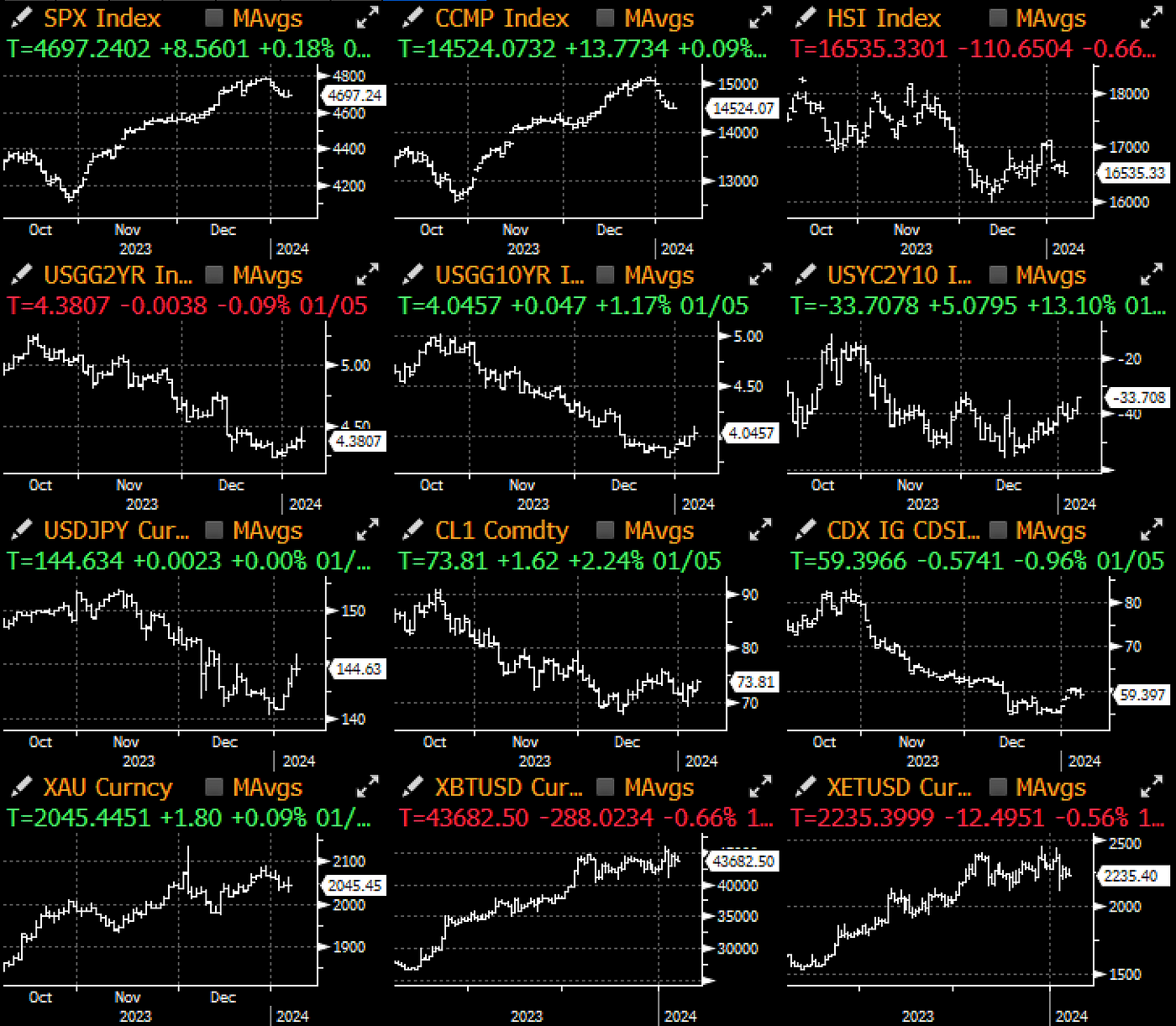

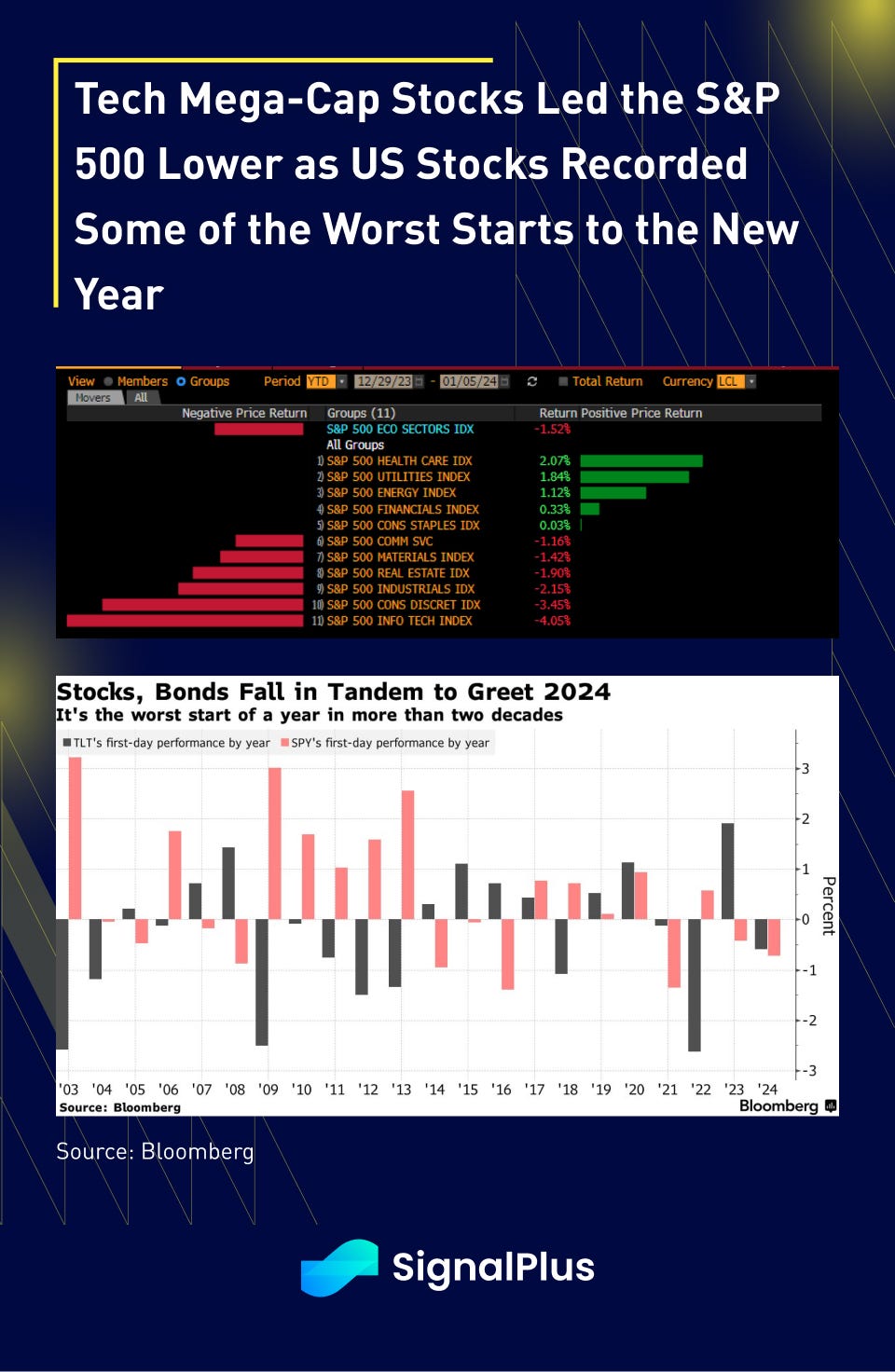

SPX ended the week down -1.5% led by tech stocks which fell -4%, while health care and utilities sectors were the winners at +2%. Both SPX and Nasdaq also recorded some of the worst starts to the new year over the past decades as investors were swift to unwind a lot of year-end froth.

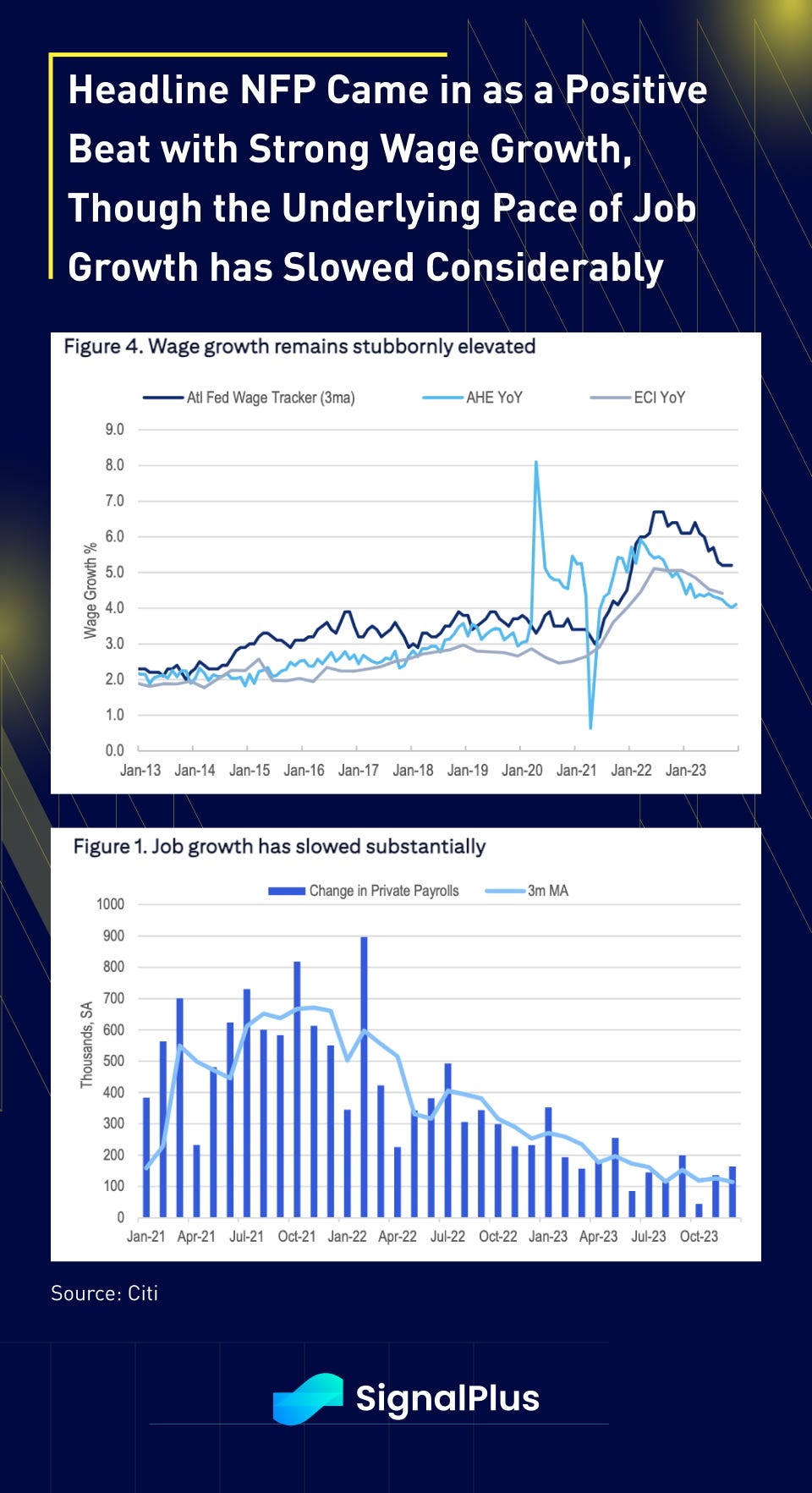

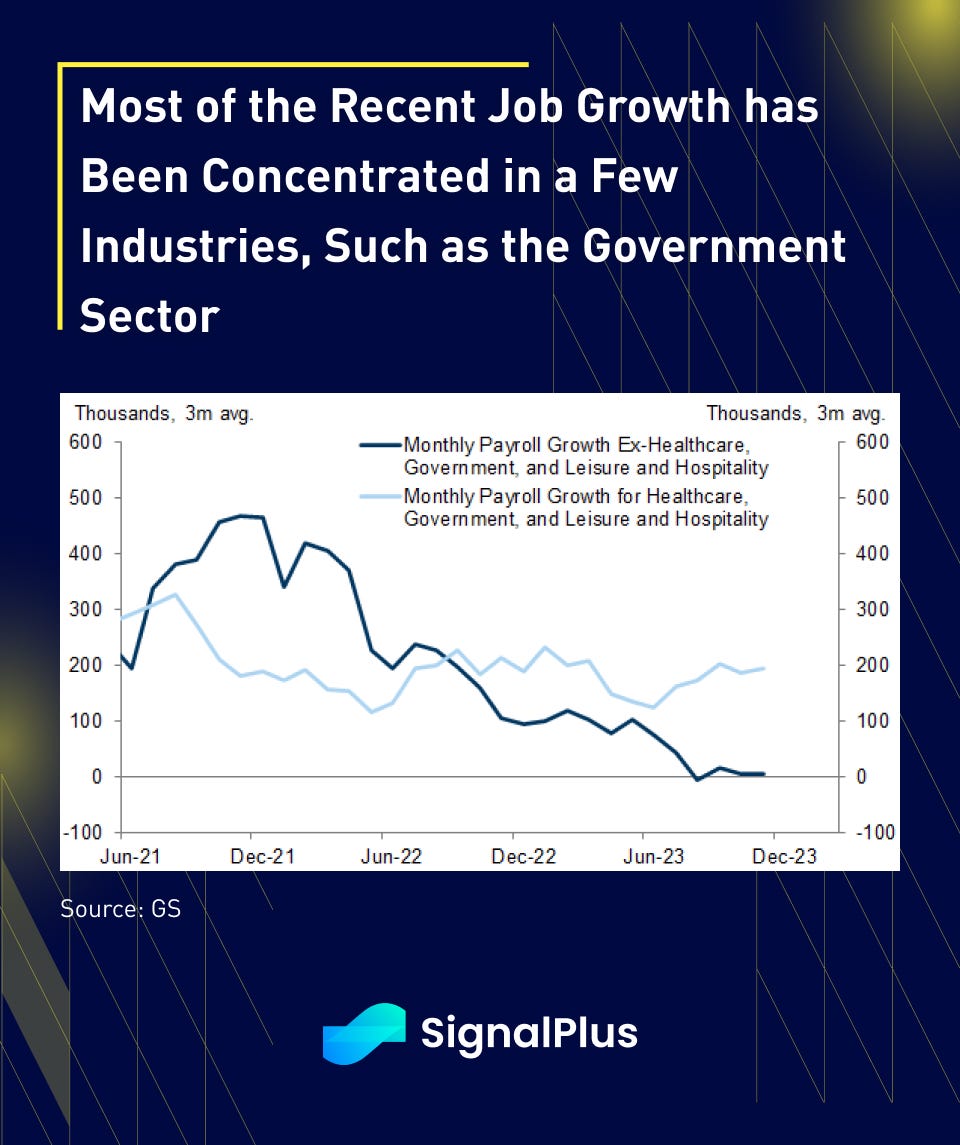

The much anticipated NFP beat expectations on the surface, reporting headline gains of +216k (vs +175k expected), steady unemployment rate at 3.7%, and hourly earnings growth stable at +4.1% YoY on a rolling 12-month basis. However, the positive beat came with a number of caveats: -71k in negative revisions for October and November (10th consecutive month of negative revisions), a drop in labour force participation from 62.8% to 62.5%, and a continued fall in weekly hours worked. Furthermore, a deeper dive reveals that recent job growth has been concentrated in a few narrow industries, notably in the government sector.

If NFP left doubts as to the strength of the labour market, the subsequent ISM Services miss left little doubts that the underlying employment market is indeed slowing. The ISM Services employment sub-component unexpectedly collapsed from 50.7 to 43.3, the sharpest drop in nearly a decade. The magnitude of the drop was surprising to even the most bearish of observers, and only previously seen in acute episodes of market stress such as 2008 and 2020.

Furthermore, a reminder that the JOLTS jobs data from earlier in the week also showed an hiring rate drop to 3.5%, the lowest since 2014, with weaknesses seen in the more economically sensitive business services sector, while the quit rate also edged to the lowest level since 2018 (2.2%)

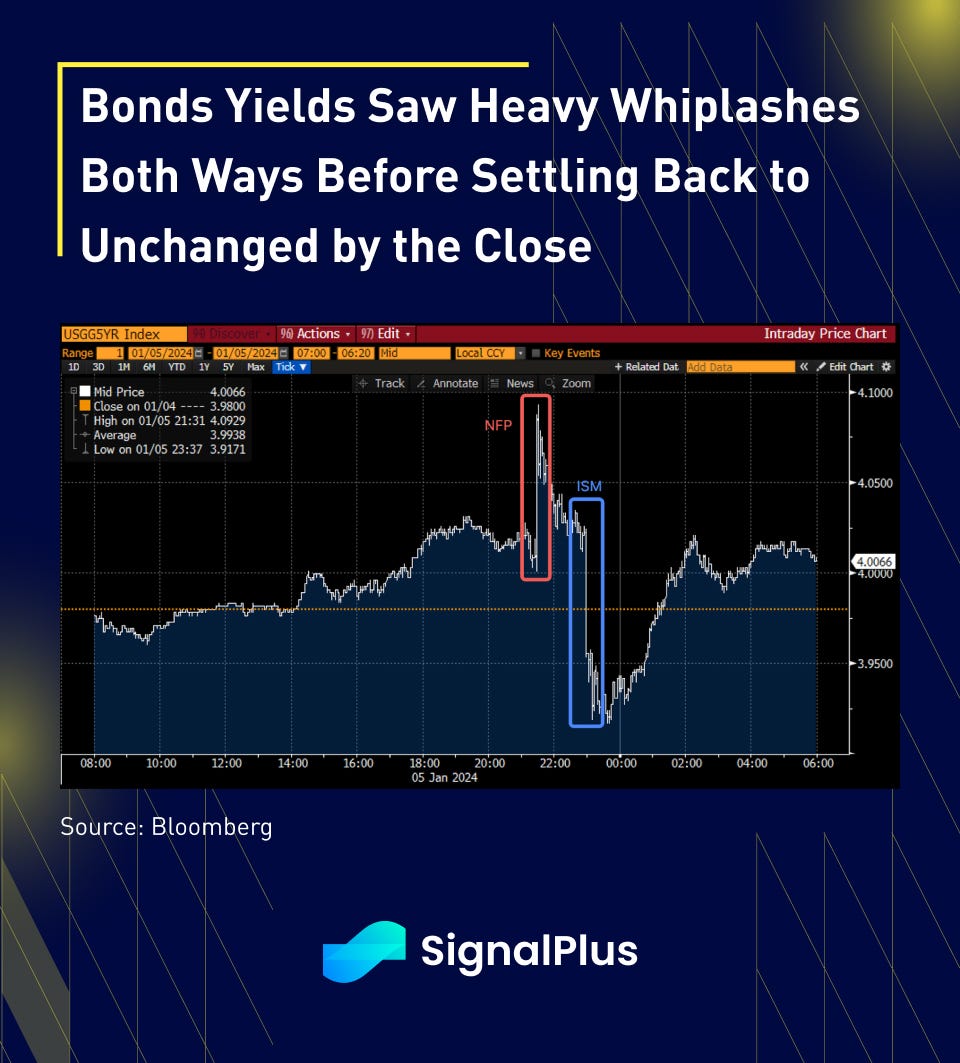

Bond markets were caught in a whip-lash all day, with 5yr yields jumping 10bp in a knee-jerk reaction after the headling NFP ‘beat’, only to see an opposite over-correction with yields collapsing ~20bp from peak-to-trough following the ISM services plunge. However, by the NY afternoon, prices across US bonds, equities, and FX reverted back to unchanged, with yields higher by only about 2–3bp when the dust had settled.

This coming week will be another busy week, with US CPI / PPI, China credit data / CPI / trade balance, and Tokyo CPI all on the immediate docket. Earnings season will also kick in next week with bank stocks leading the way.

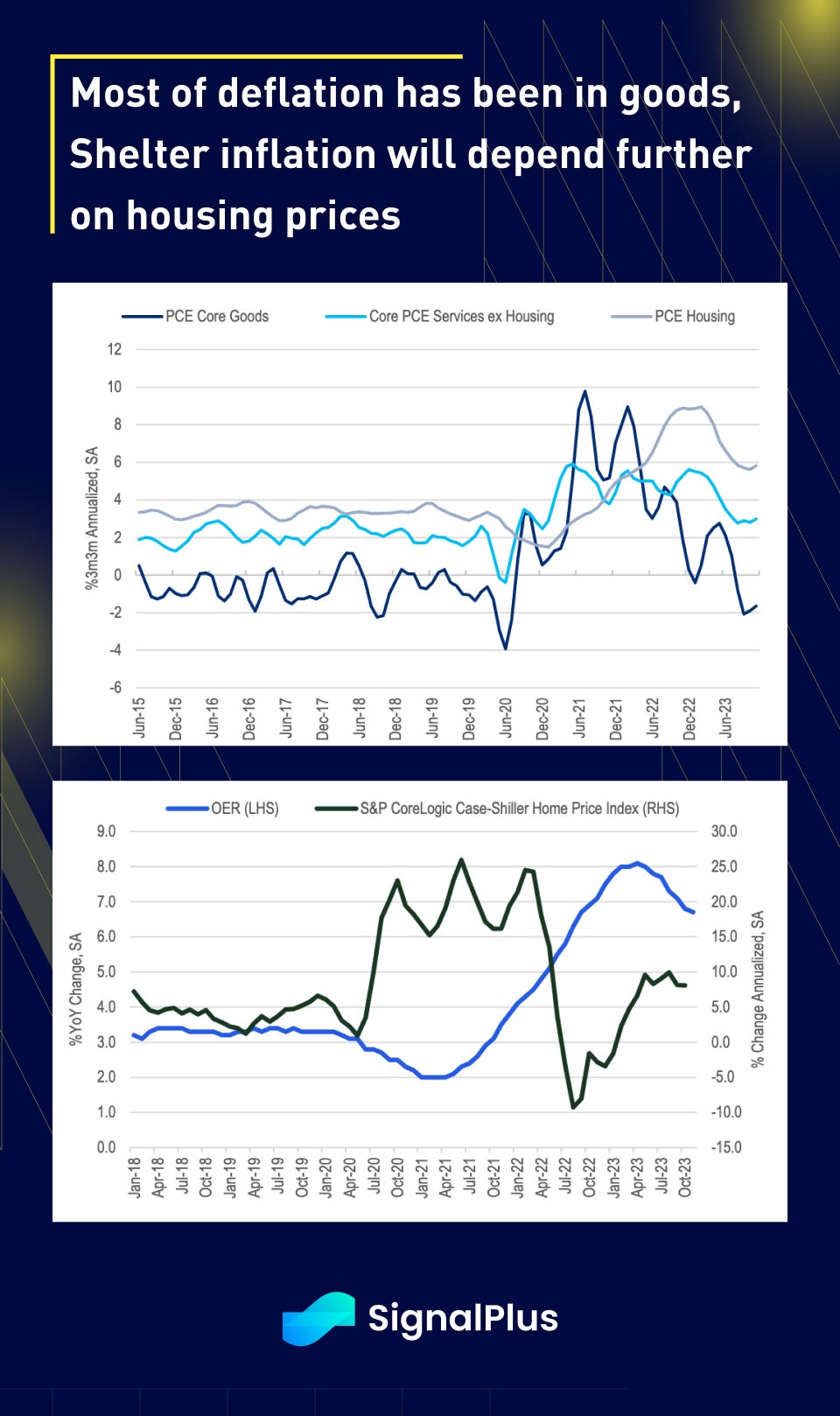

The first inflation data of the year will be an important factor in the Fed’s near term decision making, with core CPI expected to come in around 0.3% MoM and 3.9% YoY. Most of the deflation progress thus far has been concentrated in core goods, while shelter inflation is likely to remain stubborn (0.44% OER) thanks to an 8–10% rise in annualized house prices (and mortgage rates falling by ~100bp over the past few months)

Fed-speak will return in force next week, with Bostic on Monday, Williams on Wed, and Kashkari on Friday. Particular attention will be paid not only to signs of their propensity to cut in March, but also for further clarification on what the Fed is thinking about possible QT / balance sheet reduction as hinted in the December minutes.

On another note the next government shutdown period (they are back!) will likely begin on January 19, taking place right on time with the Iowa caucuses for the 2024 election a few days before hand. Particular attention will be paid to how former President performs against challengers Haley and DeStantis.

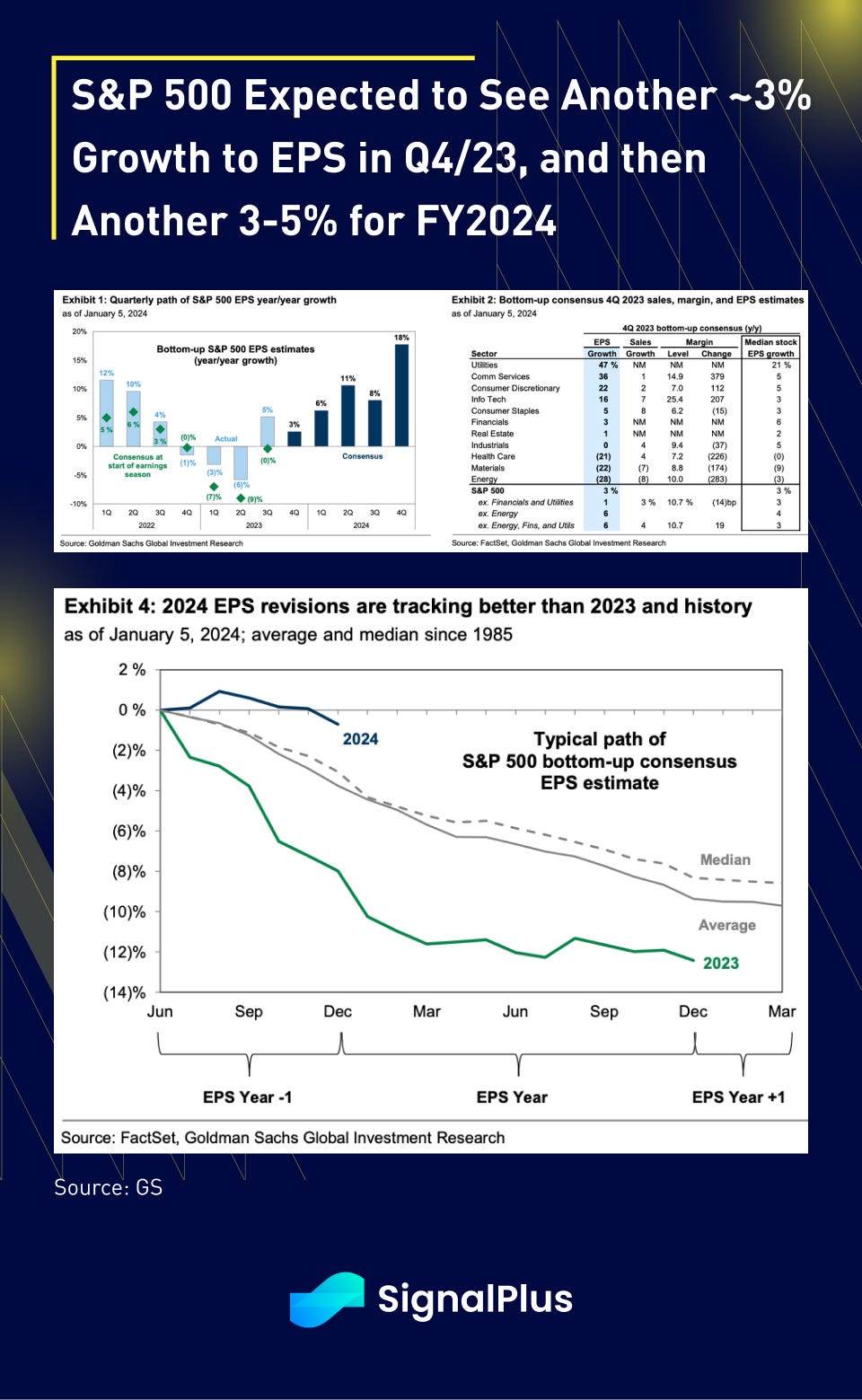

4Q2023 reporting season will kick off next week, with consensus forecasts for S&P 500 profits to rise by 3% YoY, continuing the profit rebound from a 5% quarter in Q3. 2024 EPS forecasts is expected to grow by another 3–5%, with this year’s bottom up forecasts tracking significantly better than historical trends.

Over in crypto, despite the mini market turmoil last week, markets are back to pricing in successful ETF approvals this week, with a number of issuers re-submitting their updated 19b-4 filings, which are proposals for rules changes for trading on stock exchanges, signifying another step towards the finishing line. Based on market reports, the SEC commissioners are expected to vote on the ETF filings this week, and then a final sign off on the executed versions of the S-1 prospectus documents thereafter.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments