Last week’s weak economic data represented by the US non-farm payroll and the manufacturing index sparked market concerns about an economic slowdown, leading to a continuation of global asset sell-offs triggered by “Black Monday.” The USD/JPY exchange rate briefly fell below 142, erasing almost all gains from the past year. Stock indices in Japan, South Korea, and Turkey triggered circuit breakers. The three major U.S. stock indices closed down around 3%, and the “Magnificent Seven” saw their market value evaporate by $1.3 trillion at the opening. The futures market fully priced in a 50 basis point rate cut by the Federal Reserve in September, and the yield on the 2-year U.S. Treasury briefly ended its inversion with the 10-year yield, currently reporting 3.957%.

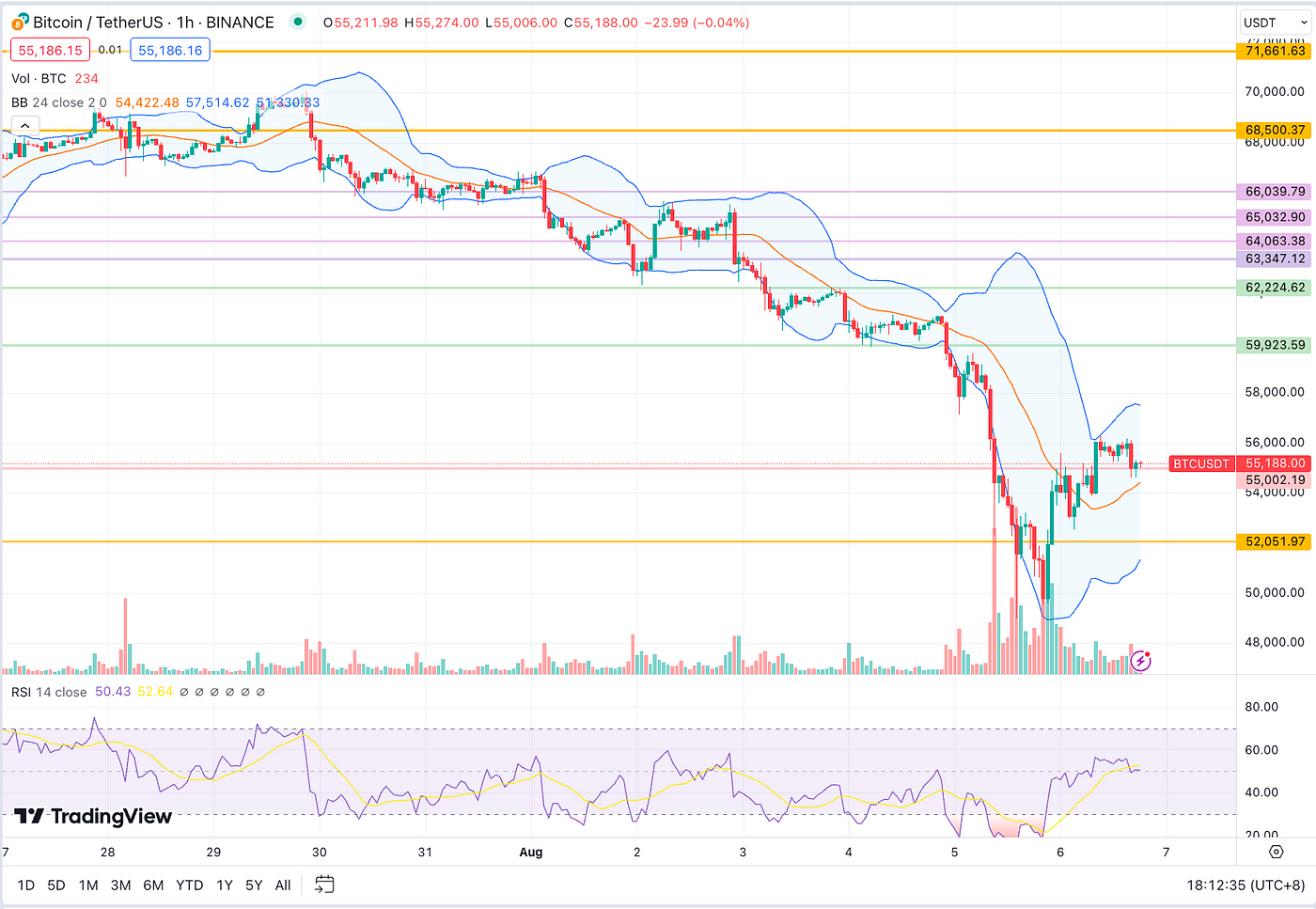

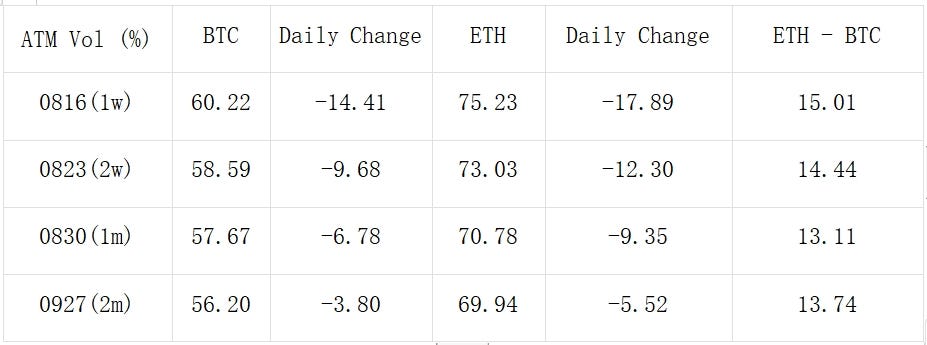

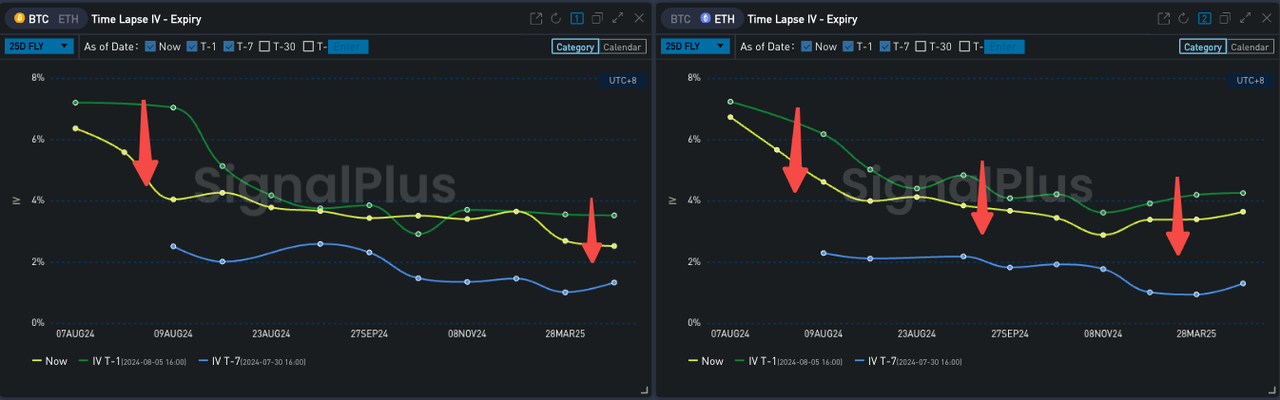

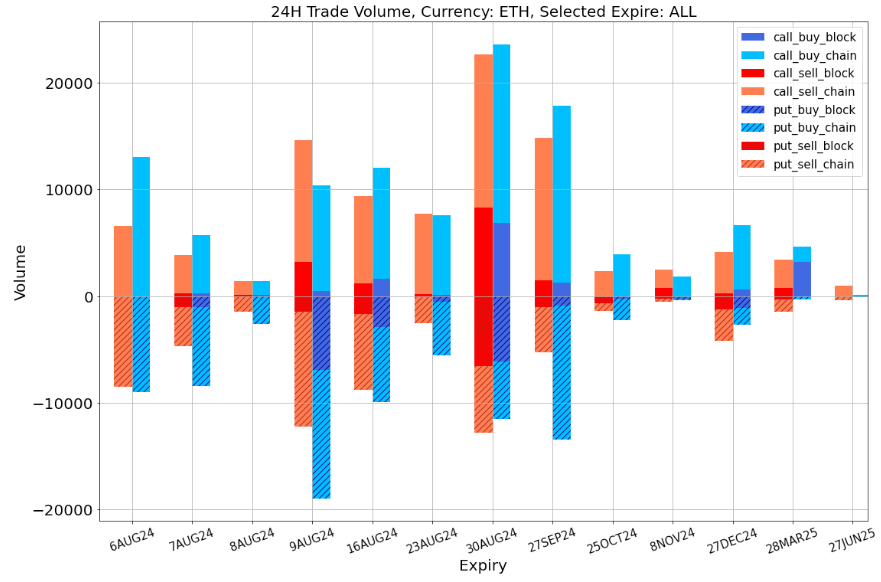

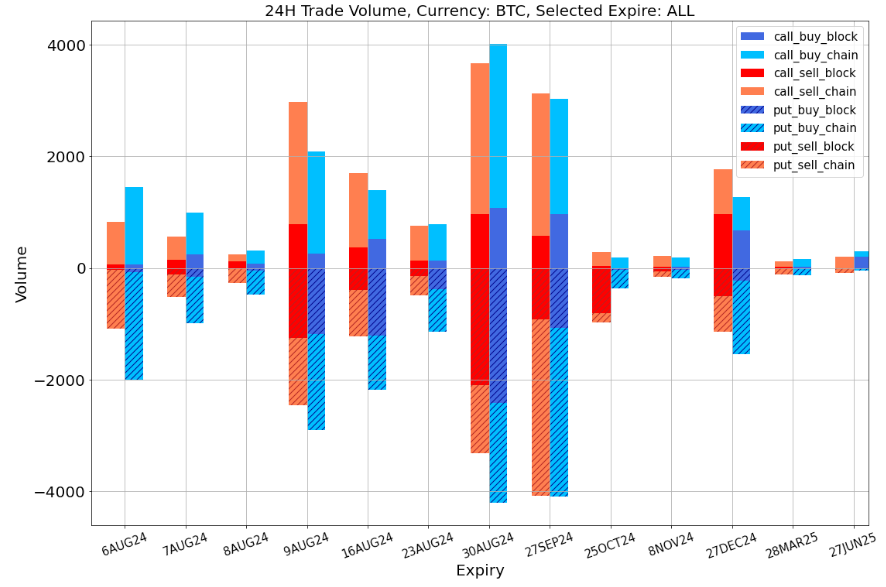

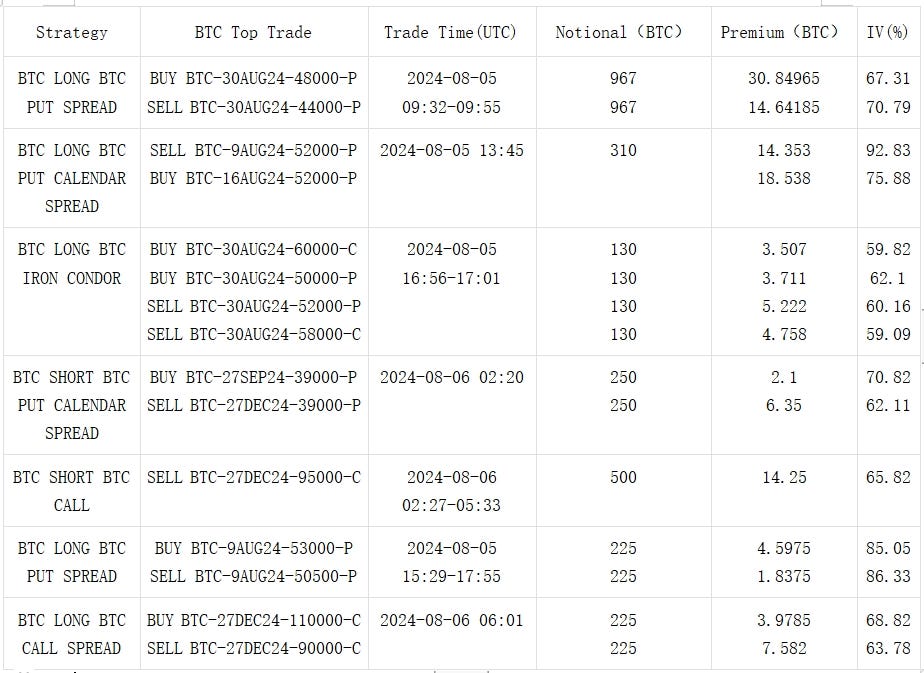

The sell-off sentiment in traditional markets has also spread to digital assets. As a highly correlated risk asset with the S&P 500, BTC plummeted below $50,000 yesterday, triggering market panic. Short-term implied volatility (IV) surged into triple digits, liquidity experienced a squeeze, and the volatility skew dropped along with prices. Demand for wings soared, causing the valuation of Butterflies to rise rapidly.

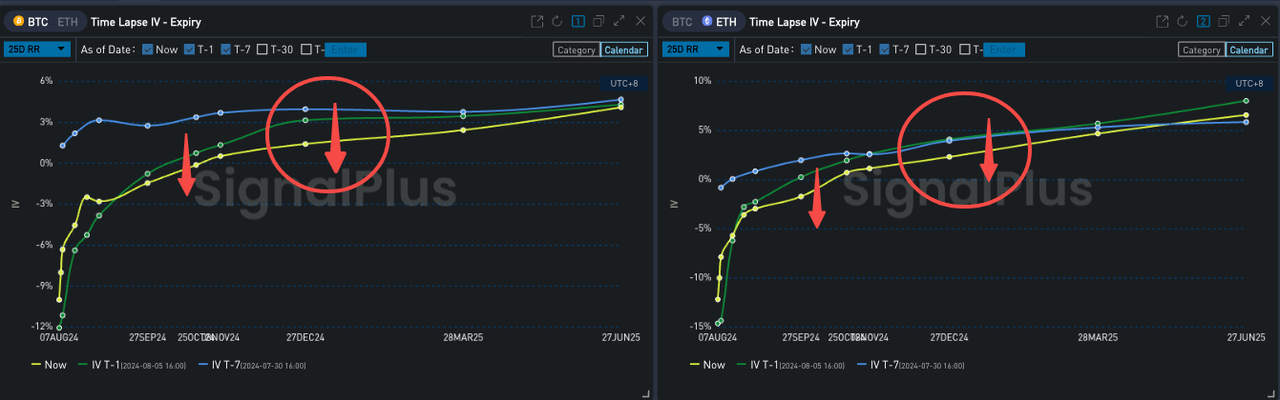

However, as the price gradually rebounded to $55,000, liquidity in the options market slowly returned, IV declined from local highs, and the high tail Vol Premium was repriced, leading Butterfly values to drop overall. For Vol Skew, despite a slight rebound in the front-end negative slope, the more significant change to watch is the further substantial decline in the far-end Vol Skew. In fact, only the front-end reacted to yesterday’s price plunge, while the illiquid far-end Risky was only repriced today.

You can use SignalPlus Trading Compass on t.signalplus.com to get more real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members:

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments