Market

1.FOMC에서 파월 의장의 강한 비둘기 발언 이후 BTC는 상승과 하락을 반복하다 주말에 천천히 회복하여 $70,000 레벨을 되찾았습니다. 매우 중요한 레벨이고 차트에 표시된 것처럼 BTC는 이 레벨에서 몇일간 다시한번 축적을 보여줄 가능성이 있습니다. $80,000이 가깝다고 느껴집니다.

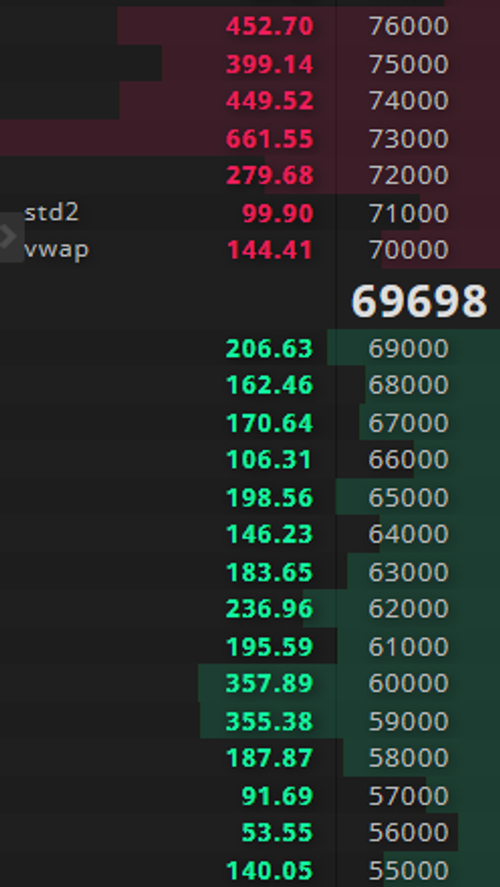

저는 BTC가 추가적으로 상승할 것이라고 보고있지만 생각만큼 쉽게 흘러갈 것 같지는 않습니다. 바이낸스와 코인베이스 거래소에서의 BTC $75,000까지의 매도 주문은 생각보다 많습니다. 강력한 매수세가 필요한 상황입니다. 어떤 고래가 움직일까요?

현재 여러가지 가능성이 CT에서 논의되고 있습니다. 반감기전까지 상승 후 하락 시나리오, 여기서 4월간 횡보 시나리오, 추가적인 하락 시나리오 등. 누구에게나 어려운 마켓 상황이기 때문에 어느 가능성이라도 충분히 일어날 수 있어 확신보다는 확인이 중요해보입니다.

개인적으로 여기서의 일봉 마감을 중요하게 생각하고 있습니다. 이 레벨을 방어해주는 모습과 좋은 일봉 마감 캔들이 여러개 형성된다면 긍정적으로 생각할 계획입니다. 마켓이 혹시라도 추가적으로 더 많은 하락을 보여준다면 저는 주저없이 구매할 것입니다. 쇼핑의 기회라고 생각하는 것이 좋습니다.

어떤 상황이 오더라도 저는 여전히 낙관적이라는 점을 다시한번 말씀드립니다.

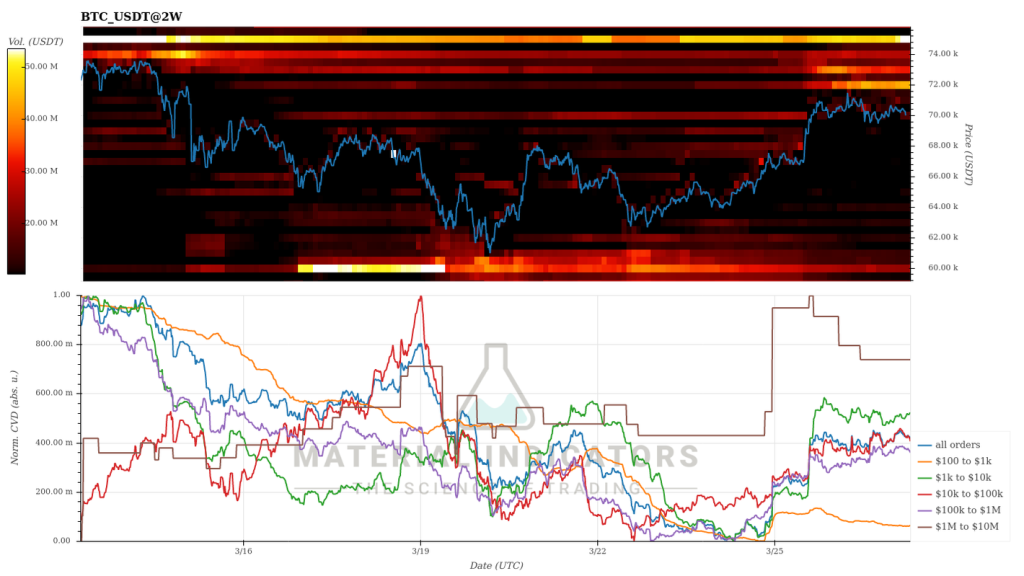

2. In last week’s analysis, I said that from an order book perspective, BTC appears to be close to the bottom. To break the $60,000 level strongly, it would not have been easy for the sell side as they would have had to sell a lot of spot BTC. Currently, buy orders still exist at the same level as before. As explained in number 1, there are quite a few sell orders, so we need strong buys to push the price higher.

3. USDT.D continues to decline after rising to the indicated level. I am not sure what will happen, but I think that if BTC continues to rise, USDT.D will fall to the 3.2% level. I also refer to the start and end of big waves in market movement through the USDT.D chart. I think it would be helpful to refer to the levels displayed on the chart when the market rises and falls.

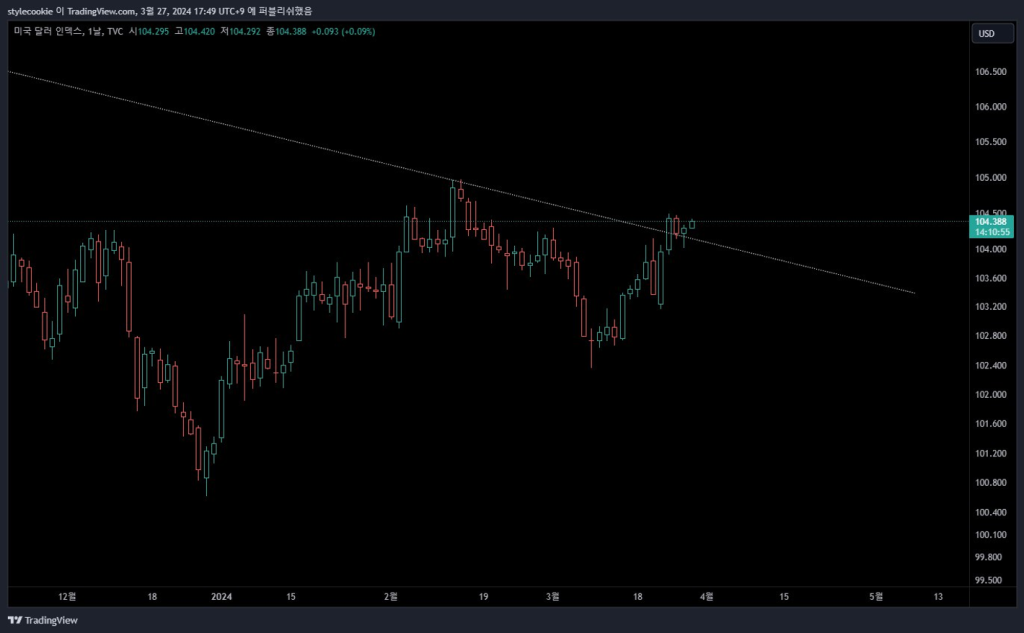

4. Last week, DXY started to rise after the FOMC, but stopped rising at 104.5 and is moving sideways. This is the level I mentioned last week. A clear reversal from this level would be a positive sign for risk assets, but there is a PCE release this week and an upcoming CPI release in April. The upcoming CPI announcement in April is likely to continue the current price rise trend, albeit slightly. Since BTC has moved largely unrelated to DXY in recent months, will it be able to continue its independent movement this time as well?

DXY has clearly broken the trend line, so there may be a further rise, but we need to watch a little more on the weekly basis. It may be a re-evaluation of each country’s currency value, but honestly, I don’t know exactly why DXY is rising.

5. I constantly mentioned GOLD in the communities where most active. My interpretation is that a new upward cycle has begun. Personally, I think that most assets and products, including GOLD, will continue to show good movements. GOLD is still showing a pretty good trend. It is expected that a structure will be created that will allow prices to continue to rise.

6. Institutional buyers will be announced via SEC 13F starting next week. It is expected that we will be able to find out which institutions purchased BTC. Of course, they may not have purchased BTC, but I definitely think they have. There may not be an immediate announcement, but we need to keep an eye on it.

ETF Flow

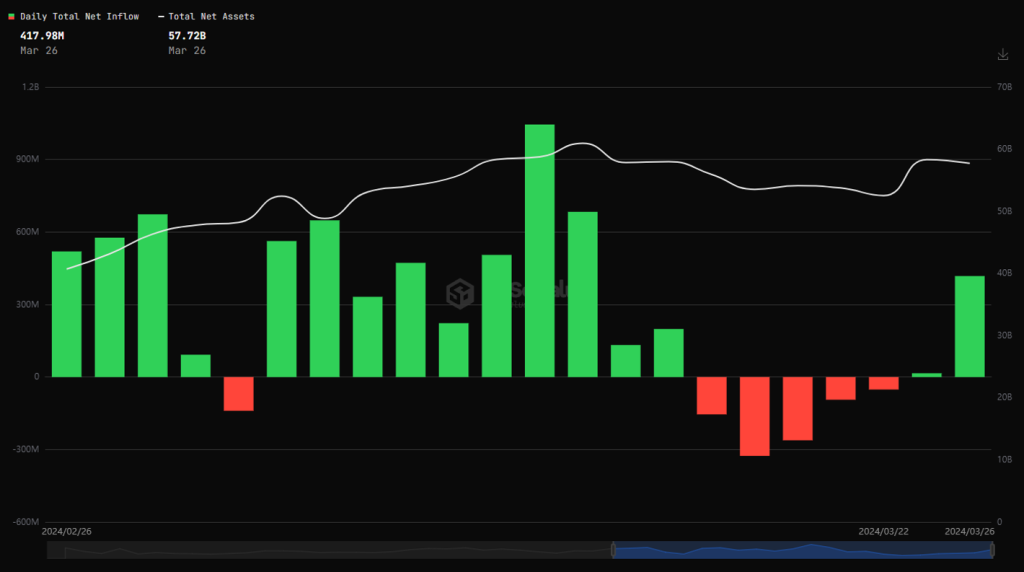

After a continued decline in inflows last week, ETF inflows this week turned positive again. I watched to see if outflows occurred from other ETFs except GBTC, but there were no such incidents. ETF buyers do not seem to have much intention of selling BTC at the current price. If supply is low and demand remains strong, prices rise. Keep it simple.

GBTC outflows have little impact on the market. Don’t pay too much attention to GBTC leaks. If this positive trend continues, the BTC flowing out of GBTC will likely be perfectly converted to other ETFs. Additionally, ETFs are now firmly established as a psychological factor for traders. The market reaction so far after the announcement of ETF flows is definitely like that.

Options Market

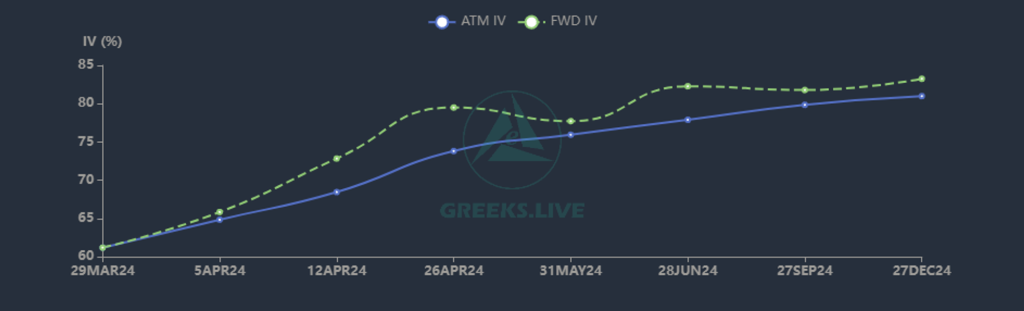

Vol remains at a high level. Nothing much has changed in a few weeks. People are still actively trading options and seem to be more inclined to do so ahead of the halving event.

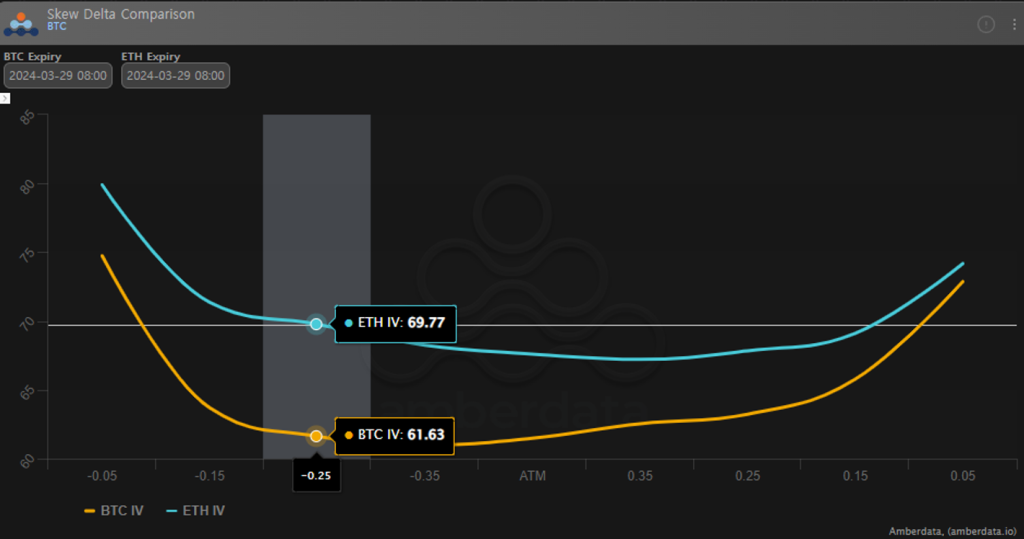

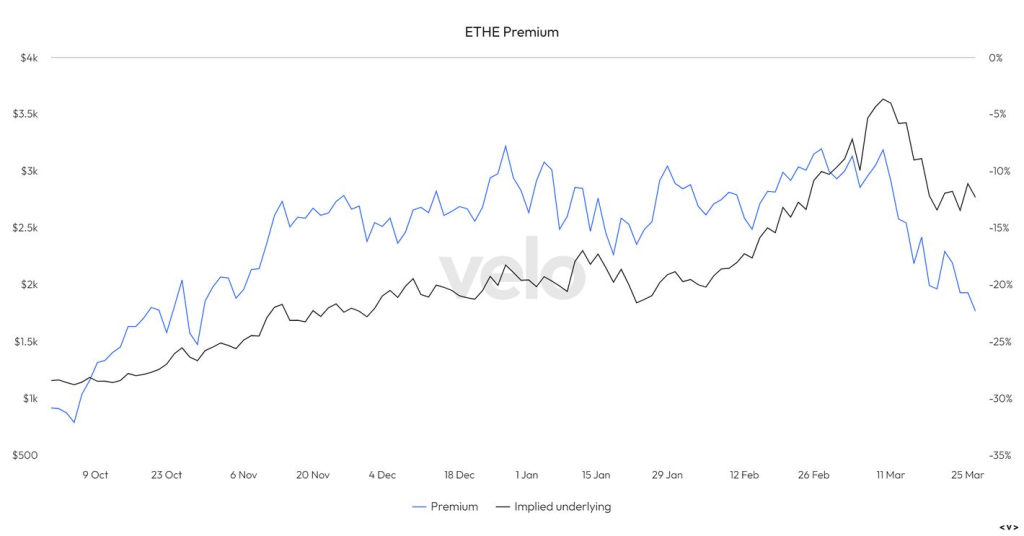

Currently, the options market is negative for ETH and bullish for BTC. There was ETH put spread trading this morning and BTC is still showing demand for long expiration calls. I also think the ETHE premium indicates that people’s expectations of ETF approval have decreased. ETH/BTC is also hitting new lows every day. It would likely take some optimistic news about ETFs for this sentiment to change.

I’m continuing to look at options for April with the halving event. It would be nice if it was 60 Vol, but 70 Vol also looks good. This BTC cycle is likely to be different from normal cycles due to the influence of ETFs, so this halving event has the potential to be interesting.

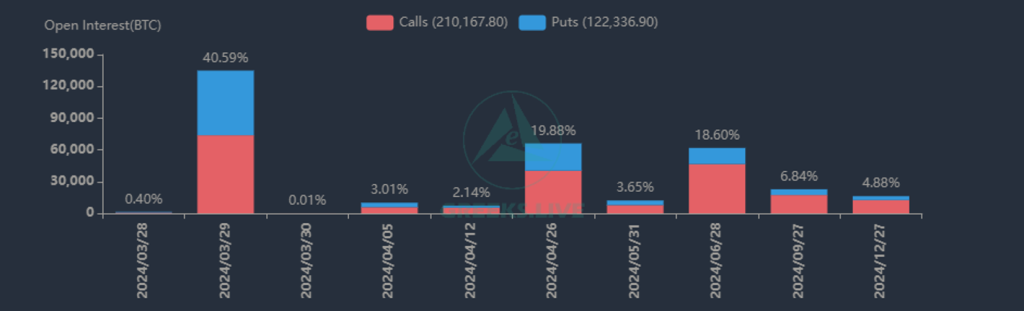

This Friday is the expiration date for quarterly options. Approximately 40% of all open interest expires. It will pass without much impact, just like any other time. Don’t worry too much. See you in April when the new positioning begins.

Have a great week everyone!

NFA DYOR 🙂

Comments