This Week in Crypto: A Snapshot

Bitcoin entered this week under the psychological $100,000 threshold. While price action demonstrated consolidation, the most notable movement occurred on Thursday and Friday, when volatility spiked sharply. Concerns surrounding a potential U.S. government shutdown contributed to market unease, but ultimately, the threat subsided.

Across the crypto landscape, sentiment remains cautiously optimistic. However, many investors are asking: What’s next for Bitcoin? Are we nearing another explosive rally, or will this consolidation persist?

Key Market Dynamics: The SPX Risk-On Indicator and BTC Decoupling

A significant development has been the decreasing correlation between Bitcoin and the S&P 500 (SPX). Historically, the SPX and BTC often moved in tandem, with correlations close to +1. Yet, recent data shows the relationship has dropped to a mere 0.22.

This divergence aligns with a “Risk-On” environment in the SPX, highlighted by recent SPX moves and a flattening of the VIX contango curve. In essence:

● Flattened VIX Contango: A nearly flat curve signals risk aversion (“Risk On”) as investors brace for potential market turbulence.

● Implications for BTC: While BTC is less tied to the SPX currently, a major shock in traditional markets could still bleed into crypto markets.

In the SPX chart, notice the flattened VIX contango structure paired with seasonal indicators. The SPX itself has experienced recent pullbacks, failing to sustain a holiday rally. Historically, Bitcoin has shown vulnerability to sharp declines in the SPX, a pattern to monitor closely.

Skew Analysis: An Opportunity in Disguise?

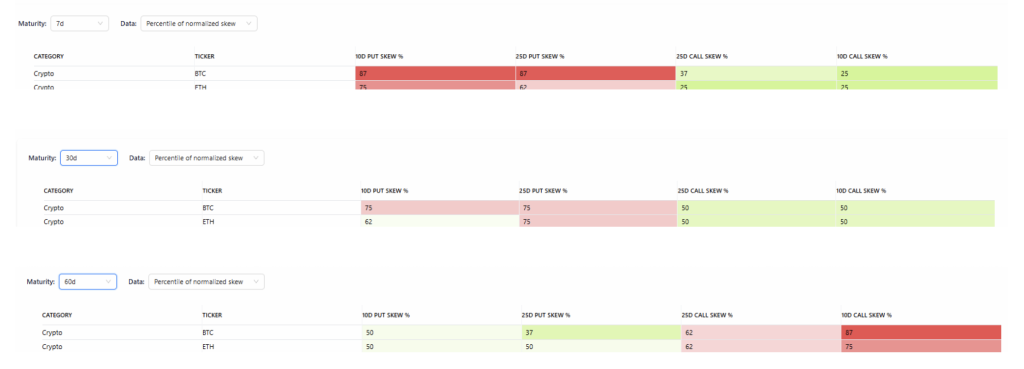

Recent skew data from BTC options markets reveals intriguing insights:

● 7-Day Maturity: The 10D and 25D put skews are elevated at 87 and 75 percentiles, respectively, signaling higher demand for downside protection.

● 30-Day Maturity: Call skew metrics remain low, indicating muted bullish sentiment for near-term moves.

This environment may suit strategies such as ratio spreads or cautious hedging, as the market’s implied volatility and directional biases create opportunities for calculated positioning.

The skew percentile charts for 7, 30, and 60 days highlight market sentiment shifts. For instance, the 60-day chart reflects expensive call options, an anomaly that professionals may use to explore low-cost downside hedges.

Performance Update: Our Current BTC Options

Strategy

Strategy Recap: We’re holding a short $90,000 put and a long $105,000 call, both set to expire on December 27. As Bitcoin consolidates between $90K and $105K, the strategy hasn’t resulted in gains or losses. It remains cost-neutral, offering upside potential should BTC rally above $105K by expiration.

Lessons This Week: Reading Risk-On Signals from VIX Contango

Professional traders often monitor the VIX contango curve for “Risk On” or “Risk Off” signals.

● Risk On: A flat contango curve reflects caution, with investors demanding protection for near-term moves.

● Risk Off: A steep curve indicates confidence in market stability, typically during bullish runs.

Understanding these signals can enhance both crypto and traditional trading strategies, offering early warnings of market sentiment shifts.

As we approach the holiday season, it’s clear that markets are increasingly volatile, yet Bitcoin holds steady. Will BTC follow the SPX into riskier waters, or will decoupling protect its consolidation phase?

Happy Holidays and a Prosperous New Year!

This is our last report of 2024—see you in January with fresh insights and new strategies!

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Every investment involves risk. Remember to follow daily strategies on our Telegram channel: https://t.me/Tokencimiento/1

I trade crypto options on Coincall. Here’s the link: https://www.coincall.com/r/T okencimiento15r

Comments