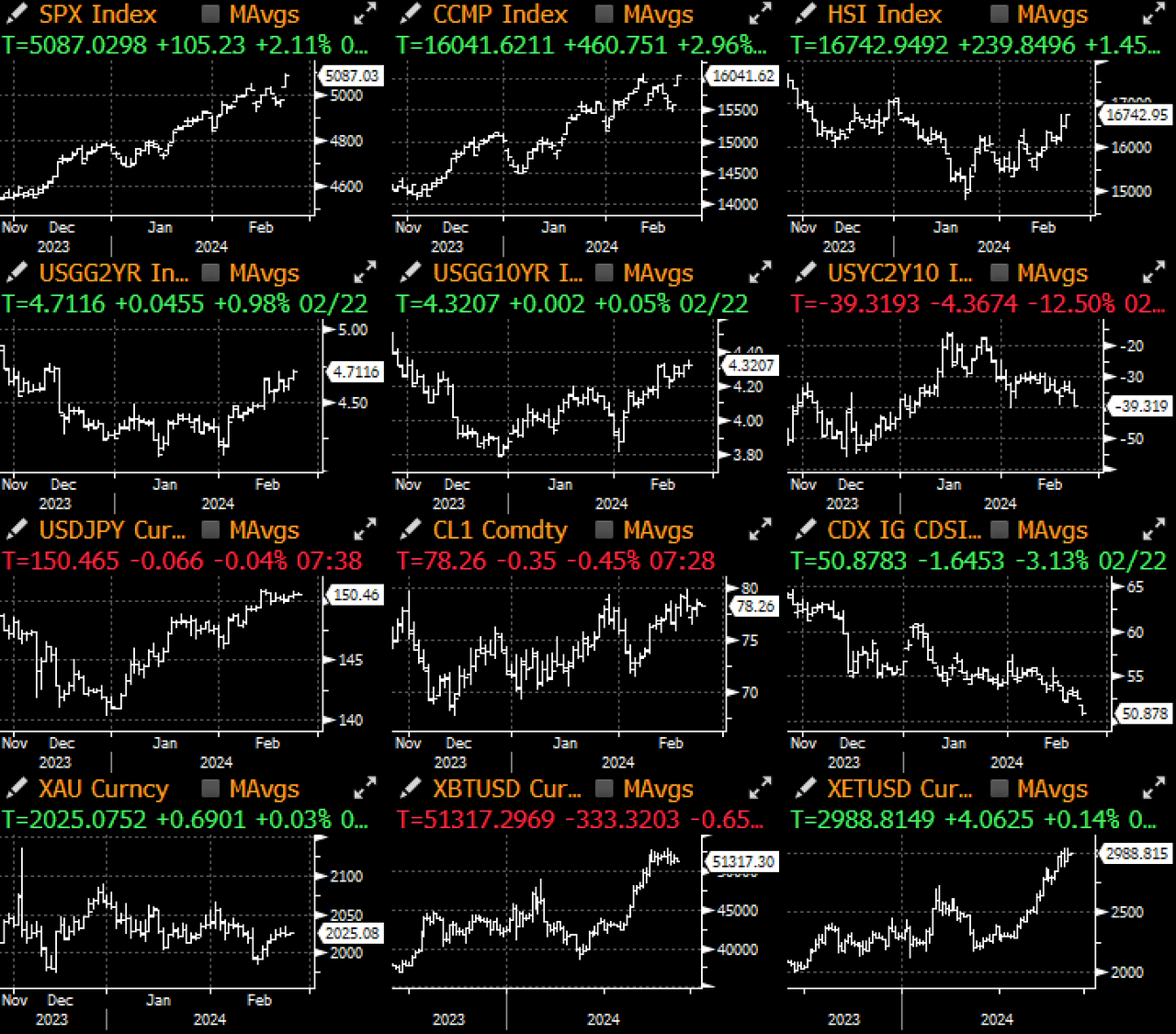

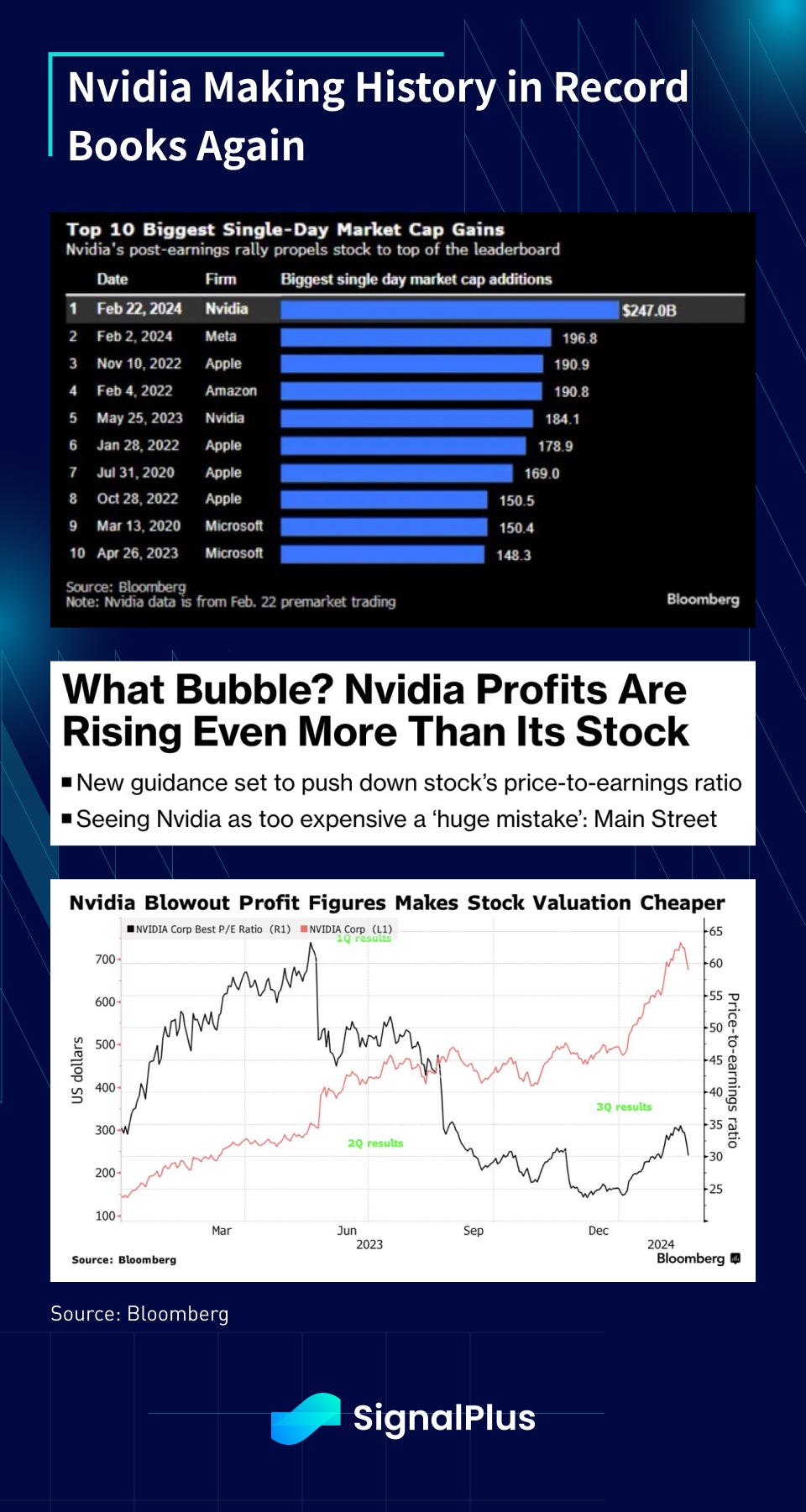

Risk markets screamed as per our note yesterday, with Nvidia’s blowout earnings giving equities the greenlight to resume its climb to ATHs. The AI giant made records yesterday in driving the largest 1-day gain market cap with a $247B haul, blowing past Meta’s previous record earlier in the month at $197B. Furthermore, mainstream analysts and media have started to make justifications for the stock’s historic rally by claiming that EPS growth has led to a compression in PE ratio (to ‘just’ 35x on a forward basis).

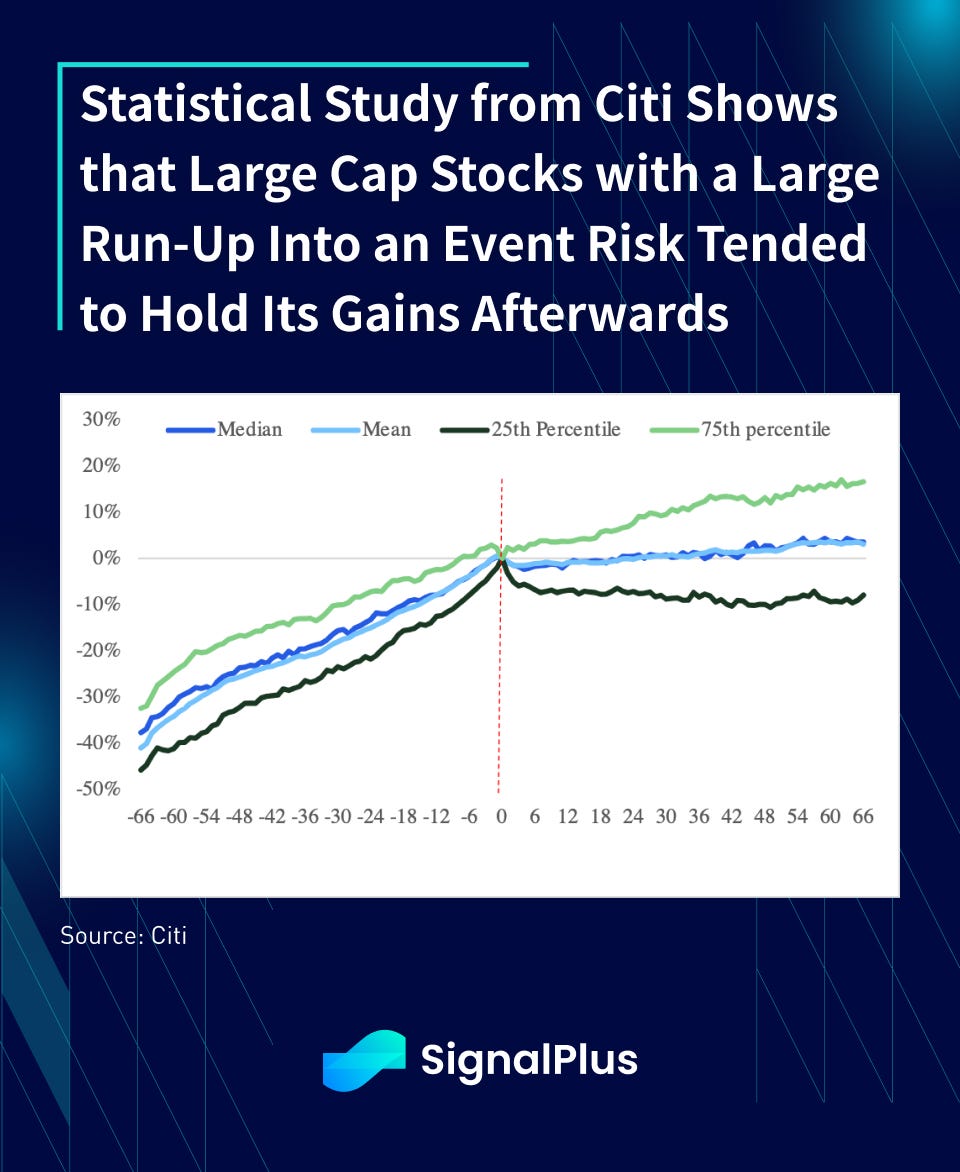

Furthermore, a statistical study from study suggests that the current AI ‘bubble’ is still early on in its phase with more room to run. In analyzing over 1000 large cap stocks in the past 30 years, each tallying a 35%+ rally over 3 months, their study shows that the returns remained marginally positive over the next quarter, and without any meaningful pull backs. That would bode well for the current risk rally should history repeat itself in the near term.

The 2% SPX rally was fierce and broad-based, leaving every sector in the green except for utilities, with technology outpacing with a massive daily gain of 4.4%. Unsurprisingly, downside hedge costs have cheapened to multi-year lows, as investors continue to see little cause for concern over the near term.

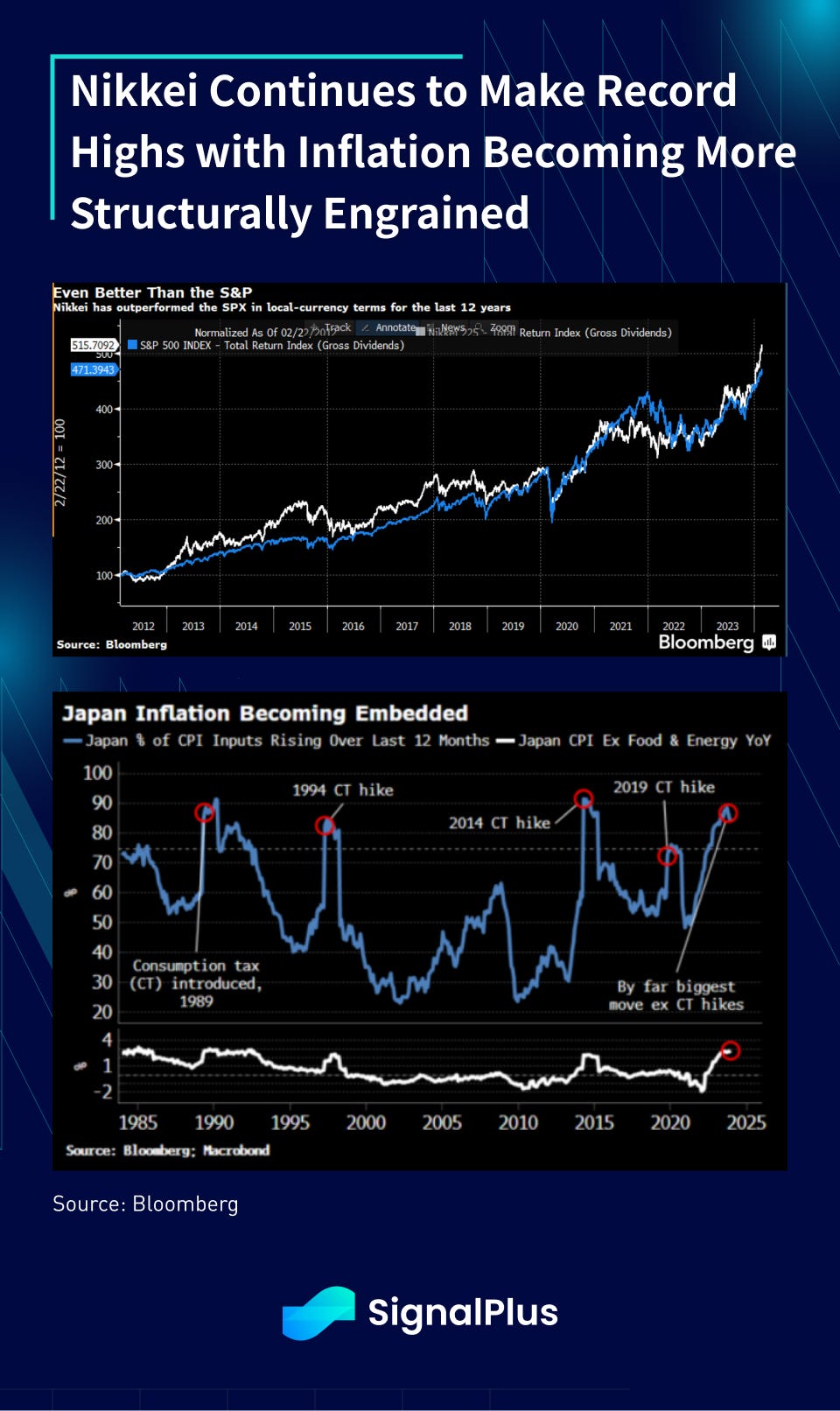

Furthermore, the strength was not limited to just the US, with Nikkei making historical highs and actually outpacing the SPX (in local currency terms) over the past decade. Inflation in Japan is starting to become more engrained with nearly 90% of its CPI basket seeing gains, with capital inflows continuing to flood across both equities and real estate.

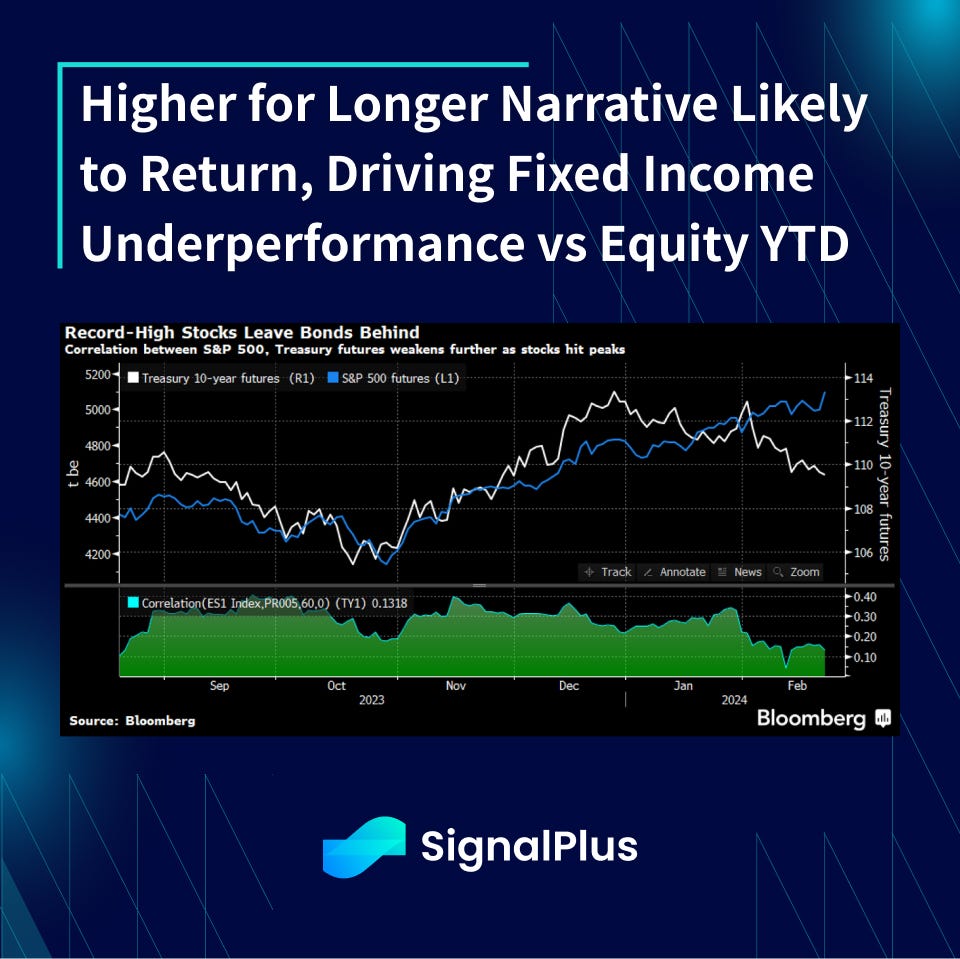

With the US economy still in good shape (initial claims and US PMI remained buoyant yesterday), financial conditions easing substantially, US large-caps still making money hand-over-feet, and gen-AI leading to incredible wealth gains and productivity-boosting promises for the future, are we heading into a period where the Fed is actually going to be forced to be hawkish, or are we entering a period where stocks have “hit a permanently high plateau” (Fisher 1929) or “irrational exuberance” (Greenspan 1996)? In either case, we should expect to see a return of the “higher for longer” narrative with stock-bond correlation likely to remain decoupled in the near term ahead.

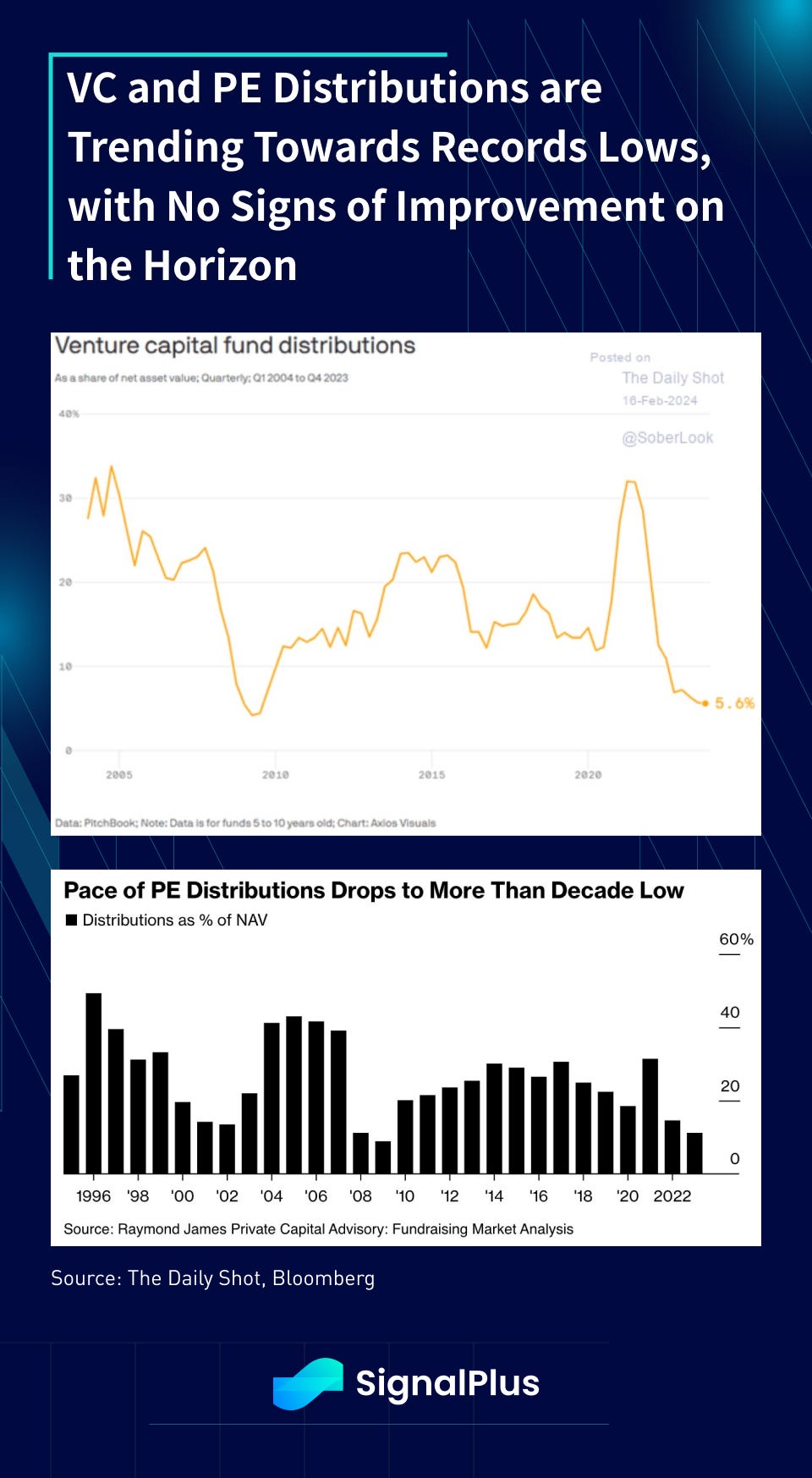

Unfortunately, a rising tide does not lift all boats in this case, as we will continue to see casualties in the illiquid VC and PE space with higher funding costs and AI-concentrated starving fund distributions, and thus lowering investor recommitment interests. With a focus on cash flow and liquidity, we’ll likely continue to see the private investment world pivot towards structured secondaries and continuation fund structures. Markets and cycles evolve, and so must we.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments