Trade Idea

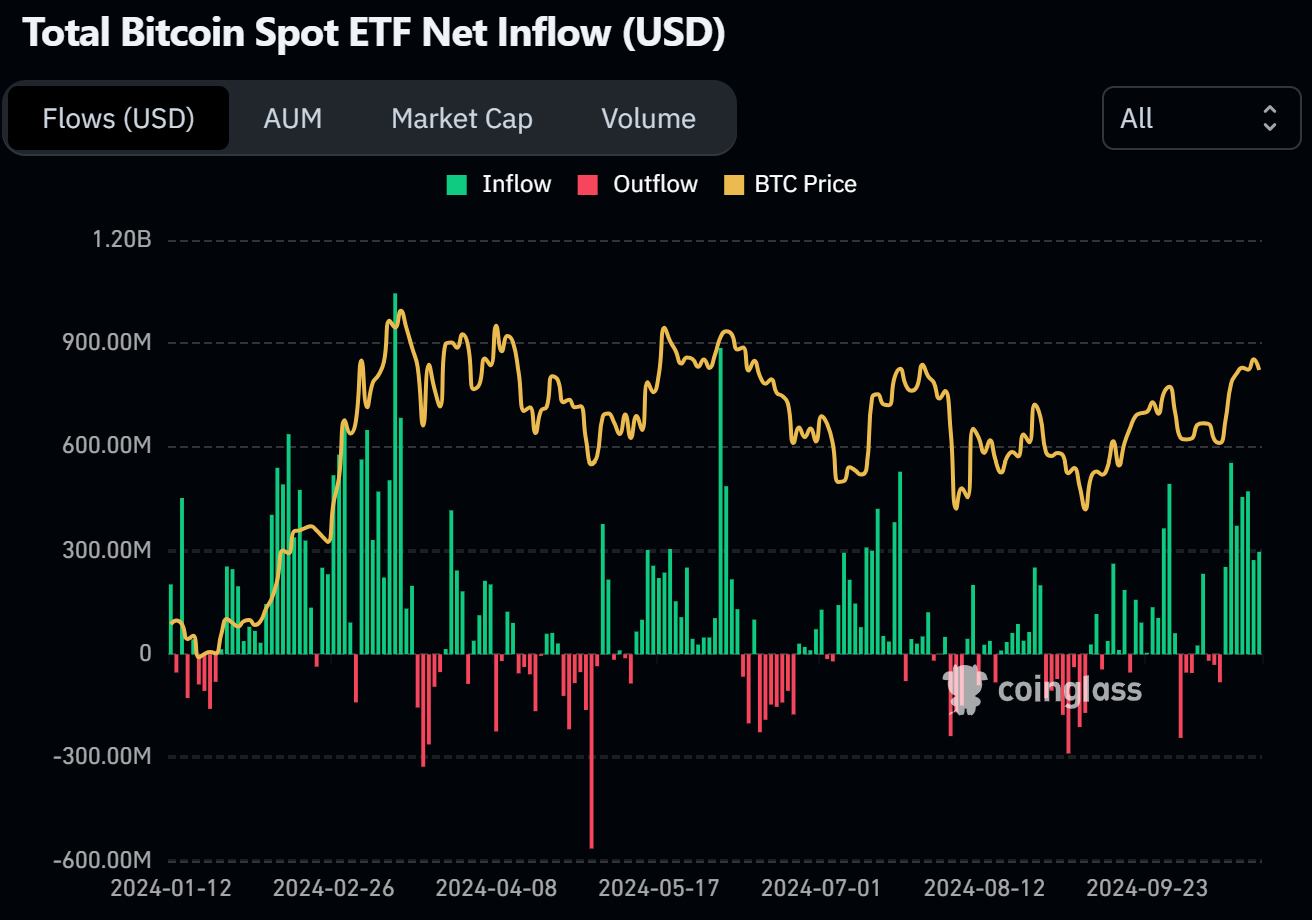

Over the past week, U.S. Bitcoin spot ETFs have seen significant net inflows. After rising to $69,500 on Monday, BTC has since pulled back and is now consolidating around $67,000. With the U.S. election approaching, market sentiment remains broadly optimistic.

Trade Structure

If you expect BTC to continue rising before the election but not surpass the previous high of $73,750, you might consider constructing a BTC ratio spread.

Buy 1x BTC-1NOV24-68000-C @ $1,810 Sell 2x BTC-1NOV24-71000-C @ $865

Max Profit: $2,920

- If BTC stays below $71,000 on November 1st when the options expire, this strategy will achieve the maximum profit.

- If BTC rises to $73,920 or above at expiration, this strategy carries the risk of significant losses.

- Breakeven points are at $68,080 and $73,920.

Disclaimer

This information is for reference only and does not constitute trading advice. Investors should conduct their own research before making any trading decisions.

👉👉 Go to the Coincall Combe Trade page to place an order now:

Comments