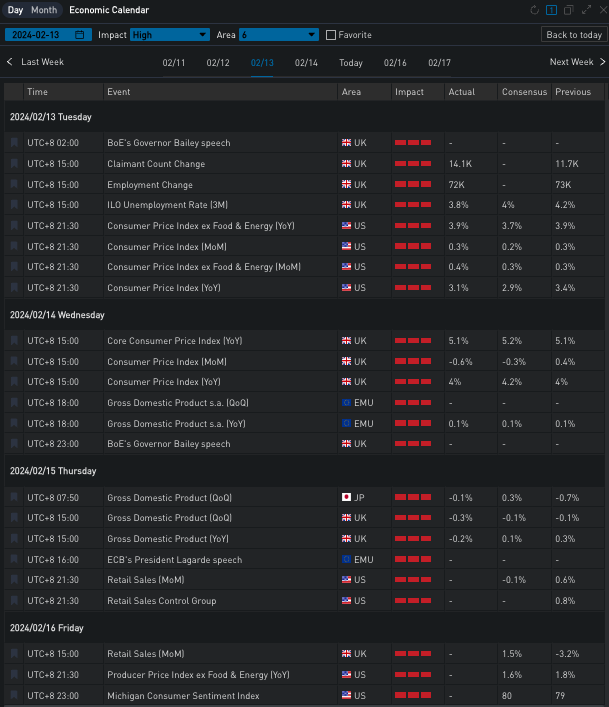

Following Wednesday’s CPI data that significantly disappointed the market and led to a sharp increase in US Treasury yields, on February 14th, Chicago Fed President Goolsbee made a dovish statement, saying the market should not overreact to one month’s CPI data. He reiterated that the Federal Reserve targets PCE rather than CPI for inflation and believes that we are still on the right path to returning to the 2% target. As a result, the fixed income market was soothed, with US Treasury yields slowly declining, currently with two-year/ten-year yields at 4.57%/4.227% respectively. The stock market also rallied, recovering much of the lost ground, with the Dow Jones/S&P 500/Nasdaq up by 0.4%/0.96%/1.3% respectively.

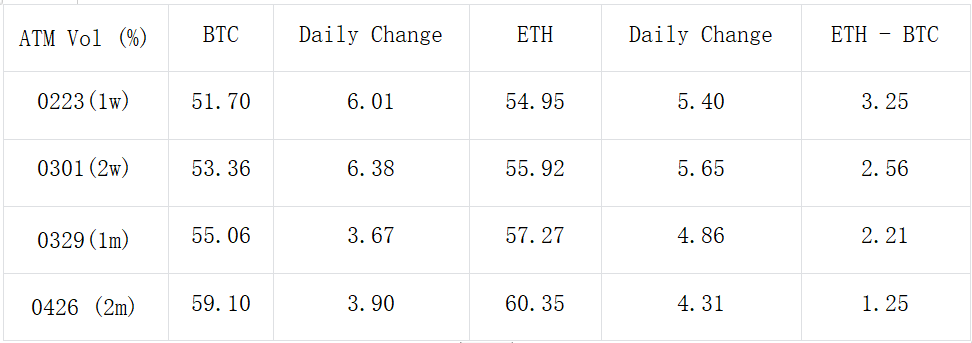

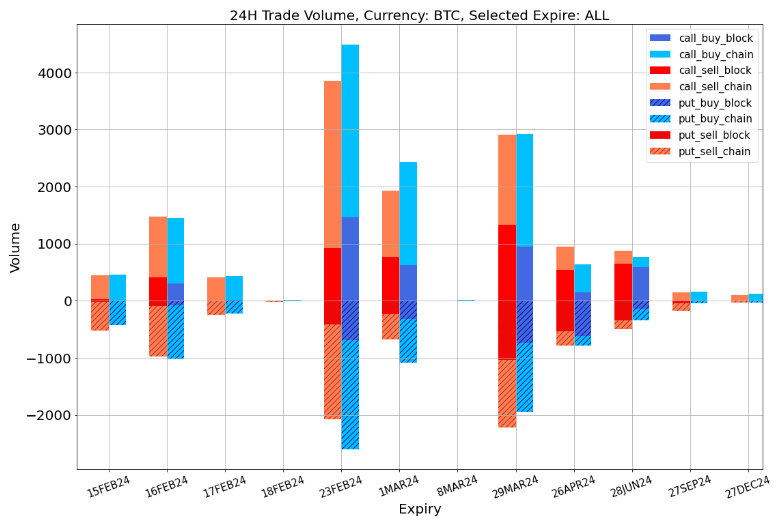

In the realm of digital currency, BTC continued its upward momentum, rising by 4.1% during the day, successfully stabilizing at the $52,000 mark; ETH ended the day up 4.6%, nearing $2,800. In terms of options, the Volatility Skew remains at historical highs, with At-The-Money Volatility continuing its trend of oscillating upwards, reaching levels above 50% Volatility, with ETH being 2 to 3% Volatility higher than BTC.

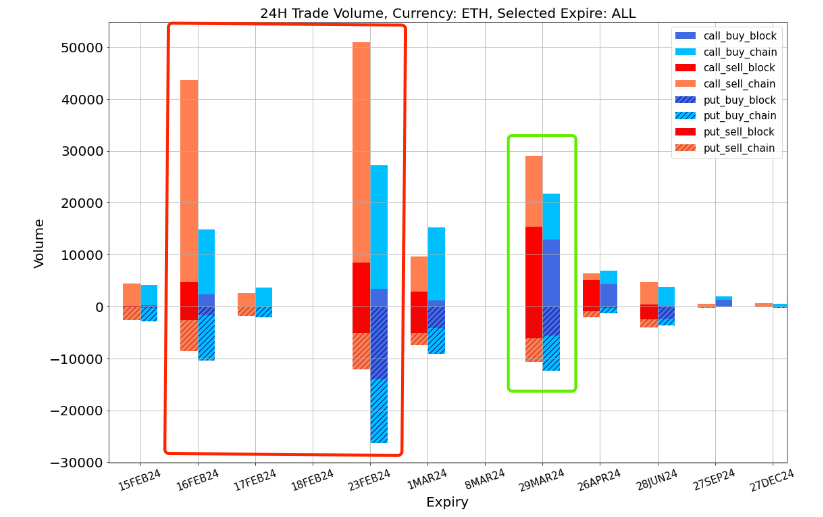

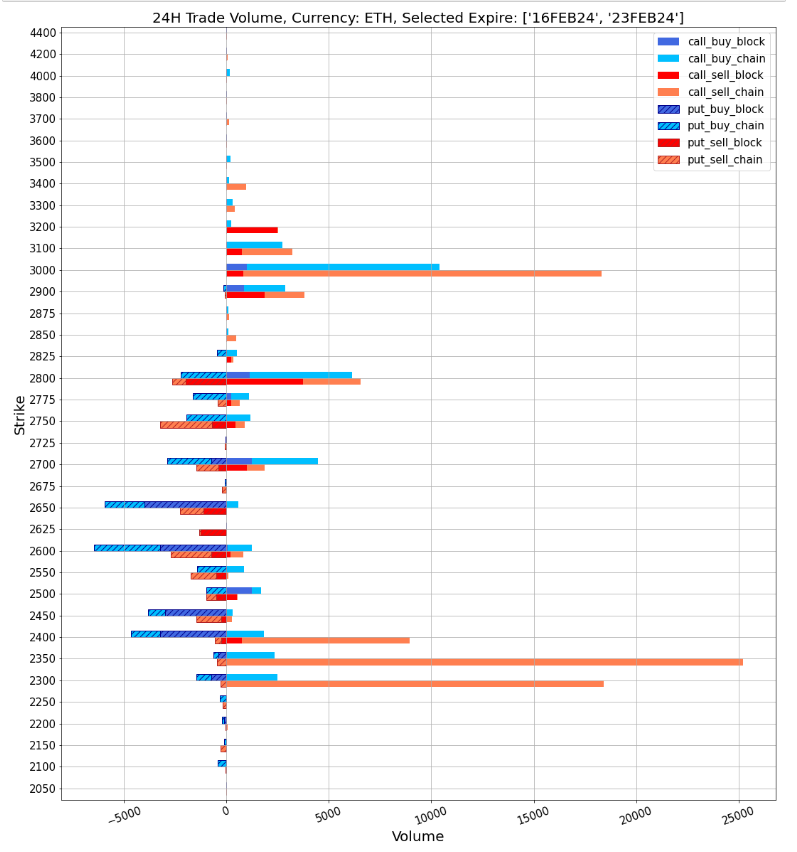

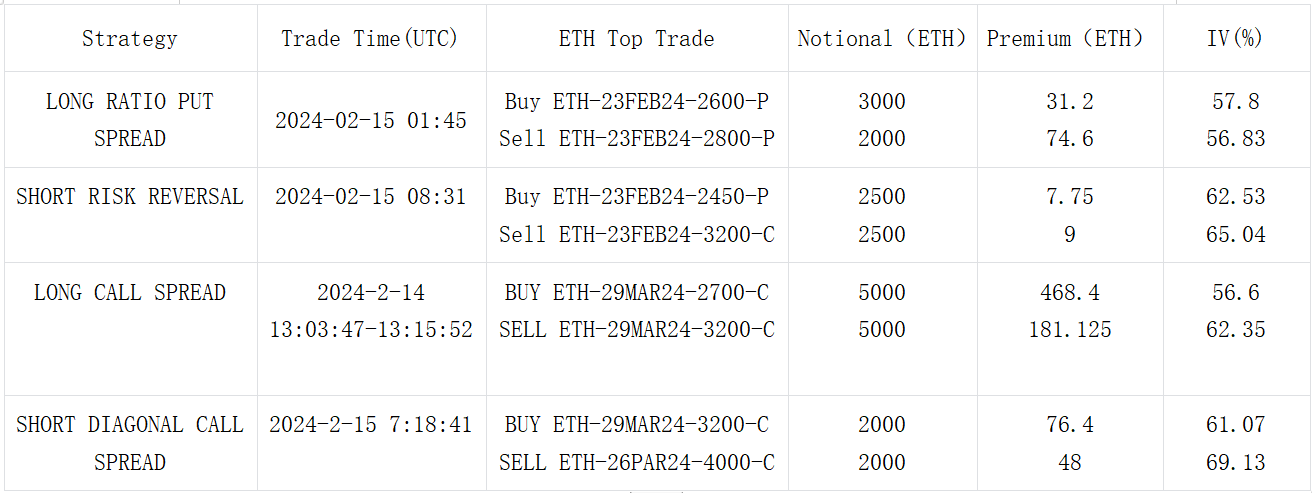

In trading, there was a significant sell-off in ETH calls for this week and the end of the month, including a large number of take-profit orders between $2,300 and $2,400. The end of March saw a concentration of bullish strategies, represented by buying the 2700 vs 3200 Call Spread. Additionally, there were strategies like buying a 29 MAR 3200-C vs selling a 26 APR 4000-C, a long-short calendar spread. Similar transactions can also be observed in BTC, for example, buying a 29 MAR 60000-C vs selling a 75000-C (350 BTC per leg).

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments