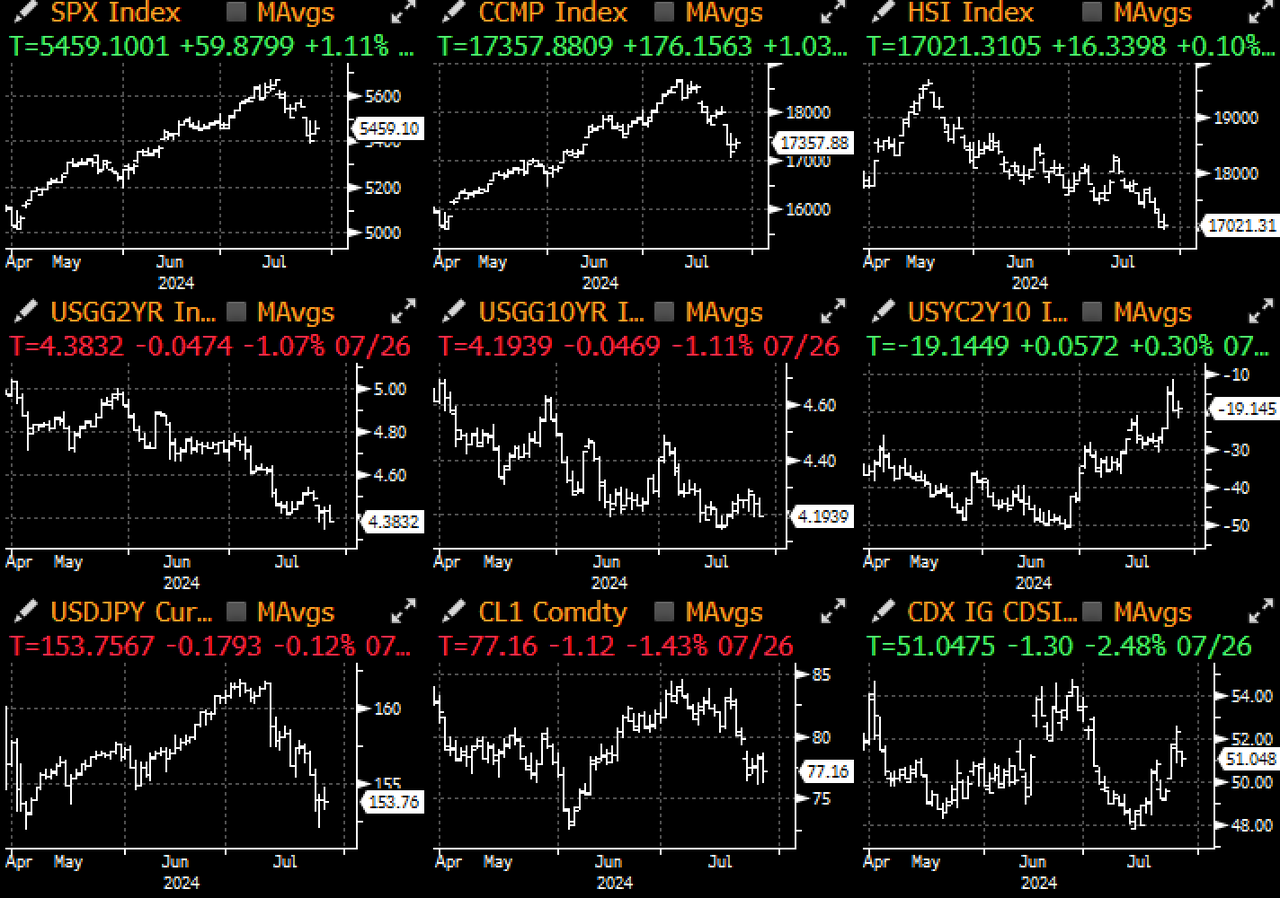

Last week was a painful week for consensus macro themes, which saw many of the most popular trades (eg. High tech, USDJPY, etc) unwind dramatically and SPX realized vol jumping to the highest levels in 1 year.

While there wasn’t a single catalyst to blame, President Biden’s election exit coincided with various unwinds of weaker ‘Trump-trades’, particularly on the equity side. Furthermore, the ‘great rotation’ trade continues at full speed with option traders being the most bullish on small-cap stocks in almost 2 decades (based on risk-parity measures), as equity investors continue to pivot out of growth names and into small-caps right ahead of the earnings period.

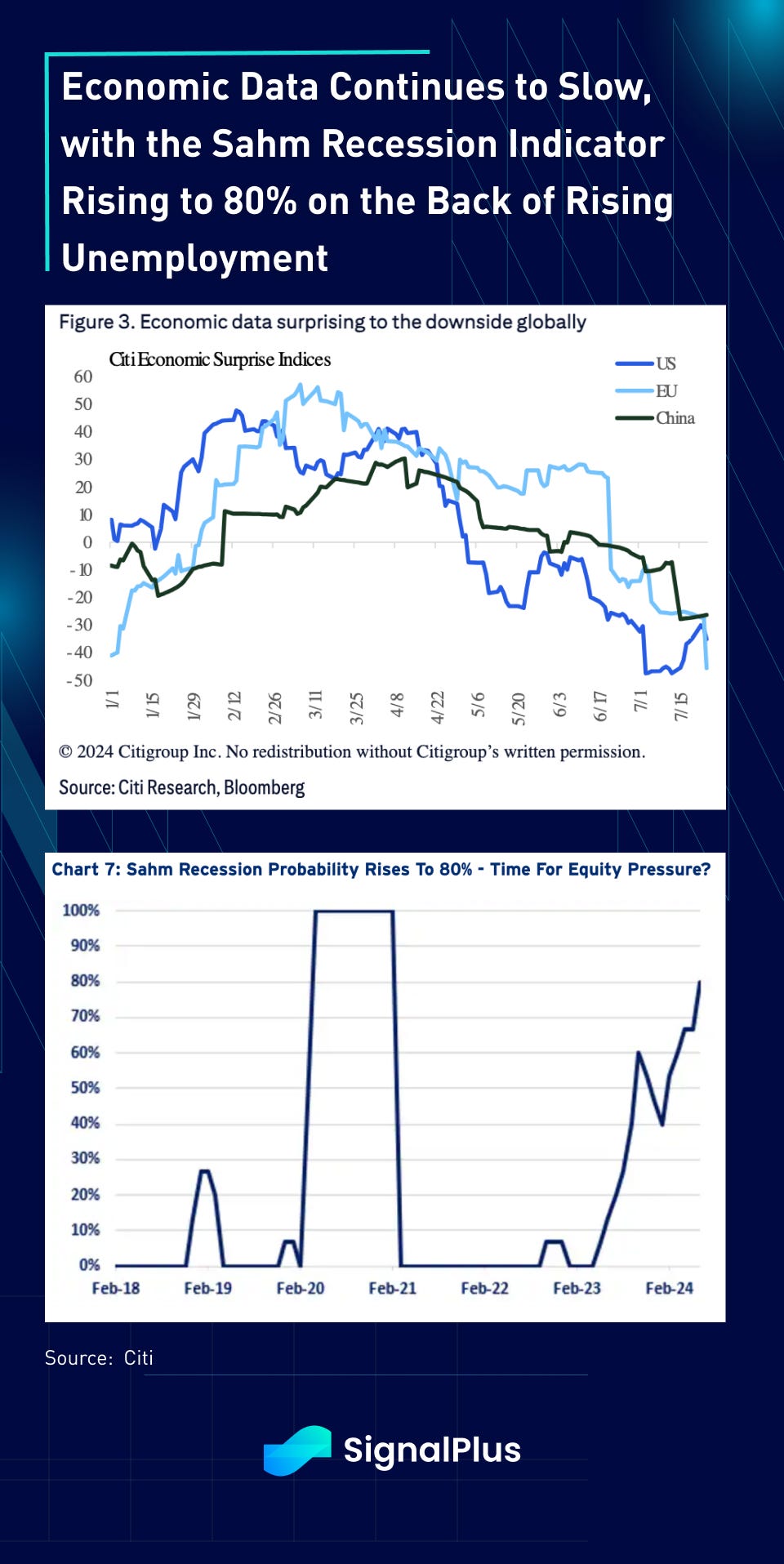

In the meantime, economic momentum has started to worsen by another notch. Global economic data surprises are trending at the lowest levels YTD, and the Sahm recession probability has risen to 80% following last month’s NFP release. This indicator measures the 3-month average unemployment rate vs its low point over the past year, and the current reading of 0.43% stands dangerously close to the 0.5 threshold that is believed to signal the onset of an imminent recession.

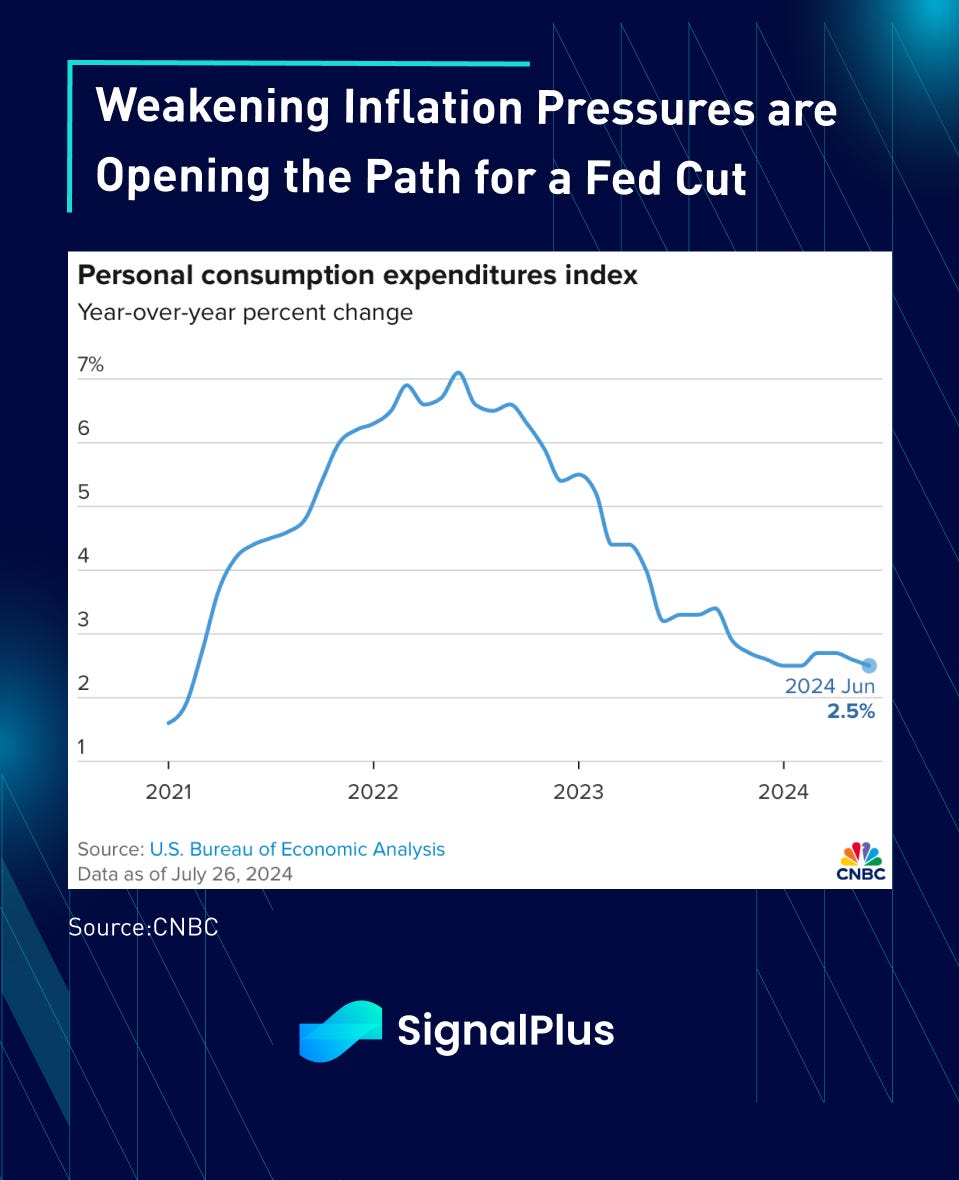

At the same time, easing inflation pressures have opened the doors to a Fed cut, with PCE falling to 2.5% on Friday, and on the right trajectory towards the Fed’s 2% long term objective. Average hourly earnings growth has also come off from a 6% peak in 2022 down to 3.9% last month, consistent with the rising labour slack and slowing job market.

These developments have led to a number of high profile macro observers calling for the Fed to cut rates earlier than expected. Mohamed El-Erian, former CEO & CIO of Pimco, penned an opinion piece stating that a soft landing could slip away if “unhelpful, noisy data delay an interest-rate cut beyond September”. Similarly, ex NY Fed President Bill Dudley also opined that the Fed needs to cut rates asap as “waiting until September unnecessarily increases the risk of a recession”.

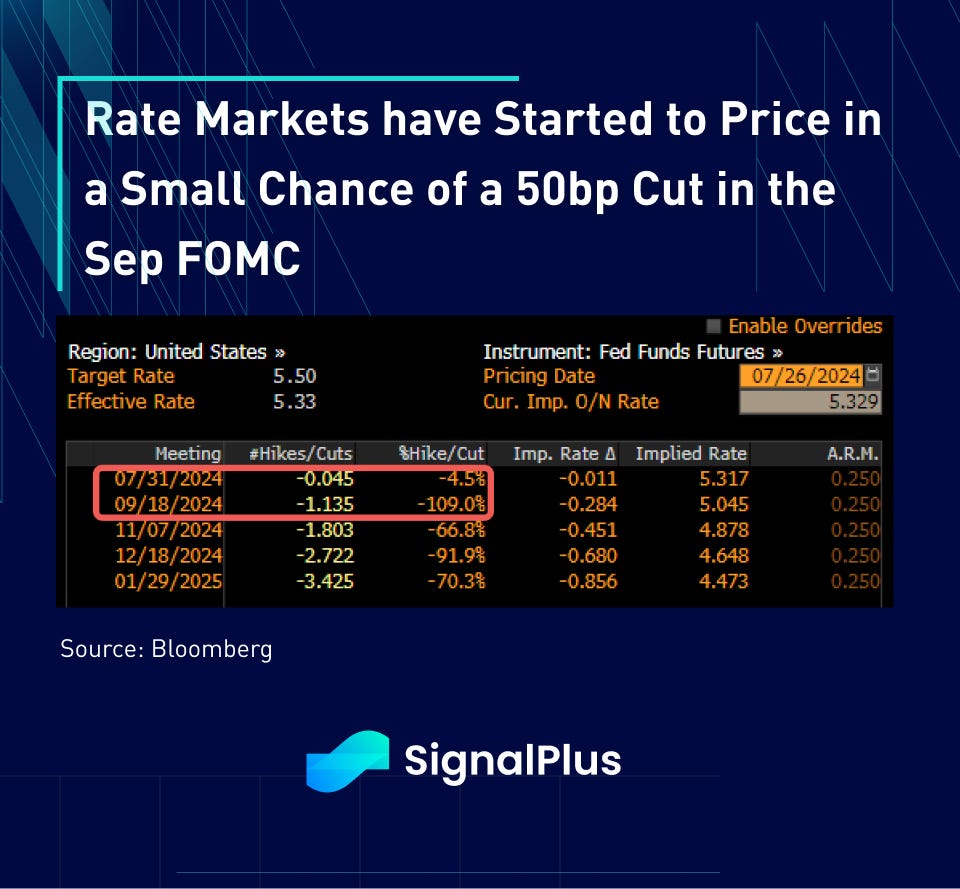

With that being said, the market’s base case is that the Fed will pause this week (<5% chance of a cut), while September is pricing slightly more than 100% of a cut as people have started considering the possibility of a 50bp move.

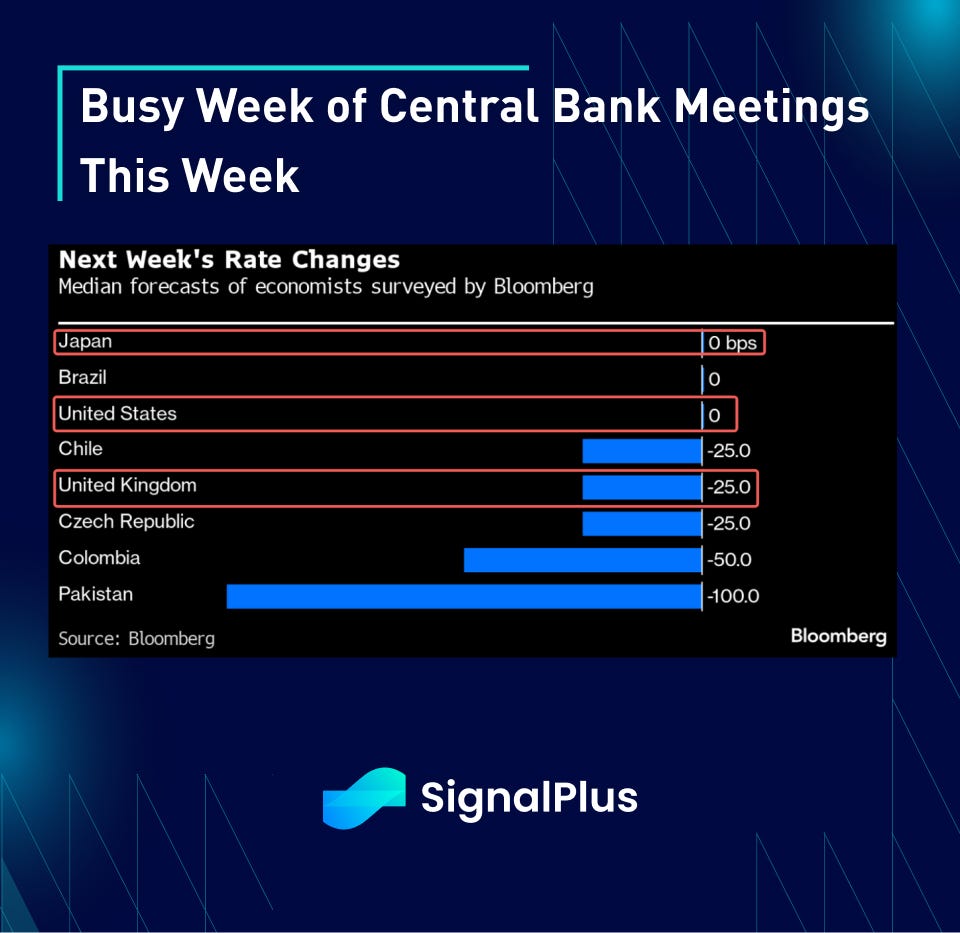

In addition to the Fed, this coming week will have 2 other major central bank meetings with the BoJ and BoE. The BoJ is widely expected to hold, but will reduce its bond buying further to allow further rises in long term yields. On the other hand, the Bank of England is expected to cut rates by 25bp, though 8 of 32 surveyed economists by Bloomberg expect a hold. Both meetings will have a chance for surprise, so expect more rate volatility ahead this week.

Outside of CB meetings, this will also be payrolls week in the US (ADP, JOLTS, NFP), with Amazon, Apple, Meta and Microsoft all due to report earnings between Tuesday and Thursday as well. All of this comes at a critical juncture with Nasdaq trading at technically important support levels, with thin summer holiday liquidity possibly exacerbating volatility even more in the meantime.

In crypto, Trump’s highly anticipated and well-advertised attendance at the Nashville conference turned out to be somewhat of a non-event, as expected. This was always going to be more of a ‘campaign’ and fund-raising event, and it was always unrealistic to expect any concrete details to have possibly been announced (e.g. Buying BTC as a strategic reserve). With that said, the narrative is probably still long-term positive with the former President stating ‘feel-good’ phrases such as “I’m laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world and we’ll get it done”, and calling out the Winklevoss brothers by name and describing them as “looking like male models with a brain.”

Furthermore, Bloomberg reports that crypto donors have contributed more money into the 2024 election than in all prior cycles combined, including the FTX/SBF era. Trump’s campaign has received over $4mm in digital token donations since announcing its donation acceptance in May, while Republican Senator Cynthia Lummis stated that she plans to draft a bill to require a govt stockpile of $1M BTC over 5 years and a holding period of 20 years (even if the bill has next to no chance of making it past Congress).

BTC is back at its familiar price of $67k, where it has gyrated around pretty much since March, though the rest of the crypto space (including ETH) has struggled to keep up during this time. Furthermore, we saw aggressive market selling of BTC implied vol after the Trump speech, and we will likely have to take our cue from the Fed and other central bank pivots, before being able to make another attempt higher >$70K in Q4.

Good luck to the (last?) busy week ahead of this very long and hot summer!

You can use SignalPlus Trading Compass on t.signalplus.com to get more real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members:

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments