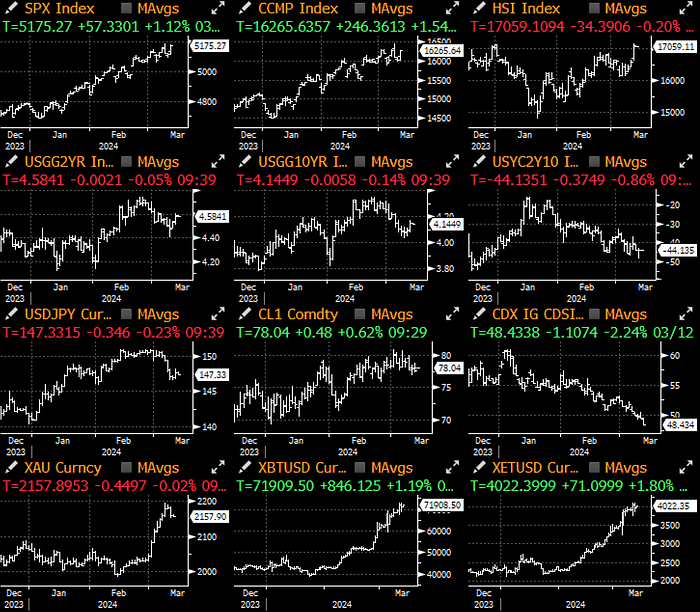

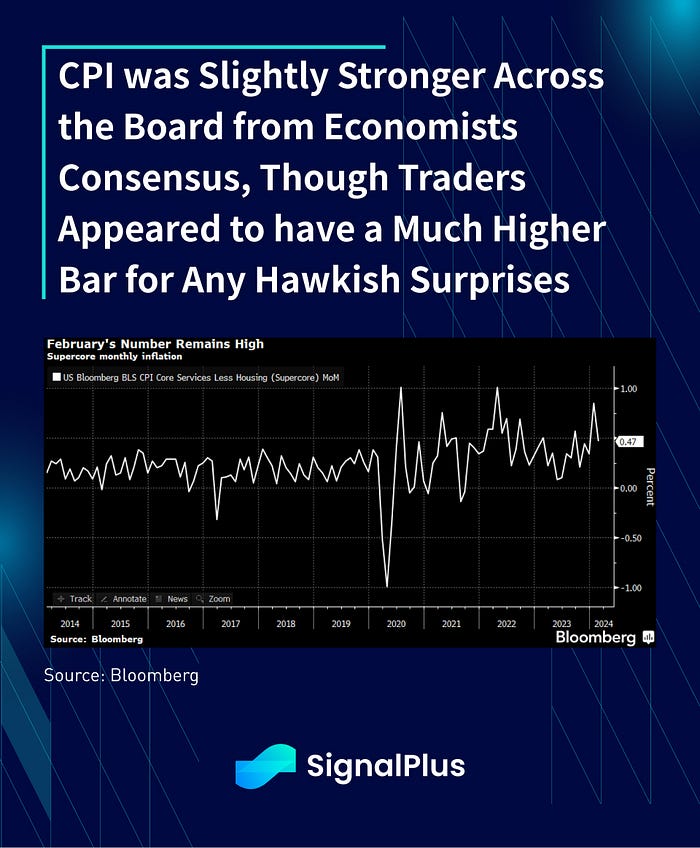

US CPI increased by 0.4% in February across both headline and core, with broad-based gains. Energy bounced +2.3%, gasoline +3.8%, services +0.5% and shelter added +0.4%. Super-core inflation remained high at 0.47% and well above Fed targets, though the bar for a hawkish surprise appeared quite high and risk assets managed to rally strongly after the dust settled.

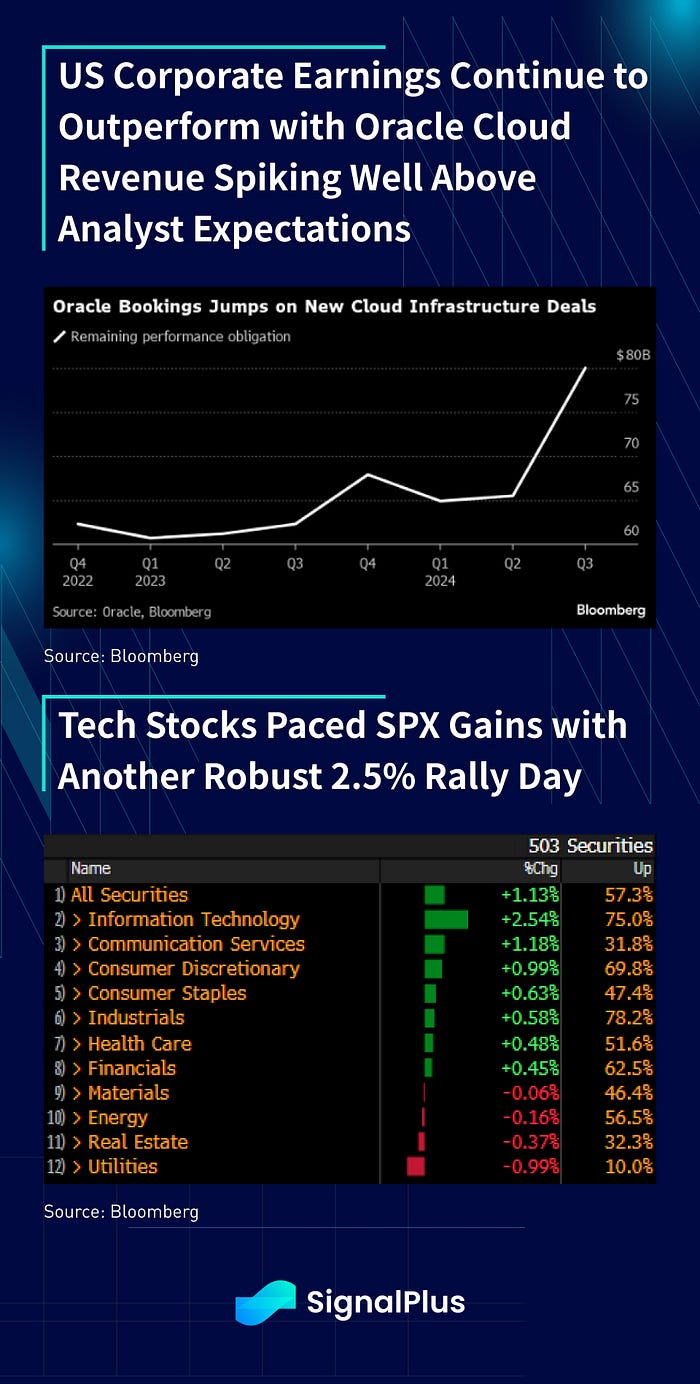

The SPX rallied 1% immediately after the number, and managed to hold to those gains after some choppy morning trading. Technology stocks once again paced gains, with Nvidia rallying another ~9% on the day (why not?), while Oracle jumped 12% on the back of a spike in cloud revenue. Sales backlog came in at $80bln vs expectations of $59bln, with overall revenues jumping 25% in the quarter.

While one should be used to daily risk rallies by now (bears are an endangered species), today’s rally in stocks was an outlier and it was one of the few instances in recent history as it happened on a strong inflation print, at least since the current hiking cycle started. Perhaps this is yet another sign that investors are focusing on micro earnings ‘fundamentals’ over macro considerations. With that being said, despite the high CPI, bond markets are still confident that the 1st Fed cut is going to arrive in June (63%) and 3.4 cuts still priced in before the end of the year. As usual, the Fed is pretty boxed in on their next moves.

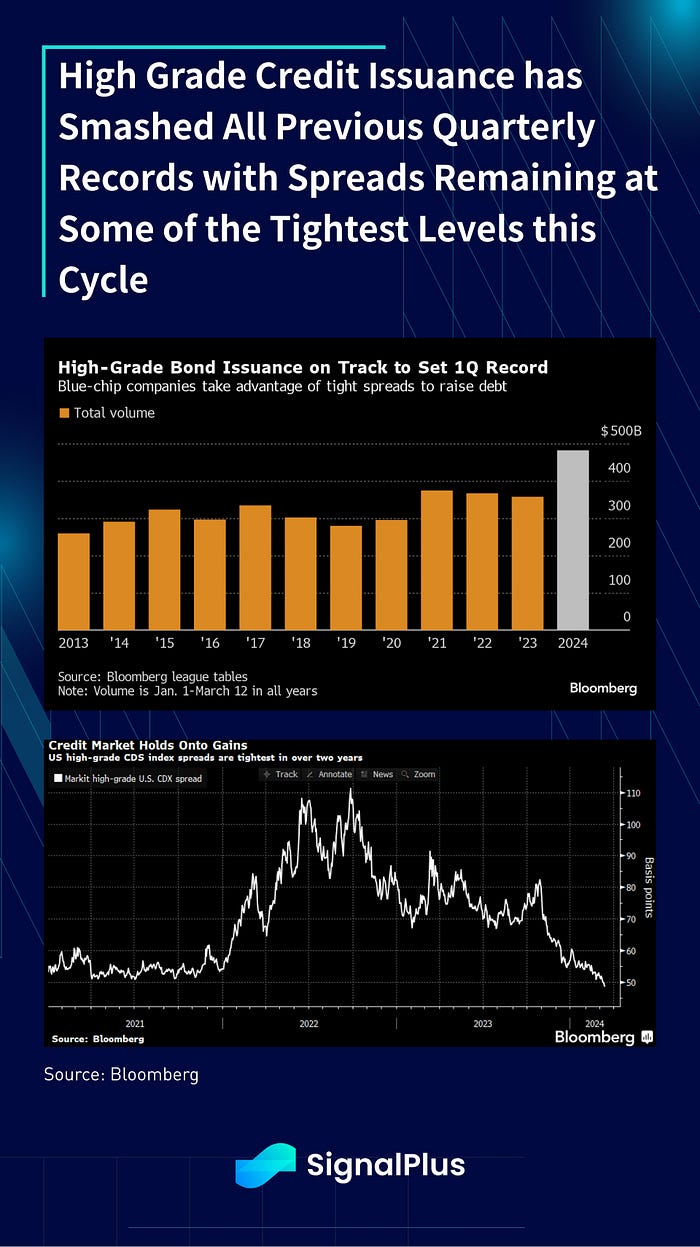

In credit markets, high grade issuance has already smashed quarterly records with still another 2.5 weeks to go in March, while CDS spreads are at the tightest in over 2 years as it’s becoming impossible to find any negative sentiment in any asset classes. What is the Black Swan risk this year is that we don’t get any form of meaningful pullback whatsoever in asset classes? Certainly scary to think about.

Unsurprisingly, crypto has continued to hold on its gains as well, with spot ETFs seeing another $8.5bln volume day, with VanEck announcing that it was waiving fees for the next 12 months. Net inflows to the ex-GBTC ETFs added $1bln yesterday, more than double GBTC’s ~$500mm in outflows. Total asset AUM held under the ETFs is just a whisker away from $60bln, and the quarter isn’t even over yet.

For those who can’t get enough, the infamous 2x levered ETFs have seen a surge in volume as well, and sees no signs of slowing down as every spike lower in Bitcoin has been bought. CME Bitcoin futures open-interest have also hit a new high, with institutional investors also joining in the fray. At this juncture, it’s not even clear to us is there’s any distinction between a levered tech/AI position and crypto, as they appear to be trading in lock-step during the US hours. But as long as everything keeps going up, who is asking questions anyway? Enjoy the ride and stay safe!

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments