Trading Idea

SOL has recently been affected by financial report and the Jump incident, leading to short-term weakness in its price action, currently around $145. Given that SOL’s implied volatility remains high, we could consider taking a Bear Call Spread strategy trade.

Bear Call Spread

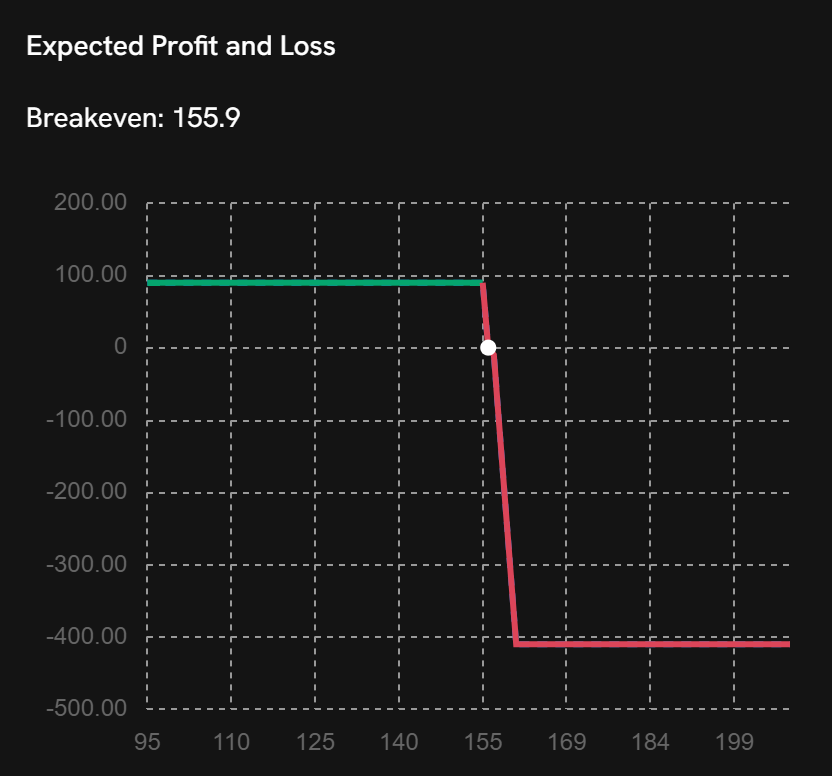

A Bear Call Spread is a bearish options strategy where an investor sells a call option at a lower strike price and buys a call option at a higher strike price, both with the same expiration, to profit from a potential decline or limited rise in the underlying asset’s price.

You might consider executing this strategy if you don’t expect SOL prices to increase significantly.

Trade Structure

Sell 100x SOL-16AUG24-155.0-C @ $2.3 Buy 100x SOL-16AUG24-160.0-C @ $1.4

Maximum Profit:$90

Breakeven: $155.9

👉👉 Go to the Coincall Combe Trade page to place an order now: https://www.coincall.com/combo

Disclaimer

This information is for reference only and does not constitute trading advice. Investors should conduct their own research before making any trading decisions.

Comments