Trading Idea

On August 25th, TON experienced a sharp drop to a low of $5.24 following news of the Telegram CEO’s arrest. The price has since rebounded to around $5.60. TON has seen a cumulative gain of over 144% this year and is currently ranked 9th in market capitalization.

Coincall Block Trade Data

According to Coincall data, both the number of traders and the trading volume for TON options surged significantly yesterday, with a focus on purchasing short-term put options. The largest block trade with the purchase of “TON-27AUG24-5.0-P” options, totaling 110,000 TON with a trading volume of $650,000.

Trade Structure

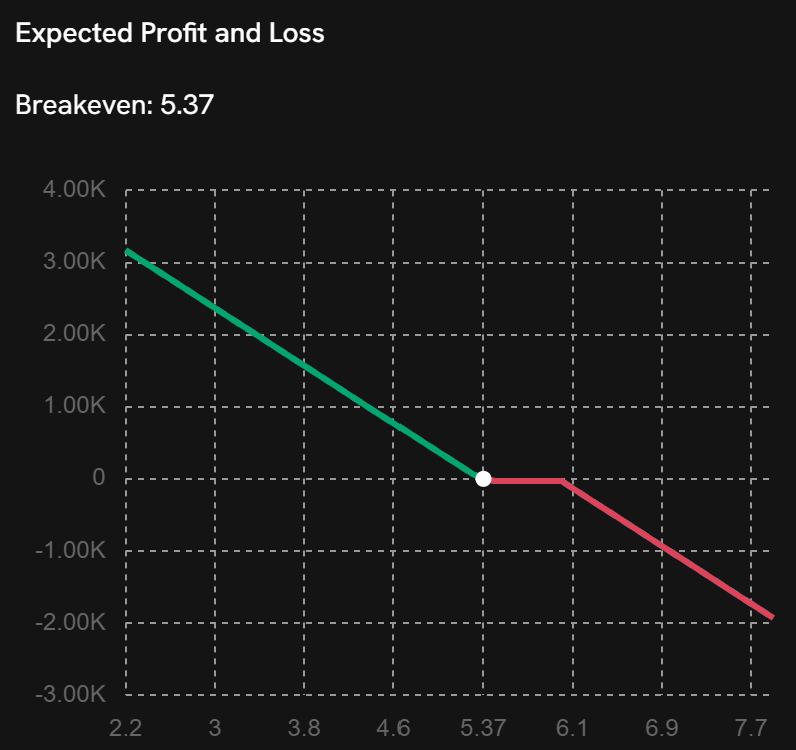

If you expect TON’s price to continue declining in the short term, you might consider constructing a bearish risk reversal strategy, where the premium received from selling call options is used to offset the cost of buying put options.

Sell 1,000x TON-30AUG24-6.0-C @ $0.1

Buy 1,000x TON-30AUG24-5.4-P @ $0.13

Please note that if TON’s price rises sharply, this strategy also carries the risk of significant losses.

👉👉 Go to the Coincall Combo Trade page to place an order now: https://www.coincall.com/combo

Disclaimer

This information is for reference only and does not constitute trading advice. Investors should conduct their own research before making any trading decisions.

Comments