK):

- BTC/USD +7.0% ($62,840 -> $67,240) , ETH/USD +3.9% ($3,350 -> $3,480)

- BTC/USD Dec (year-end) ATM vol +15% (59.5 -> 68.5), Dec 25d RR vol +40% (5.2 -> 7.3)

Market Themes:

- Trump assassination attempt drove his election odds higher (60% -> 70%)

- Trump’s continued pro-crypto rhetoric is driving bullish sentiment (‘America’s first crypto president’)

- JD Vance chosen as Trump’s running mate (pro-crypto, anti big-tech)

- ETH/USD ETF launch on 23Jul highly anticipated

- Bitcoin 2024 conference in Nashville, featuring Trump keynote speaker, in focus, as rumours swirl of BTC strategic reserve announcement and large premium embedded in options market

- Biden pulls out of presidential race, endorsing Kamala Harris — market reaction another leg higher in BTC/USD, despite Trump election odds actually pulling back 70% -> 63% (vs Harris from 19% -> 29%)

ATM implied vols:

- Implied volatility marched higher across the complex, as bullish sentiment returned to the market, with large premium embedded in the front-end of the BTC$ curve for Bitcoin 2024 conference — almost 7% daily gap priced in for Trump’s keynote speech (27July expiry will cover this, but for now observable in 2Aug expiry, which has rallied from 50 -> 67.5 implied)

- The rally in implied volatility extended across the term-structure, with 27Sep expiry ATM implied vol rallying from 51->64.5, while year-end ATM implied vol rallied from 59.5 -> 68.5

- Realised volatility remained subdued due to trending price action higher — observed high-frequency realised over the period remained around 43, while daily-fixing realised volatility was just shy of 50

- Intra-week expiries (23–26July, pre-conference) are screening very rich in that respect, with some proxy-premium in the curve for the ETH ETF launch (covered in 24July expiry), where we observe ~4% gap priced in for ETH options

- Further out the curve, expect risk-premium to remain embedded until the conference at least, though locally without a range-break higher we can see a small retracement in levels from the local highs in implied

- Supply-demand heavily tilted for demand in the past week, with bulk of buying observed in Aug-Sep topside contracts, in anticipation of breakout to ATH post Bitcoin 2024 conference

Skew/Convexity:

- Pronounced move higher in skew (favouring topside) this week, reflecting renewed bullish sentiment and repricing of tail premium higher from aforementioned narratives. 30Aug 25d RR rallied from 1.5->5.0 on the week, after briefly reaching a local high of over 7.0 vols!

- Observed correlation of spot vs implied volatility was highly positive locally, with implied volatility rising on the spot moves higher, while retracing from local highs on each pull-back in spot. Although this partly explains the increase in implied 25d Risk reversal, as alluded to earlier, realised volatility did not particularly rise on the spot moves higher, suggesting large additional premium priced in for tail scenarios on the topside, most notably the potential strategic announcement reserves

- As spot has risen to price in some probability of a strategic reserve announcement at the Bitcoin 2024 conference, this arguably opens up room for disappointment should there be no such announcement, therefore short-dated risk-reversal over the event should arguably be deflating as spot goes higher (which is indeed what we have observed in the past 24 hours)

- Overall demand for optionality was strongly tilted to the topside in the past week which has also exacerbated the implied move in skew

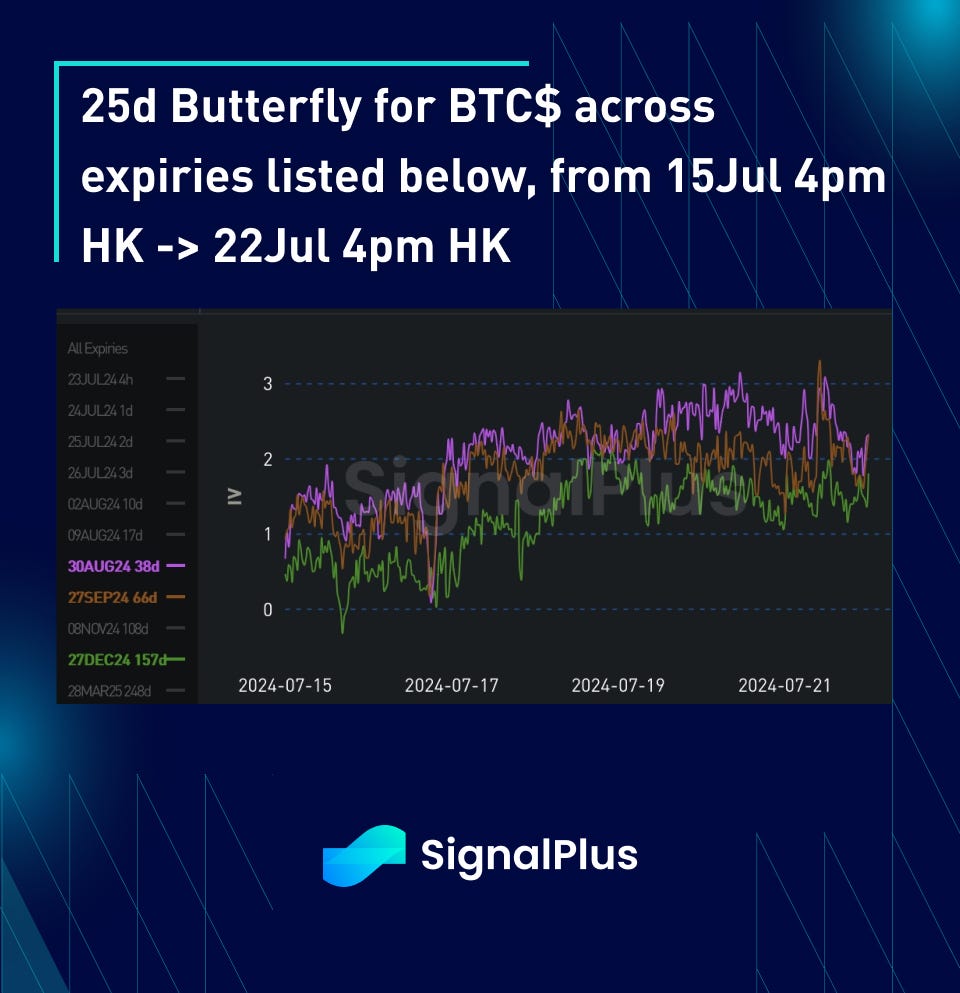

- Rally in convexity more muted in the past week compared to the move in risk reversal, with the 25d butterfly premium moving in line with the elevation of base vols

- This is despite the fact that we have had extremely high vol-of-vol in the past 2 weeks, while also observing strong correlation between risk-reversal and spot (i.e. risk reversal moving more in favour of calls on higher spot, having moved quite sharply in favour of puts on the flush down to 54k 3 weeks ago)

- Overall, while structural supply of wing premium continues to be observed via overlays and call-spreads, we observed a higher proportion of outright purchases this week (less wing supply)

Good luck for the week ahead!

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments