Cryptocurrency Trends as 2023 Nears its End

As we move beyond Thanksgiving and head into the final lap of 2023, the cryptocurrency market exhibits a mixture of stagnation and dynamic activity. Bitcoin (BTC), in the wake of SEC Chairman Gensler’s Halloween tweet commemorating the 15th anniversary of Satoshi’s white paper, has remained relatively static, indicating a period of consolidation. In contrast, the altcoin market has been buoyant, contributing to a minor dent in BTC dominance and a fluctuation in the ETHBTC ratio. Despite these shifts, BTC dominance and ETH/BTC metrics remain resilient within their exponential trendlines, suggesting an impending reassertion of their usual trends.

Anticipating Major Events: ETFs and Halvings

As BTC continues its steady climb, three key themes emerge as focal points for the remainder of the year and into 2024. First, the speculative anticipation surrounding the approval dates for Bitcoin ETFs, with symbolic dates like the 15th anniversary of the Genesis Block drawing attention. Second, the approaching Bitcoin halving, now just about 150 days away, traditionally marks a phase of gradual price increase leading up to the event.

Macro Trends and Crypto Dynamics

The recent growth in Tether’s USDT market capitalization signals a broader trend of institutional investors gravitating towards stablecoins, potentially as a gateway to other cryptocurrencies like Bitcoin. This movement, coupled with the anticipation of Bitcoin breaking the $40,000 barrier, demonstrates the growing interplay between cryptocurrency and traditional financial trends. The correlation with macroeconomic factors, such as bond yield re-pricings and stock market movements, underscores the deepening connection between the crypto market and broader economic dynamics.

Concluding Insights

As 2023 draws to a close, the cryptocurrency market continues to evolve, reflecting a complex interplay of internal dynamics and external economic forces. The resilience of major cryptocurrencies, like BTC and ETH, amid varying market conditions, points to a maturing market. The anticipation of significant events like ETF approvals and the upcoming Bitcoin halving further sets the stage for what could be a pivotal period in the crypto landscape. Understanding these intricate relationships remains critical for investors navigating the nuanced and ever-evolving world of digital assets and traditional finance.

Market Data

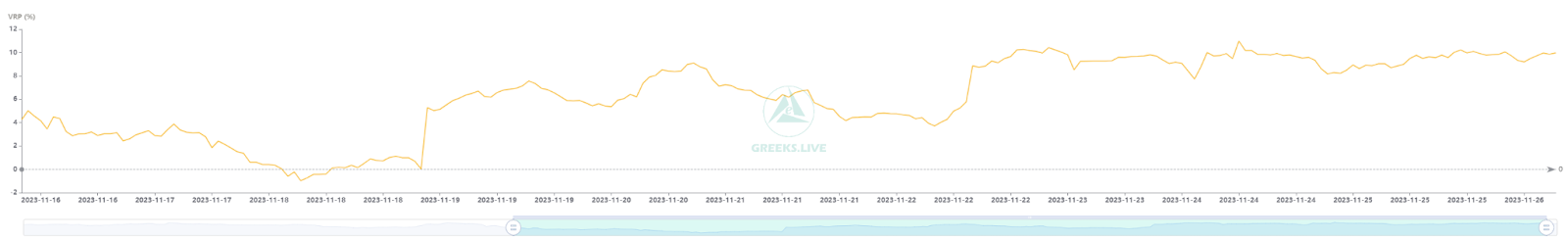

ATM implied volatility has stayed relatively stable heading into the end of the year, with recent price action and elevated levels keeping ATM IVs relatively firm. With realized volatility trailing implied, the variance risk premium has continued to grow, and option sellers have been able to capitalize on this current premium.

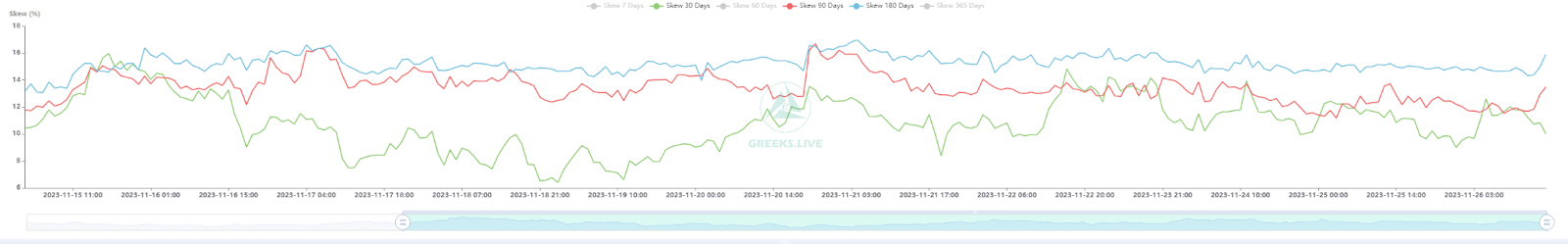

Skew has trended towards calls across all maturities, commanding a slight premium. When normalizing the skew to the current ATM implied volatility, we can see that the longer-dated skew commands a more significant premium, as longer-dated IVs are also elevated (180-day: 58, 30-day: 49) most likely off the back of ETF approval and BTC halvening bets.

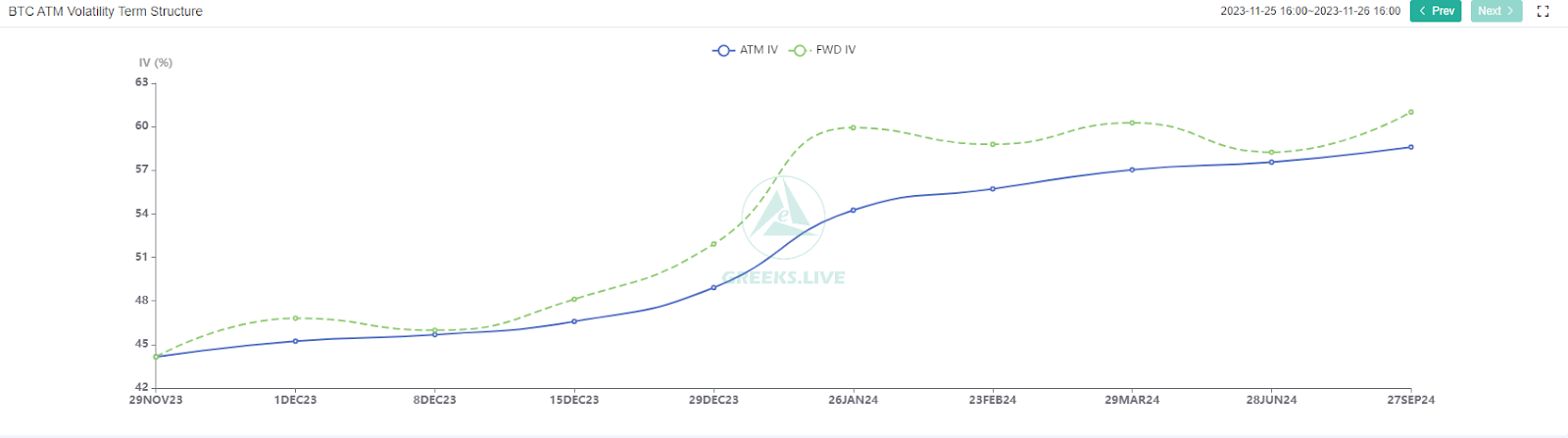

IV Term-Structure is upward sloping, with the most significant increase in forward IV after the 29DEC23 expiry. Open interest is the greatest in the 29DEC23 and more significant than the cumulative sum of the previous expiries. We recently had a massive expiry roll off with very little follow-through in the spot markets, but it’s important to keep note of large pockets of open interest.

The Kingfisher is also showing interesting data points 🙋

Comments