Well, I surely hope we all like red, because it seems like we’ll be seeing a lot more of that everywhere.

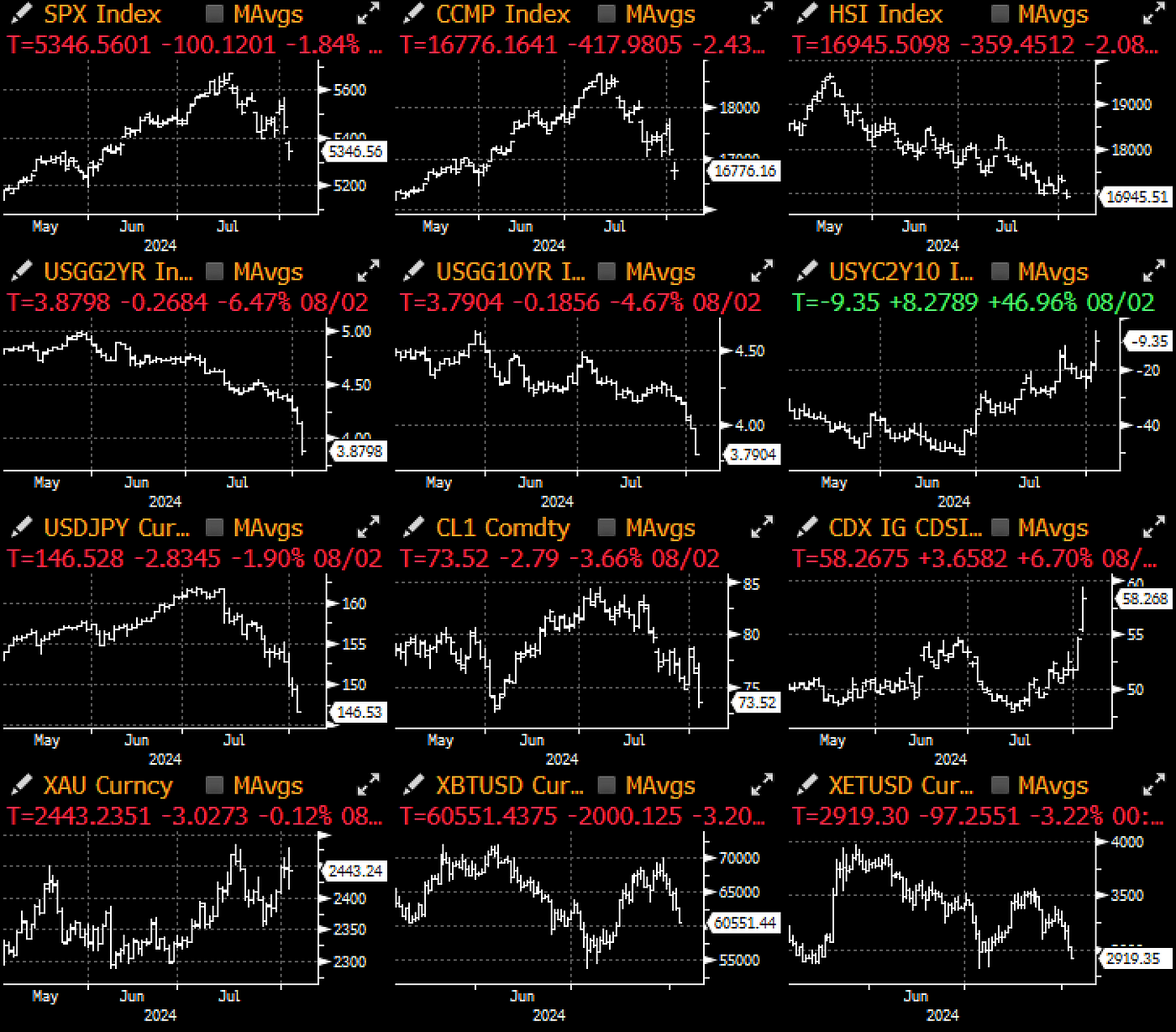

Friday’s weak NFP was the quake that up-ended macro assets across the board, with prices seeing multi-sigma moves immediately after the number and the tremors continuing into the new week.

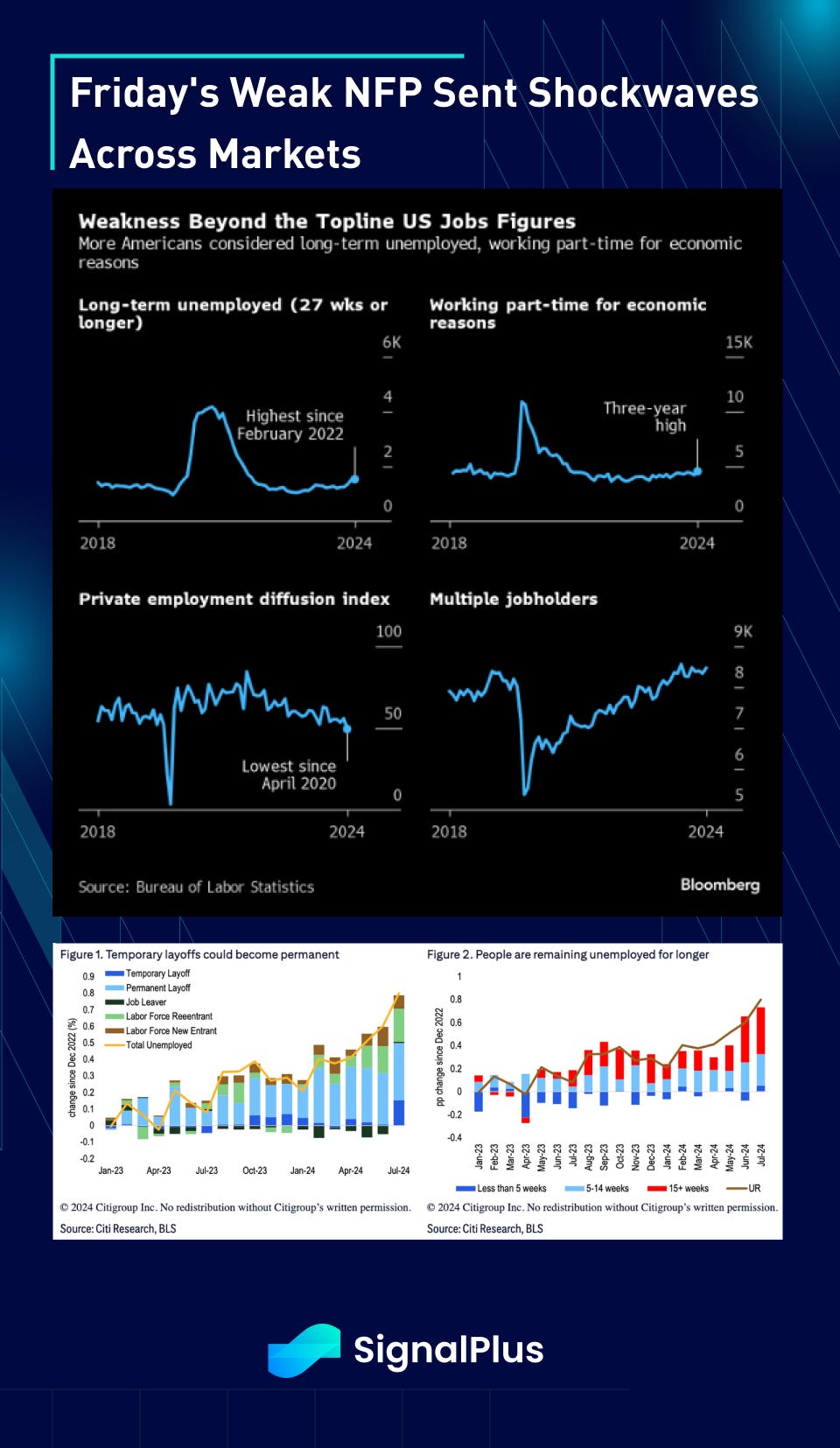

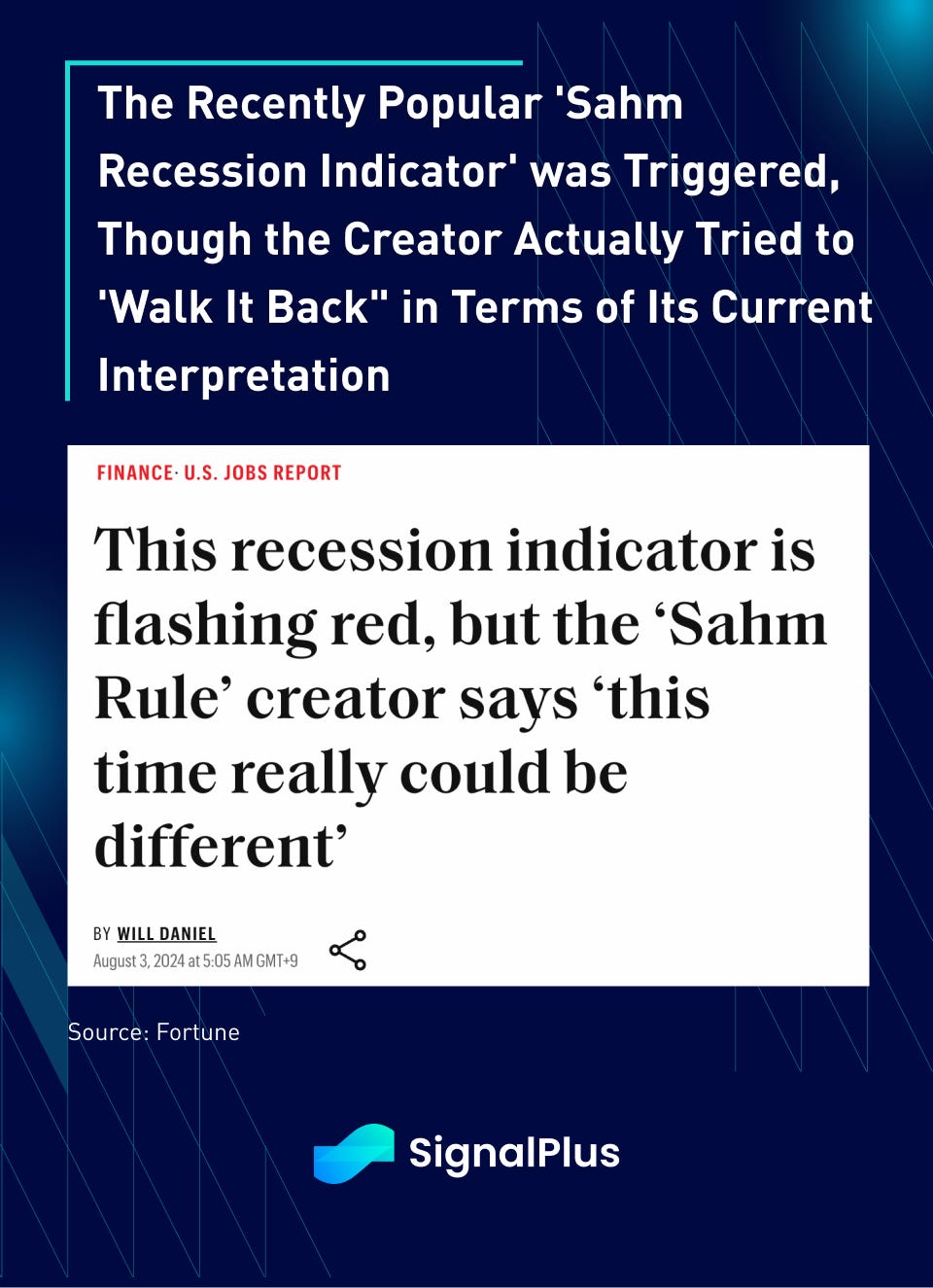

Headline NFP rose by +114k, one of the weakest prints since Covid, with negative revisions in the prior 2 months. Average hourly earnings growth slowed to 0.2% MoM and 3.6% YoY, and the unemployment rate saw yet another unexpected jump to 4.25%. The unrounded rate is dangerously close to triggering the ‘Sahm recession indicator’ (4.28% being the ‘threshold’), though markets aren’t taking any prisoners as risk assets were ruthlessly smashed across the board.

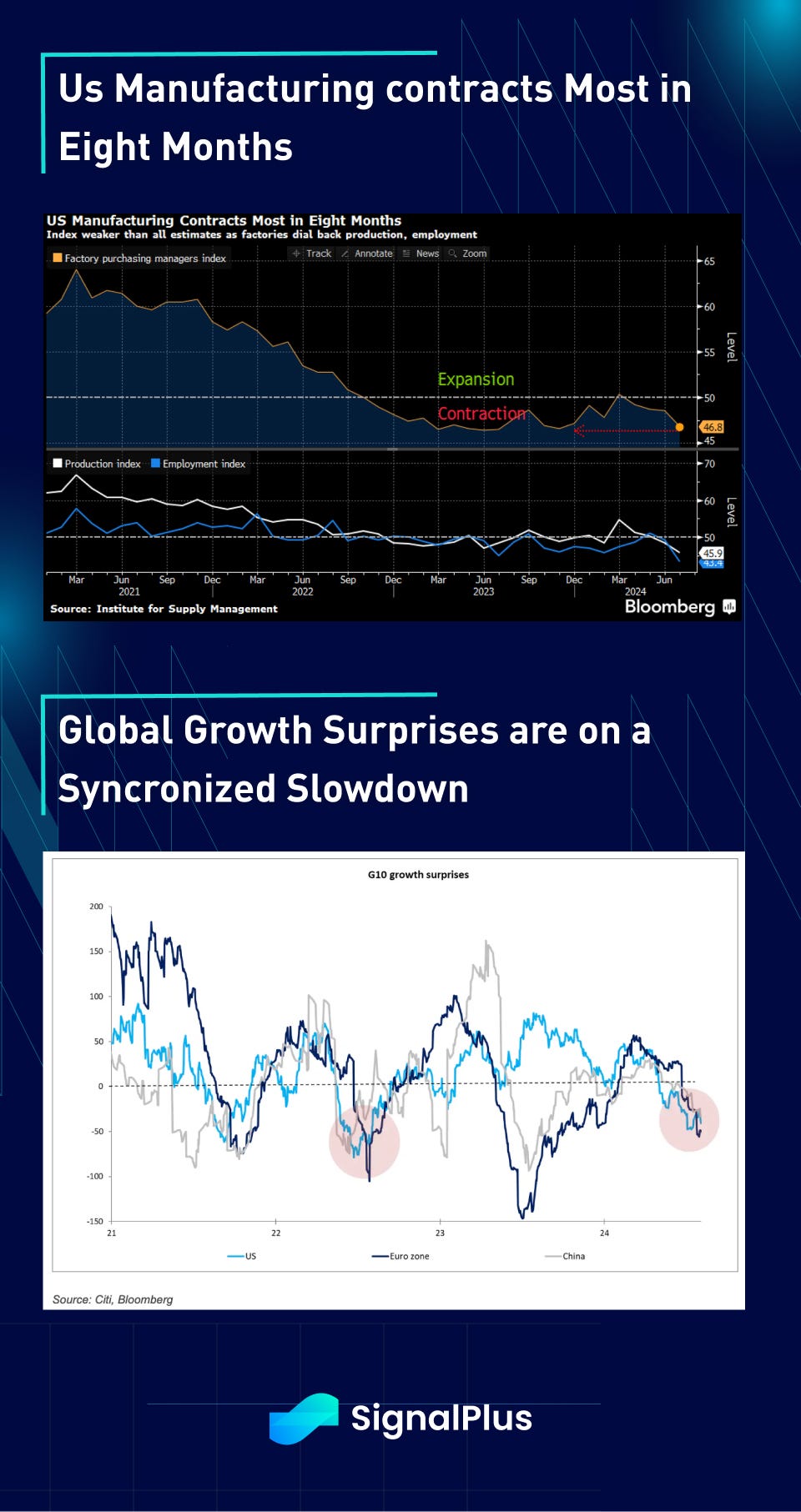

Outside of NFP, Friday’s weak figures capped off a week of disappointing data, where US manufacturing shrank by the most in 8 months (-1.7 pts to 46.8) on the back of declining orders, production, and employment cutbacks. Selected industry comments (credit: Bloomberg) seemed to suggest a more protracted slowdown happening in real-time:

- “It seems that the economy is slowing down significantly. The number of sales calls received from new suppliers is increasing significantly. Our own order backlog is also diminishing.” — Machinery

- “Demand continued to soften into the second half of the year. Supply chain pipelines and inventories remain full, reducing the need for overtime. Geopolitical issues between China and Taiwan as well as the election in November remain weighing concerns.” — Transportation Equipment

- “Sales are lighter, and customer orders are coming in under forecasts. It seems consumers are starting to pull back on spending.” — Food, Beverage & Tobacco Products

- “It seems that the economy is slowing down significantly. The number of sales calls received from new suppliers is increasing significantly. Our own order backlog is also diminishing.” — Machinery

- “Unfortunately, our business is experiencing the sharpest decline in order levels in a year. “ — Fabricated Metals

- “Business is slowing, and we are taking cost actions.” — Electrical Equipment & Appliances

- “Some markets that are usually unwavering are showing weakness.” — Nonmetallic Mineral Products

- “Elevated financing costs have dampened demand for residential investment. This has reduced our need for component products and inventory.” — Wood Products

Markets were awash in a wave of multi-sigma sell offs. Tech stocks cratered -2.5% on the day, chip stocks have sold off more than 20% since July, US 2yr yields closed a full 26bp (!!!!) lower to 3.87%, VIX spiked to nearly 30 in a 99%-tile move against the underlying equity move, USDJPY collapsed to 145 and nearly wiped out the entire year’s gains in one go.

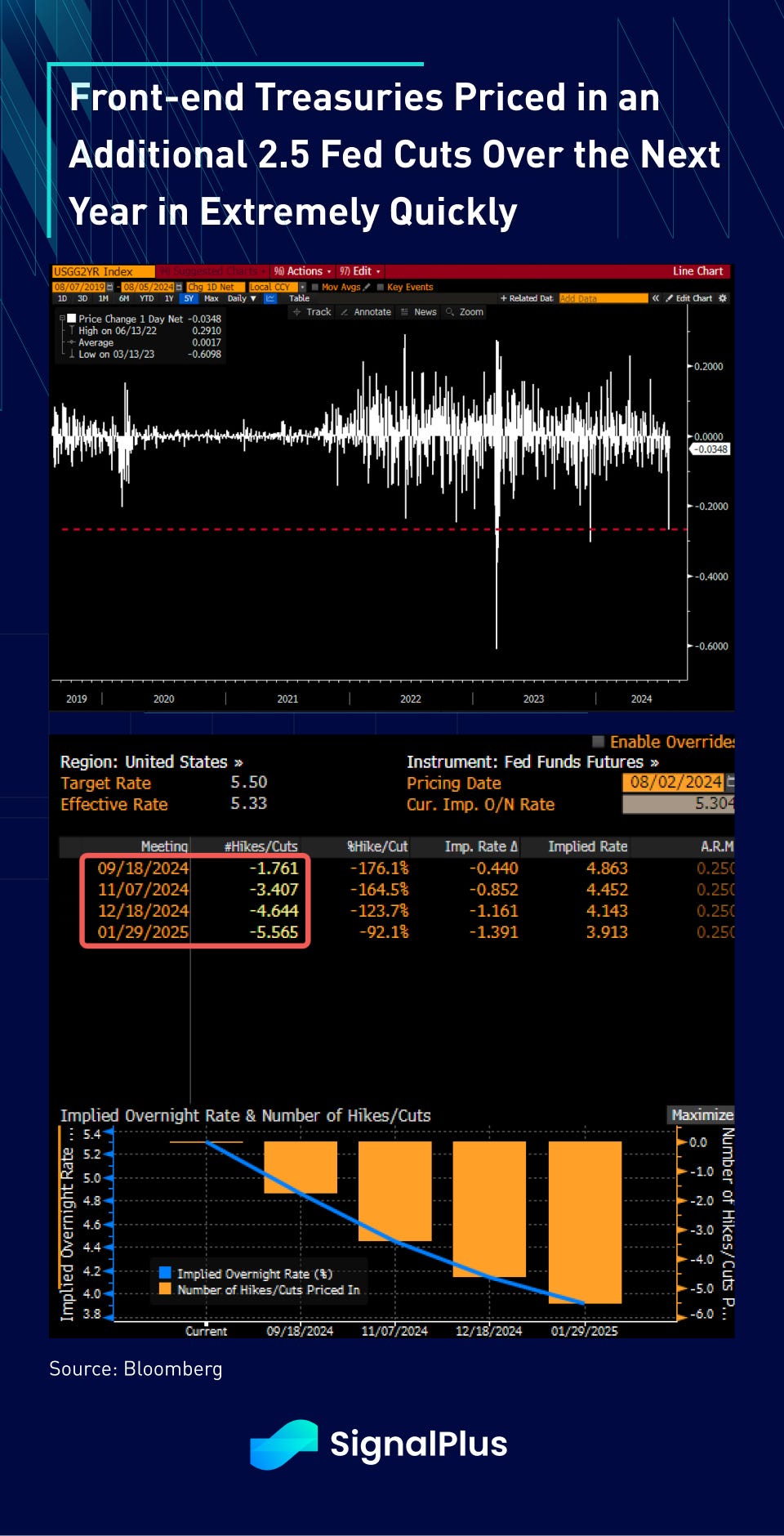

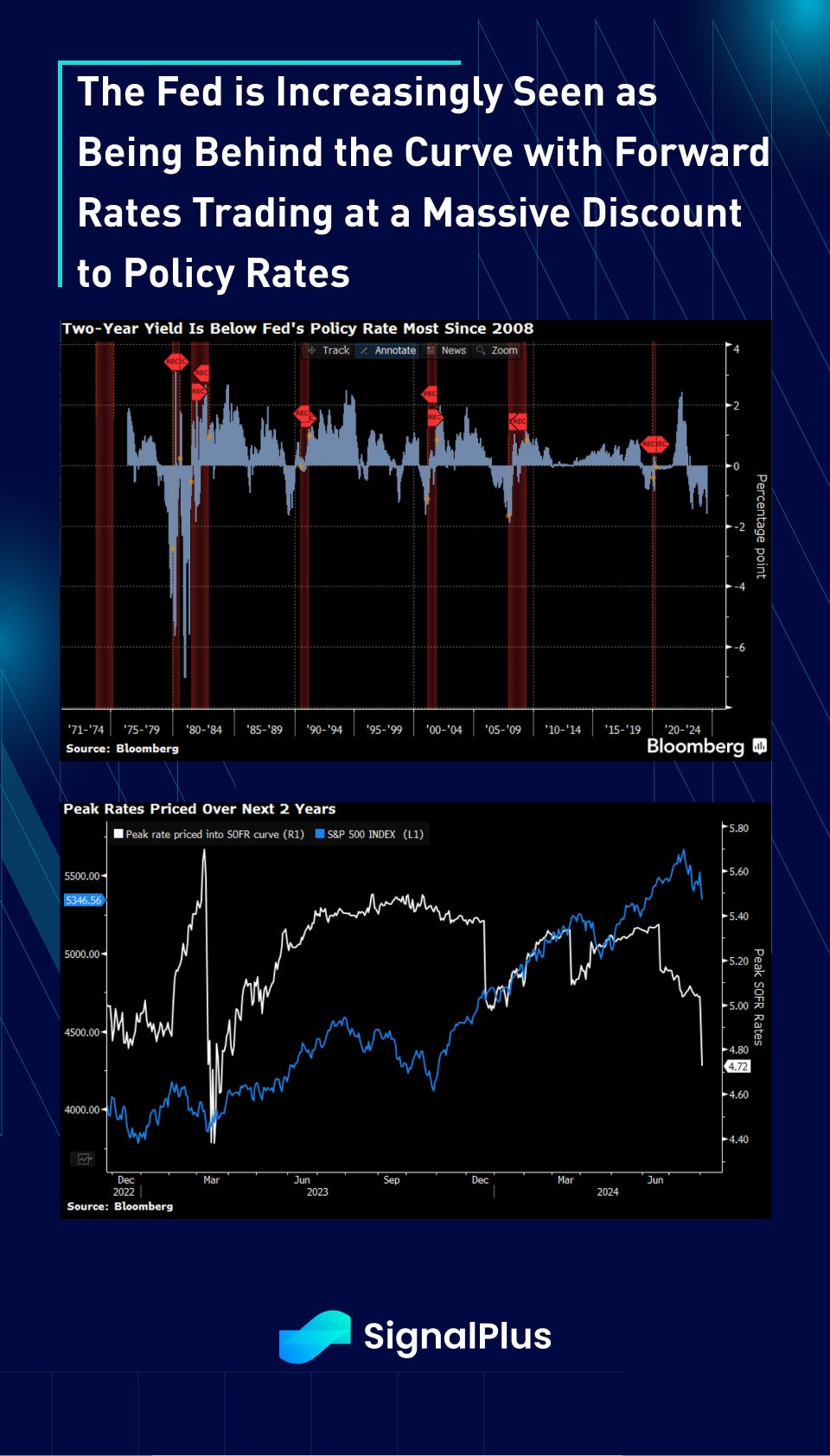

Bond traders and Fed Fund futures wasted no time in ratcheting down forward rate expectations, with both JPM and Citi calling for TWO 50bp cuts in September & November, and then another 25bp cut in December for a total of 5 (!!!!) cuts before year-end. Two year yields are trading at the most inverted levels to policy rates since the GFC, as the Fed is seen as dramatically behind the curve, though we are not necessarily in agreement with that view and believe the rate move is overdone.

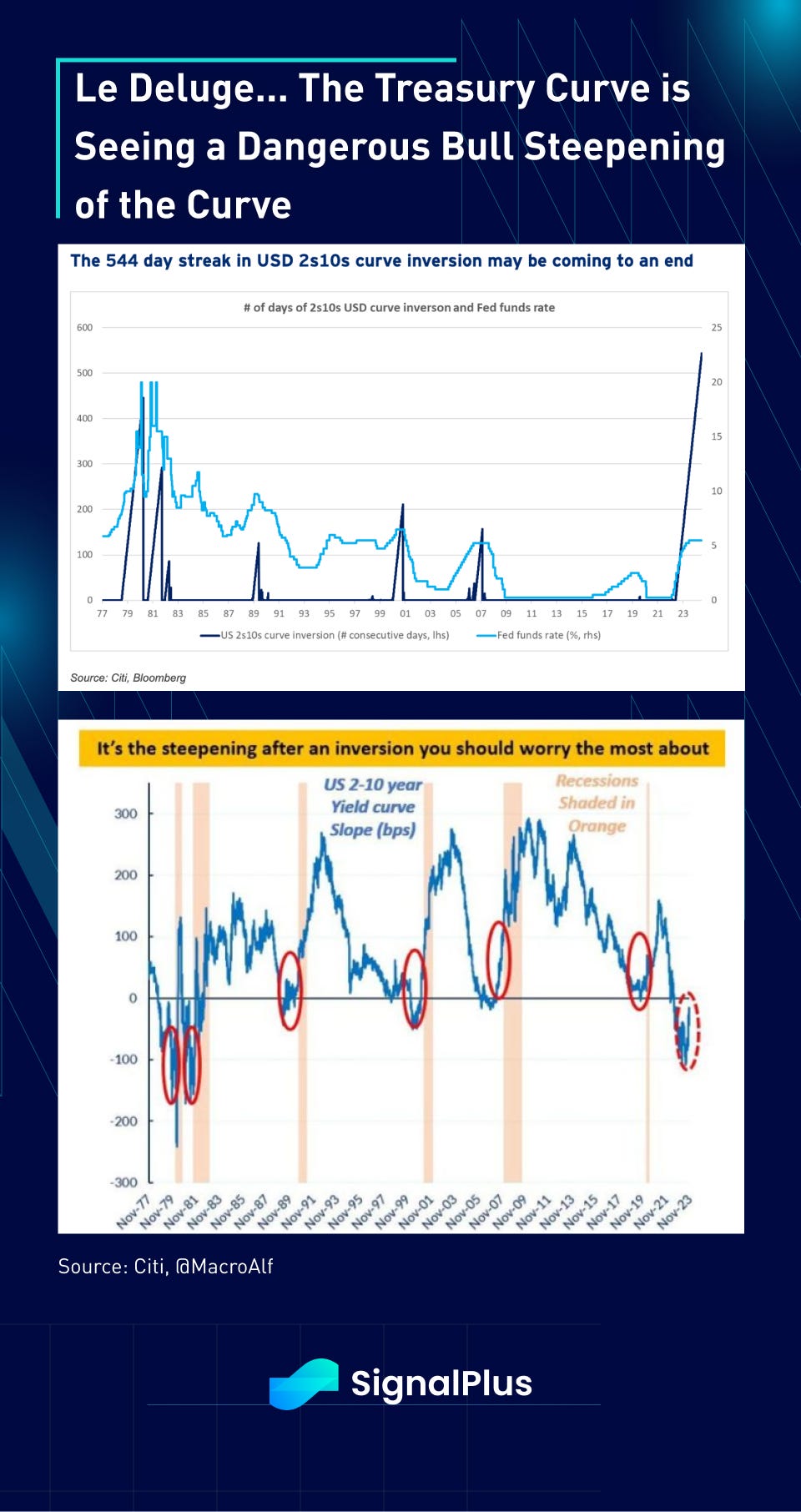

Furthermore, long term readers might remember the market’s infatuation with the inverted yield curve as a signal for recession. Obviously, as we have alluded to before, that is not a very useful signal on its own and we have gone well over 500 days of inversion without any recession, the longest in history by a long stretch. However, what is more concerning is the immediate bull steepening of the curve post the inversion, when the market ‘acknowledges’ a slowdown in the economy, and is starting to price-in aggressive rate cuts in the front-end and overall buying of bonds, which is what we are seeing now.

This is yet another piece to the puzzle as to why the market reaction was so much more violent this time around, compared to previous data misses and bond rallies.

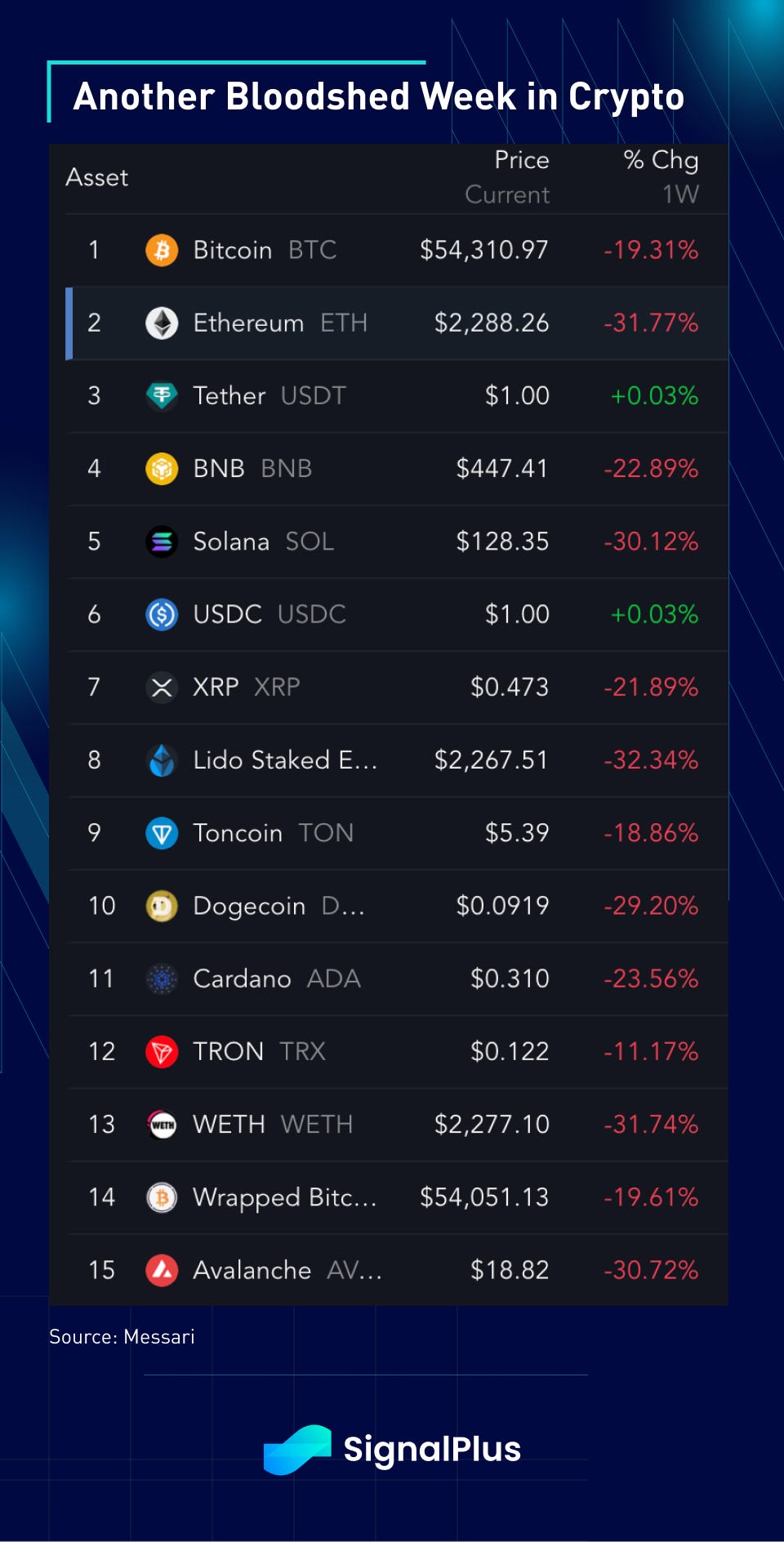

Similar to other asset classes, crypto prices cratered with BTC falling by 20% on the week and unwinding basically the entire ETF rally from January. Ethereum has cratered into the low 2k area and altcoins down -30% to -50% on the week.

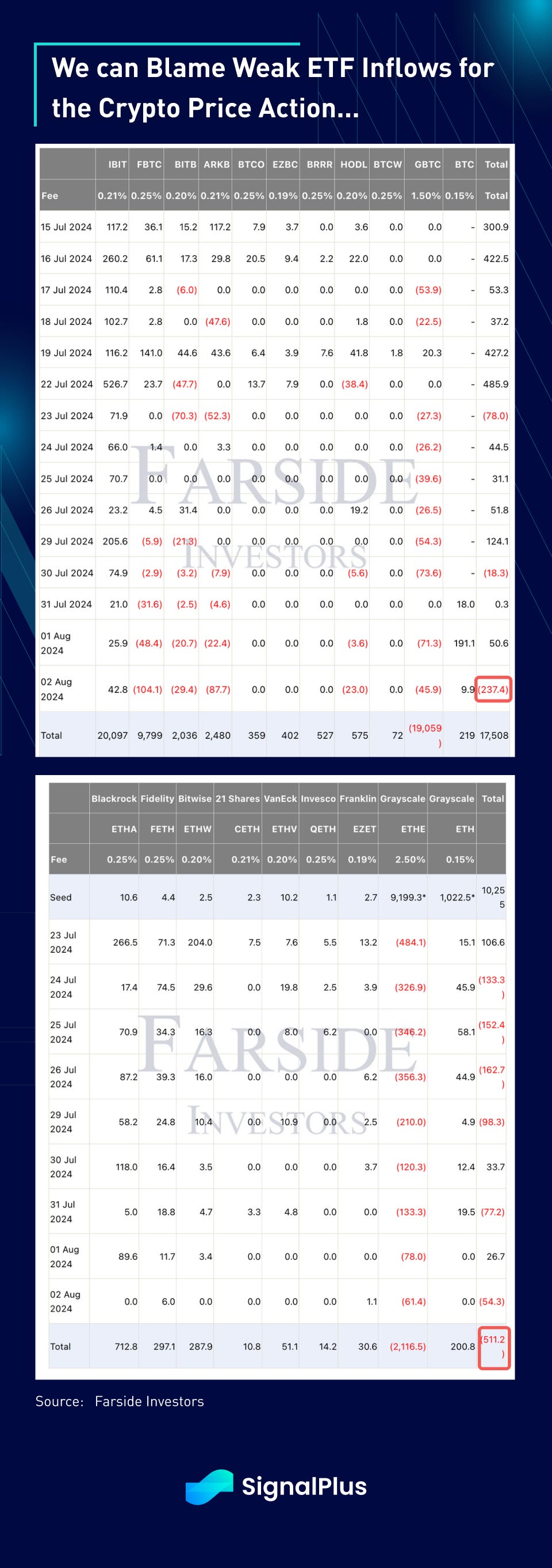

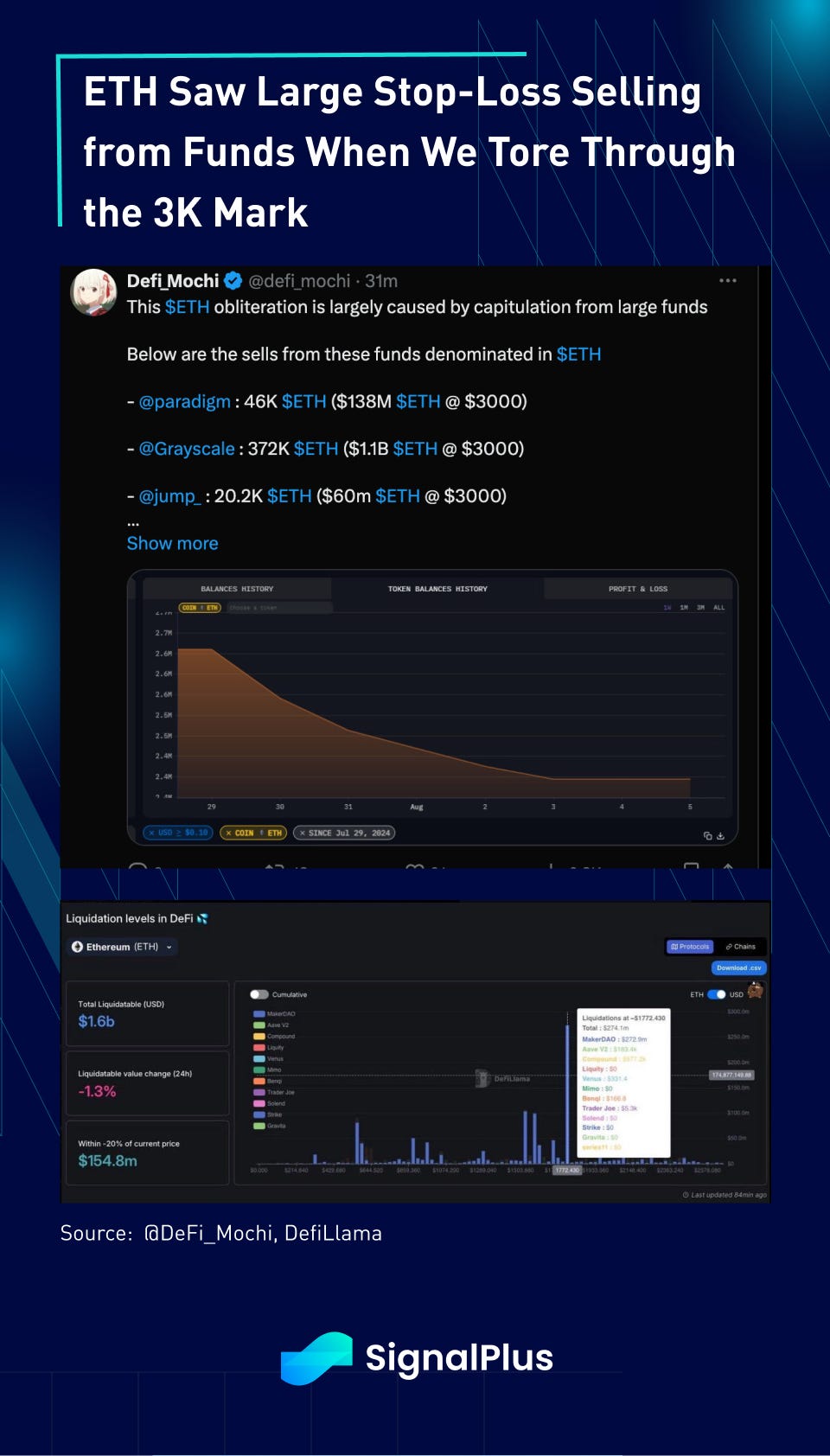

We can blame weak ETF inflows (particularly on ETH), but ultimately crypto is revealing its true proxy as a “leveraged Nasdq”, something we have been highlighting a lot in the past, and we are simply ‘catching down’ to the sell off in tech stocks since early July. Furthermore, PNL protection and risk-stops from large funds saw well over $1bln in ETH selling when we broke through the 3k mark.

A view on where crypto goes from here is effectively a call on US growth stocks, and by extension of your call on whether an imminent recession is coming, and thus whether the ~4.5 rate cuts before year-end is fair. At the risk of having ‘famous last words’, while the US growth trajectory is slowing, we don’t see the actual ‘hard’ economic numbers at anywhere close to a recession, and we believe it would be foolish for the Fed to be so reactive to wild changes in market sentiment, as we think that would be counterproductive to instilling market confidence.

After all, weren’t we just talking about a “no-landing” (ie. growth) scenario just a couple of months ago? Furthermore, with a contentious US election on the horizon, would the Fed really have the political cover to cut rates 100bp, with 50bp just mere days with Atlanta Fed’s GDPNow still calling for 1.8–2% in Q3 GDP?

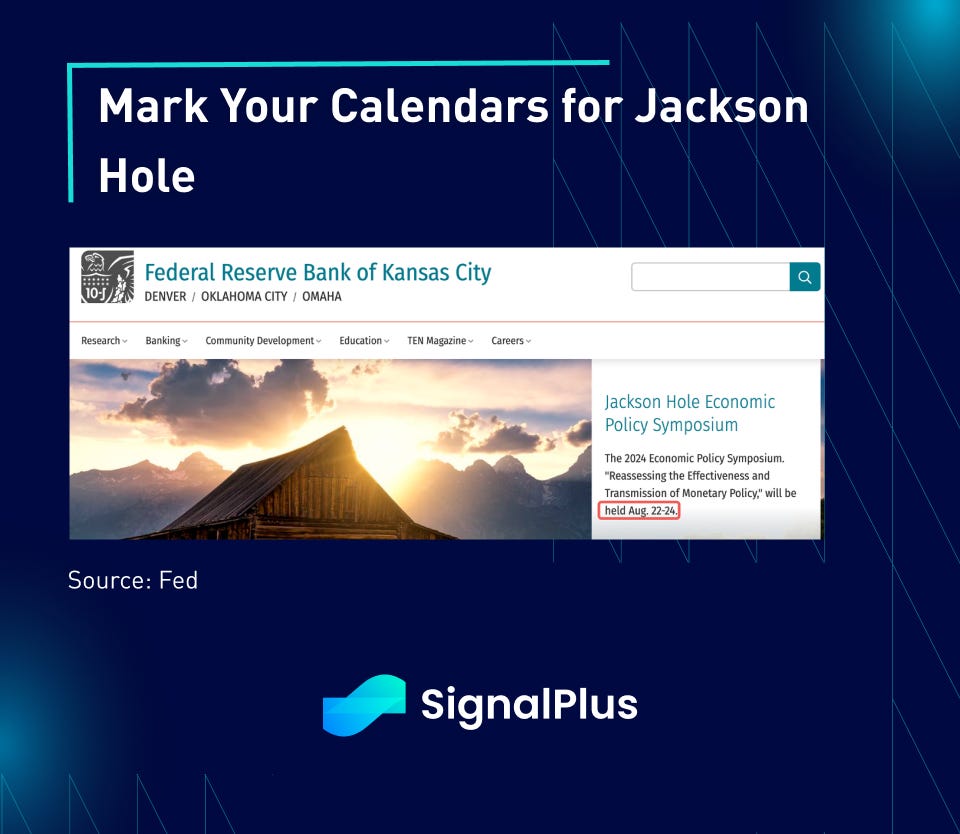

We think the brunt of the damage has been made, and will look towards the all-important Jackson-Hole event for the Fed to try to placate markets verbally without sounding the crisis bell.

Good luck and hope everything is hanging in there during this tough time.

You can use SignalPlus Trading Compass on t.signalplus.com to get more real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members:

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments