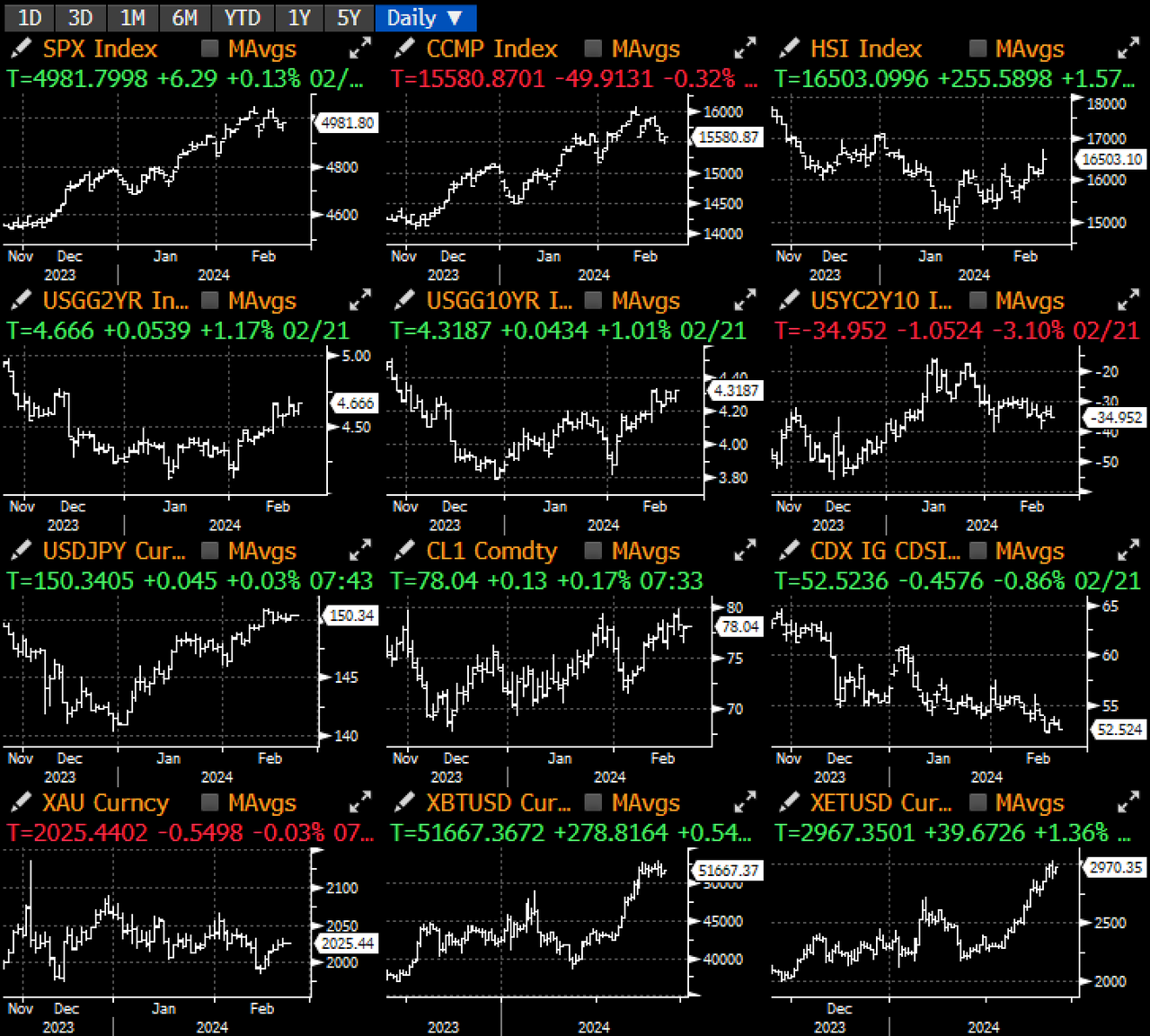

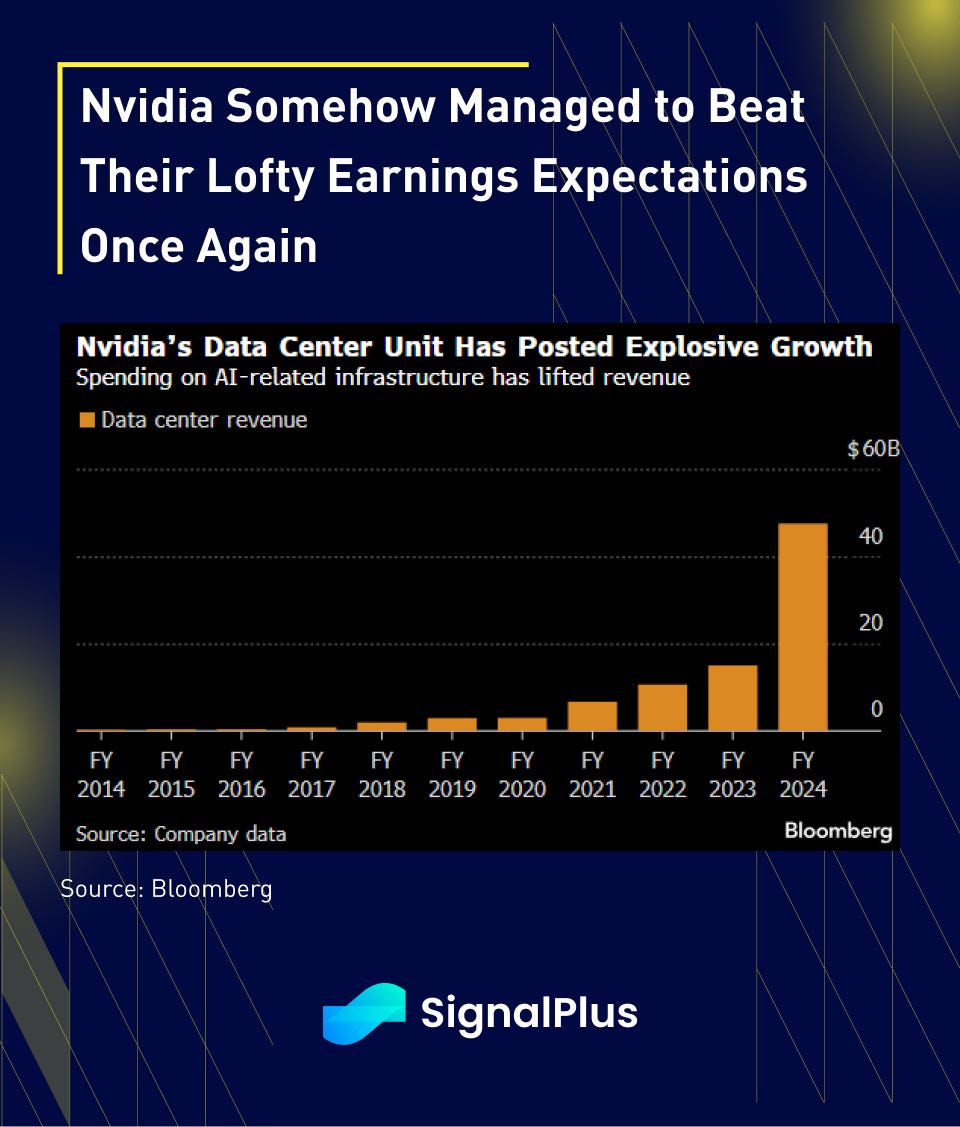

Yesterday’s focus was all on Nvidia, where the AI chip-giant managed to deliver once-again with both top and bottom line estimates coming in above expectations.

Revenues came in at $22.1B vs expectations of $20.4B (and ‘merely’ $6B last year), with data center revenue contributing 83% of results. Gaming revenues saw a 58% YoY growth to $2.9bln, while gross margins held at 76.7% vs 66.1% last year. Net income arrived at $14.8B vs $13.1B expected, while FCF also beat at $11.2B vs $10.8bln.

Most importantly, the company guided up Q1 revenues to $24B (vs $21.9B expected), with margins also expected to stay at around 77%. Furthermore, CEO Jensen Huang confidently declared that “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.,” and “Vertical industries — led by auto, financial services and healthcare — are now at a multibilion-dollar level”.

In other words, say hello to our new AI overlords.

Stock is up ~9% after-market, just under the daily option breakeven, but has likely given the greenlight for risk assets to continue their ascent in the near future.

Markets were relatively quiet heading into the earnings release. We saw a relatively ‘stale’ January FOMC release, as the meeting took place before the strong NFP and CPI/PPI figures, but the minutes nevertheless carried a more hawkish tone, with the committee showing concerns about declaring victory on inflation too early. Headlines included:

- FED MINUTES: MOST OFFICIALS NOTED RISKS OF CUTTING TOO QUICKLY

- SOME OFFICIALS SAW RISK INFLATION PROGRESS COULD STALL

- OFFICIALS SAID DEMAD MAYBE STRONGER THAN ASSESSED

- BALANCE-SHEET TALKS TO GUIDE ‘EVENTUAL DECISION’ ON RUNOFF

- SEVERAL NOTED POTENTIAL RISK FROM EASIER FINANCIAL CONDITIONS

Furthermore, Richmond Feed’s Barkin sang to a similar tune by stating that recent economic data highlighted how price pressures in some sectors are still too high, despite improvement in the overall inflation picture. We have a busy Fed officials calendar today with Bowman, Cook, Harker, Kashkari, and Waller (most important) all scheduled to be delivering speeches of their own, though we wouldn’t expect any earth shattering comments from them at this juncture.

On the other hand, a working paper from the Minneapolis Fed delved into the controversial issue of ‘R-star’, otherwise known as the long-term equilibrium interest-rate in academic circles. The conclusion saw Fed analysts declaring that neutral interest rates will likely stay capped as US productivity growth remain in the doldrums, with this type of thinking feeding into the Fed’s longer-term forecasts of monetary policy.

Finally, on crypto, as further signs that the mainstream tide is turning, Bloomberg reports that one of the lead SEC litigators against the likes of Coinbase and Ripple is leaving to join as a partner to a white collar defense group that specializes in crypto and cyber defense practices at White & Case, a 2600-person strong law firm.

In her first public interview, she stated:

“Crypto is here to stay — that’s become very clear with the launch of a slew of Bitcoin” exchange-traded funds, she said. “Given the complexity and the turbulent enforcement arena, legal questions surrounding crypto are going to be at the forefront for some time.”

Oh how the tides have turned. Should we expect Gensler to join Coinbase as a special advisor after his public service? Interesting times we live in…

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments