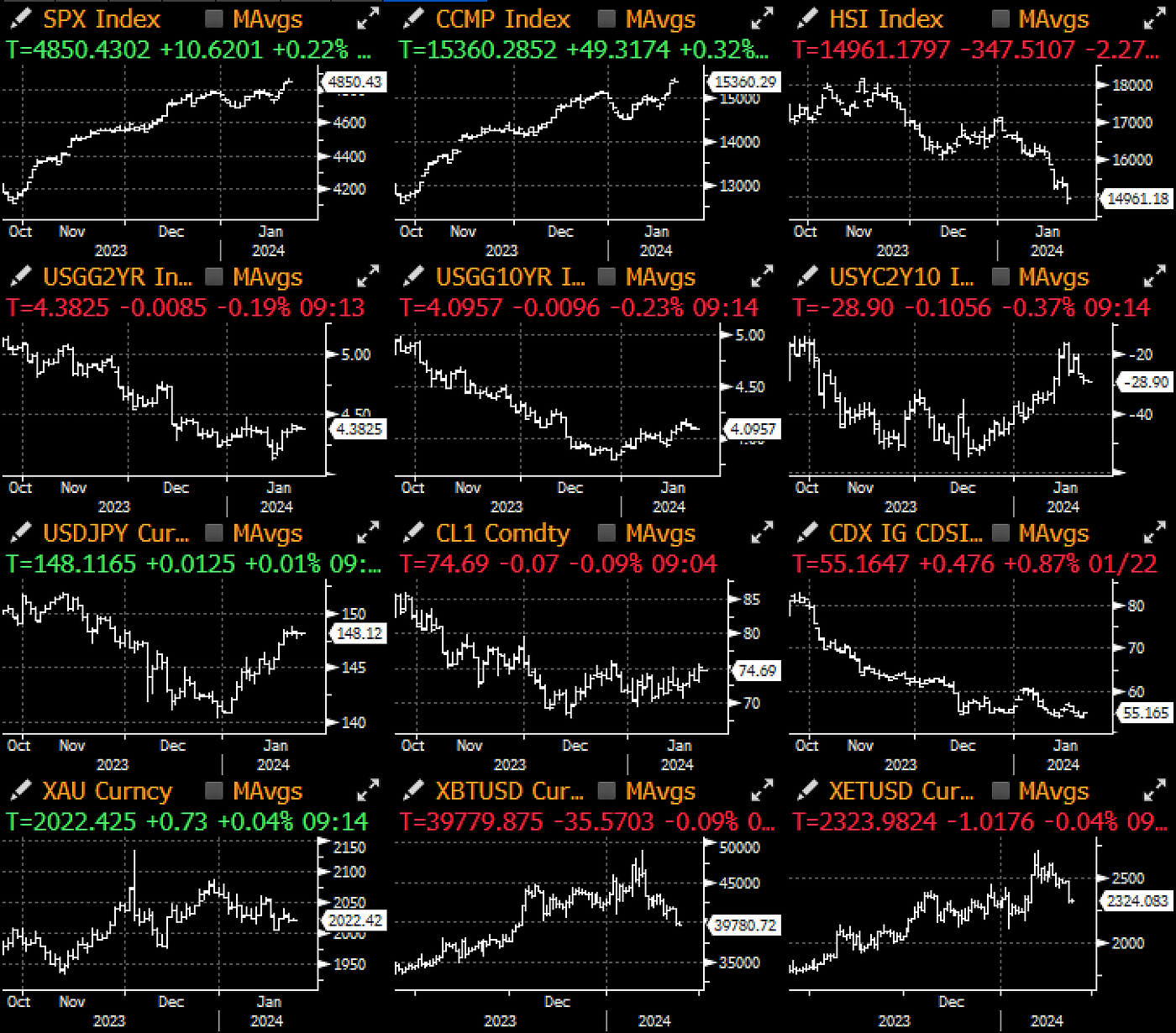

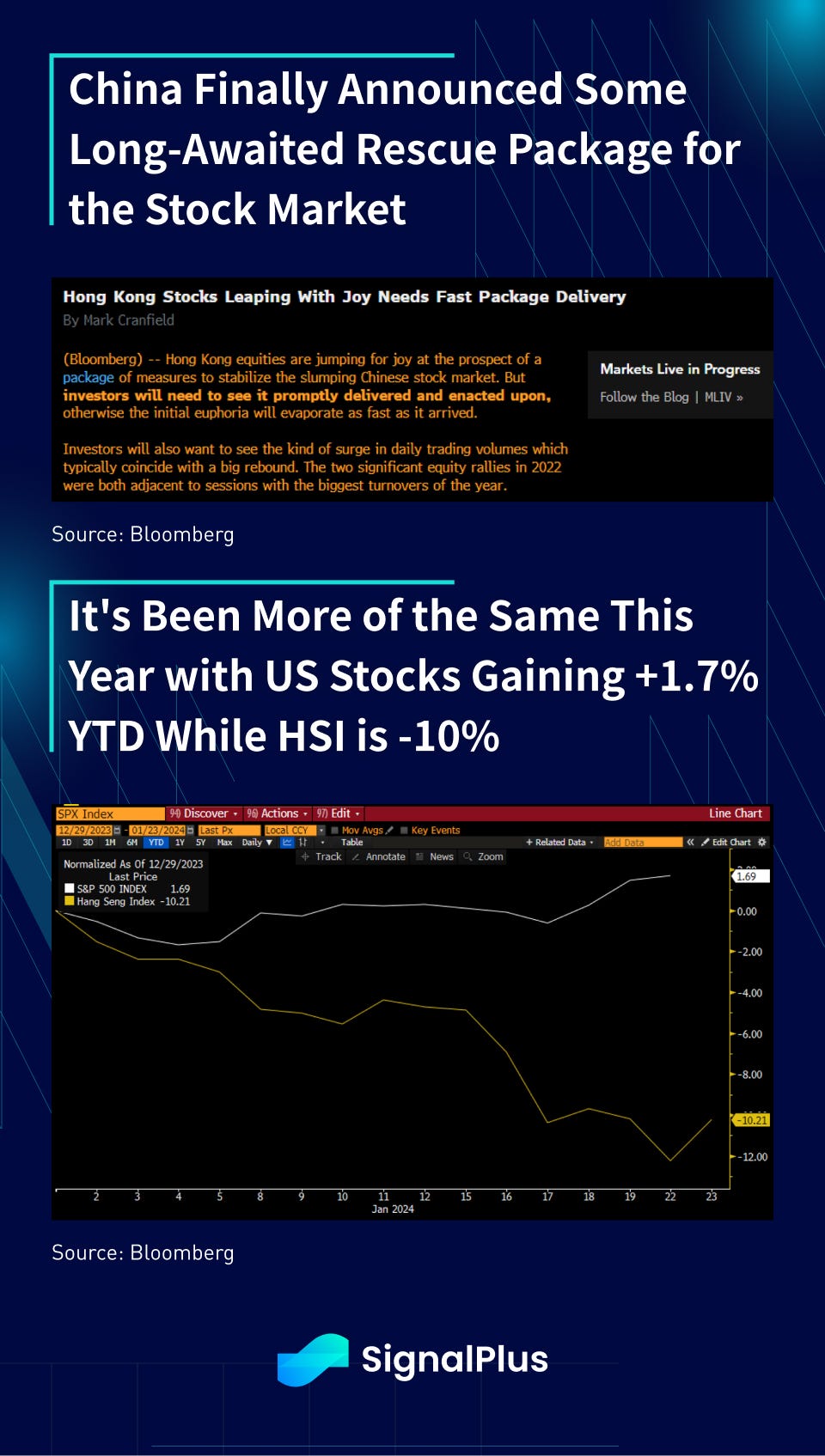

A muted start to the week with US markets grinding to new all-time highs, while China/Hong Kong stocks continue to struggle with a -10% YTD performance thus far. The continued waterfall in Chinese risk-assets is heightening expectations of macro easing policies, with Chinese authorities going on the record and stating that they are seeking to mobile 2 trillion yuan ($278 billion) of offshore capital from SOEs to provide equity buying support through the HK exchange link. A further $300 billion yuan is also being earmarked onshore to shore up equity support. Expectations are rising for further actions to be taken later in this week, though it remains to be seen whether these will provide much needed structural solutions.

Over in the US, risk sentiment remains in a bit of a flux, with equity rallying between 2–3% over the past week, though index internals were weak and 10yr treasury yields rising +19bp. Furthermore, while the incoming economic data has been largely positive, the degree of the surprise beats has shrunk, with Citi’s Economic surprise index showing a +4 reading over the past week versus an average reading of +37 in 2023. Said another one, market expectations have risen and the momentum of the economy to surpass that threshold has dwindled, which could provide a meaningful headwind to US equities should rate cuts continue to get re-priced out in the near term.

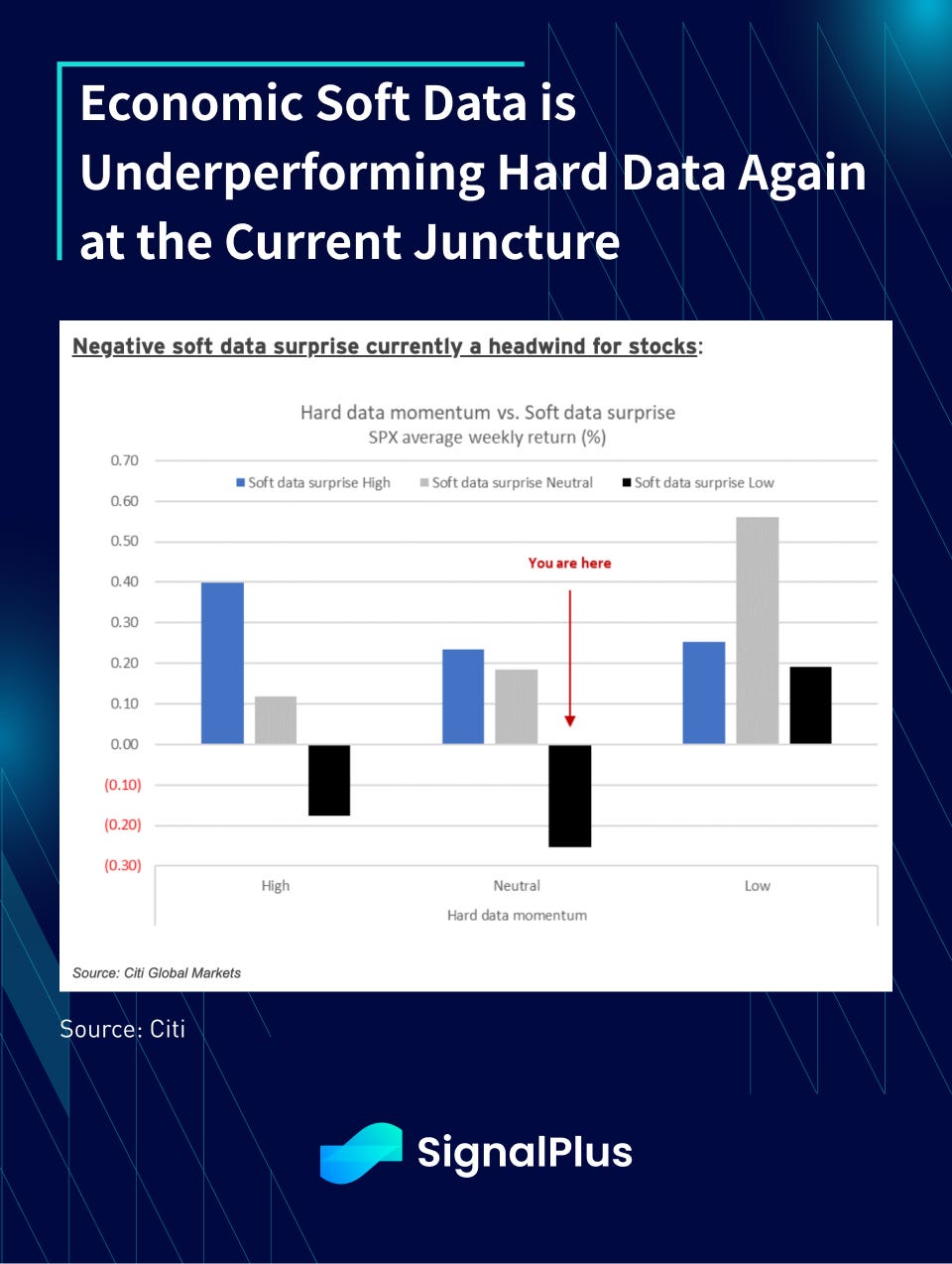

Furthermore, while hard data momentum (eg. Retail sales, GDP) have been stronger since late 4Q23, soft data surprises have lagged, giving us a setup that is reminiscent of what we saw in 2023. While soft data generally leads hard data in terms of long-term direction, this was not the case last year, and optimism ultimately prevailed, albeit from a much lower base and threshold. Will Lady Luck be on our side again this year?

It’s probably sensible that risk sentiment has cooled off substantially since the turn of the year, given the lack of clarity and confusion in the outlook currently.

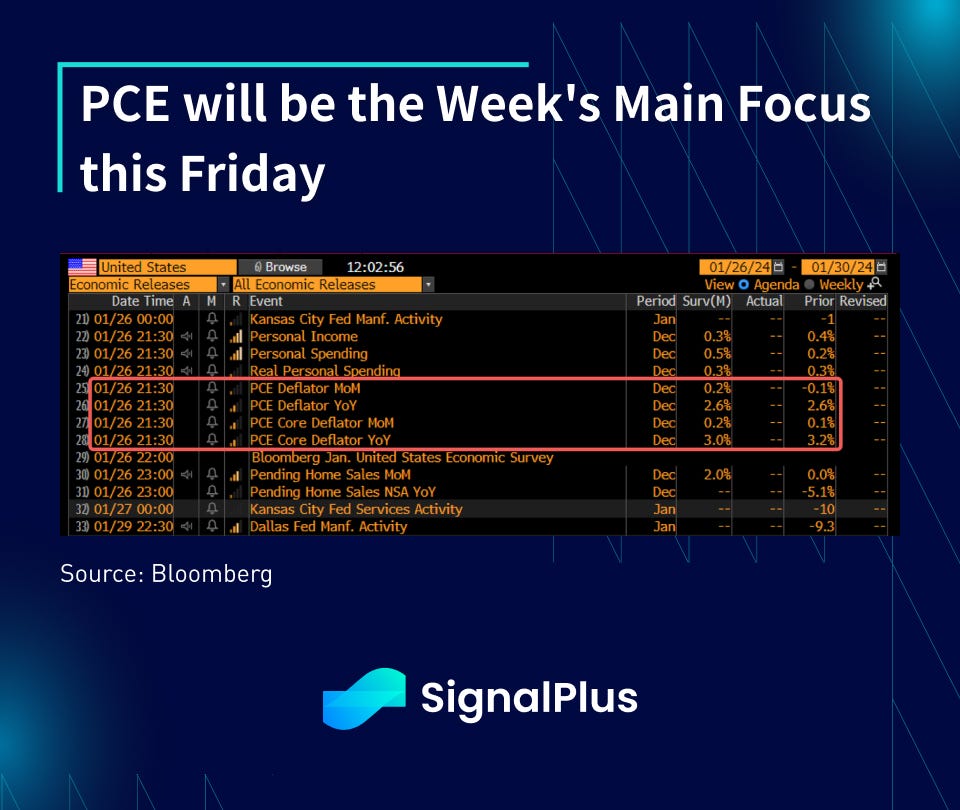

The main focus will be on the core PCE data to be released this Friday, where a consensus 0.2% MoM print will leave us with a 2.9–3.0% annualized rate, and a six-month annualized pace at just 1.9%. Such data will give further support to the Fed’s much desired soft landing narrative.

Crypto prices continue to suffer from a hangover, as BTC prices have sold off nearly 20% from the peak since the ETF launch, with spot prices now sub 40k as GBTC outflows continued. There are reports that the FTX estate has sold 2/3 of its shares in the Grayscale Trust (via Marex Capital Markets), equivalent to around $500–600mm in dollar value, which would constitute a substantial portion of the outflow.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments